This note is one reserved for clients of Prometheus Institutional. We share a short preview of the note to showcase our offering. Occasionally, we make these notes available to augment our offering on Substack.

If you are a professional investor interested in access to our institutional work or want a copy of this note, email us at info@prometheus-research.com.

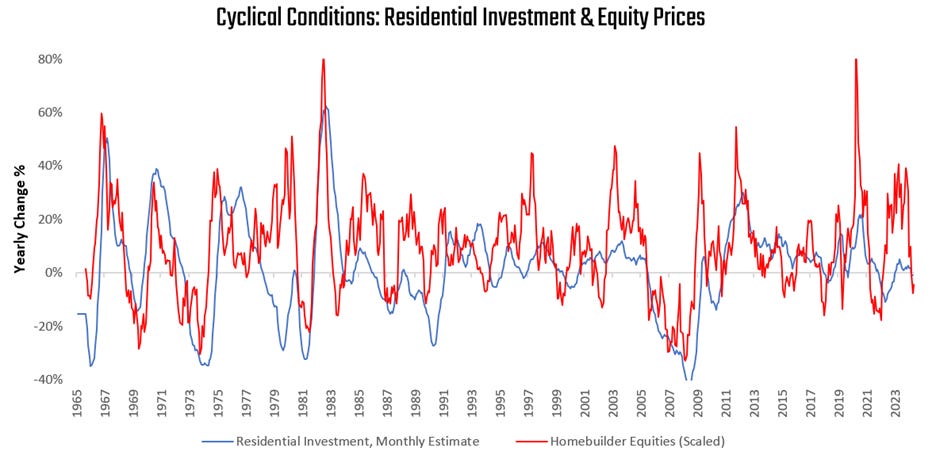

Homebuilder stocks are significantly exposed to macroeconomic forces. This is primarily a function of their dependence on large amounts of leverage required for the construction and purchase of homes. This leverage is highly sensitive to monetary policy and business cycle conditions. Recently, homebuilder equities have faced significant headwinds on an outright basis and relative to the broader equity market. In this note, we assess the likelihood that these macroeconomic pressures will continue to weigh on homebuilders.

Our assessment is as follows:

Mortgage spreads remain contained, and mortgage applications have been rising.

Housing permits, starts, and completions continue to show mixed trends, distorted by large and persistent construction backlogs.

Weak output and profit conditions have led to a slowdown in residential employment.

Thus, while household conditions remain strong, homebuilder conditions remain weak, which is reflected in homebuilder equity trends.

Housing remains at a complex junction, driven by cross-currents of backlogs, corporate pressures, and strong household conditions. Homebuilder equities continue to look unattractive in the cross-section of equity sectors given these mixed and modestly negative dynamics. In the pages that follow, we share the data driving this assessment.

If you are a professional investor interested in access to Prometheus Institutional or want a copy of this note, email us at info@prometheus-research.com.