Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

The business cycle is the cyclical variation of economic growth over time, driven by changes in business conditions. These changes in business conditions are a function of current and expected income, which determine output and employment. Extremes in business cycle conditions create serial correlations in the economy and markets. Extremely strong business cycle conditions result in inflation, while extreme weakness in business cycles results in recession. These extreme environments are highly influential on market trends. As such, we think a consistent, comprehensive, and timely assessment of these dynamics is key to navigating market cycles. Our assessment is as follows:

Businesses’ investment has improved on a broad-based basis, broadening the support for profits.

Households and government spending dynamics continue to provide an undercurrent for profits.

Wages, spending, and production continue to support revenue growth.

The US economy remains in a business cycle expansion, which is supportive of stocks and commodities relative to bonds, conditional upon attractive pricing.

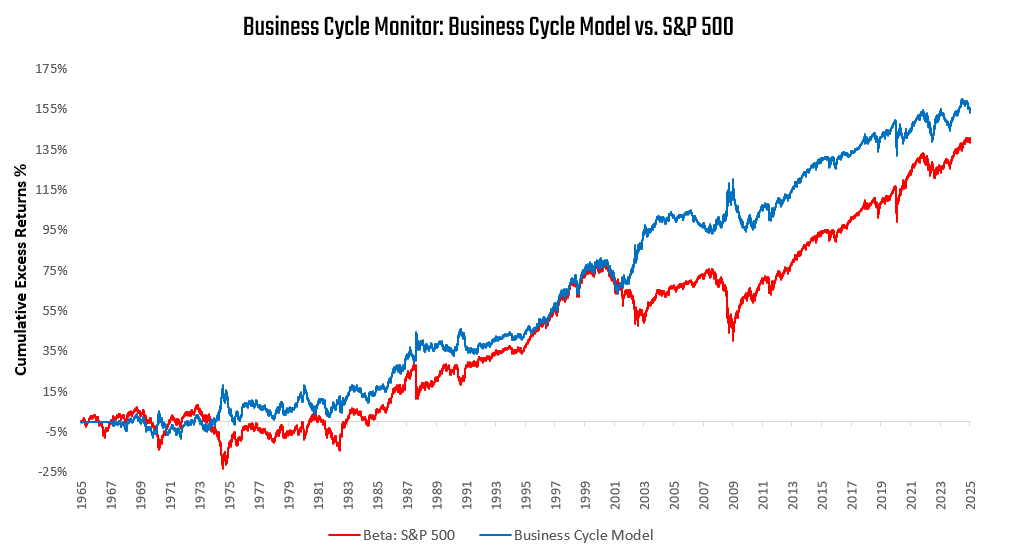

We begin by showing how applying these assessments systematically through our Business Cycle Model can meaningfully improve or add value to equity market exposure.

As we can see above, using our Business Cycle Model has been value-additive to equity market exposure. In this note, we evaluate the drivers of the business cycle that drive this strategy. We begin with the most important part of the business cycle: