Welcome to the Prometheus ETF Program. The Prometheus ETF Program aims to allow everyday investors to access an investment solution that combines active macro alpha and strict risk control, all in an easy-to-follow solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We offer this in a highly accessible package, rotating between four highly liquid ETFs that are readily available to any investor with a brokerage account.

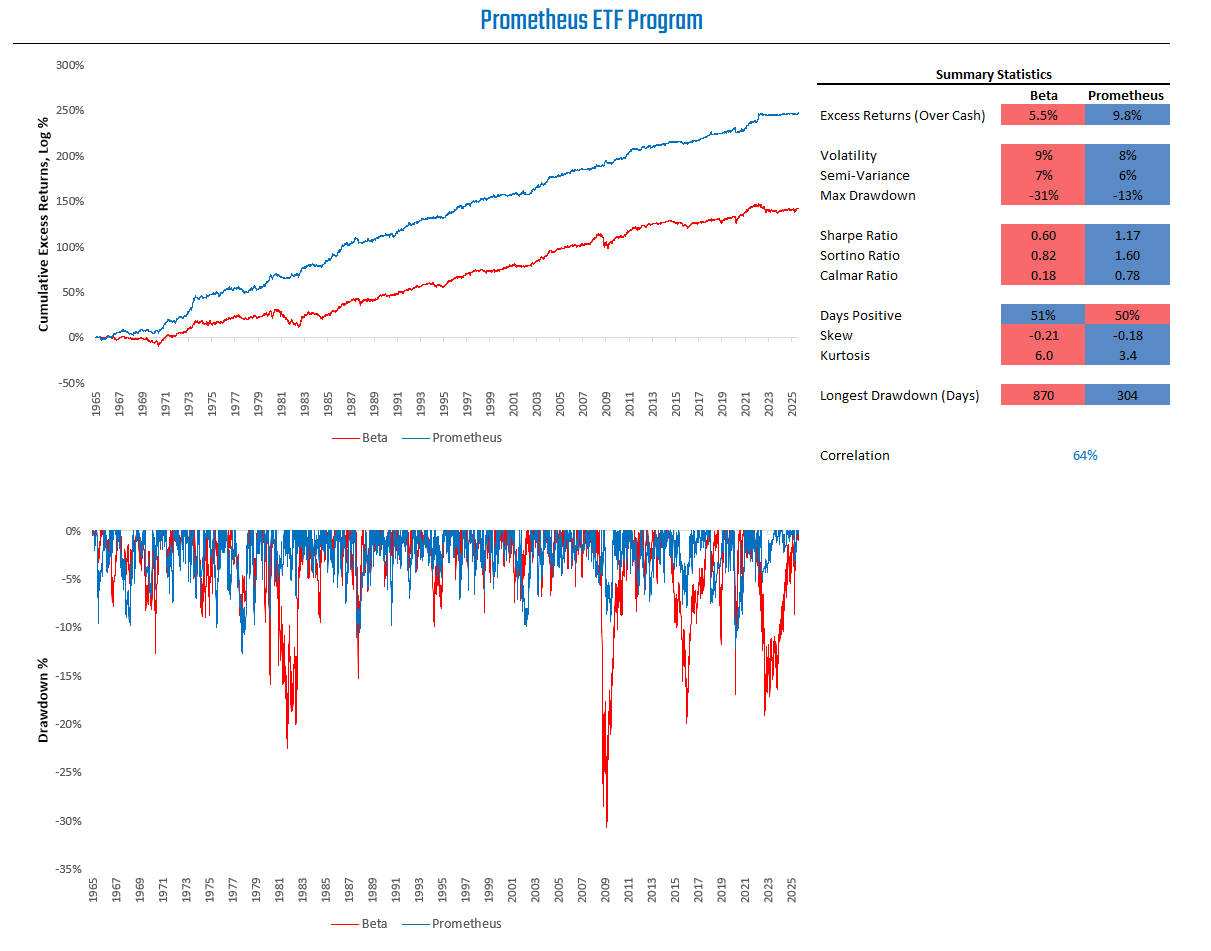

We visualize the simulated return path for the program below:

To complement this offering, we recently released our Crisis Protection Program. The Prometheus Crisis Protection program seeks to offer a portfolio diversifier during periods of economic and financial instability by blending active, long-only exposure to Gold, TIPS, and VIX. The program is designed to have minimal turnover, barring crisis periods, and is meant to be a portable solution for both active and passive equity market investors. With an average Sharpe Ratio of 2.0 during days when the equity market declines, we expect the Prometheus Crisis Protection Program to offer a valuable addition to investor portfolios.

You can read the full primer here as well:

Back to our ETF Program. Our observations are as follows:

Macro assets are experiencing strong upward trends, with trends led by stocks and gold.

The business cycle remains in an expansion, there is modest pressure on the Fed to ease monetary policy, and capacity utilization remains muted.

Our forward-looking macro regime probabilities show a dominance of rising growth outcomes.

A procyclical asset allocation remains appropriate.

Let’s begin sharing the data that drives our current assessment of the macro regime and our subsequent risk management and positions.

Macro Trend Monitors

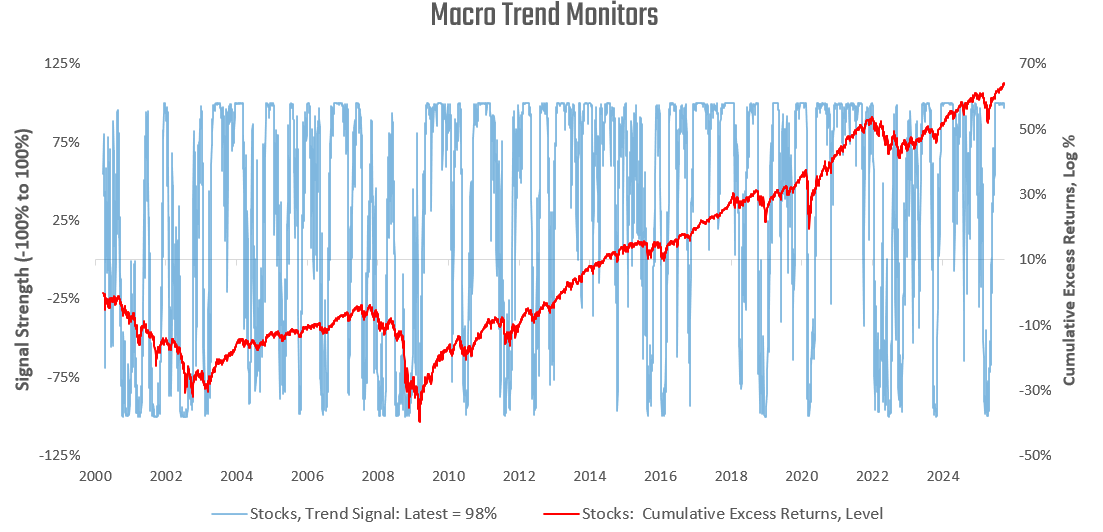

Asset prices in aggregate reflect changes in conditions relative to expectations. As such, carefully monitoring macro market trends is an integral part of evaluating conditions in the macroeconomy. To do this, we use our macro trend monitors, which we share here. We begin with stocks:

Equities continue to show extremely strong trend signals. Next, we turn to bond market trends:

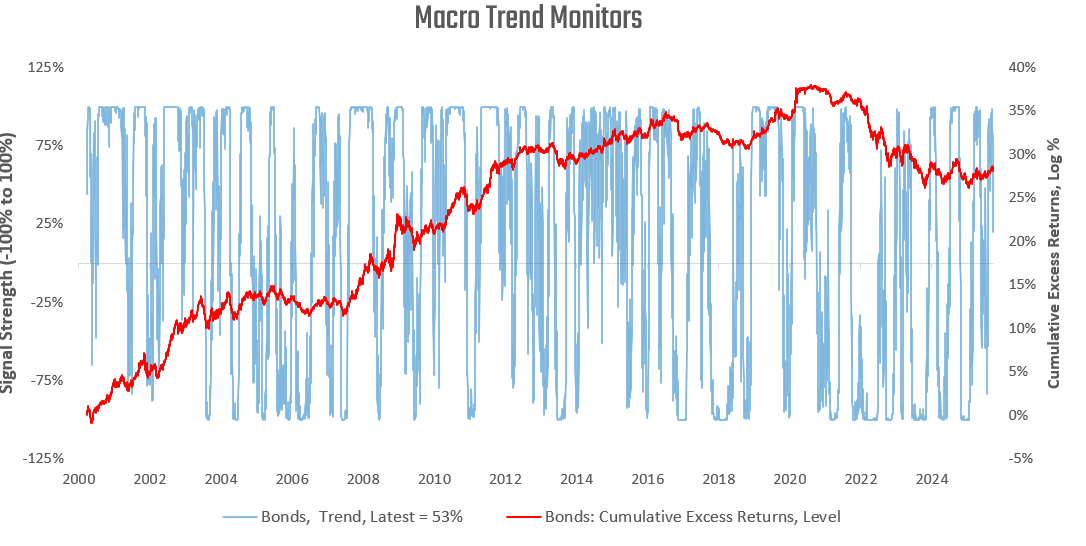

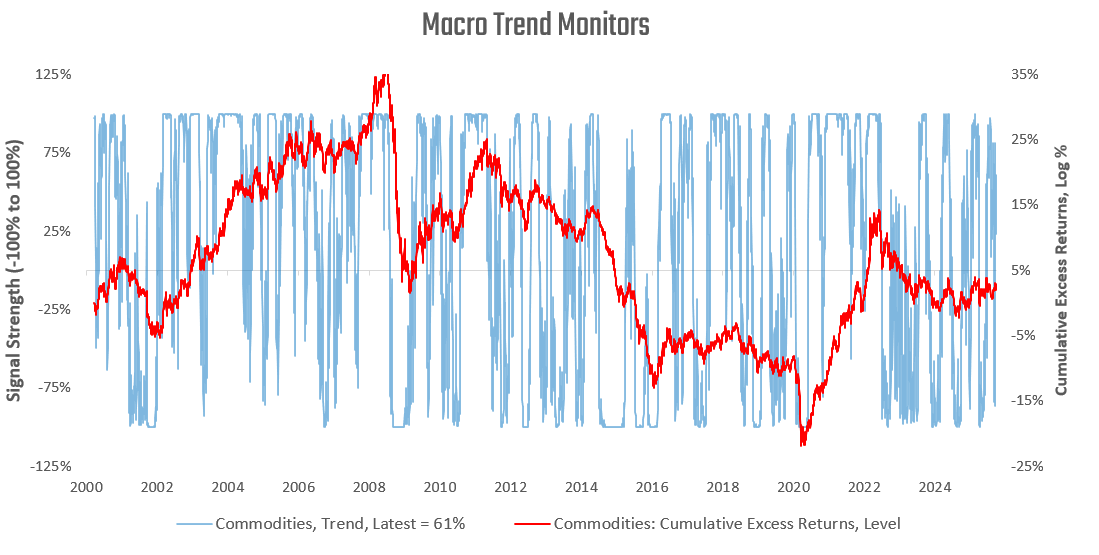

Bond market trends are moderately positive. We now move on to broad commodity aggregates:

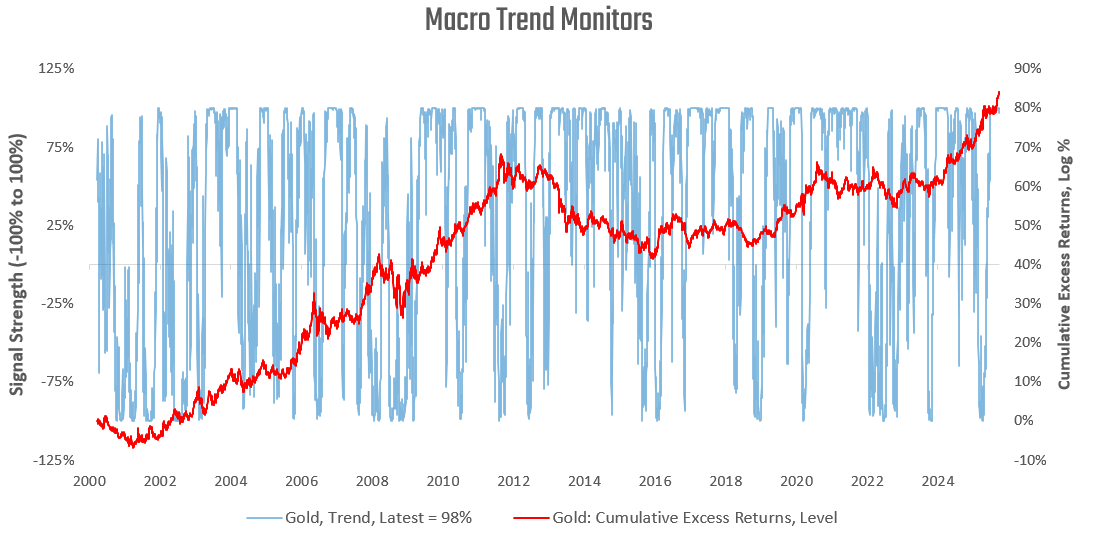

Commodity trends show modest strength. Finally, we examine our macro trend signals for gold:

Our trend signals continue to show robust trends in gold. Assets in aggregate are experiencing strong upward trends, suggesting stable financial conditions and moderate macro volatility.

Macro Cycle Monitor

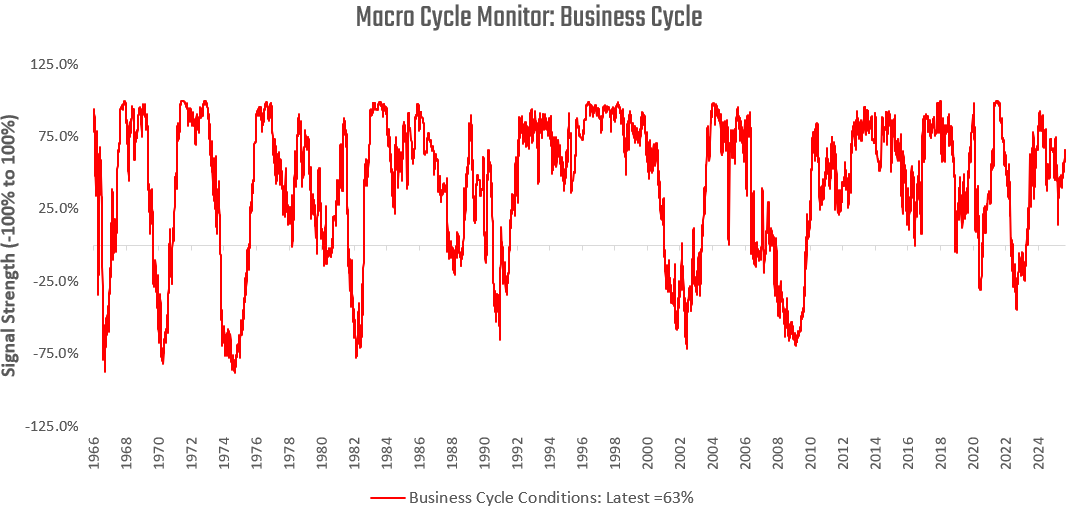

Our systems aggregate a wide variety of fundamental economic data to create timely proprietary estimates for the current stages of the macro cycle. We share some of these gauges, starting with our signals for business cycle conditions:

Our latest readings continue to show consistent signs of an expanding business cycle. Next, we turn to monetary policy pressures. Our monetary policy gauges measure the pressures on the Federal Reserve to move monetary policy based on the trade-off between growth and inflation data. The higher our readings, the more pressure there is to hike policy rates. The lower the gauge, the more pressure there is to cut policy rates.