Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

We visualize the simulated return path for the program below:

Our observations are as follows:

The distribution of forward-looking macroeconomic regime probabilities is now dominated by rising growth, although deflationary odds have also increased.

Our high-frequency tracking of macroeconomic fundamentals continues to suggest muted economic volatility.

Our systems take signals from markets and the economy to create a comprehensive, high-frequency macro view. A pro-cyclical asset allocation continues to look attractive at this junction.

Let's begin sharing the data that drives our current assessment of the macro regime and our subsequent risk management and positions.

Macro Regime Monitor

Our Macro Regime Monitors combine measures of macro trend, mean reversion, expected returns, and fundamental economic conditions to estimate tomorrow’s cross-asset, macro market environment. We recommend checking out the primer if you’re unfamiliar with these tools:

We share the latest readings below:

Our Macro Regime Monitors continue to indicate rising growth as the dominant macro regime, although disinflation probabilities have increased. We visualize the expected return profiles that one can expect during this distribution of predicted regimes below:

The distribution of expected returns now favours equities.

Fundamental Macro Monitor

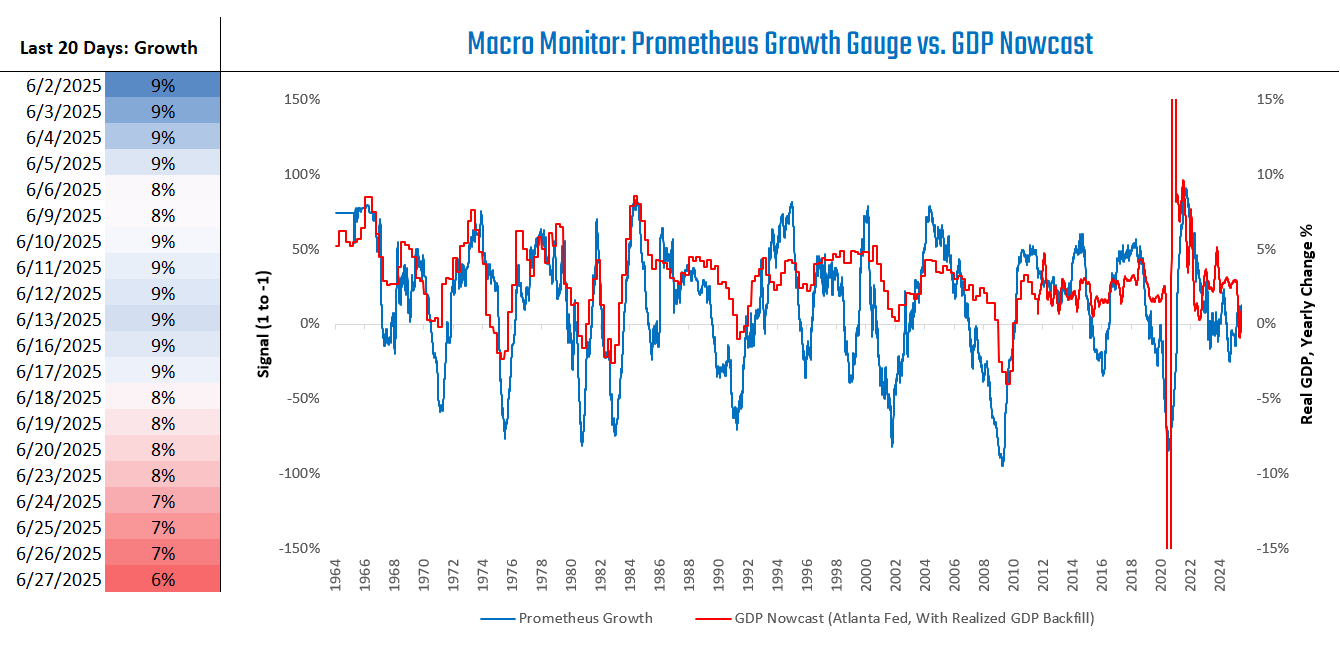

Our systems aggregate a wide variety of fundamental economic data to create timely, leading estimates for the direction of growth and inflation. We begin with our Growth Gauge. Our Growth Gauge aggregates data from hundreds of economic growth variables to provide a timely read on forward-looking macro pressures affecting GDP growth. We visualize this gauge below:

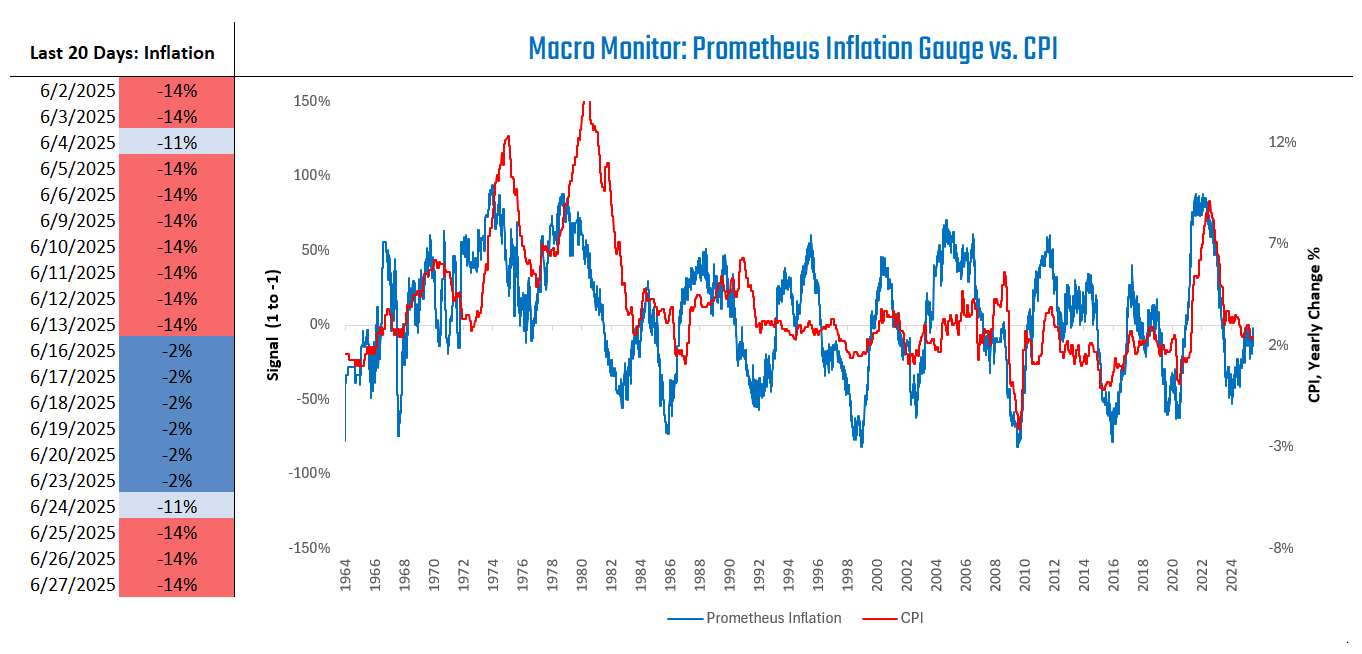

Our Growth Gauge has stabilized at minimally positive levels. Next, we turn to our Inflation Gauge. Our Inflation Gauge, like our Growth Gauge, aggregates data to provide a timely read on forward-looking macro pressures affecting future inflation:

Our Inflation Gauge has fallen in response to falling energy prices.

Market Monitor

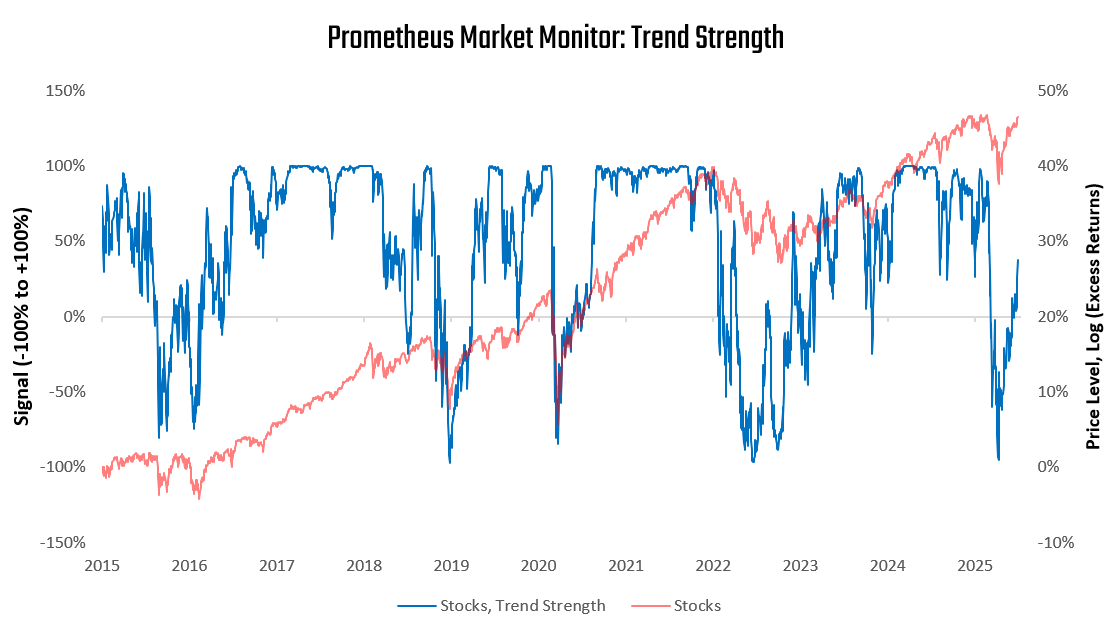

Our Macro Regime Probabilities account for changes in market prices and fundamentals. We now zoom in on some of the market measures we track. Particularly, we focus on measures of trend, as they help us contextualize the current backdrop and signal the need for risk management.

We begin with stocks:

Equity market trends have strengthened meaningfully.

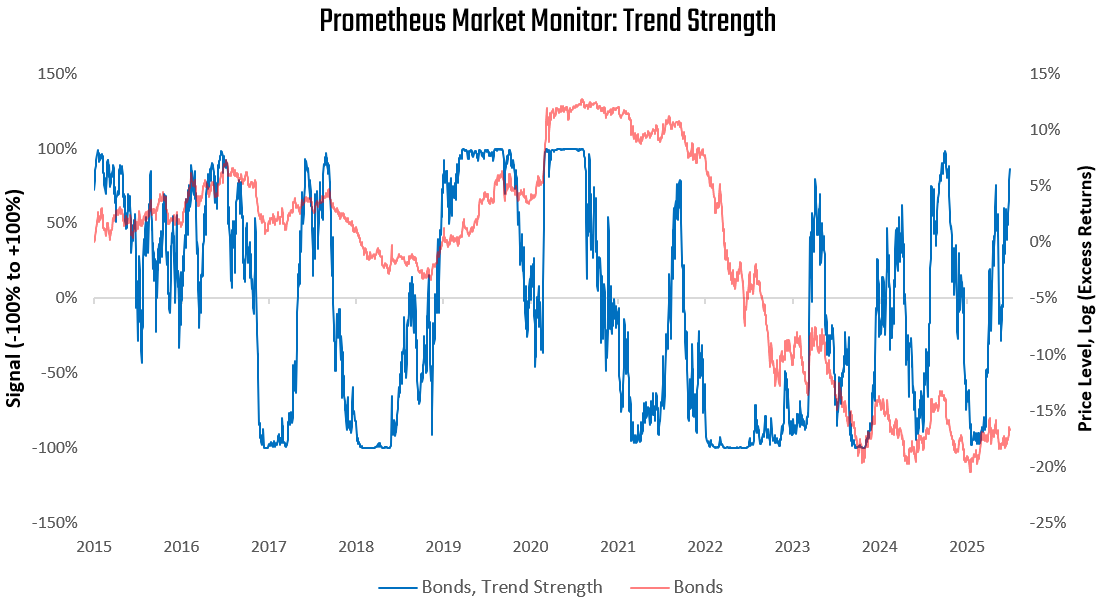

We turn to bonds next.

Bonds remain in an uptrend.

We turn to commodities.

Commodities trends have reversed sharply.

Portfolio Construction

Aggregating measures of macro trend, mean reversion, expected returns, and fundamental economic conditions, our systems are looking to position the Prometheus ETF Portfolio as follows: