We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the launch of our systematic Prometheus Crisis Protection Program.

The objective of this program is straightforward: offer a meaningful diversifier to the S&P 500, which is biased to outperform during periods of equity market downside. In the spirit of the program’s official release, we are offering a one-time discount of 33% on our monthly price for new annual subscribers. You can avail of this offer at the link below. The offer will expire very soon.

The Prometheus Crisis Protection program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX. The program is designed to have minimal turnover, barring crisis periods, and is meant to be a portable solution for both active and passive equity market investors. With an average Sharpe Ratio of 2.0 during days when the equity market declines, we expect the Prometheus Crisis Protection Program to offer a valuable addition to investor portfolios.

The program trades the following assets:

Gold: GLD

Treasury Inflation Protected Securities: TIP

VIX: VIXY

The program rotates between these assets weekly, with updates on Mondays between 3:30 and 4:00 PM ET, along with our S&P 500 Program.

The US equity has become central to investor portfolios across the globe. Most investors are seeking to either match equity market returns or outpace them over the long term. Regardless of whether investors seek to match our outperform equity returns, most investors seek higher risk-adjusted returns than simply holding market beta. These higher risk-adjusted returns can be achieved in two ways: time exposures to equity markets or increased diversification. As active quantitative investors, we believe that both timing and diversification are essential components to long-term outperformance. Our S&P 500 Program, released earlier this year, while diversified, leans more on the timing component to achieve this long-term goal of outperformance versus the benchmark.

Our Crisis Protection Program leans primarily on diversification to create a portfolio that is biased to outperform during equity market downturns, creating an extremely strong complement to both active and passive equity exposure. Below, we outline the steps to creating this portfolio:

We work through each step below

Understanding Fundamental Drivers

Every asset (stocks, bonds, commodities, currencies) is embedded with underlying biases towards macroeconomic conditions. Given that our primary objective with this program is to create a diversifier to equity markets, recognizing the biases of equities is a natural starting point. Equity markets are biased towards rising real growth and liquidity conditions. There is a wide variety of literature on this subject, including our own Macro Mechanics, so we won’t go into depth on how those linkages work. What’s crucial to recognize here is that if we are going to diversify equity downside risk successfully, we need to create an asset mix that outperforms during a falling nominal growth, rising inflation, and tightening liquidity conditions.

Choosing Natural Diversifiers

No single asset is going to perfectly hedge equity risk and provide a positive expected return. However, our objective is not to find a perfect hedge, but rather to find a mix of assets that, by and large, should outperform or remain unimpacted when equities underperform. We identify the following assets:

TIPS: Treasury Inflation Protected Securities are the most natural and direct diversifier to equities. Their returns are driven by real yields and by the accrual from inflation indexation. Real yields can fall through either higher inflation expectations or weaker growth expectations, both of which benefit TIPs. This combination makes TIPS one of the few assets that benefit as growth deteriorates and inflation accelerates—conditions that typically hurt equities. However, much like equities, TIPs are negatively impacted by rising policy rates. As such, TIPs and equities can both underperform when rising policy rates are the dominant driver of asset prices. However, this hole can be filled with gold.

Gold: Gold has been used as a medium of exchange and store of value for thousands of years. Its long history has made it a natural safe haven for global investors and central banks. As such, gold often has the risk-off characteristics of a bond, i.e., gold rallies as global growth expectations falter. At the same time, gold also has pro-cyclical properties related to the wealth effect and nominal jewellery demand. As such, gold can often operate like a commodity as well, rising as inflation rises. The combination of these features often makes gold move similarly to TIPs, though with one notable exception: policy hiking cycles. Gold, unlike stocks and bonds, does not represent a series of discounted cash flows. It is a spot asset. As such, gold is not directly hurt by changes in monetary policy and often outperforms TIPs during periods of rising policy rates. Given these biases, combining Gold and TIPs creates a better allocation mix relative to holding either one on a standalone basis. While this is already a strong base of diversifiers for the growth, inflation, and policy biases of equities, this mix still doesn’t cover the risk of sudden financial contagion or liquidity drying up. This is where long VIX exposures can be beneficial.

VIX: The VIX Index is mechanically tied to the price movements of the S&P 500. Given the long bias of investors to the equity market, periods of equity market declines are accompanied by reduced financial liquidity and increased volatility. Long volatility exposures via VIX futures are direct mechanical beneficiaries of these periods. Long volatility exposures offer significant, though infrequent, benefits in the event of sudden and unforeseen financial stress, which may not always be the case for Gold and TIPs exposures.

Given this recognition of the inherent natural biases in these asset classes as diversifiers to equity market downside risks, combining these assets in a portfolio offers a balanced and comprehensive diversifier to equities. However,

Beta Timing: Adding Modest Timing

Beta Timing is the most proprietary component of our process, coming from our institutional alpha programs. To maintain our competitive edge in markets, we cannot disclose the formulas and techniques we use to predict market direction. However, we can share the conceptual mechanics that drive our approach. At the core of our alpha generation process is a fundamental understanding of the nature of asset price returns. Every asset carries an expected return for a given level of risk. This return can come through one of two ways: the asset can generate a cash flow for simply holding it, like an interest payment or a dividend, or the asset's price can change. If an asset generates positive returns for merely holding it, it has a positive carry. By and large, the most preferable assets to own over the long term are assets that offer a reasonable carry relative to their risk. In addition to carry, an asset may offer returns via its appreciation. This price appreciation can come in one of two ways: prices can rise after a recent fall (mean reversion) or after a recent gain (trend). To generate alpha, an investor needs a forward-looking view of the asset's carry and whether its price will mean-revert or trend. At Prometheus, we believe that macroeconomic forces dominate the intersection of these forces, determining whether carry, trend, or reversion will explain future returns.

Our research process is built around understanding these cause-and-effect relationships to create a dynamic exposure to carry, trend, and mean reversion based on macro conditions.

Given the “diversifier-first” nature of this program, we don’t want to structurally change the nature of the underlying assets, though significant amounts of timing from macro mean reversion and macro trend factors. Instead, we aim for the program not to incur substantial drag for negative carry and avoid outlier losses, while preserving its diversifying characteristics. This is particularly important given the negative carry of owning long-volatility exposures and the persistent bear market experienced by fixed-income markets since 2021.

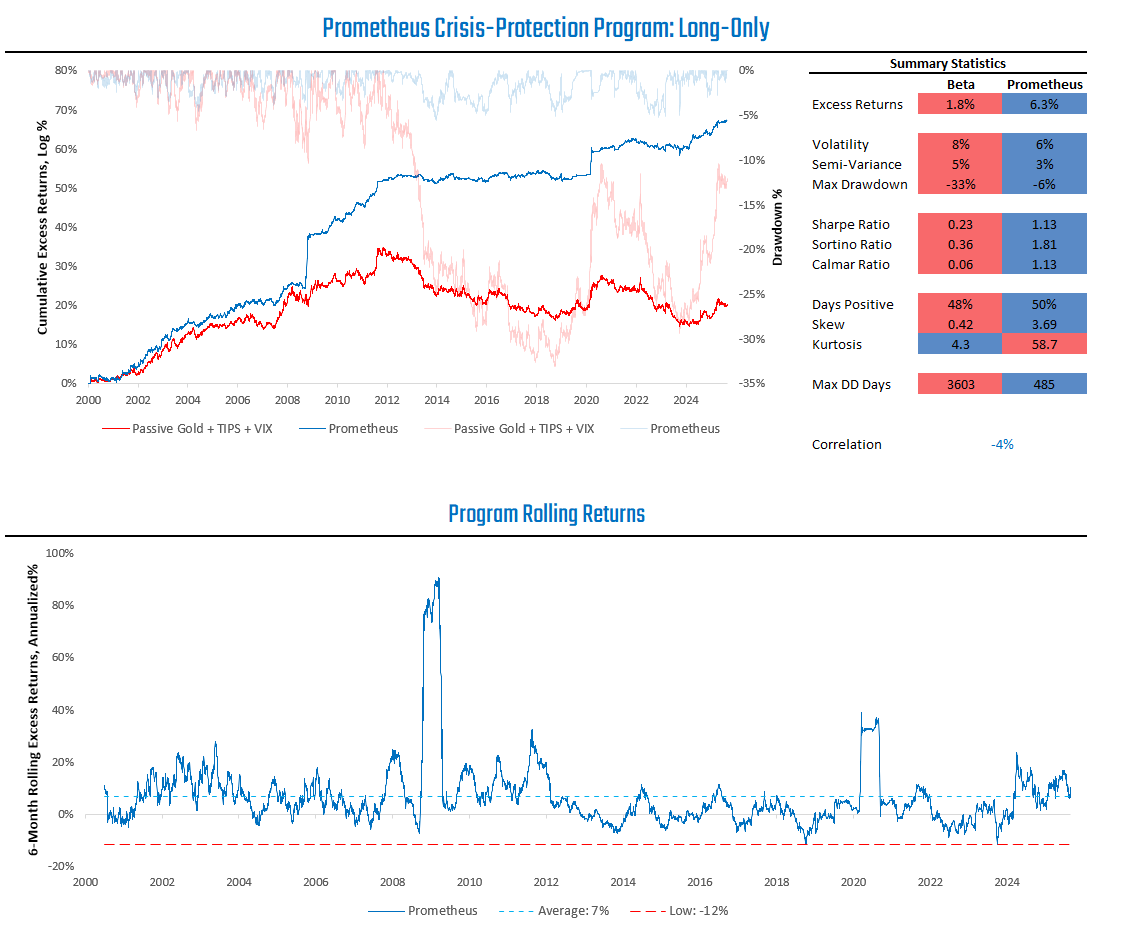

These objectives do not require a dramatic timing edge or significant turnover, but nonetheless, adjusting exposure based on evolving conditions with an emphasis on carry can have substantial positive effects, with modest turnover of about 200% annually. We illustrate this by comparing our actively managed Crisis Protection Program to a risk-parity weighted passive allocation to Gold, TIPS, and VIX Futures:

As we can see above, the Prometheus Crisis Protection Program significantly outperforms a passive mix of Gold, TIPS, and VIX.

Portfolio Risk Control

Risk control is an integral part of any portfolio construction process, with varying levels of complexity and dynamicism. When it comes to risk control for the Prometheus Crisis Protection Program, we opt for a dynamic risk profile that evolves based on the expected returns of the portfolio mix. There are two major drivers of this process:

Long Volatility, Prioritized: Long volatility strategies have two important features. First, they are only sporadically attractive to own, usually during or at the onset of a panic. Second, they are mechanically correlated to S&P 500 volatility. The combination of these features means that long volatility is an excellent hedge for equity exposure, but the hedge has a positive expected value during extremely short and concentrated periods. As such, a portfolio seeking to diversify equity risk should be cautious and attuned to any potential long volatility signals. Further, given the lack of activity of this sleeve over long periods, a program seeking to diversify equity downside risk should prioritize long volatility exposure in its risk budget during times when long volatility signals are triggered. Given these factors, the Prometheus Crisis Protection Program seeks to prioritize long volatility exposure when our signals trigger. During these times, the long volatility program will at maximum match the local level of S&P 500 volatility.

10% Maximum Volatility: When our long volatility signals are inactive, the portfolio will contain a mix of Gold, TIPS, and Cash. During these times, the Prometheus Crisis Protection Program will seek to have a maximum of 10% volatility, with risk moving dynamically under this threshold based upon the expected return landscape.

The combination of these two portfolio construction levers creates a portfolio that has a volatility of less than 10%, but during times of heightened equity market stress, it will operate at a level of risk consistent with the ongoing level of equity market volatility.

Applications: Three Options For Investors

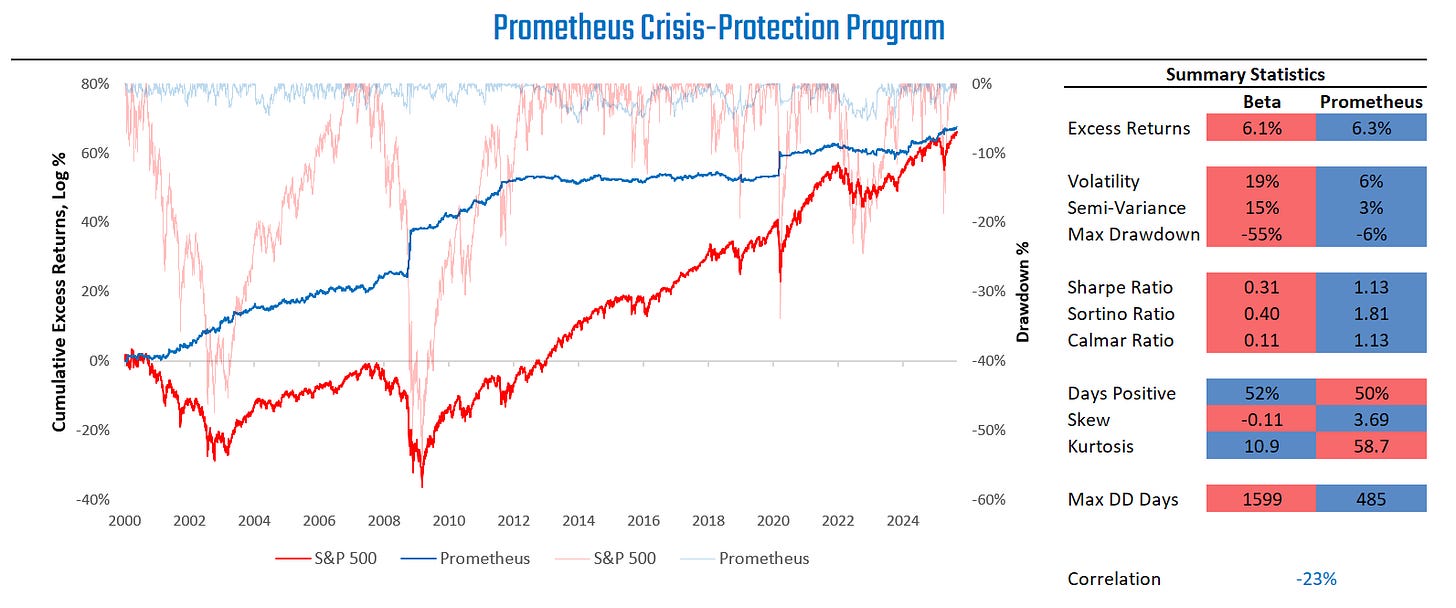

The approach we have described here drives the Prometheus Crisis Protection Program. With appropriate asset selection and modest beta timing, the program seeks to create a meaningful diversifier to equity downside risks. As always, we’ve carefully stress-tested by simulating this approach over time:

As we can see above, the program offers positive expected returns, with strong diversification characteristics. We can see these diversification characteristics when we look at the programs’ negative 23% correlation to the S&P 500. Furthermore, on equity market down-days, the program has a Sharpe Ratio of 2.0, offering a strong ballast during equity market downturns.

Now, given the explicit objective of being a diversifying exposure to equities, we don’t think this program is meant to be held on a standalone basis, but rather in conjunction with either passive or active equity exposure. We think there are three broad use-cases for this program:

Passive S&P 500 + Crisis Protection

Defence First

Prometheus S&P 500 Program Integration

We describe each of these applications individually.

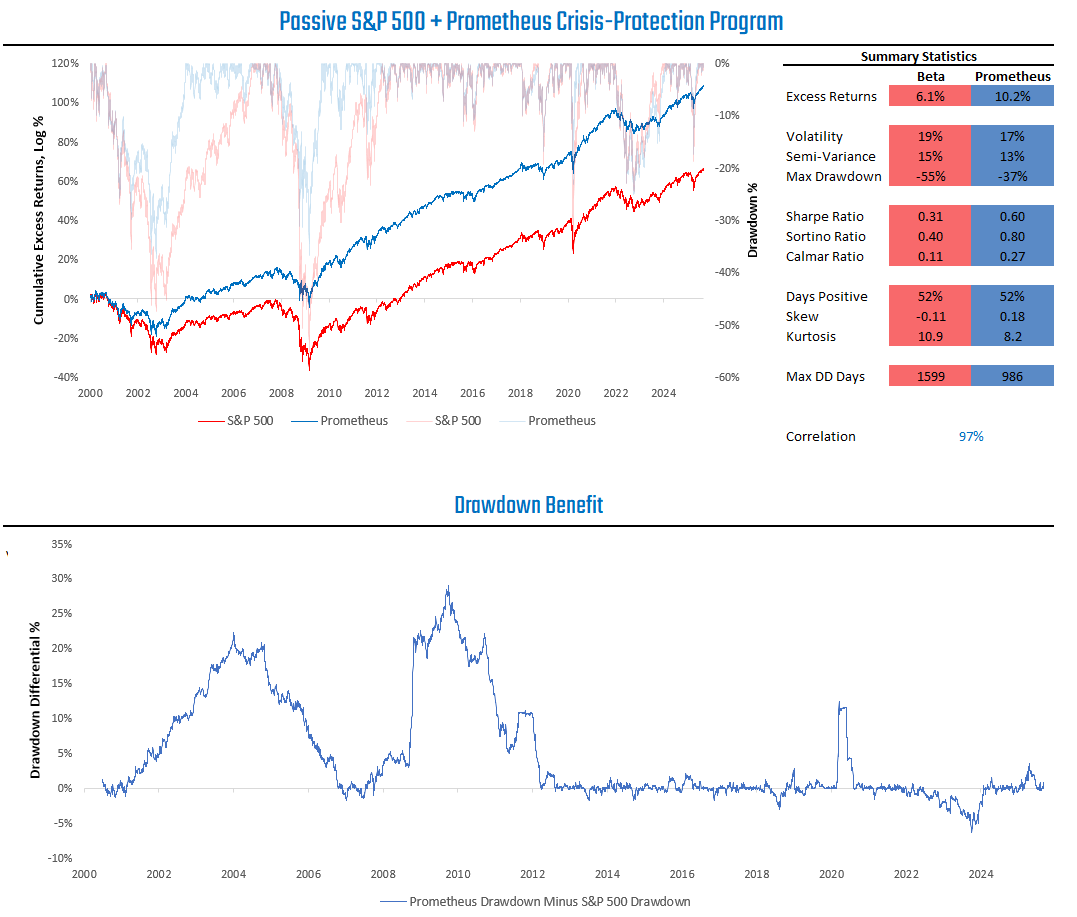

Passive S&P 500 + Crisis Protection

For a variety of reasons, many investors want to maintain passive exposure to the S&P 500. While we don’t think 100% passive exposure is optimal, it is often the reality of many investors. Given the diversifying characteristics of the Prometheus Crisis Protection Program, we think it can offer investors significant value by adding incremental returns and reducing drawdowns. This can be achieved through the use of leveraged ETFs or futures, which allow us to get access to capital-efficient exposure to the S&P 500 while freeing up capital to invest in the Prometheus Crisis Protection Program.

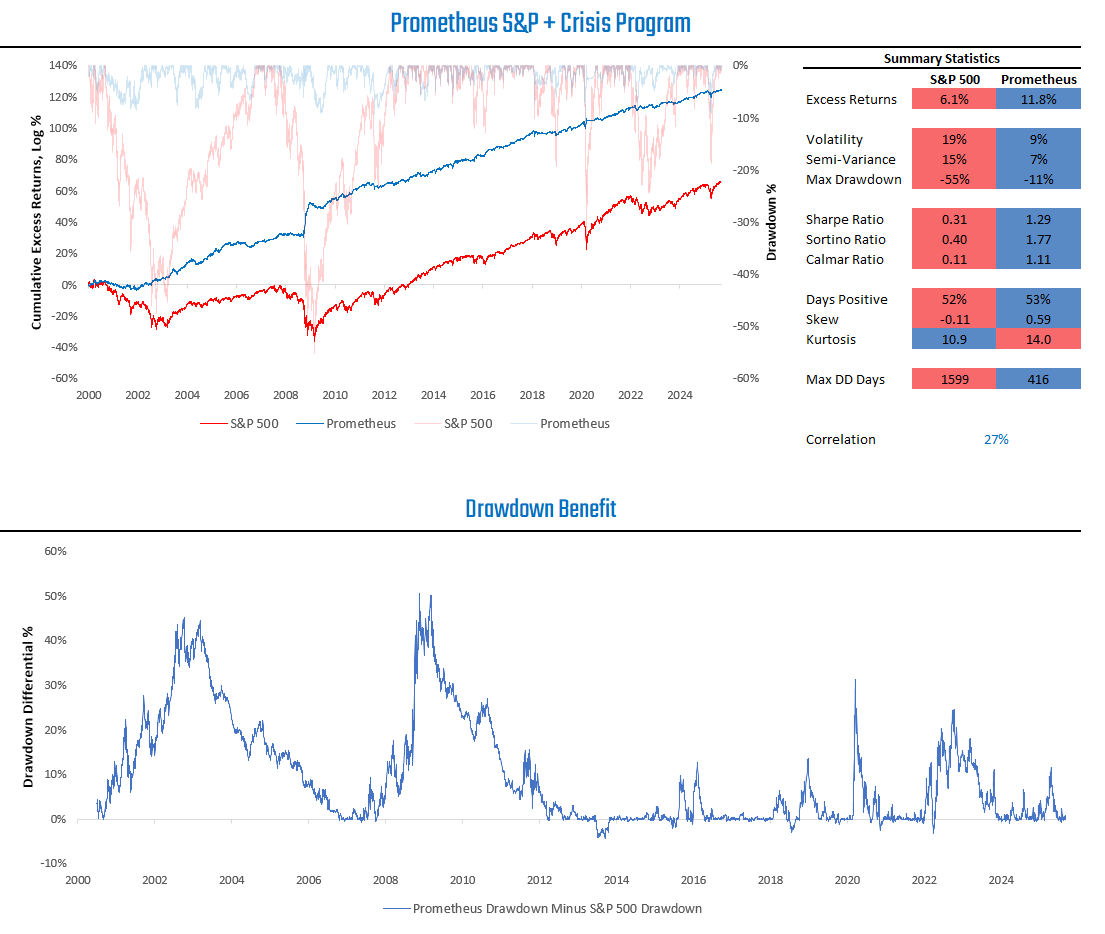

This can be implemented as follows: the S&P 500 3x leveraged ETF, SPXL, and allocate 30% of capital to this ETF. This provides us with 100% of S&P 500 exposure in excess of the risk-free rate plus a spread (0.30%). This leaves us with the remaining 70% of our capital to allocate to the Prometheus Crisis Protection Program. Below, we visualize the benefits of applying this approach versus passively investing in the S&P 500 alone:

As we can see above, using the Crisis Protection Program as an overlay for S&P 500 exposure allows an investor to achieve higher absolute returns, with lower risk and drawdowns. The drawdown benefits during periods of equity market stress are also significant, reducing maximum drawdowns consistently. For those limited by preference or circumstance in their active investing, this implementation method may be attractive.

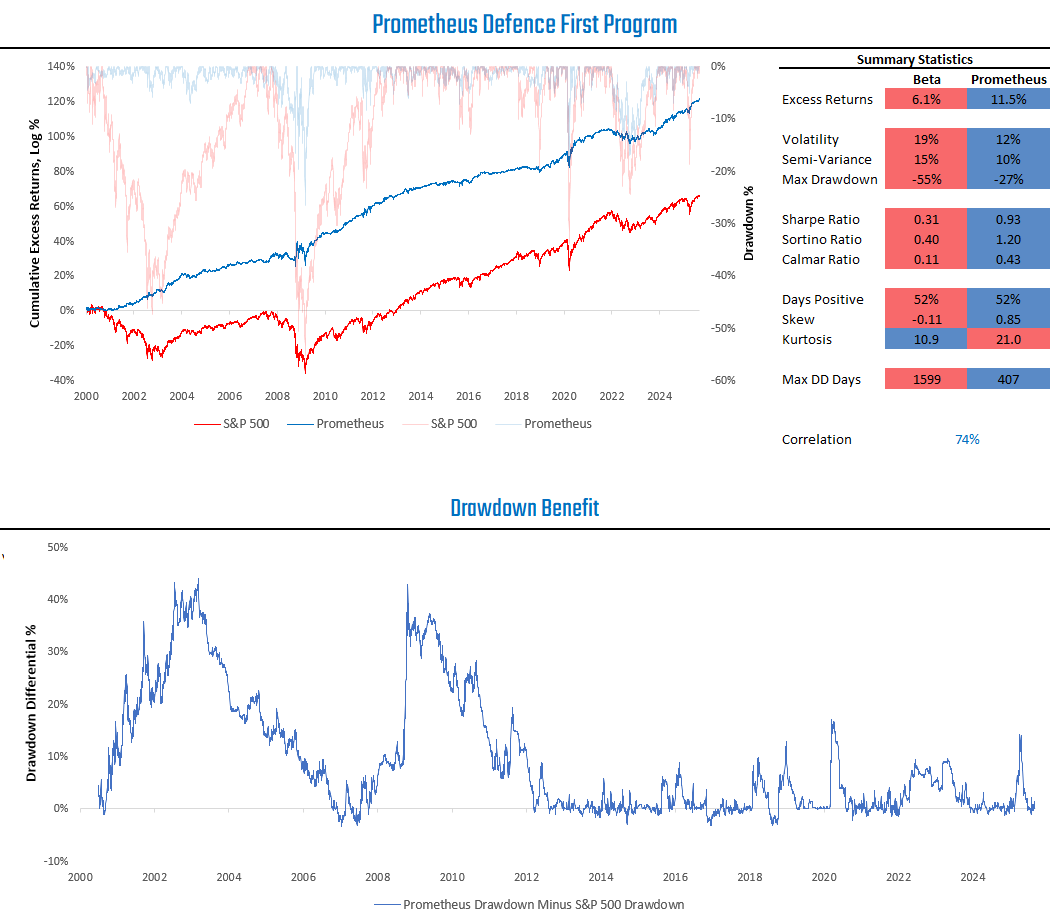

Defence First Program

Now, while a completely passive approach may be attractive to some, others may prefer a more active approach to investing. Enter our Defence First Program. Every week, our Crisis Protection Program chooses how much to allocate to Gold, TIPS, and VIX. However, there can often be large amounts of cash left over, as the reward-to-risk justifies taking less than 100% exposure. Given that these exposures are based upon signals to evaluate the attractiveness of holding equity diversifiers, the lack of signals to hold them may be interpreted as an indication to own equities. Therefore, we can take the cash holdings from our Prometheus Crisis Protection Program and invest in the S&P 500. We show the simulated performance profile of doing so:

The benefits of diversification show more significantly here as the Crisis Protection Program now has a much larger risk contribution to the total portfolio, enhancing diversification. As we can see above, this more active approach to managing equity market risk significantly improves both absolute returns, while also reducing risk and drawdowns.

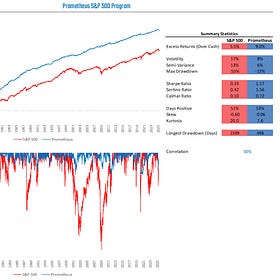

Prometheus S&P 500 Integration

Finally, for active investors, we can integrate the Prometheus Crisis Protection Program with the Prometheus S&P 500 Program. If you’re unfamiliar with this program, it is an active strategy that aims to outperform the S&P 500 over a full investment cycle. You can read the complete primer below:

Prometheus S&P 500 Program Primer

We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the official launch of our systematic Prometheus S&P 500 Program.

Integrating both programs creates a strong solution for active investors seeking to navigate equity market cycles. We visualize this below:

As we can see above, integrating the Crisis Protection Program into our Prometheus S&P 500 Program creates a strong risk-adjusted return profile, with limited drawdown. The program is suitable for investors comfortable with active, multi-asset long/short investing. For a sample of how we share this integrated portfolio, we recommend checking out the note below:

Prometheus S&P 500 Program

The Prometheus S&P 500 Program aims to outperform the S&P 500 over a full investment cycle. The program will aim to achieve this objective by leveraging a combination of Sector Selection, Beta Timing, Active Overlays, and Dynamic Risk Control.

Conclusions

The Prometheus Crisis Protection program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX. Our simulations and mechanical understanding show that the Prometheus Crisis Protection Program likely offers benefits to both passive and active investors. This program will be published every Monday between 3:30 and 4:00 PM ET, along with our Prometheus S&P 500 Program. We will also offer allocation from the integrated Prometheus S&P 500 + Crisos Protection Program in the same report. We continue on our journey of bringing the highest quality of institutional-grade macro investment research to everyday investors.

Until next time.

VIX and SJB are useful tools to hedge tail risk with; you'll in effect be paying a premium by holding them, but because of IV and OAS clustering, you don't have to hold too much of them to hedge some tail.

Solid write-up by the way.

Could you also share the rolling 260 returns of the Prometheus SP500 + Crisis Program integration?