Keep All Your S&P 500 Returns, But Protect The Downside?

Crisis Protection Program Implementation

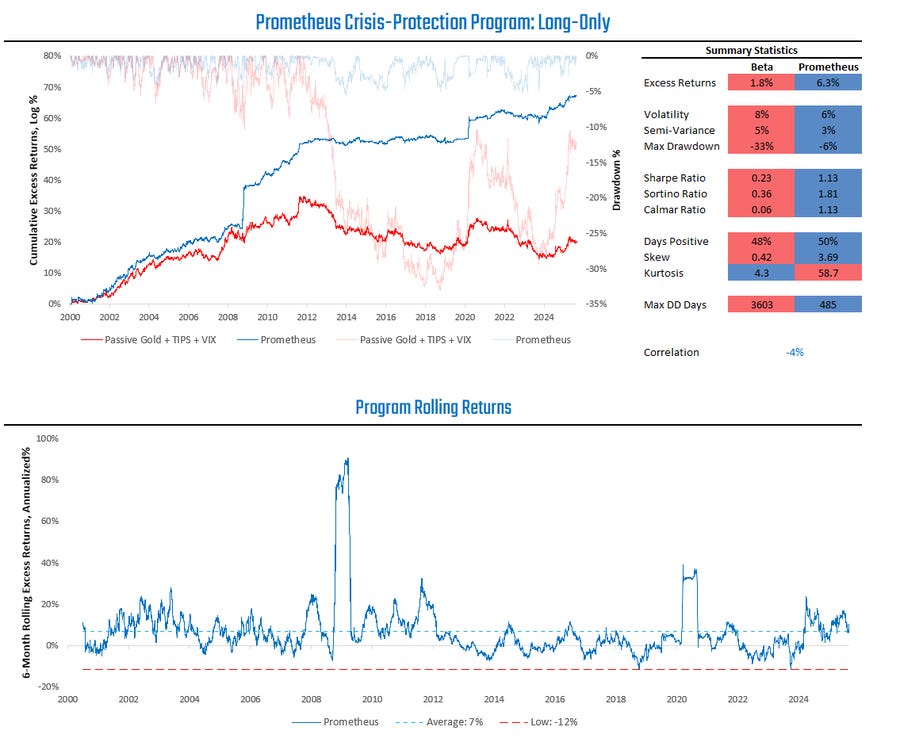

The Prometheus Crisis Protection program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX. The program is designed to have minimal turnover, barring crisis periods, and is meant to be a portable solution for both active and passive equity market investors. With an average Sharpe Ratio of 2.0 during days when the equity market declines, we expect the Prometheus Crisis Protection Program to offer a valuable addition to investor portfolios.

If you’ve already studied the Prometheus Crisis Protection Program Primer, you may be familiar with some of this content. If you haven’t checked out the primer yet, you can find it at the link below:

The S&P 500 is the core exposure for many investors. While the S&P 500 is a good asset over the long term, it can have large drawdowns. What if we can diversify the downside risk while maintaining the upside capture? Enter the Prometheus Crisis Protection Program.

Many investors want to maintain passive exposure to the S&P 500, but the market can go through periods of very weak performance. The Crisis Protection Program is designed to diversify during those periods of underperformance.

The program rotates between gold, TIPS, and VIX futures. These diversifiers, while valuable, often come at a cost—reduced upside in equity rallies. With some portfolio engineering, however, you can maintain the equity upside while reducing a portion of the downside.

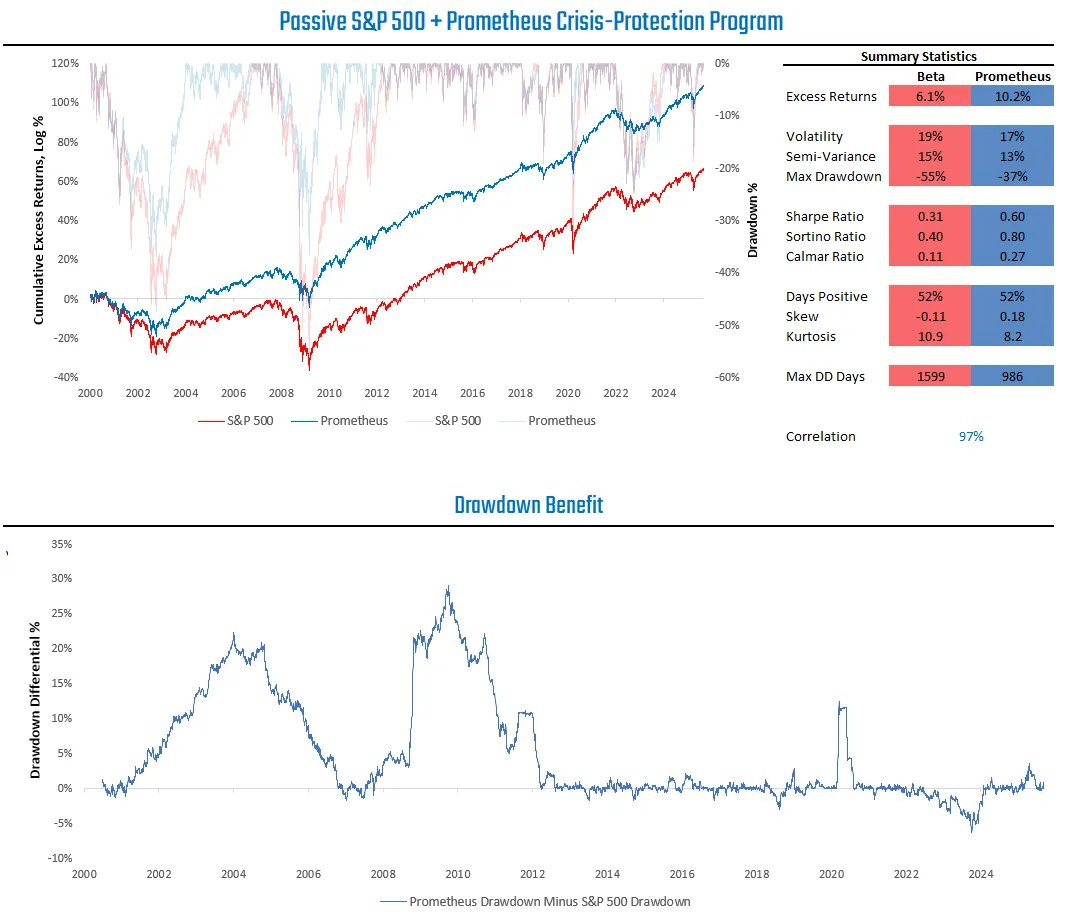

The key is to use leverage intelligently—not to increase risk, but to allocate capital more efficiently. A straightforward implementation is to allocate 30% of capital to SPXL, a 3x S&P 500 ETF. Alternatively, the same can be achieved using S&P 500 Futures. That provides roughly 100% S&P 500 exposure financed at the risk-free rate plus a spread, leaving the remaining 70% of capital to allocate to the Crisis Protection Program. We show the simulated results of this portfolio below:

As we can see above, using the Crisis Protection Program as an overlay to S&P 500 exposure delivers higher absolute returns with lower risk and smaller drawdowns than holding the index alone. The drawdown benefits during periods of equity market stress are especially significant.

So what’s the catch?

You give up some of the cash rate plus a spread to finance the leveraged equity exposure. Crucially, this applies only to the 30% of the portfolio allocated to leveraged equities. Therefore, as long as you expect a mix of gold, TIPS, and VIX futures to outperform cash over the long term, this overlay will be value-additive. That’s before accounting for any potential active investing alpha. Of course, from time to time, the Crisis Protection Program itself will draw down. So, you may lag the index because Gold, TIPS, and VIX drag on performance for a while—but over time, they are likely to outperform cash and thus add value.

Given the low hurdle to add diversification, increase returns, and reduce drawdowns for a passive S&P 500 allocation, the Prometheus Crisis Protection Program is a strong complement for stock market investors.

Until next time.

Would balancing leverage across assets—for example, 2x gold (UGL) and 2x SPY instead of 3x SPY—help reduce the path-dependent losses that a 3x SPY ETF can suffer in extreme equity moves due to daily resets?