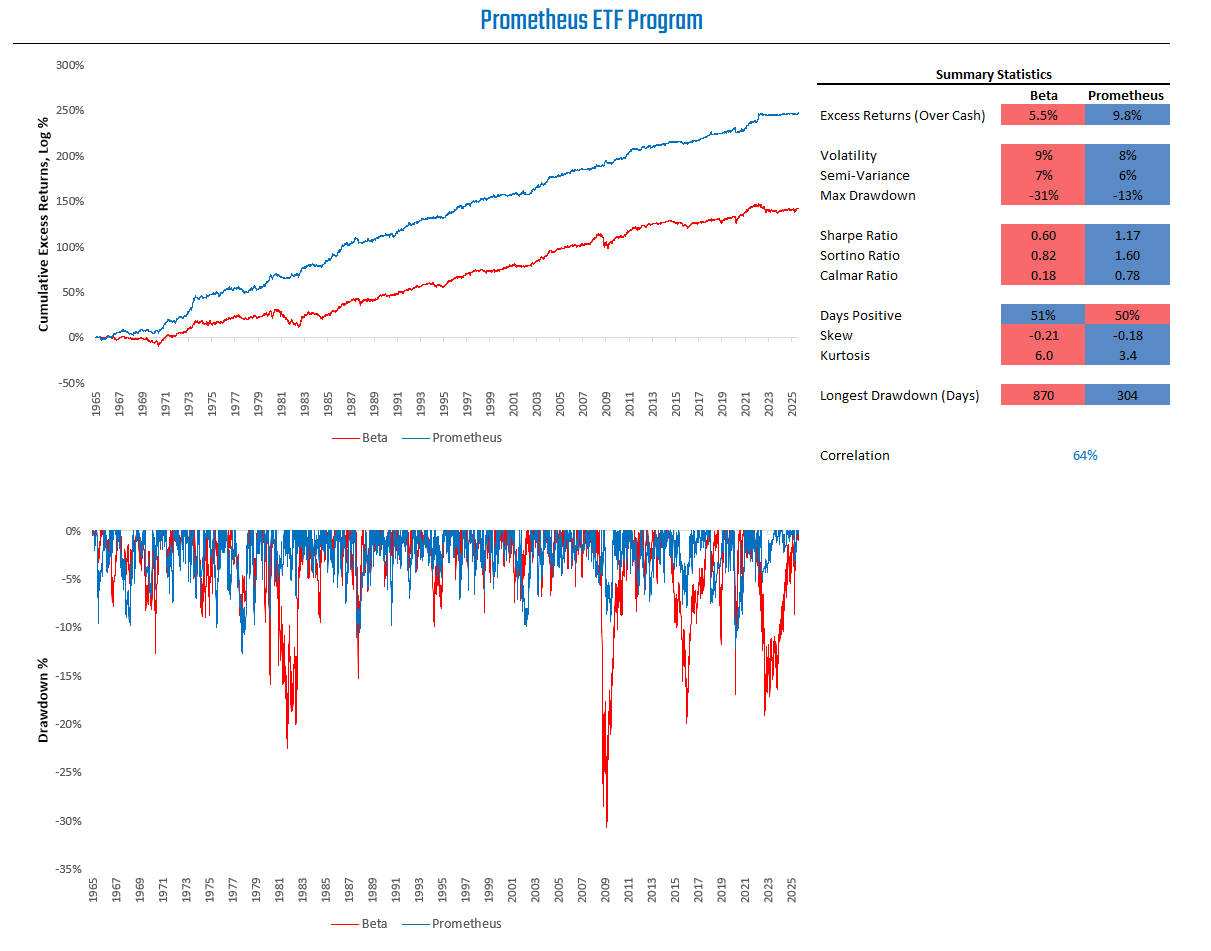

Welcome to the ETF Program. The ETF Program is an investment program that combines active macro alpha and strict risk control, all in an easy-to-follow solution for individual investors.

We visualize the simulated return path for the program below:

We will have an abridged note today as the team enjoys the Thanksgiving break. We’ll be back at it, firing on all cylinders, starting next week. To today’s note.

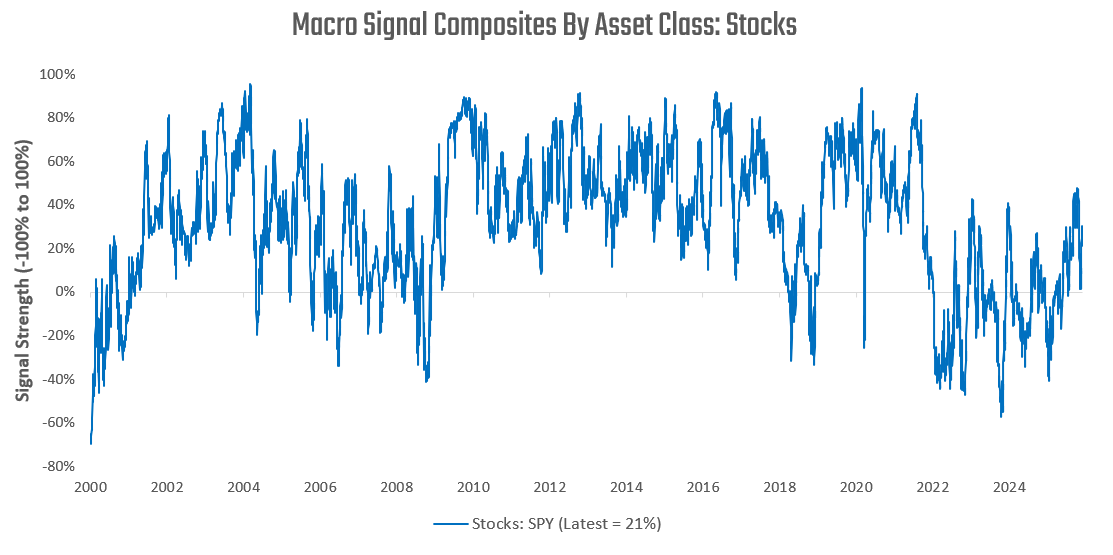

Macro Signal Composites

Using the macro cycle gauges, adding asset-specific factors, and leveraging carry, trend, and reversion, we can create asset-class-specific composite signals. We share these signals below and their latest readings. These signals are proportional to our conviction for a given asset and are directly tradeable. We begin with our stock signals for SPY:

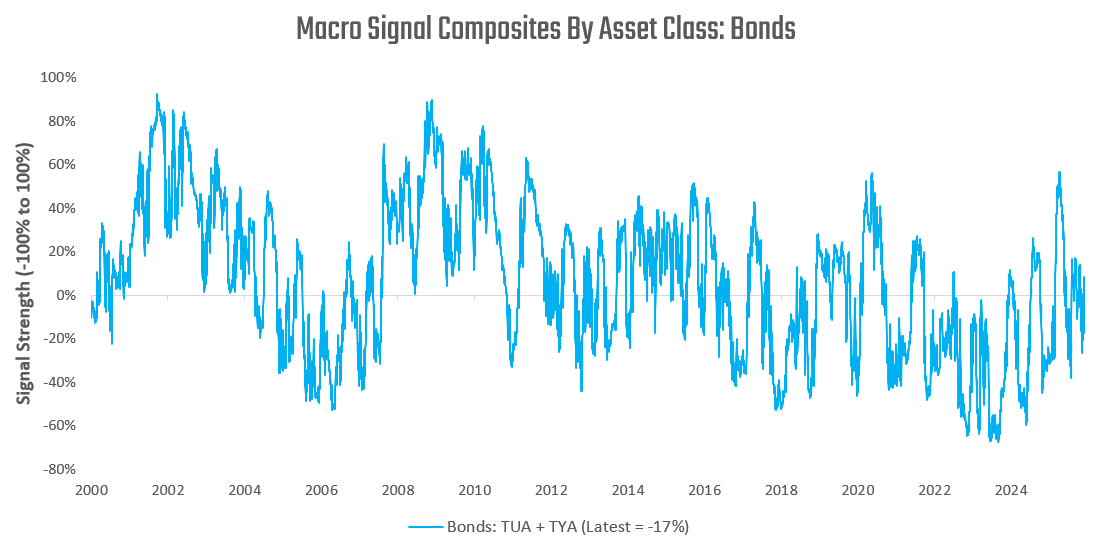

Equities continue to present a moderately positive signal strength, supporting moderate exposure. Next, we turn to our bond signals for an equal-weighted blend of TUA and TYA:

Bond markets continue to see weak signal strength as markets wrestle with policy normalisation amidst strong economic growth.

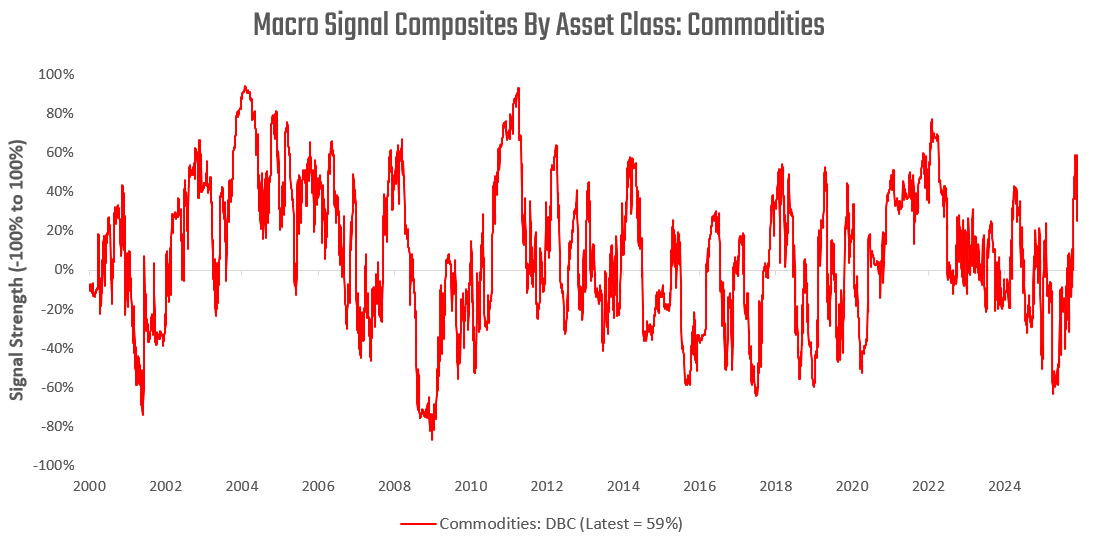

Finally, we share our signals for commodities in the form of DBC:

Commodity markets have begun to trend higher, with industrial conditions supporting these price trends.

Portfolio Construction

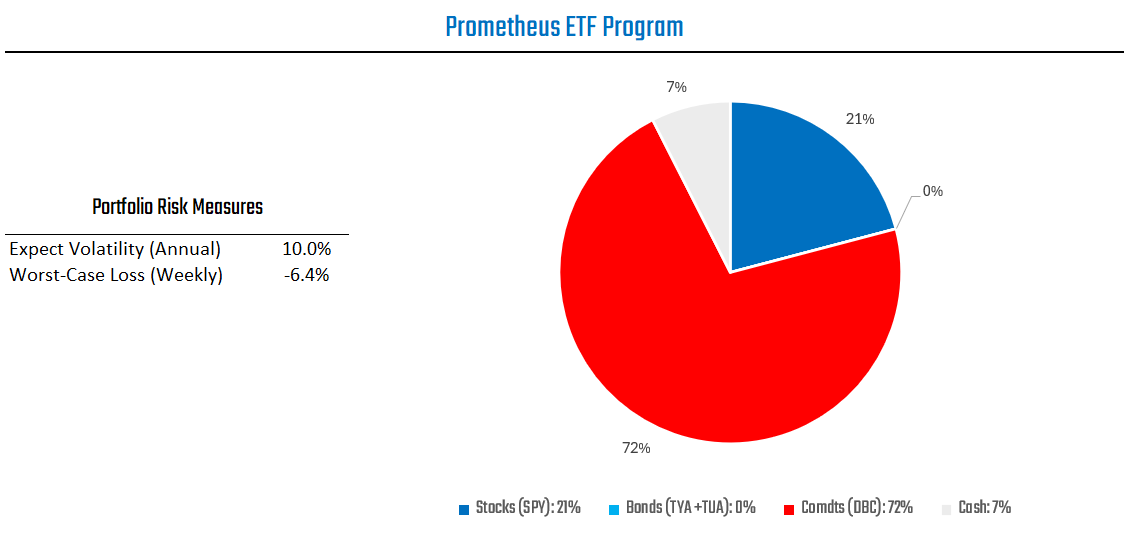

Aggregating our previously described measures, our systems are looking to position the Prometheus ETF Program as follows:

The ETF Program currently has an expected volatility of 10%, with a maximum of 10%. In an outlier event, our estimate for a worst-case loss at the portfolio level over the next week is -6.4%.

Commodity trends have begun to rise, with industrial activity continuing to look like a recovery from an expansion. Trend strength across the commodity complex has solidified, suggesting increased cyclical activity. As such, our programs continue to allocate to commodities. Equity positions remain significant as well, and we remain in an economic expansion. Given the risks we have highlighted recently (link here) to the equity market and its correlation to commodities via growth expectations, considering an allocation to our Crisis Protection Program and its variations may be valuable.

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.

With the ETF portfolio at 7% cash and S&P Program at 18% cash, is allocating only the S&P Program's cash portion into Crisis Protection sufficient? I know you had guided ~30% of AUM as a reasonable Crisis Protection target before, which was met in the past but is no longer.