This note is one reserved for clients of Prometheus Institutional. We share a short preview of the note to showcase our offering. Occasionally, we make these notes available to augment our offering on Substack.

If you are a professional investor interested in access to our institutional work or want a copy of this note, email us at info@prometheus-research.com.

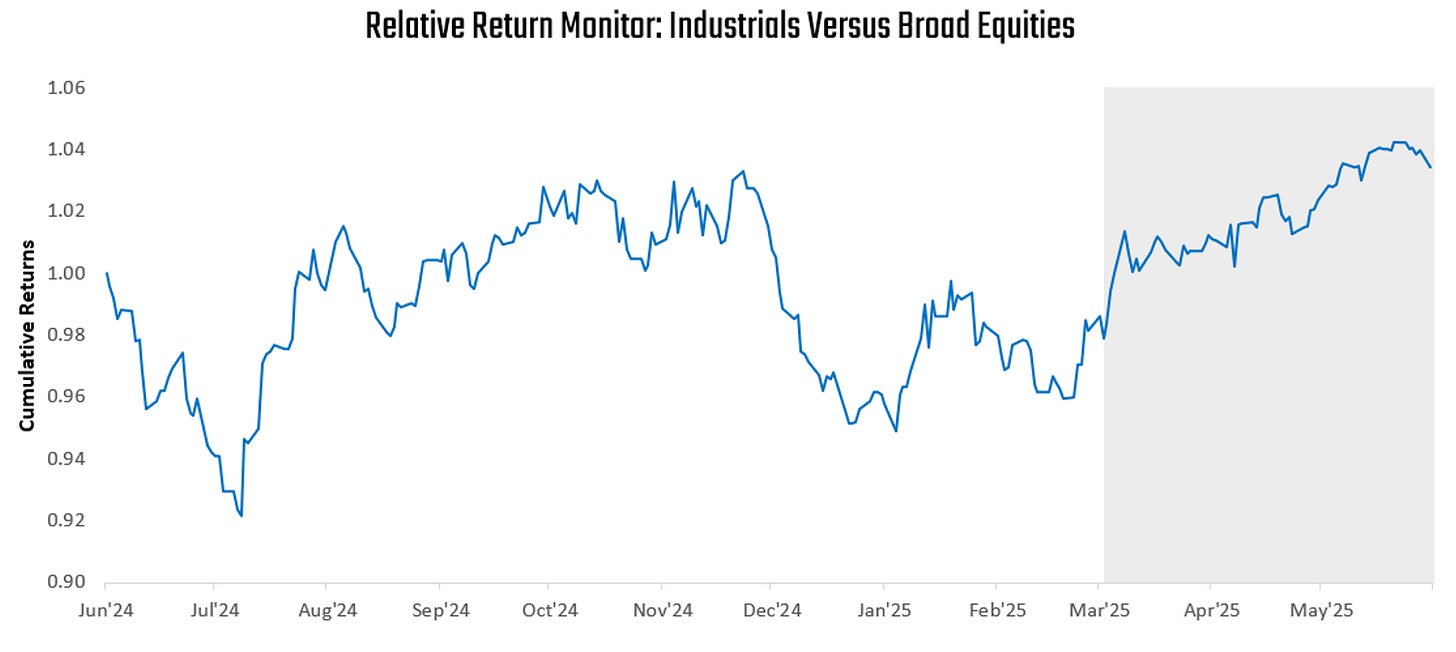

Industrial equities and commodities are significantly exposed to changes in the manufacturing cycle. Over the last few years, the manufacturing economy has been experiencing persistent and prolonged contraction. Recently, however, industrial equities have turned upwards, and measures of manufacturing activity have shown renewed positivity. We take stock of the factors driving these shifts to understand their durability.

Our assessment is as follows:

Manufacturing orders, sales, and output have not materially changed in their trends, though there has been considerable volatility due to tariff front-running.

Furthermore, despite significant news flow around re-shoring, we find negligible evidence of re-shoring efforts thus far.

Nonetheless, manufacturing firms have thus far been able to right-size their labor force, creating a more positive profit backdrop.

This increasingly positive profit backdrop continues to support industrial equities and commodities.

The manufacturing sector has experienced stronger economic conditions due to accommodative financial conditions, labor right-sizing, and tariff front-running. As tariff front running recedes, the recent improvement in conditions will likely slow, but underlying conditions remain marginally supportive for both industrial equities and broad commodities. In the pages that follow, we share the data driving this assessment.

If you are a professional investor interested in access to Prometheus Institutional or a copy of this note, email us at info@prometheus-research.com.