The Observatory is how we monitor the evolution of the economy & markets in real-time. The insights provided here are integrated algorithmically into our systems to create rules-based portfolios.

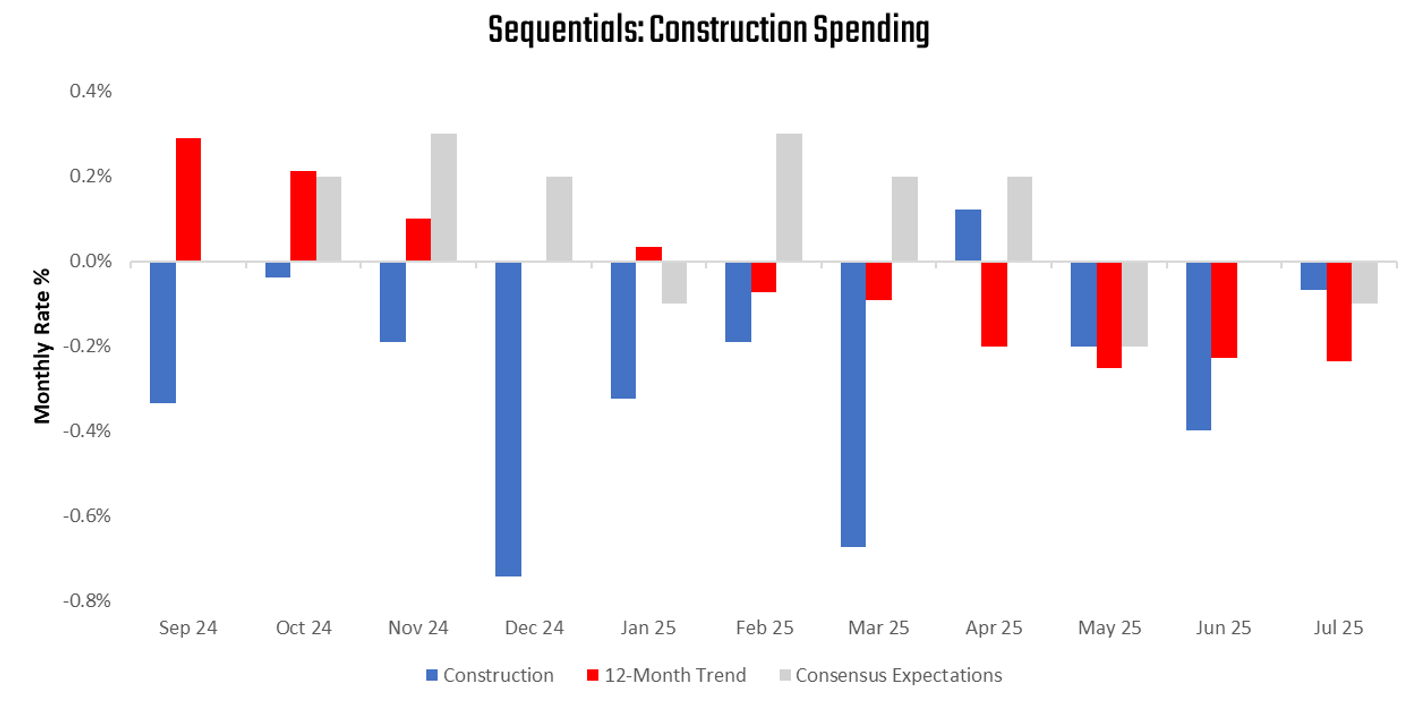

We examine the latest developments in the construction industry, which remains one of the key areas of weakness in aggregate business investment. The most recent data continues to show a deterioration:

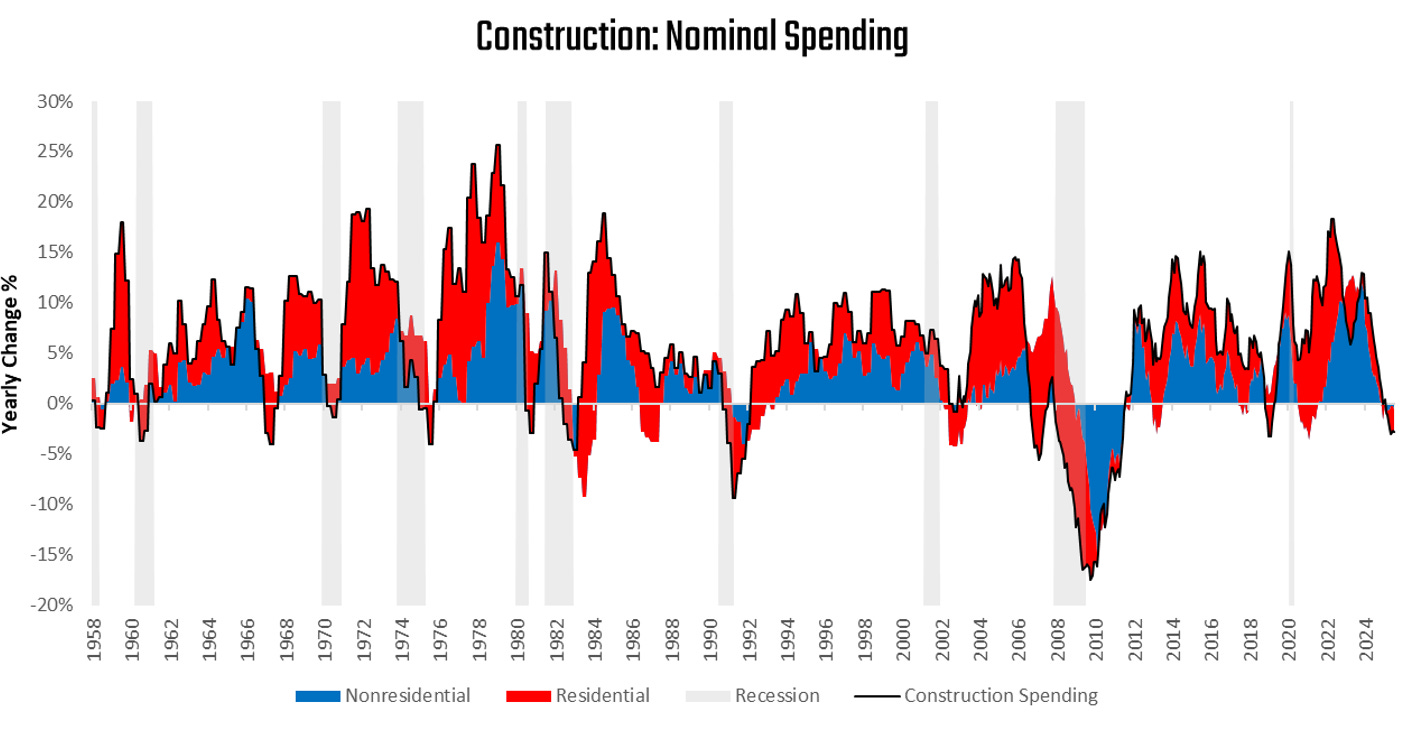

This has flowed through to the long-term trends of the sector:

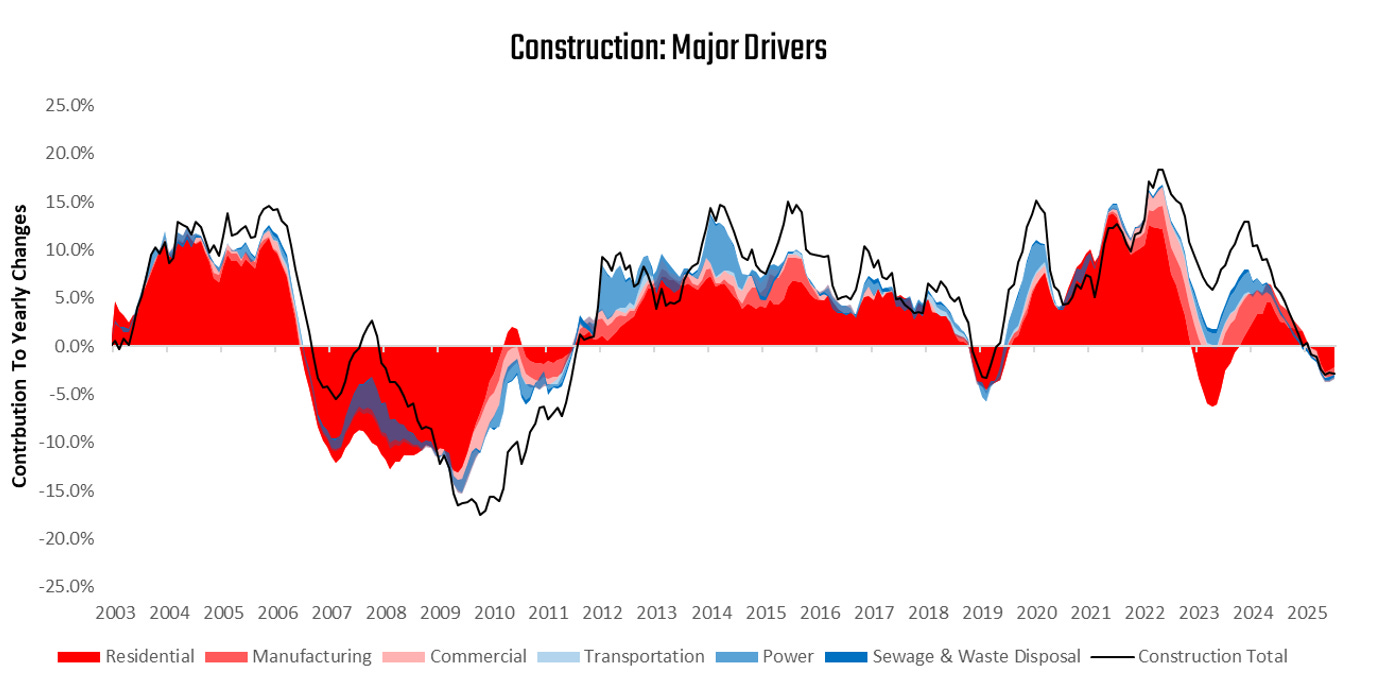

The construction sector is now experiencing weakness that is typically consistent with a recession. We show the evolution of construction spending over the last year, which fell by -2.8%%. This was driven by a -2.19% decrease in residential spending and a -0.61% fall in nonresidential spending. Below, we drill down further to show the top 3 drivers of strength in blue (Sewage & Waste Disposal, Power, and Transportation) and the top 3 drivers of weakness in red (Residential, Manufacturing, and Commercial):

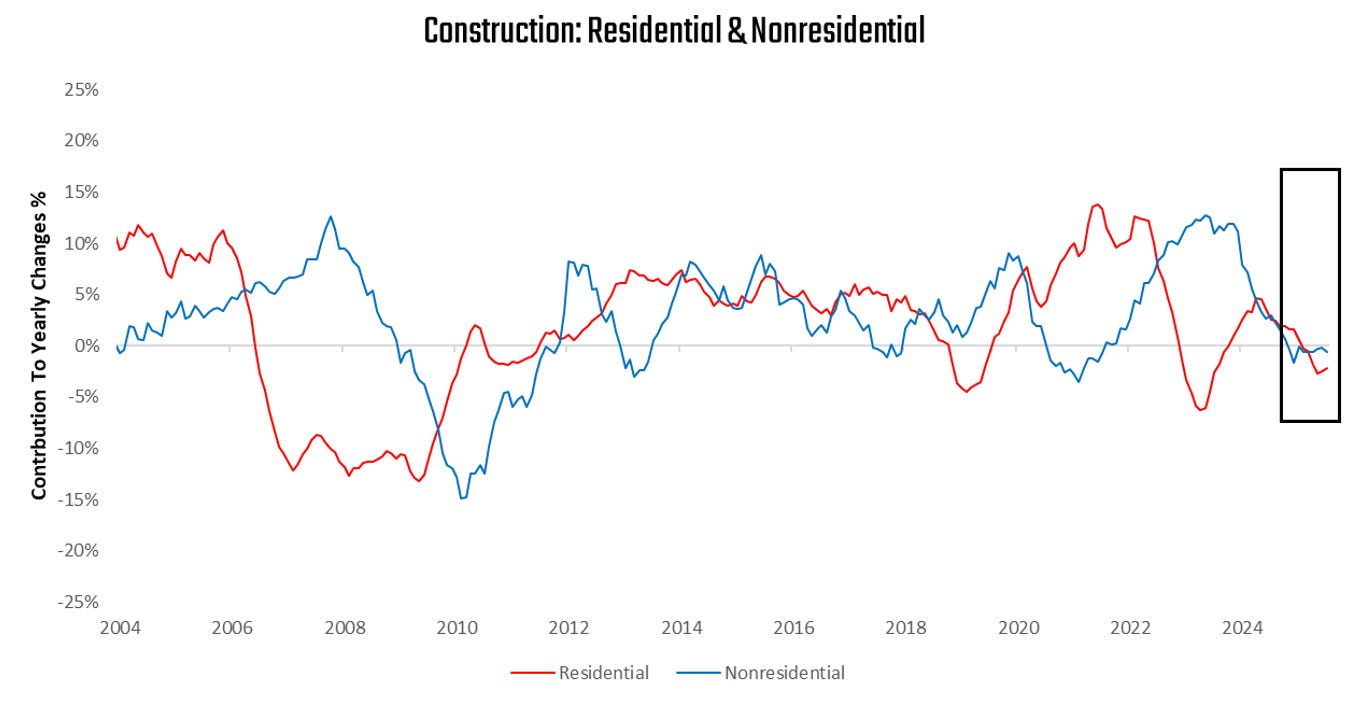

We show that both major sectors of construction are now in contraction:

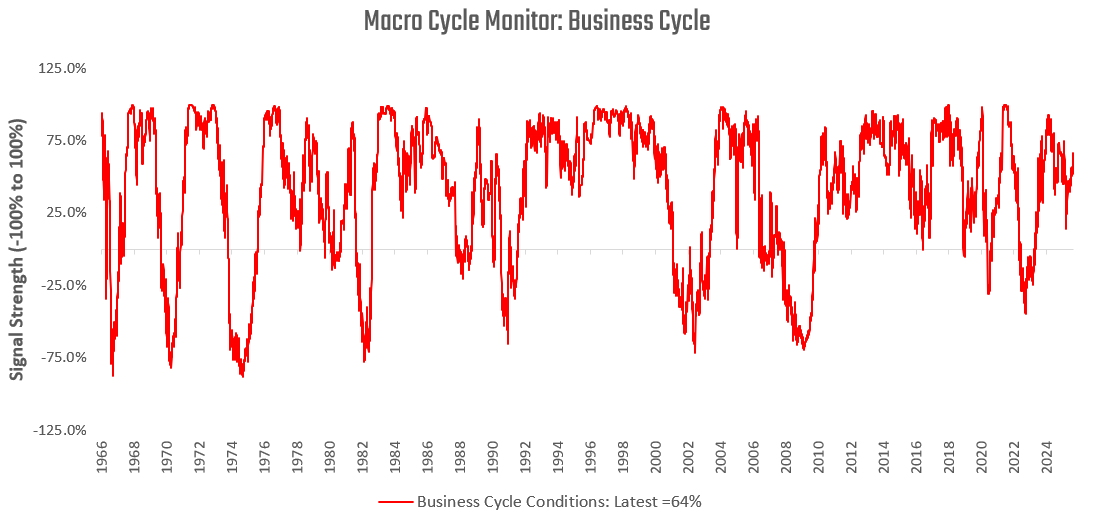

In prior cycles, this weakness in itself would have been enough to catalyze a recession. However, the evolution of the economy has made economic growth more resilient to these types of weakness. Despite weaker construction, our proprietary business cycle gauge continues to remains in positive territory:

Nonetheless, these are not positive developments and weigh on the outlook. Today’s backdrop remains a complex and challenging mix of macroeconomic conditions, with secular shifts complicating the economic picture.

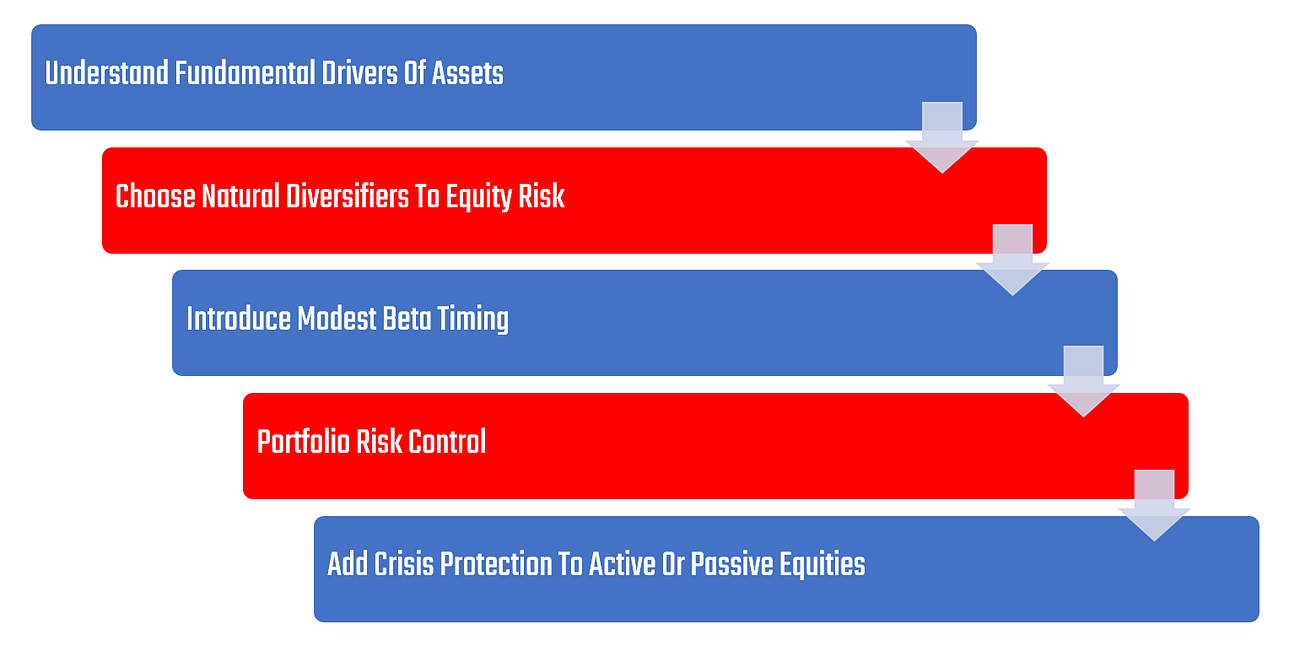

Maintaining equity exposure during these times remains prudent, but protecting the downside is equally important. It is in this spirit that we developed our Prometheus Crisis Protection Program. The program aims to provide a portfolio diversifier during periods of economic and financial instability by combining active, long-only exposure to Gold, TIPS, and VIX. The program is designed to have minimal turnover, barring crisis periods, and is meant to be a portable solution for both active and passive equity market investors. With an average Sharpe Ratio of 2.0 during days when the equity market declines, we expect the Prometheus Crisis Protection Program to offer a valuable addition to investor portfolios.

We highly recommend checking it out:

Prometheus Crisis Protection Program

We started Prometheus with a simple premise: bring the highest quality of institutional-grade macro investment research to everyday investors. Today, we are taking another big step in this direction with the launch of our systematic Prometheus Crisis Protection Program

Until next time.

Hmmm... possible interpretation also appears like the "crack" is no deeper than June and the business cycle (including residential construction, if mortgage rates continue to soften) is finding new traction. Seems like something to monitor, but not react to yet.

Layman here, but what's causing the slowdown in housing construction? Tight interest rates? How come that's not affected power, sewage etc. equally? Is that because those sectors are more driven by government instead of private spending?

And what's driving the resilience of the markets against such shocks; is that a larger portion of growth coming from other sectors?

I am concerned for most "westernized" nations, including US and Western Europe, where housing is tight and increasingly unaffordable for the lower to middle class. It's impossible to buy a modest house in any city of import on two modal incomes. It seems likely to me that the outcome will be some form of yield curve control on the long end to artificially drive these rates down, as not doing so will cause further enthusiasm for a populist leftist vote (which most rightists in power now would rather avoid). What do you think about this? I know you do not believe in long-term prognoses, but with the greying economies and ever growing debts, it seems we'll have to grow or inflate out of it. Fiscal austerity's not coming. So that's bad for bonds, USD, good for equities, bonds, crypto. And really bad for anyone without assets.