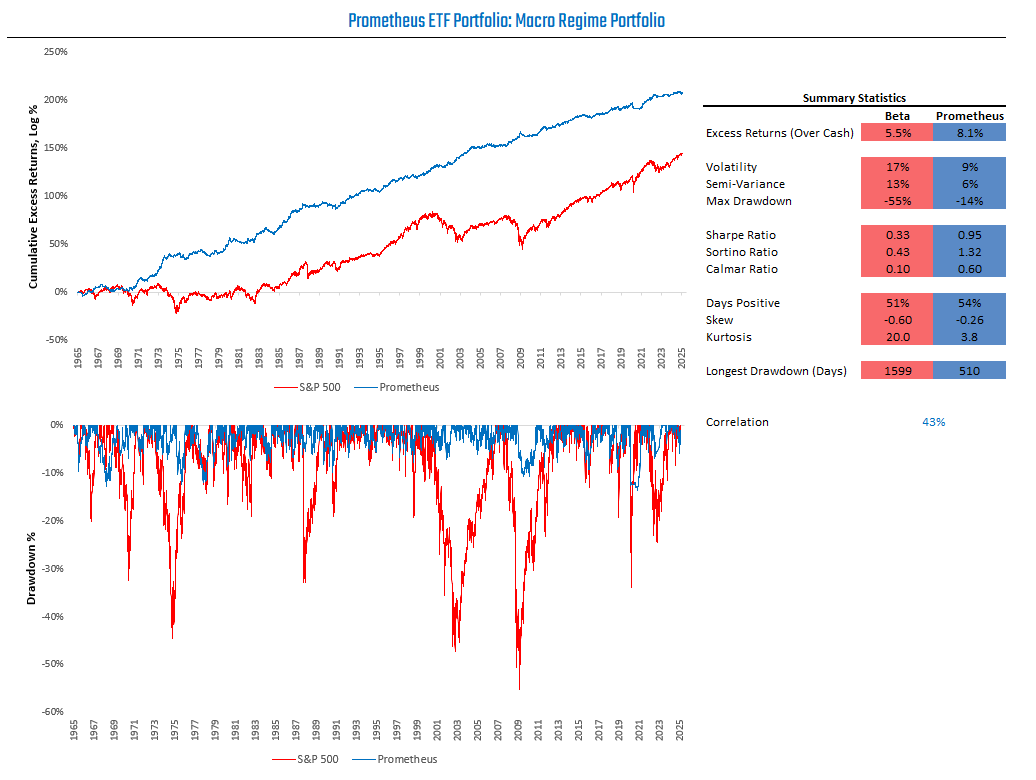

Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

Our observations are as follows:

The distribution of macroeconomic regime probabilities has skewed towards disinflationary outcomes, benefiting a mix of stocks and bonds.

Our high-frequency tracking of macroeconomic fundamentals continues to suggest low realized fundamental macroeconomic volatility. Markets are being driven not by realized macro volatility, but expected volatility from tariff policy.

Our systems take signals from markets and the economy to create a comprehensive, high-frequency macro view. Our risk management process has kept us on the sidelines through a heightened period of macro market volatility. As macro uncertainty begins to fade, our sizing will rise. Our current allocations reflect this.

Let's begin sharing the data driving our current assessment of the macro regime and our ensuing risk management and positions.

Macro Regime Monitor

Our Macro Regime Monitors combine measures of macro trend, mean reversion, expected returns, and fundamental economic conditions to estimate tomorrow’s cross-asset, macro market environment. We recommend checking out the primer if you’re unfamiliar with these tools:

We share the latest readings below:

Our Macro Regime Monitors now show a dominance of disinflationary outcomes for macro markets. We visualize the expected return profiles that one can expect during this distribution of predicted regimes below:

The payoff profile for bonds has continued to improve throughout the year, consistent with the evolving macroeconomic landscape. A package of stocks and bonds now looks well-suited to navigating the current environment.

Fundamental Macro Monitor

Our Macro Regime Probabilities account for changes in market prices and fundamentals. Our systems aggregate a wide variety of fundamental economic data to create timely, leading estimates for the direction of growth and inflation. We zoom into these fundamental gauges to offer a more granular view of the factors driving our strategies.

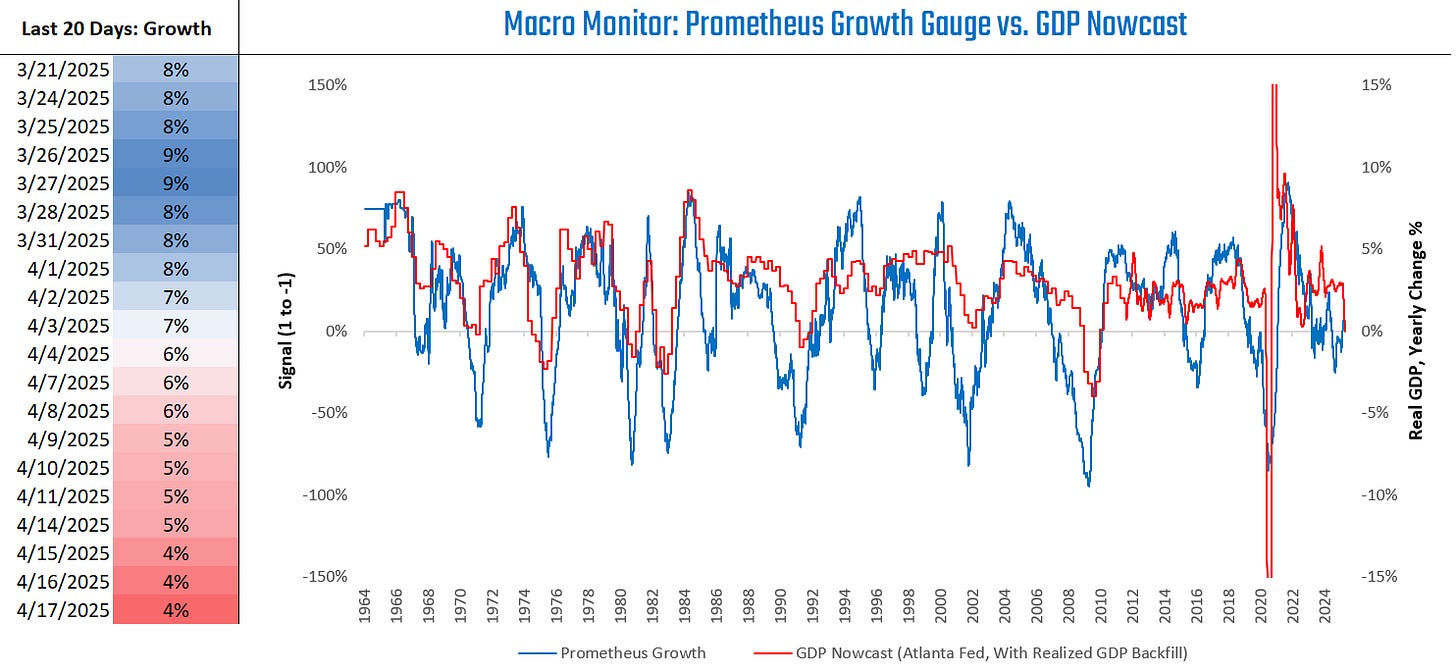

We begin with our Growth Gauge. Our Growth Gauge aggregates data from hundreds of economic growth variables to provide a timely read on forward-looking macro pressures affecting GDP growth. We visualize this gauge below:

Our Growth Gauge remains neutral, indicating no significant changes in growth ahead.

Next, we turn to our Inflation Gauge. Our Inflation Gauge, like our Growth Gauge, aggregates data across hundreds of economic growth variables to provide a timely read on forward-looking macro pressures affecting future inflation. We visualize this below:

Our Inflation Gauge moderated its recent declines, driven by higher commodity prices. Overall, markets remain dominated not by realized macroeconomic volatility, but by expected macroeconomic volatility based on tariff policy. To understand the range of prospective outcomes, we performed a detailed study to estimate worst-case impacts of tariffs on economic activity. You can read the whole note here:

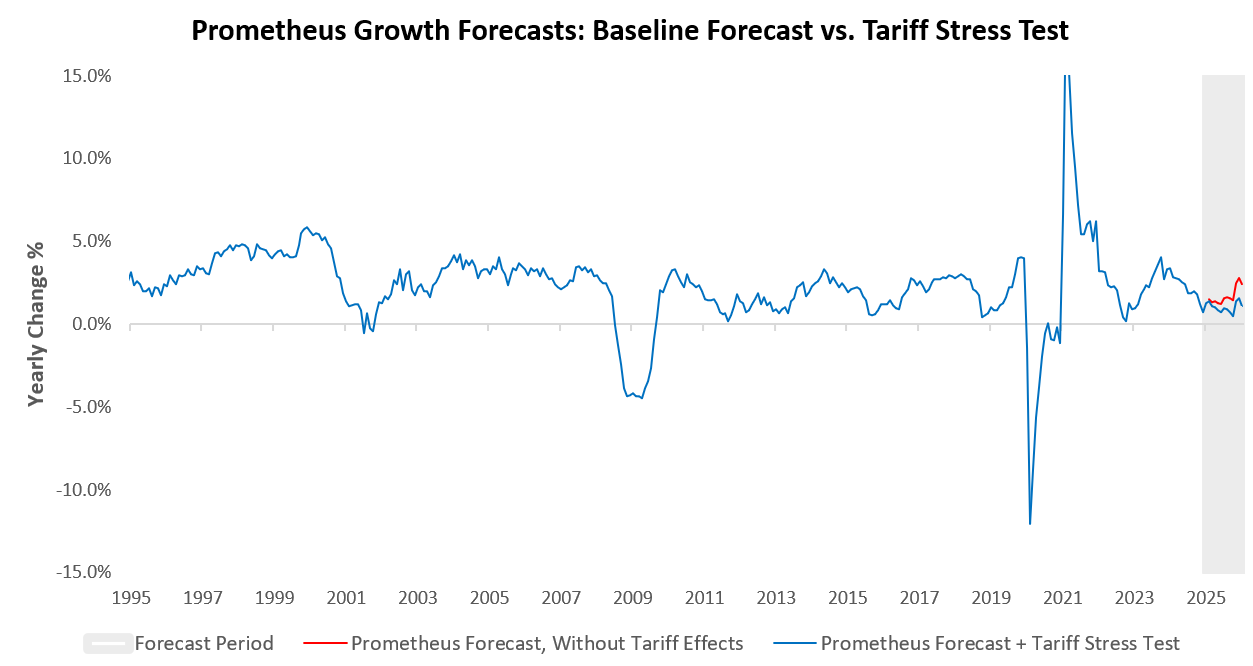

Using these estimates for the worst-case outcomes from tariffs, we can create a stress test scenario for our programmatic GDP forecasts. We visualize this below:

Our current systematic projection, based on domestic business cycle conditions, stands at 2.4%, excluding this drag. Accounting for this drag and time series factors, our estimate falls to 1.09 % GDP Growth over the next year. We share the breakdown below:

Consumption: 2.2%

Investment: -1.3%

Government: 0.24%

Trade Balance: -0.4%

Of these numbers, we estimate that there is room for consumption to be weaker than we anticipate, in the event of a weakness in employment. We do not see the pressures in place for that weakness yet today, but the future is dynamic.

Overall, we estimate that a worst-case implementation of the tariffs within the current economic dynamics can reduce the trajectory of economic growth primarily by weighing on investment conditions. Whether this weight comes to bear on the economy will depend on whether business investment can be eroded by persistent pessimism about economic prospects, as measured by asset prices.

Market Monitor

Our Macro Regime Probabilities account for changes in market prices and fundamentals. We now zoom in on some of the market measures we track. Particularly, we focus on measures of trend, as they help us contextualize the current backdrop and signal the need for risk management.

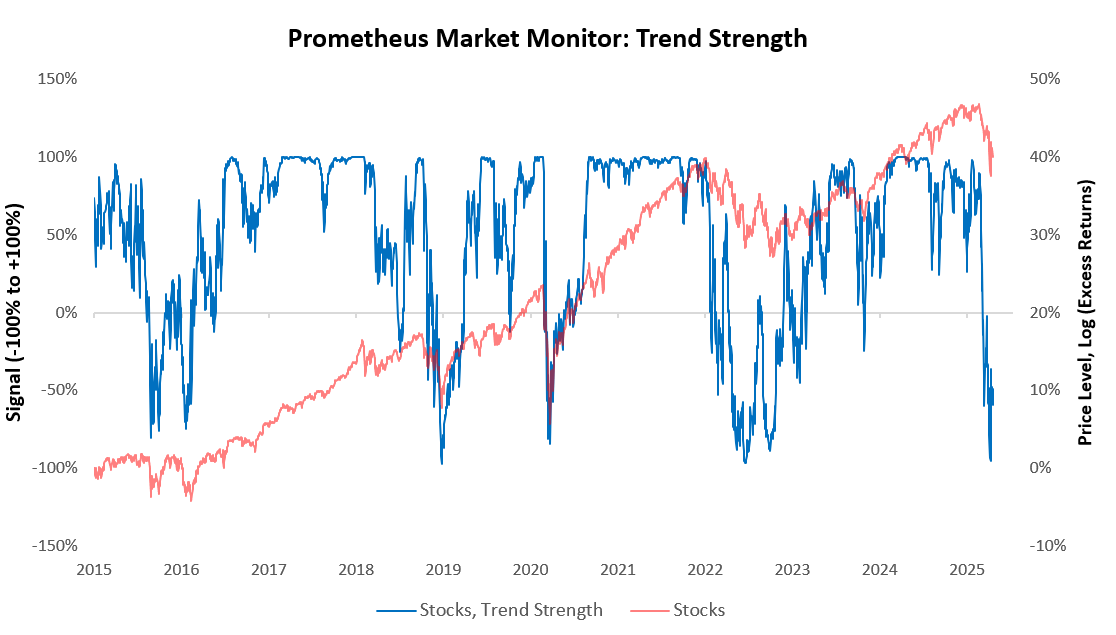

We begin with stocks:

Equity markets remain in a decisive downtrend despite the recent bounce in equity prices.

We turn to bonds next.

Bonds are now back in a downtrend, unable to hold on to their gains due to their richness versus macro fundamentals.

We turn to commodities.

Commodities are now in a modest uptrend.

Portfolio Construction

Aggregating measures of macro trend, mean reversion, expected returns, and fundamental economic conditions, our systems are looking to position the Prometheus ETF Portfolio as follows: