The Prometheus S&P 500 Program aims to outperform the S&P 500 over a full investment cycle. The program will aim to achieve this objective by leveraging a combination of Sector Selection, Beta Timing, Active Overlays, and Dynamic Risk Control. Our S&P 500 Program can be integrated with our Crisis Protection Program, which seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX.

You can read the 27-page primer detailing the mechanics of our approach to our S&P 500 Program below:

Prometheus S&P 500 Program Primer

We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the official launch of our systematic Prometheus S&P 500 Program.

And the primer for our Crisis Protection Program as well:

Prometheus Crisis Protection Program

We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the launch of our systematic Prometheus Crisis Protection Program

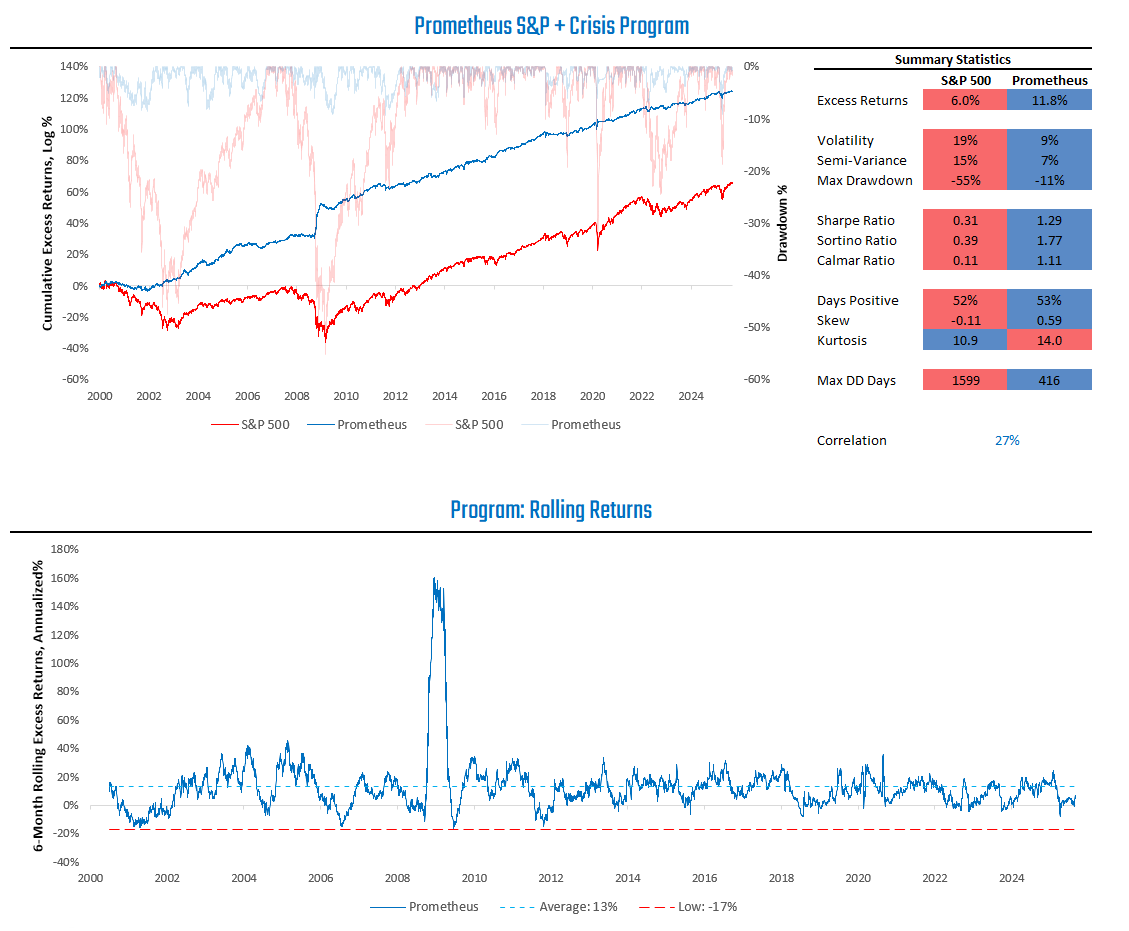

For reference, we visualize the simulated path of the integrated Prometheus S&P 500 + Crisis Protection Program below:

And the live returns for our major programs (with simulation extension for context):

Our S&P 500 Program is operating in line with its long-term expectations. Today, the S&P 500 Program is positioned as follows:

Our systems are maintaining equity allocations with elevated cash. There are four major takeaways from these positions:

Beta Timing: Our beta timing measures show modest downward pressures in equity markets. More moderate exposure looks warranted.

Sector Selection: Within the cross-section of equity sectors, our signals favor a mix of industrial and technology stocks. Our positioning remains skewed towards industrials due to better relative valuations.

Risk Control: Our risk control continues to guide us effectively in managing drawdowns. In a multi-standard deviation event across all our positions, our expected drawdown is 6%.

Bond Overlay: While the term structure of interest rates has continued to normalize, macro conditions remain too positive to consistently support bonds. We continue to look for better pricing to re-enter the bond market.

Our systems combine these dimensions to create one comprehensive outlook reflected in our portfolio positions.

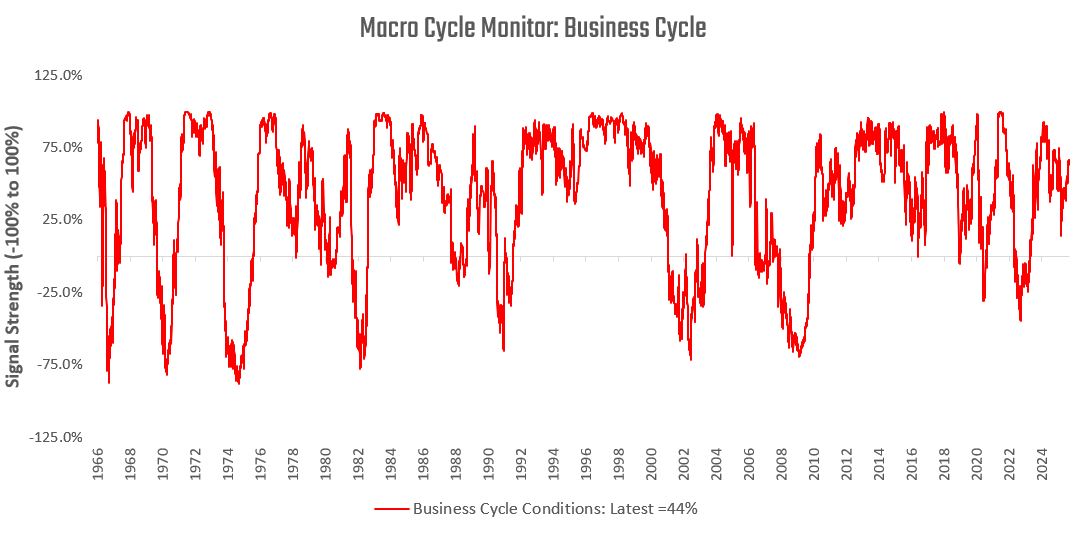

Our latest tracking of economic growth indicates that the business cycle is slowing modestly, but remains in an expansionary phase. We show these proprietary tradable signals below:

These business cycle conditions continue to support the prospects for positive earnings growth. However, expectations may have gone too far:

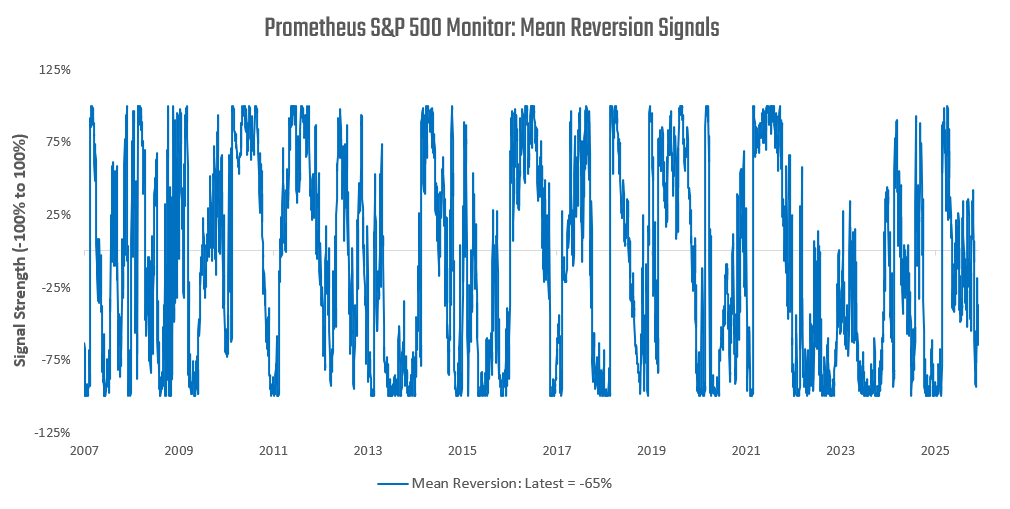

These conditions have developed over the last few weeks, with earnings expectations likely too exuberant at this junction. Further, mean reversion headwinds for equities have meaningfully risen, increasing the downside pressures on the index:

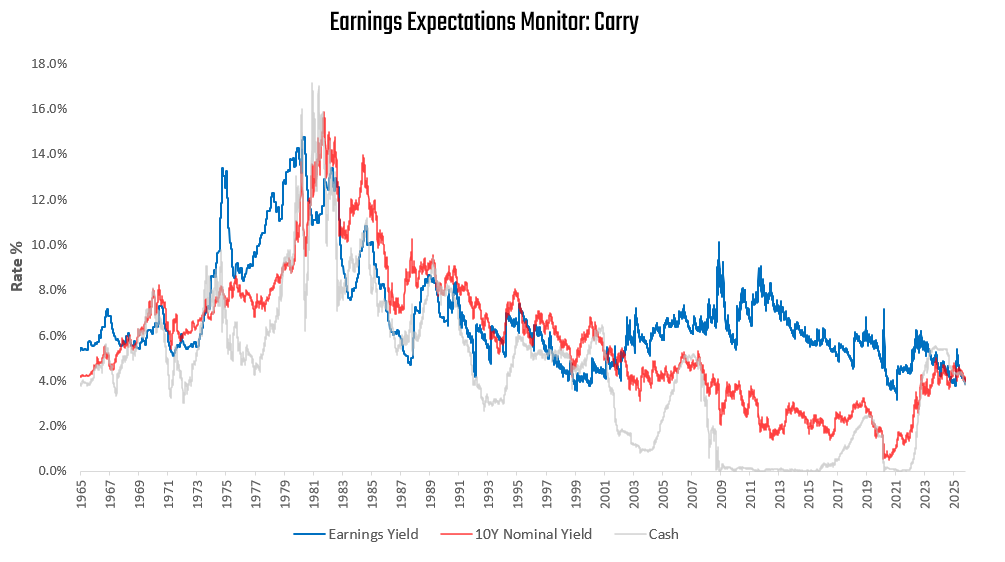

Further, expected returns for equity markets remain compressed versus other assets. Recall, today, cash offers essentially the same expected returns as stocks and bonds, with none of the risk:

Given our moderating beta timing signals and compressed expected returns across equities and bonds, max exposure is not warranted, and we can use our Crisis Protection Program as an overlay.

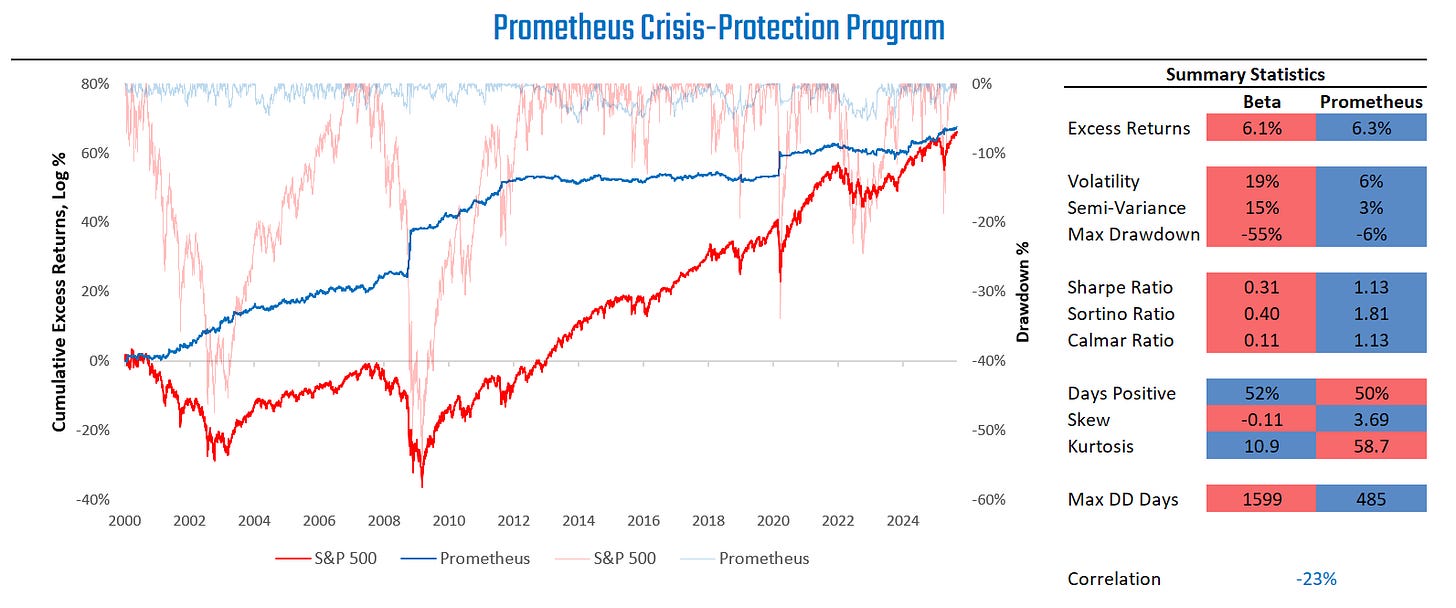

The Prometheus Crisis Protection Program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active exposure to Gold, TIPS, and VIX. Actively managing these exposures is integral, as their expected returns are time varying with the macro cycle. We demonstrate how actively managing these exposures can add significant value compared to holding them passively:

The most crucial part of this program is its correlation to equity markets. During equity market down days, this program has a mean Sharpe Ratio of 2, suggesting strong diversification characteristics to beta. Today, these programs do not see signs of elevated financial stress, which we capture in the form of our Volatility Stress gauge:

Nonetheless, gold and TIPS offer attractive expected returns during periods of elevated nominal GDP, easy monetary conditions, and above target inflation. As such, the Prometheus Crisis Protection Program is allocated as follows:

The Crisis Protection Program currently has an expected volatility of 3.9%, with a maximum of 10%. In an outlier event, our estimate for a worst-case loss at the portfolio level over the next week is -2.7%.

A Defence First implementation of this program would be 100% invested, with no S&P 500 exposure. An S&P 500 Overlay would have 30% invested in leveraged S&P 500 exposure, with the remainder invested in this portfolio.

Integrating our S&P 500 and Crisis Protection programs offers an attractive and highly diversified portfolio. We visualize the simulated path of this portfolio below:

Today, this portfolio is allocated as follows:

The business cycle remains in an expansion, but equity prices look to have exceeded price gains justified by fundamental dynamics. This pricing doesn’t mean equity prices need to crash imminently, but rather that we’re likely to see higher price volatility. Moderate exposure remains a sensible approach, and increasing diversification will likely decrease portfolio volatility, while maintaining positive expected returns.

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.