The best information we can ever provide investors is the mechanics of how we think about macro conditions over time, rather than what we think about them at any particular time.

Consistent with this idea, we present our Macro Mechanics, a series of notes that describe our mechanical understanding of how the economy and markets work. These mechanics form the principles that guide the construction of our systematic investment strategies. We hope sharing these provides a deeper understanding of our approach and ongoing macro conditions.

Thus far in this series, we have covered a wide variety of topics, some of which we list below:

Thus far in our Macro Mechanics series, we have provided our understanding of the following subjects:

If you’re unfamiliar with our approach, we suggest checking out some of these notes, as they offer insight into our approach to markets. Let’s dive in.

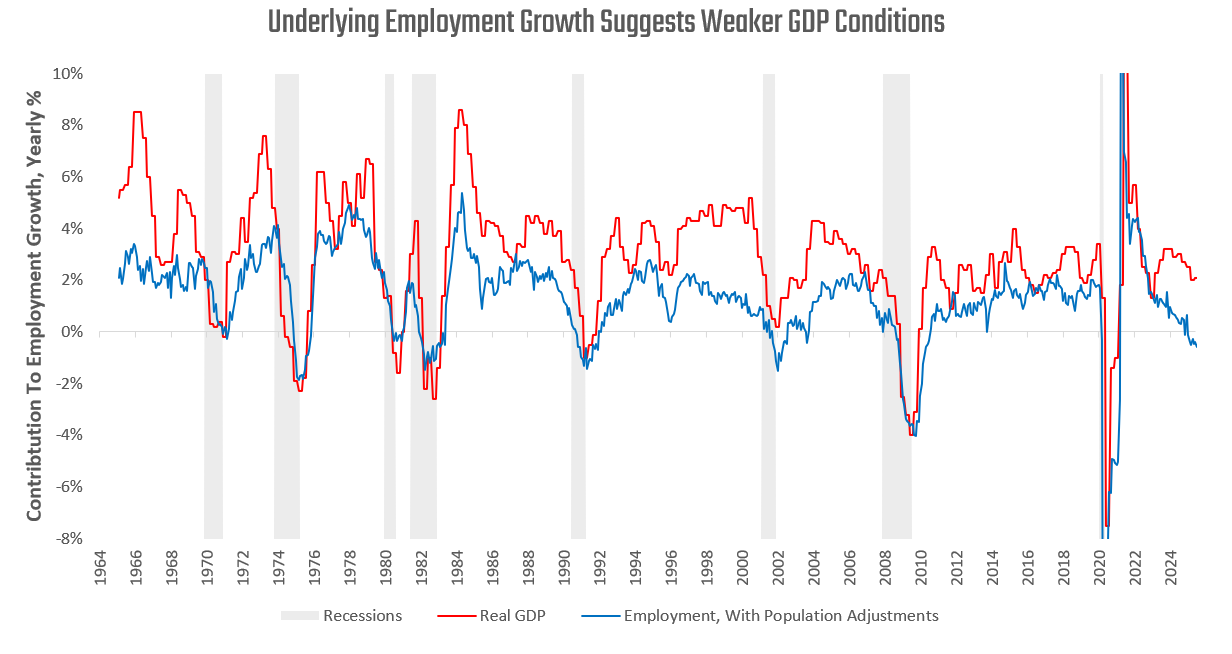

The US labor market is showing signs that are typically consistent with recessions— declining employment, rising unemployment, and cyclical weakness. Yet, nominal and real GDP conditions continue to remain positive, corporate earnings continue to expand, and risk assets stay within range of all-time highs. This constellation of macroeconomic conditions is largely inconsistent with the historical template of cause-and-effect linkages that have driven recessions through history. However, it is crucial to recognize that all recessions are driven and defined by a contraction of the labor market. As such, we think it is essential for investors to work through the mechanics of a recessionary process to contextualize today’s dynamics.

We start by outlining a typical recession process. For a detailed note on recession mechanics, we highly recommend reading our prior note describing recessions:

A business cycle recession typically begins with a tightening of financial conditions. This tightening of financial conditions elicits a drag on investment in the real economy. Over time, the dominant driver of corporate profits at the macro level is businesses’ own investment. With a prolonged decline in this investment, business profits begin to slow. This adverse chain of events is not experienced by the entire economy homogenously, but rather impacts industries with capital intensity much more so than others. These industries, if placed under enough pressure, begin to lay off their employees, but this does not cement the recession process in itself. For a recessionary spiral to start, the size of the layoffs needs to be adequate to put pressure on other areas of the economy, beyond those feeling the direct effects of declining investment levels. Once this pressure turns into economy-wide firing, due to declining economy-wide activity, it manifests primarily via rising unemployment rates for a given level of labor force participation and population growth. When rising unemployment drives a decline in employment alongside falling output, the recessionary process is underway.

Today, we have the unique circumstance in which financial conditions are loose, real investment conditions are mixed, corporate profits are elevated, and yet, employment has begun to show meaningful indications of weakness. In particular, both the household and establishment surveys have begun to show significant weakness. The household survey, in particular, shows signs that are consistent with the onset of a recession. Therefore, the question before investors today is: Can we have a recession without the typical sequence of events that define a business cycle downturn?

We believe the answers likely lie in understanding what is driving the current weakness in employment growth. When we triangulate across data, we see the following:

Slowing population and participation rates are driving weaker employment growth, not the rising unemployment rates.

Cyclical job sectors (manufacturing, construction, trade) have begun to see declining jobs, but the weakness is still small versus other sectors.

The combination of these labor conditions is indicative of a weak labor market environment, but the weakness is not business-cycle induced. In contrast to the labor data:

Consumer spending continues at a strong pace.

Business investment is positive but mixed. Industrial & construction activities are harmful, but information and intellectual property investments are very elevated.

The combination of these spending conditions suggests a mixed backdrop for the primary sources of corporate profits.

Therefore, we think that a case can be made for a slowing of the business cycle, but not a contraction of the business cycle. Furthermore, the weakness in the labor market is not driven by cyclical weakness— but rather by an immigration shift, changing both the pace and composition of labor market growth.

This backdrop warrants significant caution. While spending and income may well result in a positive profit backdrop, economic activity remains centered around the labor force. Regardless of whether the economy follows the archetypal business cycle template, the weakness of the labor market is noteworthy and concerning. For now, this weakness is not enough to create a self-reinforcing downwards spiral because we have yet to see adverse profit conditions. As such, we continue to view the business cycle as an expanding one, but one that’s at risk due to a labor force contraction.

We believe that navigating these dynamics effectively requires a combination of active investment strategies and diversification to protect the potential downside for risk assets. In an environment that is anomalous relative to most of history, we think diversifying against downside equity risk is imperative. In that spirit, we released our Crisis Protection Program. The Prometheus Crisis Protection program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX. You can read all about it here:

Until next time.