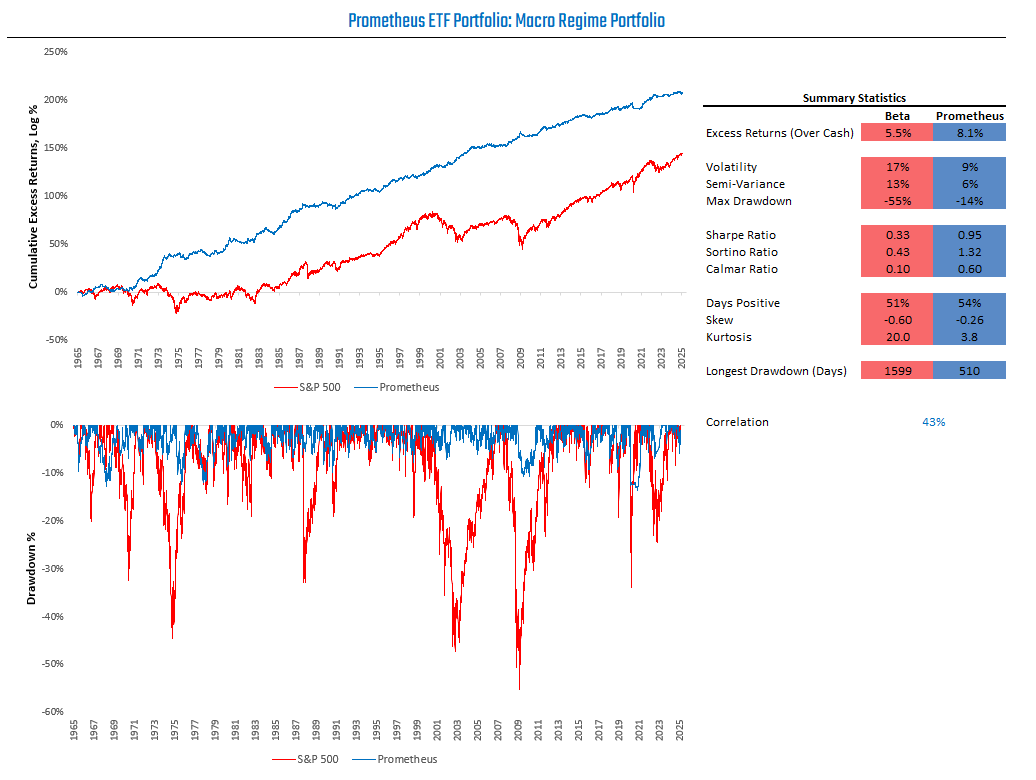

Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between three highly liquid ETFs, readily available to any investor with a brokerage account.

Our observations are as follows:

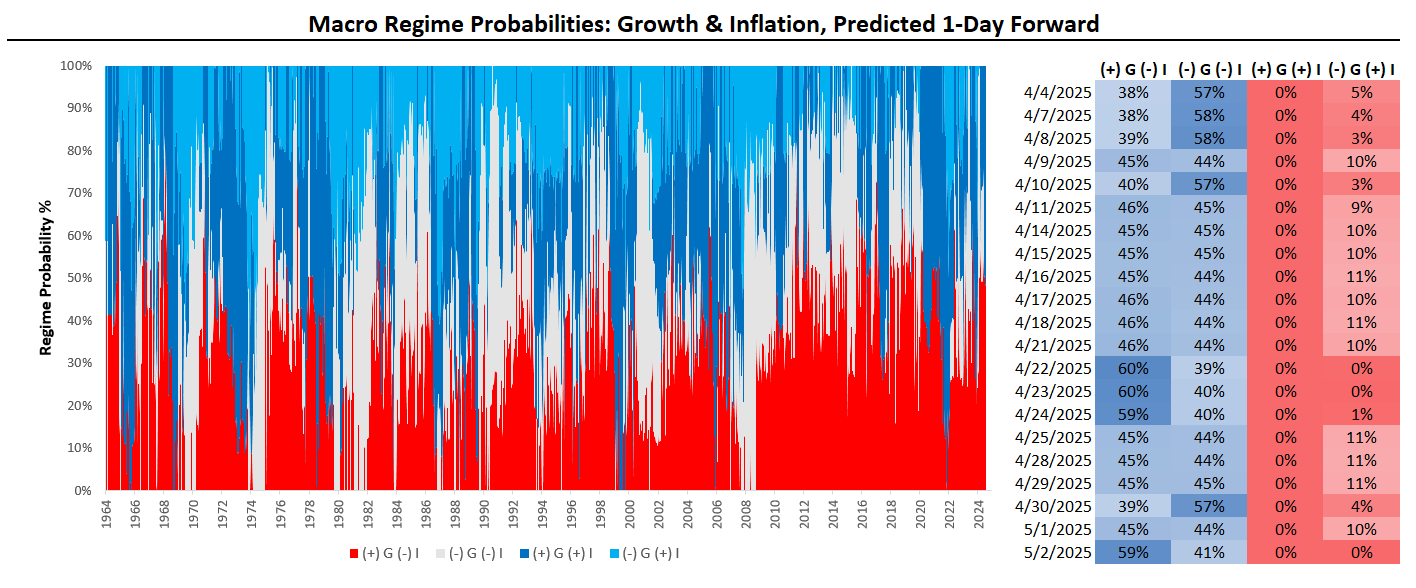

The distribution of macroeconomic regime probabilities is now dominated by disinflation, though rising growth probabilities have increased.

Our high-frequency tracking of macroeconomic fundamentals suggests low realized fundamental macroeconomic volatility.

Our systems take signals from markets and the economy to create a comprehensive, high-frequency macro view. Our risk management process has kept us on the sidelines through a heightened period of macro market volatility. Our strategies have slowly begun to add back exposures, which will continue if asset price volatility declines.

Let's begin sharing the data driving our current assessment of the macro regime and our ensuing risk management and positions.

Macro Regime Monitor

Our Macro Regime Monitors combine measures of macro trend, mean reversion, expected returns, and fundamental economic conditions to estimate tomorrow’s cross-asset, macro market environment. We recommend checking out the primer if you’re unfamiliar with these tools:

We share the latest readings below:

Our Macro Regime Monitors continue to show a dominance of disinflationary outcomes for macro markets. However, rising growth probabilities have risen relative to falling ones. We visualize the expected return profiles that one can expect during this distribution of predicted regimes below:

The payoff profile for equities has improved modestly over the last week.