The best information we can ever provide investors is the mechanics of how we think about macro conditions over time, rather than what we think about them at any particular time.

Consistent with this idea, we present our Macro Mechanics, a series of notes that describe our mechanical understanding of how the economy and markets work. These mechanics form the principles that guide the construction of our systematic investment strategies. We hope sharing these provides a deeper understanding of our approach and ongoing macro conditions.

Thus far in this series, we have covered a wide variety of topics, some of which we list below:

Thus far in our Macro Mechanics series, we have provided our understanding of the following subjects:

If you’re unfamiliar with our approach, we suggest checking out some of these notes, as they offer insight into our approach to markets. Let’s dive in.

A significant part of investing involves recognizing the risk of being wrong about one's portfolio positions, assessing the expected losses of those potential mistakes, and creating contingencies to protect against significant losses.

In our most recent Macro Mechanics note, we evaluated the risk of recession based on conflicting expansionary and contractionary forces in the economy. If you haven’t already read the note, we recommend doing so here:

Are We In A Recession?

The best information we can ever provide investors is the mechanics of how we think about macro conditions over time, rather than what we think about them at any particular time.

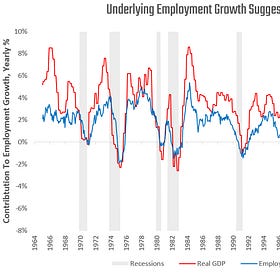

We assessed that we are not in a business cycle downturn, but immigration shifts put us at risk of an idiosyncratic downturn regardless.

Consistent with this assessment, our systematic programs have been biased towards long equity exposure this entire year, and remain biased in that direction. However, we have begun to see indications of a significant slowdown in the labor market. In the event that such a slowdown metastasizes into a sudden recession, it would put our current positions at risk of losses. However, our process is dynamic and likely to adapt to sudden recessionary pricing. We outline the likely path if indeed our current equity bias is wrong-sided.

We see two extremes in terms of how a potential labor-shock-induced recession may manifest:

A Rapid Sell-Off: These have become more typical since the GFC in 2008, lasting only a few months.

A Prolonged Bear-Market: A bear market of 6-18 months was more typical during recessionary events prior to 2008.

We believe there are three key levers to pull to mitigate losses across various potential equity-sell-off archetypes, even with a starting bias towards being long equities as the recession unfolds:

Diversification: Diversification is the gold standard for protecting a portfolio from large and persistent drawdowns. The key to protecting equity market downside is selecting assets that have a positive long-term expected return and are economically biased to outperform during environments where equities underperform. A mix of Gold and TIPS offers these characteristics over time. Nominal bonds may be considered as well, but they continue to face challenges in today’s more inflationary backdrop.

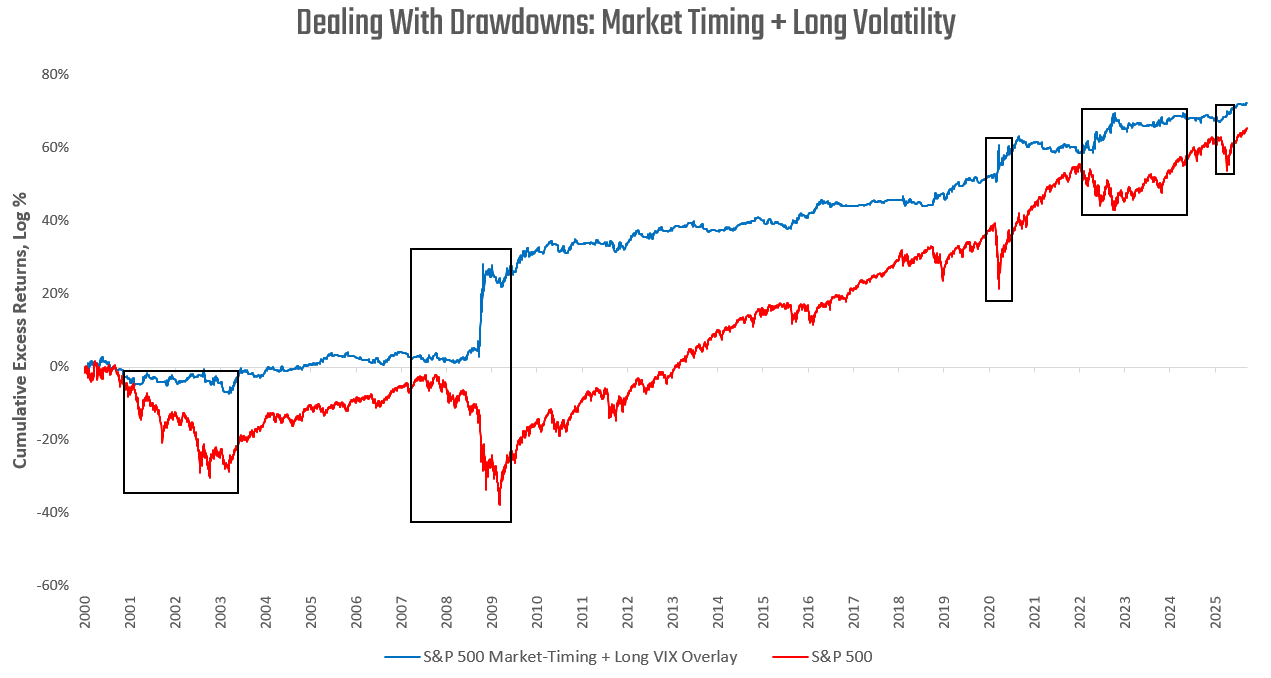

Crisis Protection: During rapid sell-offs, equity markets often fall precipitously due to idiosyncratic, non-business cycle phenomena. These types of sell-offs are usually a sign of significant financial stress, and can be seen in short-term funding spreads, extremely elevated local cross-asset volatility, and inverted volatility curves. During these brief but severe periods of stress, owning long volatility via VIX futures may offer significant rewards and hedge any equity market downside, particularly if your portfolio enters these periods with long equity exposures.

Market-Timing: When in a rapid sell-off or prolonged bear market, adding a layer of market timing on top of a fundamentals-based process is essential. During an actual recession and bear market, price-based measures of market trends are critical to mitigating and potentially benefiting from equity market downside. Even if your investment process did not predict an ongoing drawdown in equity markets, it is essential to recognize it and adjust risk shortly after it begins.

Combining these three levers, we think that an active investment process can significantly mitigate the impact of a recession-induced equity market drawdown. As ever, these insights are backed by our own systematic study and implementation of these mechanics. Given that holding gold and TIPs are mechanical benefits and require no active investing, we isolate our price-based market timing and long volatility exposure to show the empirical benefits of such an approach:

The above only isolates a small part of our process aimed at dealing with equity market downside; as such, it does not deal with upside capture optimally. Recall, the focus of this note is on minimizing downside capture with a starting bias of being long equities.

Thus, when we take a step back and evaluate our long equity exposure, in the face of potential risks coming from the labor market, we expect a combination of diversification and market timing to enable us to adapt well if the situation requires it. For now, we continue to see the business cycle as expanding, and are positioned accordingly across programs.

These concepts can be applied regardless of whether you’re following our systematic programs, but if you’re interested in a programmatic process that applies all these principles, you can check out our integrated Prometheus S&P 500 + Crisis Protection Program:

Until next time.

Love these breakdowns Aahan. Helps to better understand what drives the models and how we can be confident running modest risk at nominally high asset prices historically.