What's Moving Markets

Slowing But Growing

This publication is a short excerpt from our weekly Prometheus ETF Portfolio note. While we reserve our forward-looking views on macro and portfolio construction to paid subscribers, we offer our high-level diagnostic of macro conditions here as we aim to offer value to the broader public.

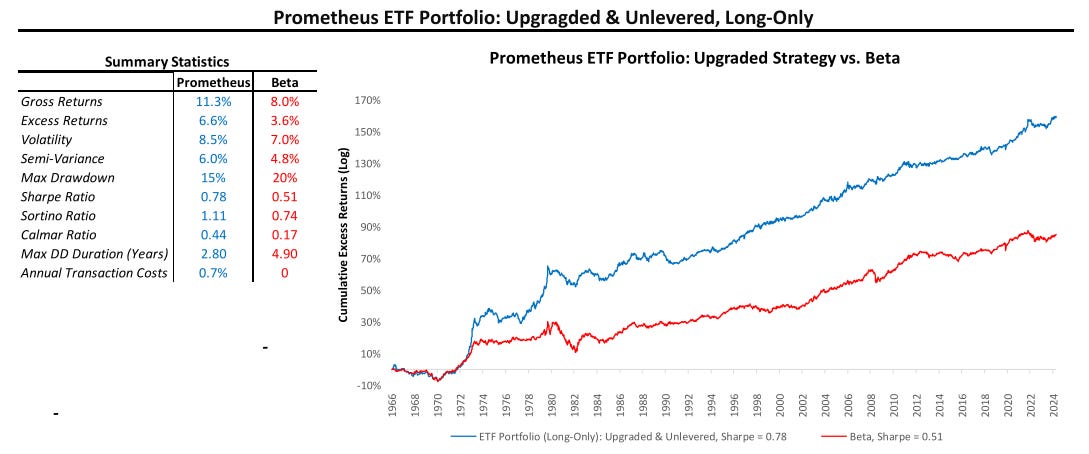

For those unfamiliar: The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between five highly liquid ETFs, readily available to any investor with a brokerage account. You can sign up for it here:

Let us dive into our assessment of macroeconomic conditions:

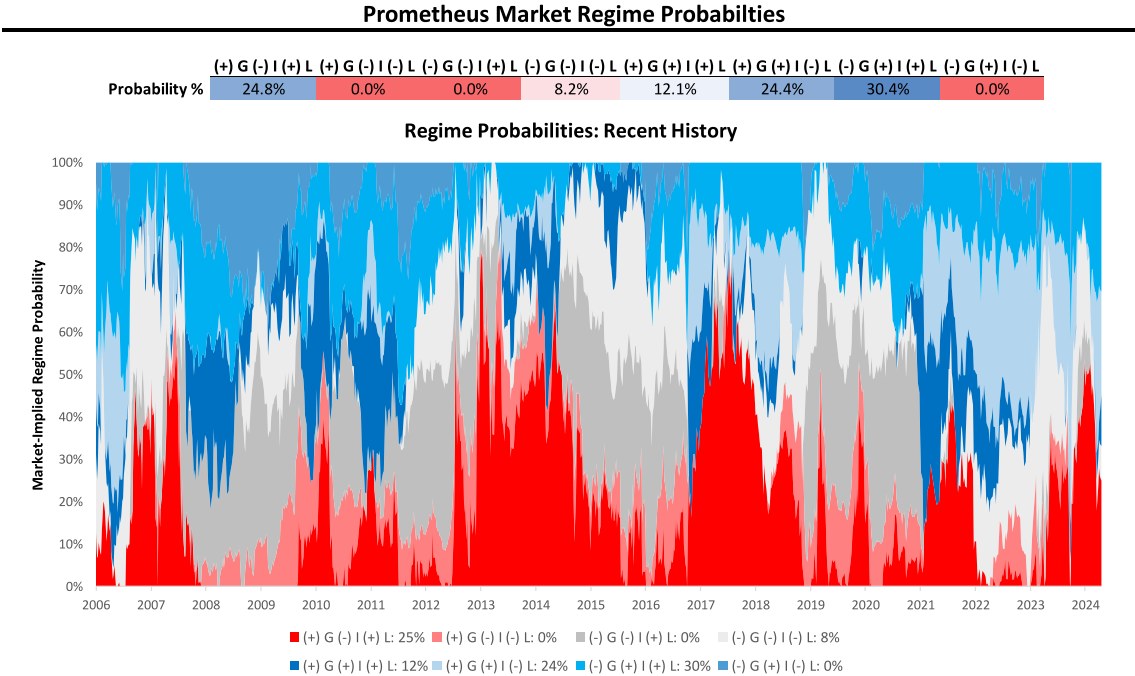

Over the last week, markets have moved in a manner consistent with a slowing but growing economy. After a large volatility shock, markets have now moved to price these regime conditions consistently over the last week.

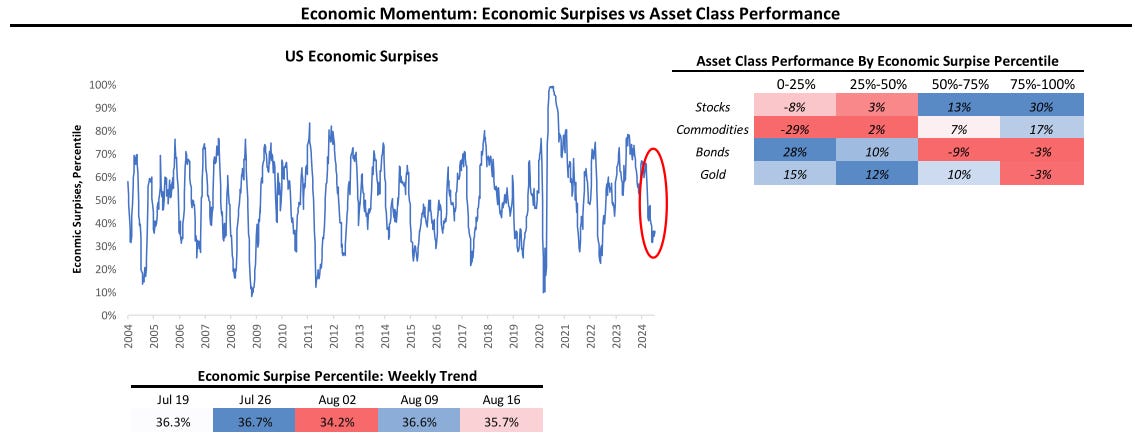

Economic data momentum slowed moderately with mixed data this week. The weakening of industrial production data remains something that we continue to monitor closely, which remains consistent with the pressures on the manufacturing economy.

Our long-only portfolio was up 1.86% this week on the back of markets normalizing to macro regime conditions.

Let's dive into the data driving our assessment before moving on to positioning. Over the last week, macro market rose in aggregate. Equities and gold rose significantly, bonds were modestly positive, and commodities fell significantly.

Economic data momentum slowed very modestly, with strong retail sales and initial claims, but weak industrial production data.

Additionally, we see a significantly increased probability that the Fed will be able to achieve its 2% inflation objective. However, it is important to not that CPI & PCE inflation have deviated significantly.

For a further understanding of how economic dynamics have been priced into markets, we show our tracking of market-implied macroeconomic regime probabilities.

Markets have now moved to dominantly price in slowing nominal growth conditions with ample liquidity. This pricing is consistent with fundamentals, suggesting regime stability. We allocate accordingly. Until next time.