Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

On Monday, we released the complete primer for our Prometheus S&P 500 Program. In celebration of the program’s official launch, we are offering a one-time discount of 38% on our monthly price to annual subscribers. You can avail of this offer at the link below. The offer will expire very soon.

We’re not the type of company to constantly push sales and promotions on you, but if you've been part of Prometheus for a while or plan to stay for a while, this is the best deal we have ever offered, and we think you should take advantage of it if it suits your circumstances.

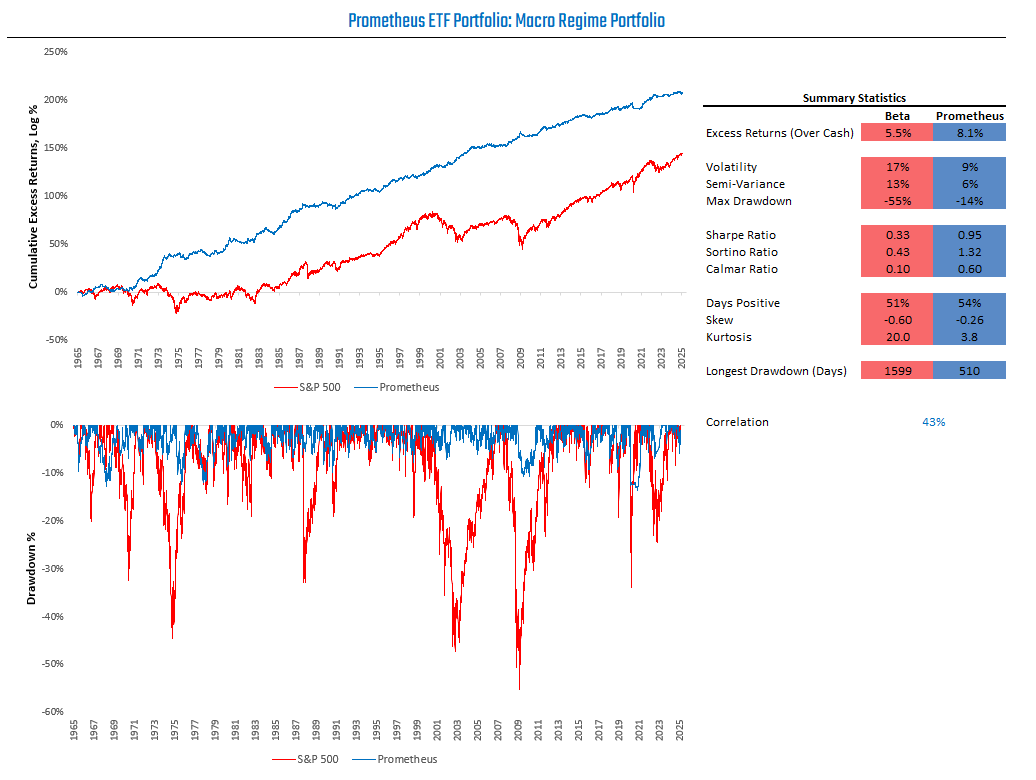

Back to Prometheus ETF Portfolio. We visualize the simulated return path for the program below:

Our observations are as follows:

The distribution of macroeconomic regime probabilities is now dominated by rising growth.

Our high-frequency tracking of macroeconomic fundamentals suggests low realized volatility in fundamental macroeconomic conditions, but high prospective volatility as indicated by markets.

Our systems take signals from markets and the economy to create a comprehensive, high-frequency macro view. Our risk management process continues to maintain low exposures to risk assets given elevated cross-asset risks.

Let's begin sharing the data that drives our current assessment of the macro regime and our subsequent risk management and positions.

Macro Regime Monitor

Our Macro Regime Monitors combine measures of macro trend, mean reversion, expected returns, and fundamental economic conditions to estimate tomorrow’s cross-asset, macro market environment. We recommend checking out the primer if you’re unfamiliar with these tools:

We share the latest readings below:

Our Macro Regime Monitors have now moved towards showing rising growth probabilities as the dominant regime. We visualize the expected return profiles that one can expect during this distribution of predicted regimes below:

A mix of stocks and commodities looks attractive in the near term.