The Prometheus S&P 500 Program aims to outperform the S&P 500 over a full investment cycle. The program will aim to achieve this objective by leveraging a combination of Sector Selection, Beta Timing, Active Overlays, and Dynamic Risk Control. Our S&P 500 Program can be integrated with our Crisis Protection Program, which seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX.

You can read the 27-page primer detailing the mechanics of our approach to our S&P 500 Program below:

Prometheus S&P 500 Program Primer

We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the official launch of our systematic Prometheus S&P 500 Program.

And the primer for our Crisis Protection Program as well:

Prometheus Crisis Protection Program

We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the launch of our systematic Prometheus Crisis Protection Program

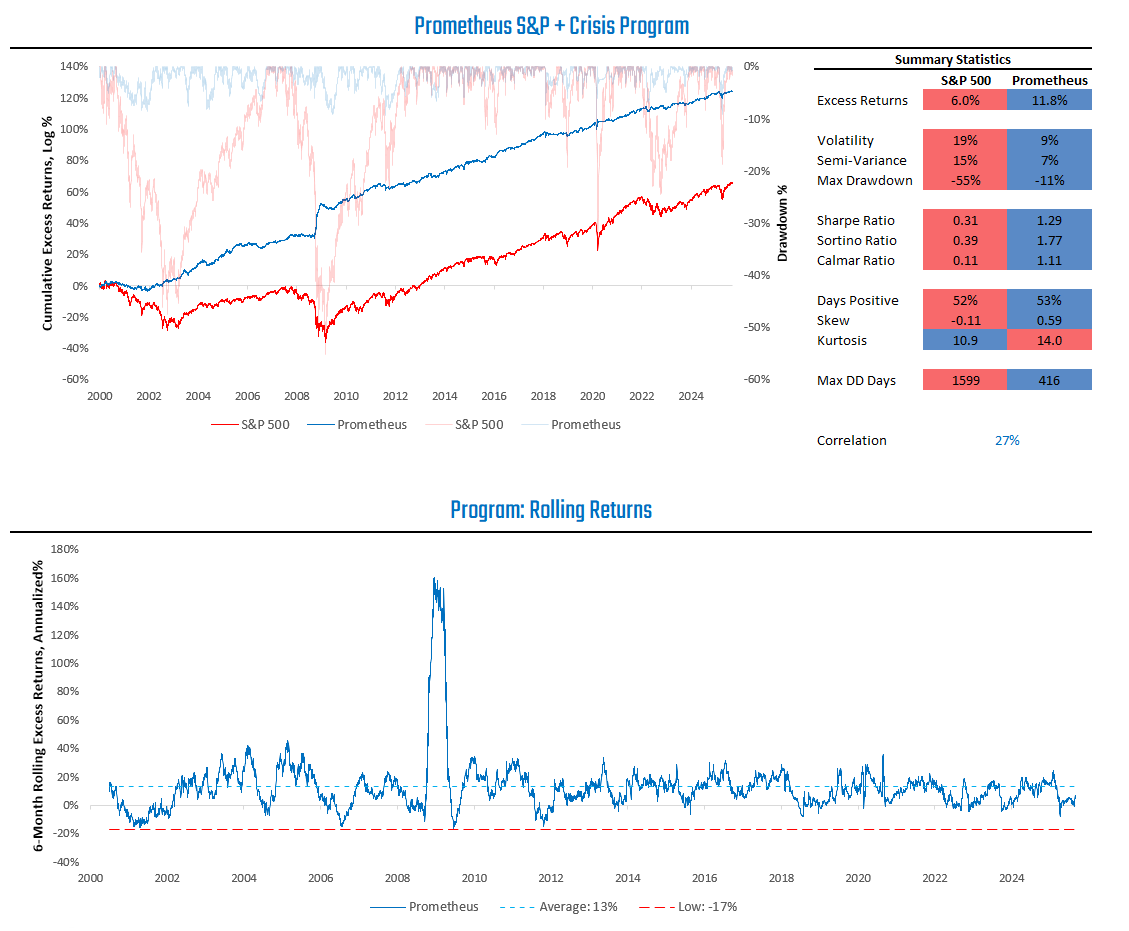

For reference, we visualize the simulated path of the integrated Prometheus S&P 500 + Crisis Protection Program below:

Today, this program continues to control the equity market drawdown using risk control measures. While the S&P 500 experienced a drawdown of 20% during the 2025 correction, the Prometheus S&P 500 Program never exceeded a 10% drawdown. Further, the program has maintained upside capture while maintaining these improved drawdown characteristics. Integrating our Crisis Protection Program has furthered those objectives.

Over the last week, our programs maintained moderate equity exposure, driven by an ongoing economic expansion, while also continuing to hold crisis protection assets. Our programs continue to stay the course.

Today, the S&P 500 Program is positioned as follows: