This note is one typically reserved for clients of Prometheus Institutional. Occasionally, we make these notes available to augment our offering on Substack.

If you are a professional investor interested in access to our institutional work or want a copy of this note, email us at info@prometheus-research.com.

While an integral part of macro alpha is assessing short-term pricing of assets versus their fair value, an integral part of assessing medium-term asset trends is understanding the big-picture macro dynamics and whether they support ongoing market trends. The big picture assessment is a systematic tallying of three factors: the status of the business cycle, the tightness of output relative to capacity, and the extent of monetary policy pressures. These factors directly contribute to the sustainability of macro market trends across stocks, bonds, and commodities. We take stock of these factors through our systematic lenses to understand their implications for asset allocation.

Our assessment is as follows:

The business cycle continues to expand, monetary policy is stable, and output is neutral versus capacity.

The combination of these dynamics creates a steady-state backdrop where no asset class is exposed to a significant left-tailed loss environment.

These macro trends primarily support stocks, with modest support for bonds. Commodities continue to have mixed drivers due to the cross-currents created by tariff-front running.

While these dynamics support macro trends, these prospective trends must be weighed against asset pricing, which remains rich across stocks, bonds, and commodities.

Let's dive into the signals driving this assessment of conditions.

We begin with our signals for business cycle conditions. Our gauges aggregate leading measures of the business cycle to assess forward-looking pressures on corporate profits and economic growth. While the signal construction is proprietary, the causal linkages were outlined in a recent note, linked below:

Our gauges aggregate leading measures of the business cycle to assess forward-looking pressures on corporate profits and economic growth. We transform these gauges into proprietary tradable signals, which we visualize below:

Our latest readings suggest that business cycle conditions are favorable after a modest slowdown. We see positive readings across business cycle measures, with domestic investment rising, and households and the government adequately dissaving to support private surpluses. This dynamic supports equities relative to bonds. Next, we turn to monetary policy pressures:

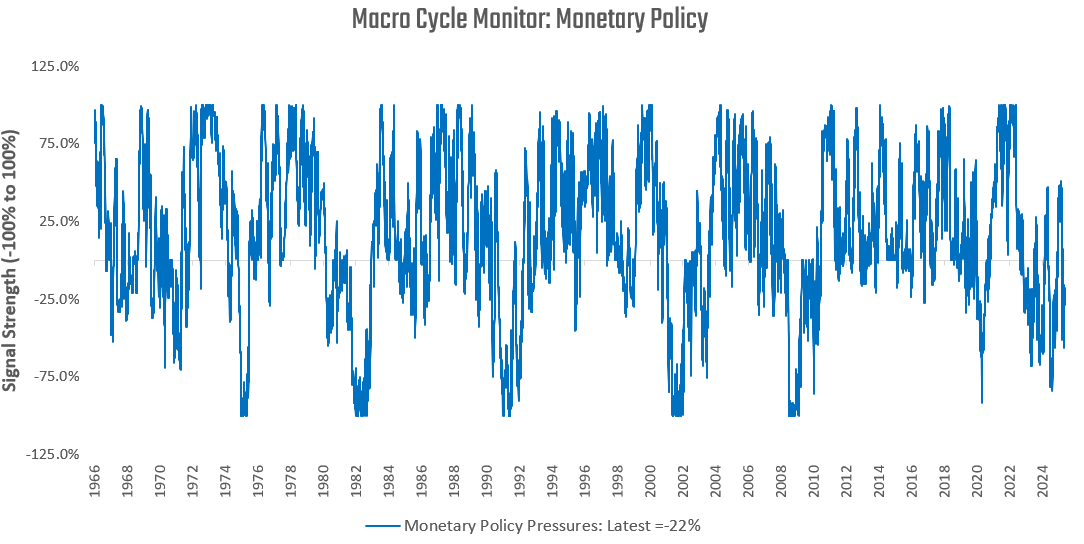

Our monetary policy gauges measure the pressures on the Federal Reserve to move monetary policy based on the tradeoff between growth and inflation data. The higher our readings, the more pressure there is to hike policy rates. The lower the gauge, the more pressure there is to cut policy rates. Our latest readings suggest there is modest pressure on the Fed to ease, based on deteriorating labor market conditions. This dynamic benefits stocks and bonds, which benefit from easier policy. Next, we turn to measures of economic tightness:

Above, we share our gauges of manufacturing tightness, which tell us whether the economy is running up on capacity constraints when its readings are high, or when there is a significant amount of economic slack when readings are low. Our latest readings show that the economy is mainly at a neutral state. These dynamics are neutral for all assets, but most likely to weigh on commodity prices, which perform their best when the economy is running hot. There remains considerable cross-currents for the manufacturing sector, which makes us neutral rather than bearish. We outlined these cross currents in a recent note for Prometheus Institutional clients:

Systematizing these concepts allows us to test their effectiveness over time. We visualise the improvement achieved by adding an active overlay to a passive beta portfolio based on these signals:

As we can see above, using our macro measures as an addition to a beta portfolio offers significant improvements, increasing gross returns while cutting drawdowns in half. Now, our various programs offer better return characteristics. As such, this note aims to discuss a single dimension of our process: the big picture macro cycle and how it can inform positioning today in a systematically validated manner. The purpose of this note is not to suggest specific strategies for the near term but to outline the big picture guardrails within which we can apply strategies.

To reiterate our assessment:

The business cycle continues to expand, monetary policy is stable, and output is neutral versus capacity.

The combination of these dynamics creates a steady-state backdrop where no asset class is exposed to a significant left-tailed loss environment.

These macro trends primarily support stocks, with modest support for bonds. Commodities continue to have mixed drivers due to the cross-currents created by tariff-front running.

Applying this assessment to asset allocation, we think a baseline portfolio skewed towards stocks will likely outperform a balanced portfolio of assets. However, these exposures must be managed tactically, as all assets are priced richly versus cash today. We visualize this below:

As we can see, the excess expected returns from carry across stocks, bonds, and commodities are all near zero. Given the current macro backdrop of an expanding business cycle, stable monetary policy pressures, and neutral capacity constraints, our primary preferences at this time would be to fade extremes across markets and look for attractive opportunities that align with the current macro cycle. Particularly, we would look to add equities on sharp sell-offs, fade extreme pricing of cuts or hikes in bond markets, and wait for better information on commodity fundamentals.

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.

Lovely context to better understand what's driving the model portfolios. Thanks!