The Prometheus Crisis Protection program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX. The program is designed to have minimal turnover, barring crisis periods, and is meant to be a portable solution for both active and passive equity market investors. With an average Sharpe Ratio of 2.0 during days when the equity market declines, we expect the Prometheus Crisis Protection Program to offer a valuable addition to investor portfolios.

If you’ve already studied the Prometheus Crisis Protection Program Primer, you may be familiar with some of this content. If you haven’t checked out the primer yet, you can find it at the link below:

In a recent note, we described a process for how a passive equity investor can keep all of their S&P 500 returns while reducing their drawdowns by leveraging the Prometheus Crisis Protection Program. This approach uses leveraged S&P 500 exposure to create capital efficiency and allocates the remaining to the Crisis Protection Program. By its nature, this approach is an “offense-first” program— prioritizing constant exposure to the equity market. Today, we share the other side of that proverbial coin— the Defense-First Program.

A Defense-First approach to investing prioritizes the mitigation of adverse macro conditions, such as recessions, stagflation, and market crashes, while treating long exposure to pro-cyclical assets as a secondary concern.

Every week, our Crisis Protection Program determines the allocation to Gold, TIPS, and VIX. The combined package of these assets performs best during crisis dynamics: recessions, stagflationary shocks, and financial crises. The inherent bias of this mix of assets is the exact opposite of equities, which prefer rising real growth and stable financial conditions. As such, positive return expectations for these assets often signal weaker return expectations for equities. Said more plainly, when our signals allocate heavily to Gold, TIPS, and VIX, it is usually indicative of a weak environment for stocks. The converse is also true; when our signals allocate minimally to Gold, TIPS, and VIX, it is usually indicative of a strong environment for stocks. Therefore, when our Crisis Protection Program has low holdings of Gold, TIPS, and VIX, it can be used as a signal to allocate to stocks.

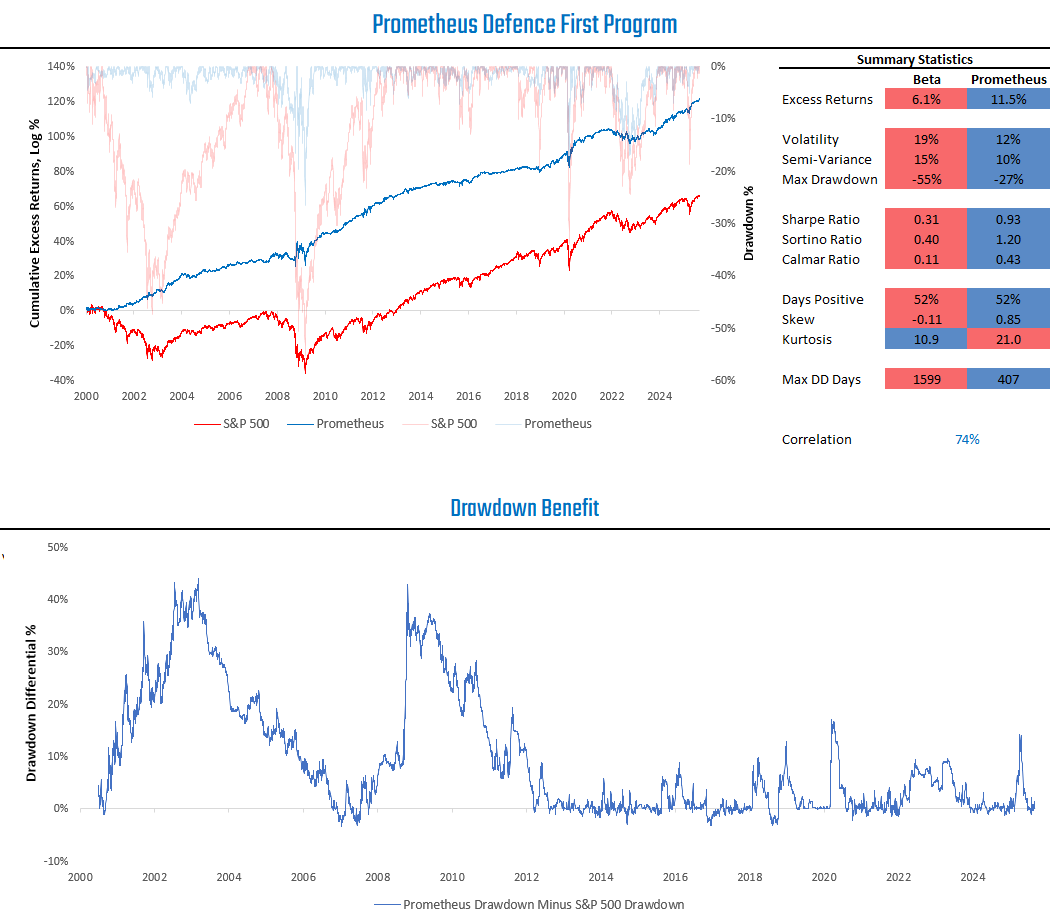

Therefore, we can take the dynamic cash holdings from our Prometheus Crisis Protection Program and invest them in the S&P 500. We show the simulated performance profile of doing so:

As we can see above, this Defense-First approach to investing generates strong risk-adjusted returns versus holding equitie passively. This outperformance come through two features. First, scaling equity exposure after considering “defense-first” introduces a modest amount of timing alpha, effectively improving the risk adjusted returns of our equity holdings. Second, the diversification characteristics of blending equities with assets mechanically biased to outperform when equities underperform has a signficant impact on risk, reducing volatility and drawdowns. Putting these features together, our Defense-First Program shows outperformance versus equities, while still maintaining relatively elevated correlations to the S&P 500.

We think this approach to investment may be align with those that have a Defense-First mindset to investing. Further, this type of approach may be valuable in a time of historically anomalous macroeconomic conditions and elevated uncertainty. You can read our assesment of those conditions below:

If you’re interested in the Defence-First Program, you can avail of it via the Prometheus Crisis Protection Program. In the spirit of the program’s official release, we are offering a one-time discount of 33% on our monthly price for new annual subscribers. You can avail of this offer at the link below. The offer will expire very soon.

Until next time.