We scan through the latest CPI data to chart a course for the future.

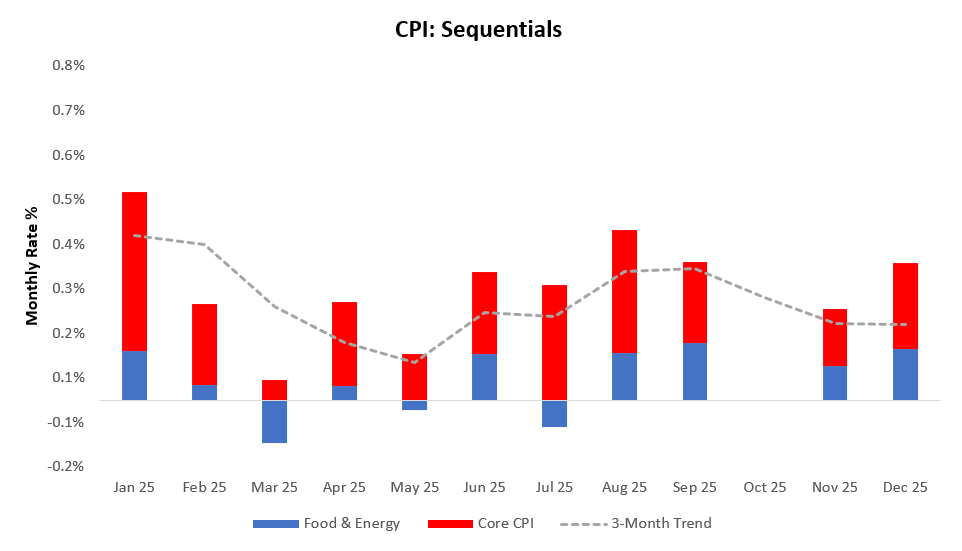

In December, headline CPI came in at 0.31% surprising consensus expectations of 0.3%. Core CPI contributed 0.19% to this print, with food & energy contributing the remaining 0.12%. This print drove a deceleration in the three-month trend. Below, we display the sequential evolution of the data:

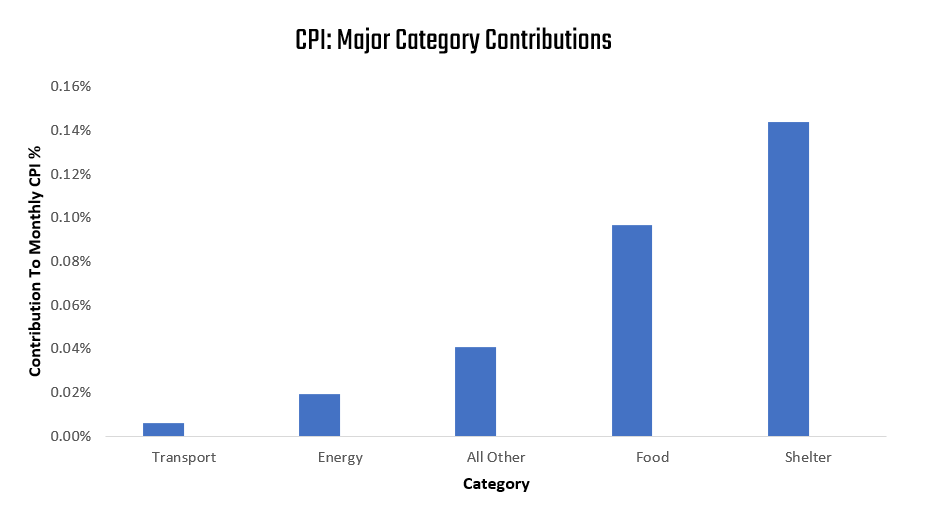

The primary drivers of CPI inflation are food, energy, transport, and Shelter. These components have contributed 0.1% (Food), 0.02% (Energy), 0.01% (Transport), and 0.14% (Shelter), respectively. We display these contributions to the 0.31% change in CPI below:

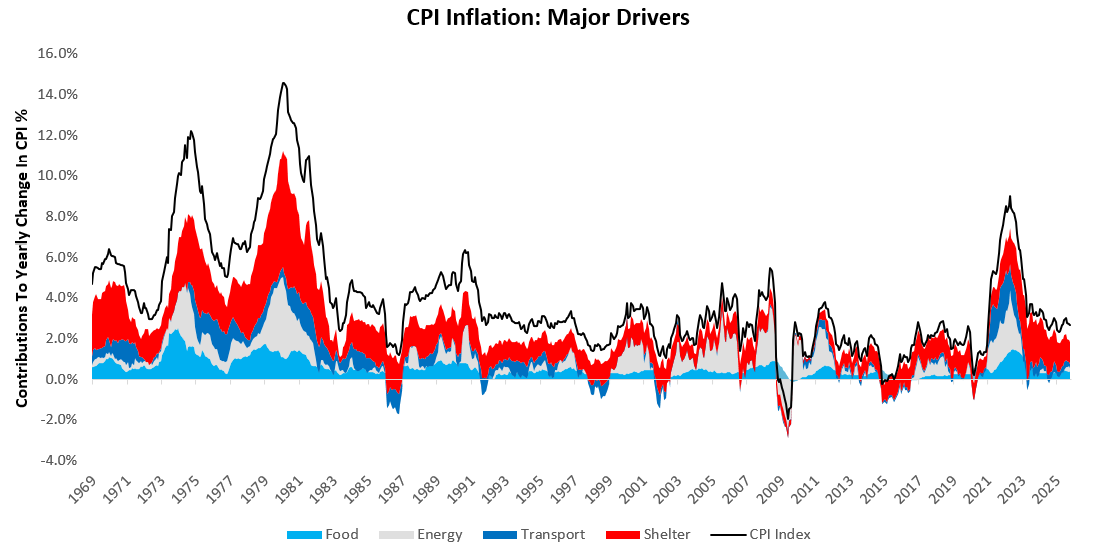

For further perspective, we show that these areas have accounted for the majority of the variation in inflation, both economically and statistically. Over the last year, food, energy, transport, and housing have contributed 0.41% (Food), 0.15% (Energy), 0.18% (Transport), and 1.11% (Shelter), respectively, to the change in inflation. We display these principal drivers of inflation over time below:

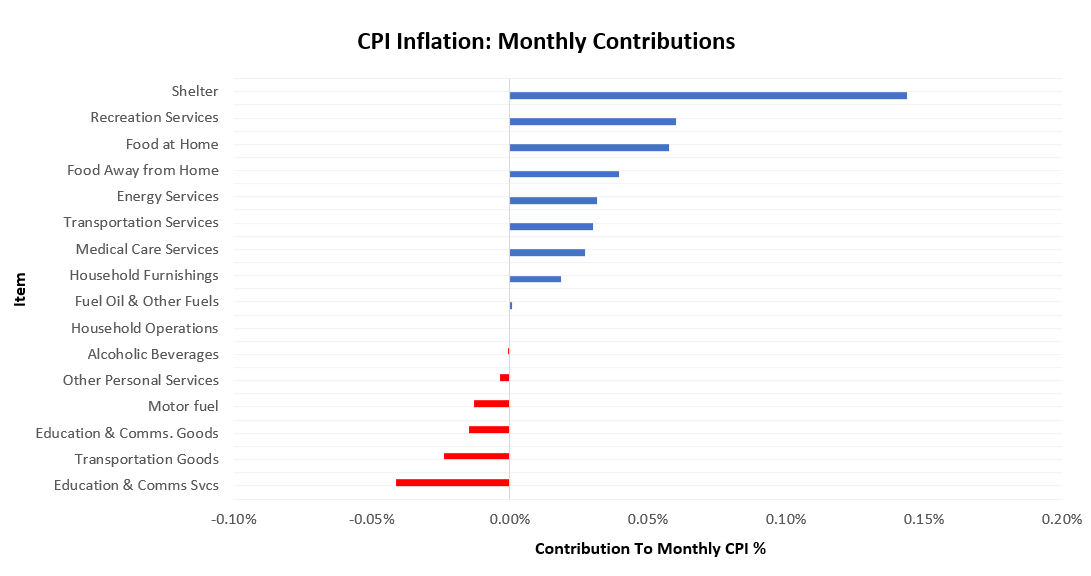

We now zoom back into the most recent print. Inflation was somewhat mixed, with Shelter contributing most positively, and Education & Comms Svcs contributing most to weakness. We display the largest movers to the upside and downside below:

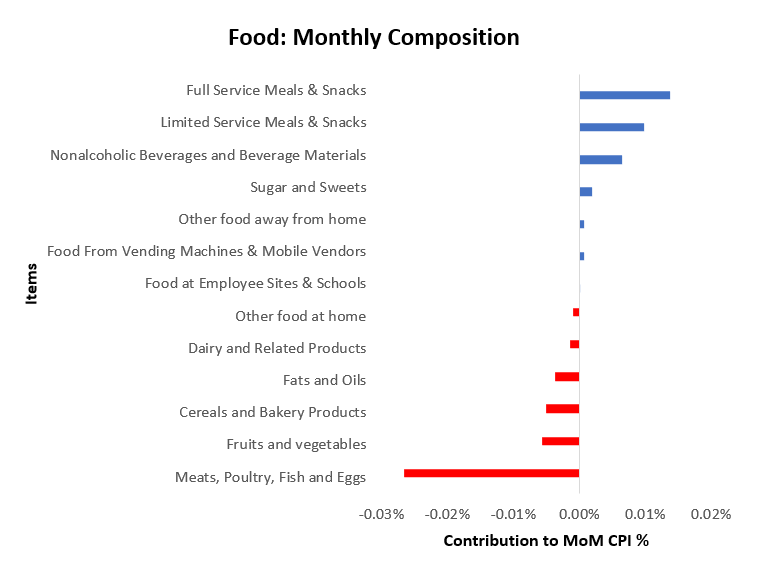

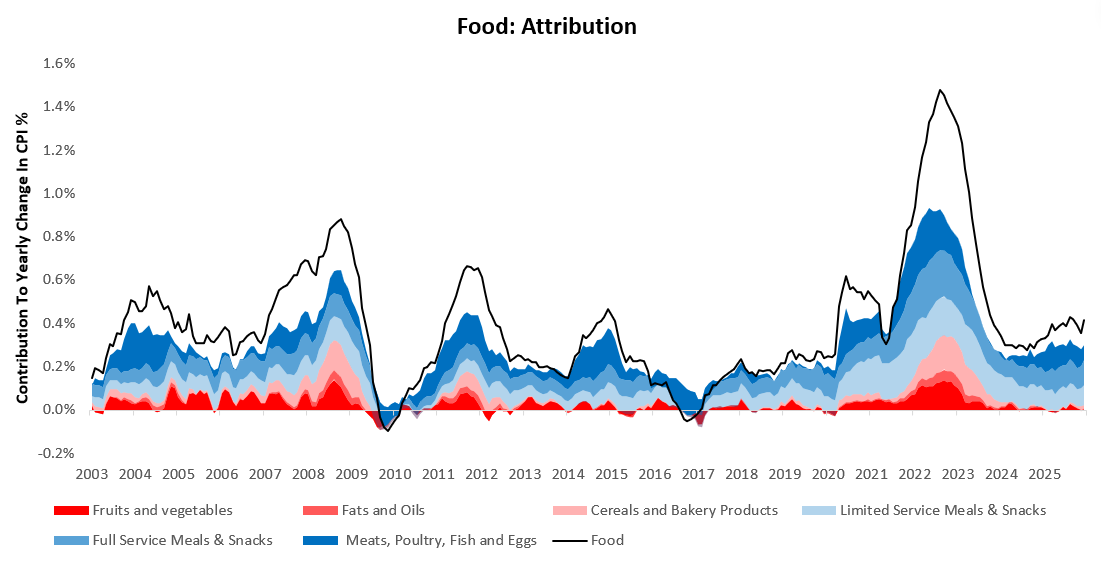

We now zoom in on our major categories: food, energy, transport, and Shelter. We begin with food. The most recent data showed food inflation was somewhat mixed, with Full Service Meals & Snacks showing the most relative strength and Meats, Poultry, Fish, and Eggs showing the most weakness.

For further perspective, we also show the evolution of food inflation over the last year with the strongest contributors in shades of blue ( Meats, Poultry, Fish and Eggs, Full Service Meals & Snacks, Limited Service Meals & Snacks) and the weakest in shades of red (Fruits and vegetables, Fats and Oils, Cereals and Bakery Products):

Food inflation remains persistent.

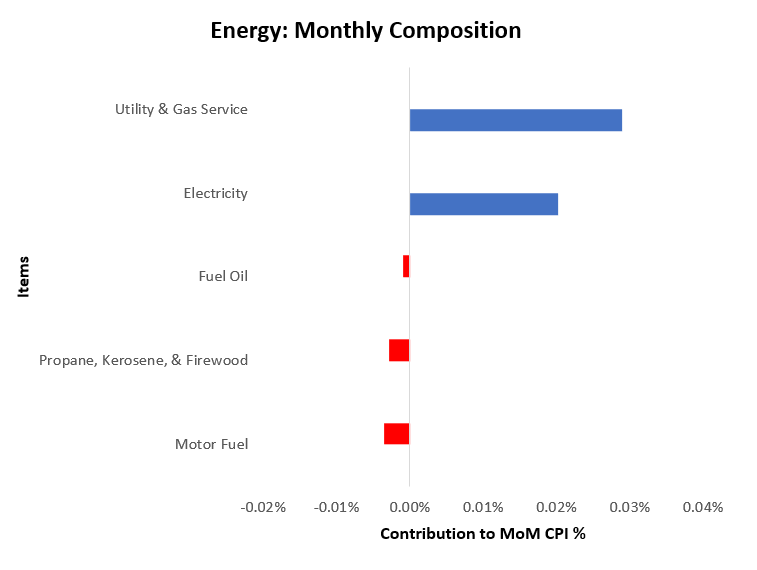

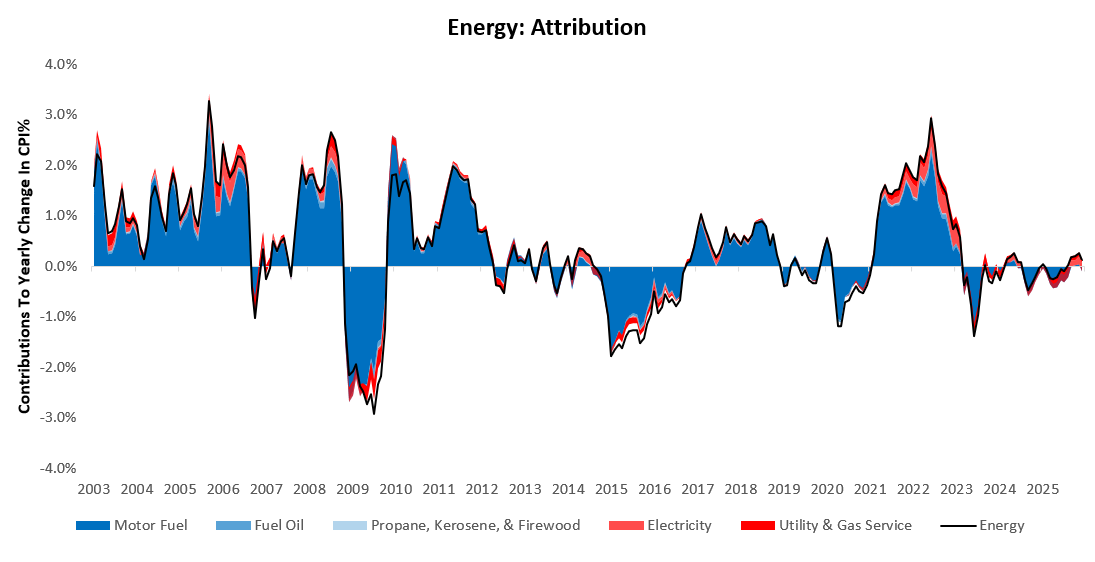

Next, we turn to energy. The most recent data showed energy inflation was largely negative, with Utility & Gas Service showing the greatest relative strength and Motor Fuel the most significant weakness.

We also show the contributions of these items to total energy inflation over the last year with historical context:

Energy inflation is likely to face headwinds amid global oil supply dynamics that are consistent with meaningfully lower motor fuel prices.

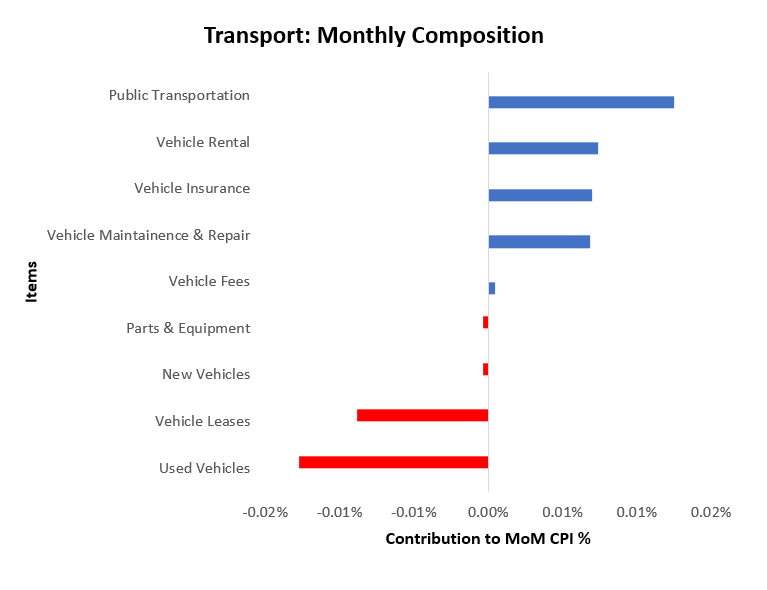

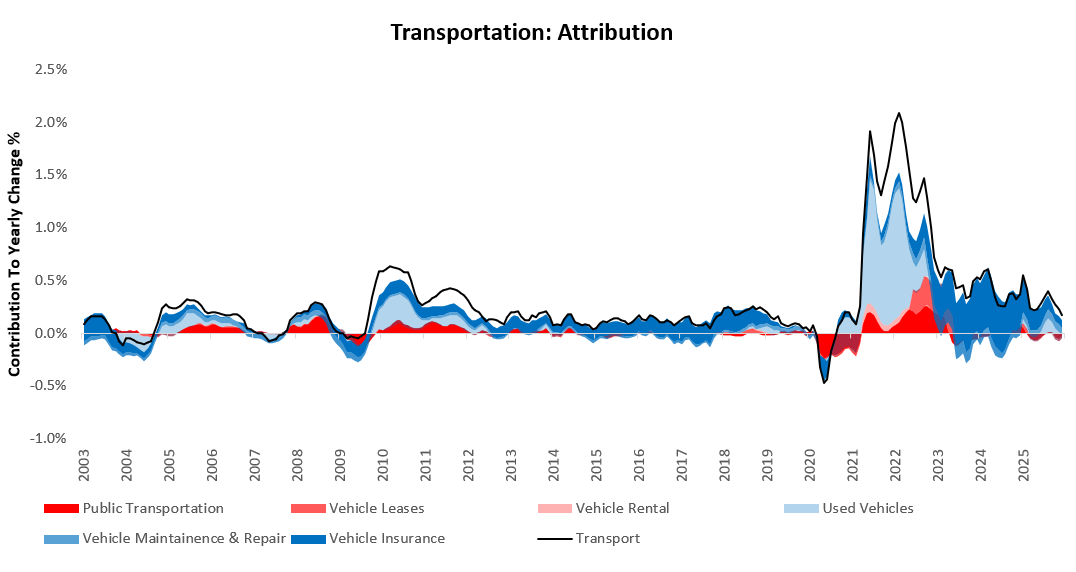

We now turn to transportation. The most recent data showed transport inflation was somewhat mixed, with Public Transportation showing the greatest relative strength and Used Vehicles the most significant weakness.

For further perspective, we also show the evolution of transportation inflation over the last year, with the strongest contributors in shades of blue (Vehicle Insurance, Vehicle Maintenance & Repair, Used Vehicles) and the weakest in shades of red (Public Transportation, Vehicle Leases, Vehicle Rental):

Transportation inflation persists due to a generational shortage of US automobile inventory.

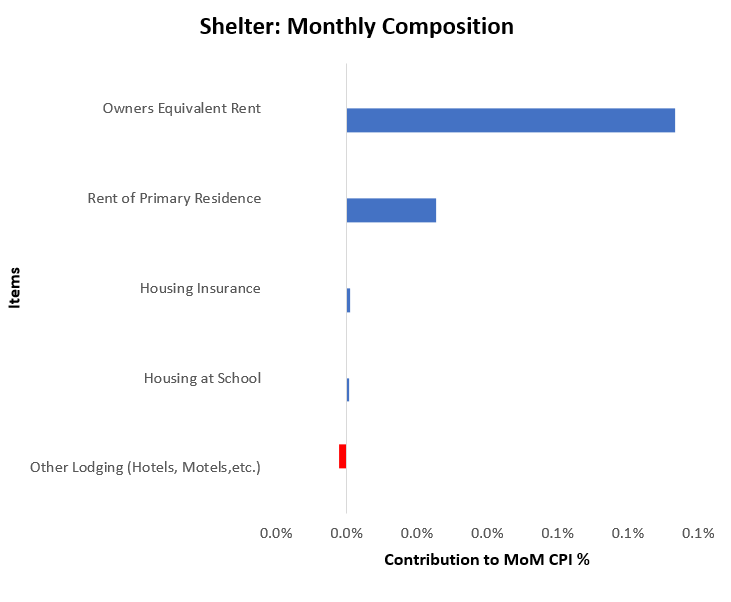

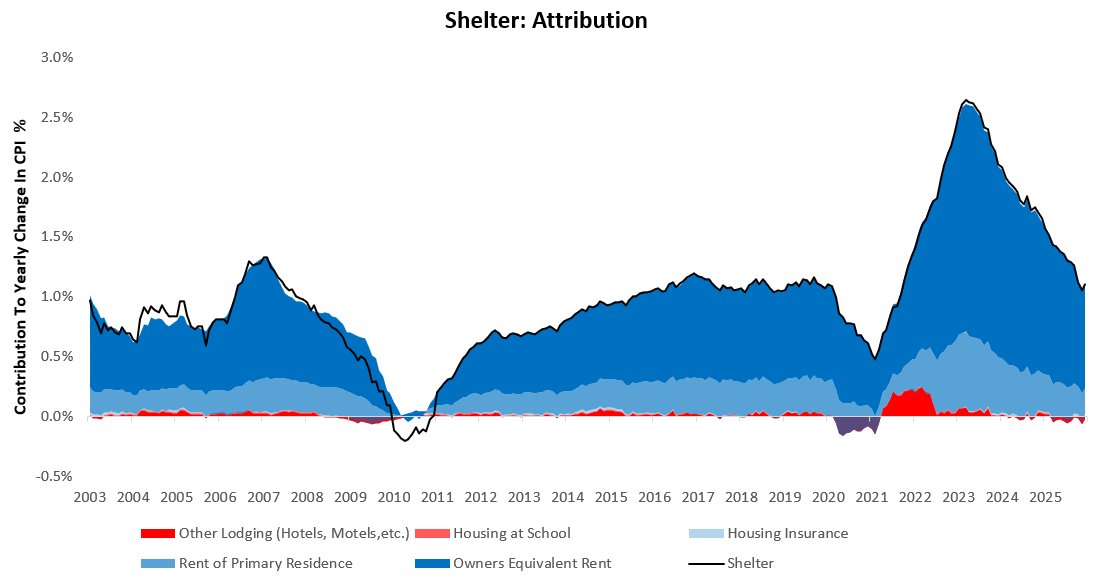

Finally, we examine Shelter, which is the most significant driver of consumer inflation in the economy. The most recent data showed shelter inflation was largely positive, with Owners Equivalent Rent showing the greatest relative strength and Other Lodging (Hotels, Motels, etc.) showing the most significant weakness.

We also show the contributions of these items to total shelter inflation over the last year for historical context:

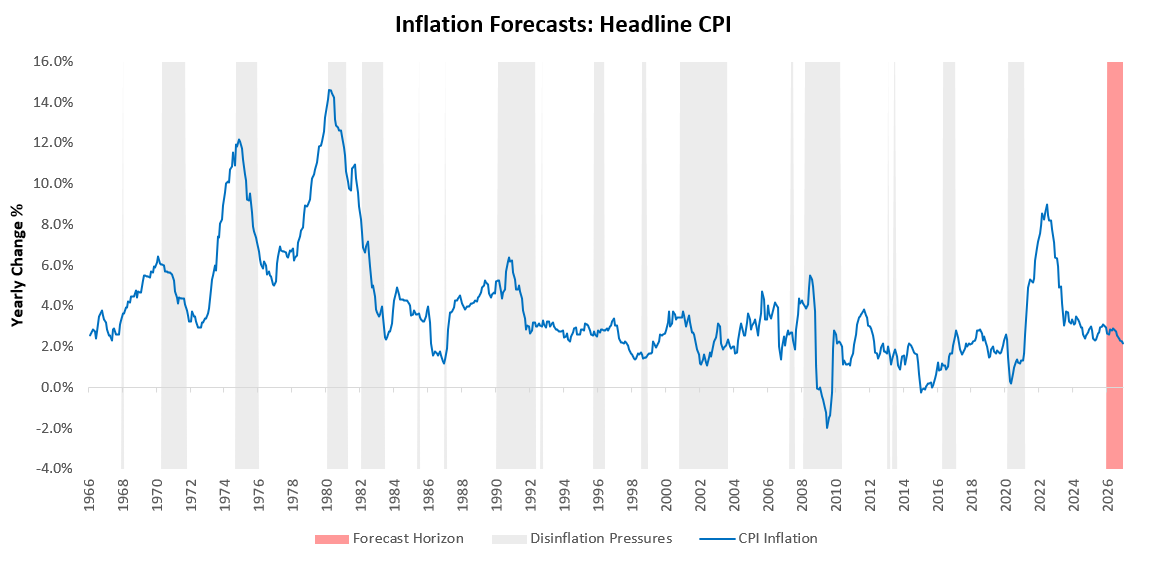

Finally, we turn to our systematic projections for CPI based on the constellation of current CPI prints and macro conditions. Our current programmatic estimates point to an average annualized CPI rate of 2.15% over the next 12 months. We visualise this below:

Our programmatic estimates take into account current trends in CPI categories, along with projected housing trends based on BLS computational lags. As housing activity and prices continue to decline, the likelihood of a further decline in the housing CPI increases. With potential for weaker energy and housing prices, we see an increasing probability for a path to 2% CPI inflation.

As always fantastic work!