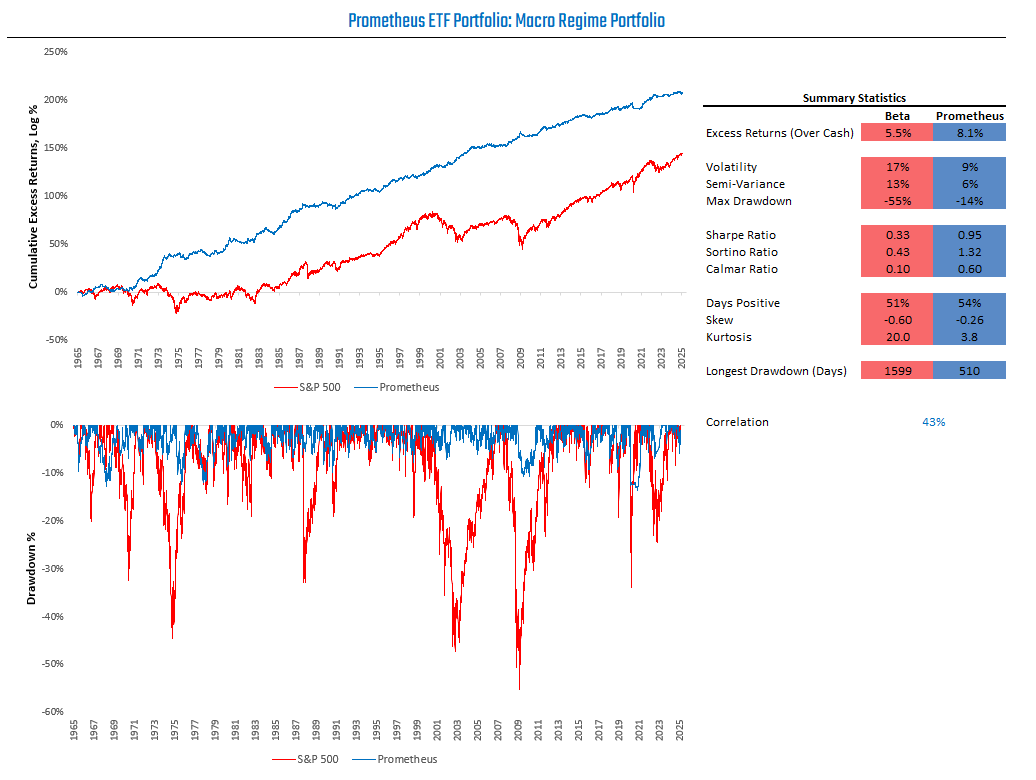

Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

Our observations are as follows:

The distribution of macroeconomic regime probabilities is now dominated by disinflation.

Our high-frequency tracking of macroeconomic fundamentals continues to suggest low realized fundamental macroeconomic volatility, though we see marginal signs of increased disinflation.

Our systems take signals from markets and the economy to create a comprehensive, high-frequency macro view. Our risk management process has kept us on the sidelines through a heightened period of macro market volatility. As macro uncertainty begins to fade, our positioning has begun to rise. Our current allocations reflect this.

Let's begin sharing the data driving our current assessment of the macro regime and our ensuing risk management and positions.

Macro Regime Monitor

Our Macro Regime Monitors combine measures of macro trend, mean reversion, expected returns, and fundamental economic conditions to estimate tomorrow’s cross-asset, macro market environment. We recommend checking out the primer if you’re unfamiliar with these tools:

We share the latest readings below:

Our Macro Regime Monitors continue to show a dominance of disinflationary outcomes for macro markets. We visualize the expected return profiles that one can expect during this distribution of predicted regimes below:

The payoff profile for bonds has continued to improve throughout the year, consistent with the evolving macroeconomic landscape. In our latest note from The Observatory, we offered a deep dive into the mechanics at play in the bond market. We highly recommend reading this note, as it provides significant detail on the factors driving bonds today:

Overall, a package of stocks and bonds now looks well-suited to navigating the current environment relative to commodities.

Fundamental Macro Monitor

Our Macro Regime Probabilities account for changes in market prices and fundamentals. Our systems aggregate a wide variety of fundamental economic data to create timely, leading estimates for the direction of growth and inflation. We zoom into these fundamental gauges to offer a more granular view of the factors driving our strategies.