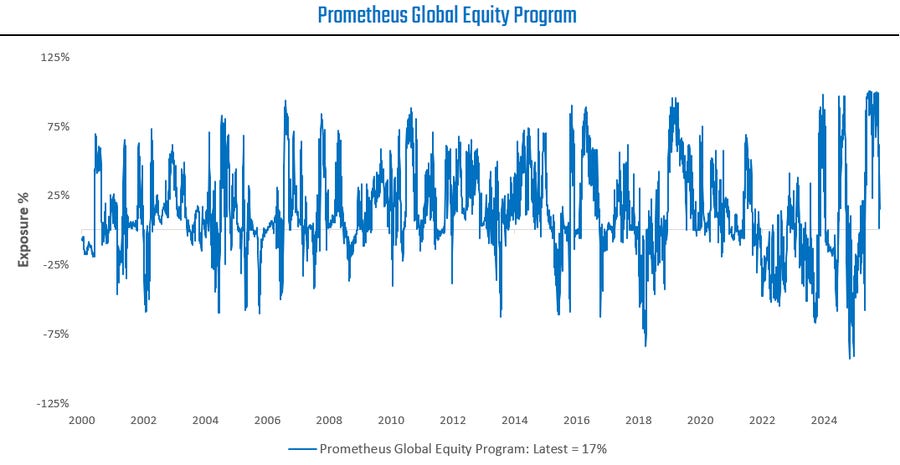

The Prometheus Multi-Strategy has gone from maximum long equity exposure to running a negative equity beta this week. Our programs have been maxed out because the economy has consistently beaten expectations. That phase may be ending. We evaluate.

The forces behind the reflation—strong households and AI capex—now face a labor-market drag that’s hard to ignore. The issue isn’t that growth is about to collapse. It’s that pricing has moved beyond what the economy can deliver.

This reflation came after a tariff-driven growth scare, when the economy surprised to the upside and markets had to reprice that strength. In that environment, the data consistently exceeded expectations baked into markets.

Two clear engines powered the entire reflation trade:

Stable, resilient household incomes and spending

A massive AI capex boom that offset traditional cyclical weakness

Together, they produced growth far stronger than markets expected after the tariff scare.

That outperformance created a clean setup: the data was stronger than the pricing. You didn’t have to overthink it—long equities and commodities simply worked. But the key question now is whether that strength relative to expectations can continue.

We are more skeptical of whether this can continue today. Our skepticism is not about recession risk. It’s about the gap between economic reality and what’s now embedded in equity prices. Driving the gap between the current pricing and the likely economic path are two forces pulling in opposing directions:

AI-driven business investment — a large positive

Labor supply — a growing structural negative

We start with labor. Employment growth is determined by population growth, participation, and hiring. Over long horizons, population growth does most of the work.

And this is where the drag appears. Population growth is slowing mainly because immigration has slowed. Immigration doesn’t just add people—it adds workers, because immigrants participate in the labor force at much higher rates than the native-born population.

So when immigration drops, you lose two things at once: the number of new people entering the country and the number of new workers entering the labor force. This slowing immigration growth creates a meaningful headwind for overall job growth and, in turn, GDP.

Now the other side: AI capex. This investment boom is unusual because it doesn’t create an equivalent rise in labor income today. The spending shows up as business investment, while the “cost” (depreciation) comes later. So AI capex flows straight into profits in the present. That’s why earnings expectations surged and why the market has anchored to the AI-capex story.

Earlier in the year, equities were undervalued based on that profit impulse. The rally corrected that. But now earnings expectations have moved beyond what a labor-constrained economy can sustainably deliver. This has first shown in cyclicals, particularly small caps and homebuilder stocks. Small caps and homebuilders don’t benefit from the AI-capex profit cycle, and they remain tied to the more traditional, interest-rate-driven business cycle. As economic activity outside tech slows, these sectors begin to feel the weight.

So the question before us today is whether the equity market—primarily dominated by a profit impulse coming almost solely from technology capex—can continue to offset the headwinds coming from the labor-supply overhang. To be direct: we don’t have a clear answer. However, it is worth recognizing that even AI consumption is fueled by labor growth—and without an ongoing expansion of labor, even AI capex cannot continue indefinitely. Said more plainly: AI capex can account for a large majority of growth, but it cannot sustainably account for more than 100% of GDP and earnings growth on a multi-quarter basis. This will likely be resolved either through lower aggregate growth or rising “non-AI growth.” Both require technology and related companies to take a smaller share of the total pie.

That’s why the Prometheus Multi-Strategy Program has initiated negative beta exposure this week, not because of a top-down bearish view, but because bottom-up cyclical signals deteriorated together. To be clear, while this may be a turn for the equity market, we do not think it is a meaningful turn for the economy.

The economy is still fine. But the pricing of the economy—especially earnings—is stretched. With structural labor constraints in place, markets may be asking more of profits than the real economy can deliver.