This week has shown an economy still running hot enough to resist recession narratives; however, equities have begun to exhibit some instability due to their pricing. Nominal growth remains firm, inflation remains sticky, and liquidity remains ample, yet sector and commodity rotations continue to define tactical opportunities.

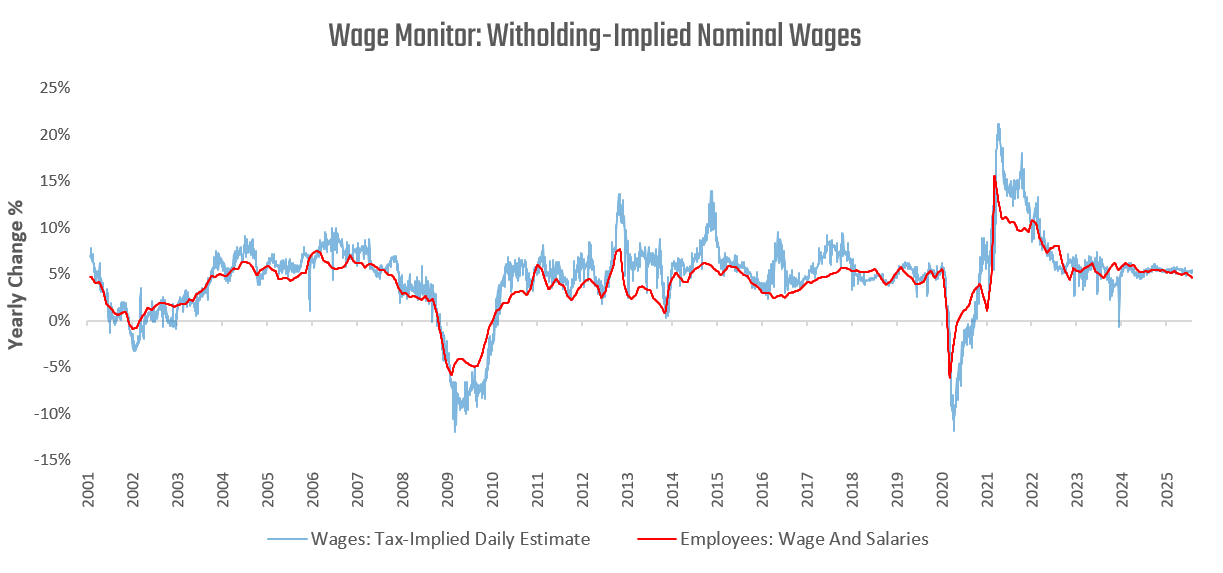

We demonstrate that our high-frequency estimates of nominal wages continue to exhibit strength.

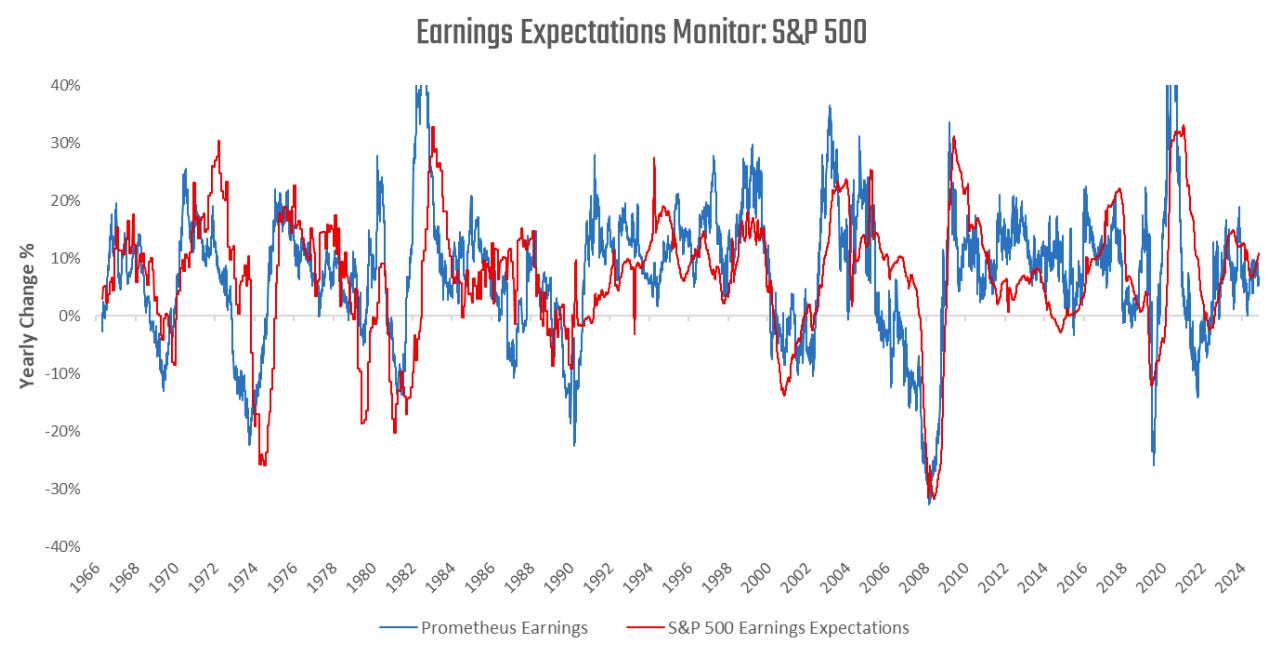

As we can see, the US economy continues to experience stable income growth. This will continue to support US corporate profit growth. We see this in earnings expectations for the US, which continue to power equity indexes higher:

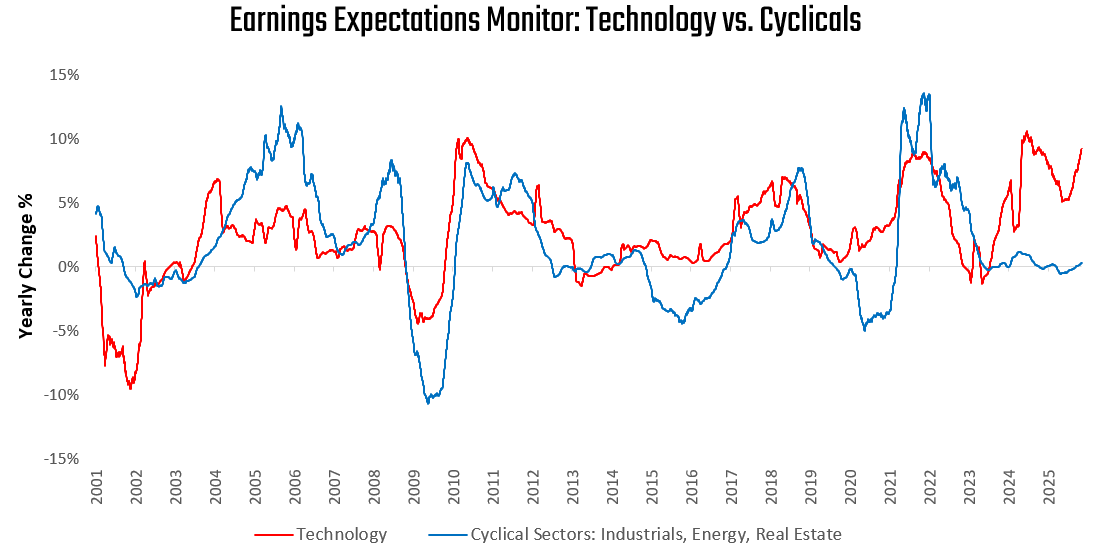

However, we find that this strong earnings growth remains relatively lopsided, driven almost entirely by technology and associated sectors:

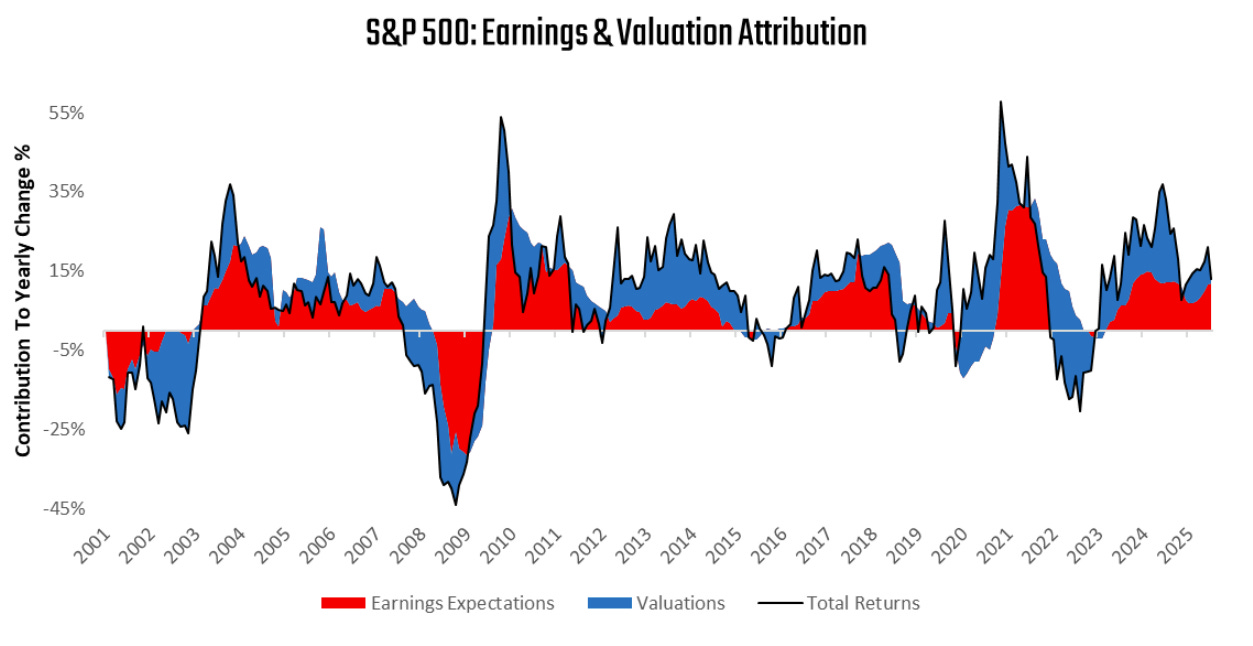

Furthermore, earnings expectations have potentially exceeded what the economy can deliver. We see this in our measures below:

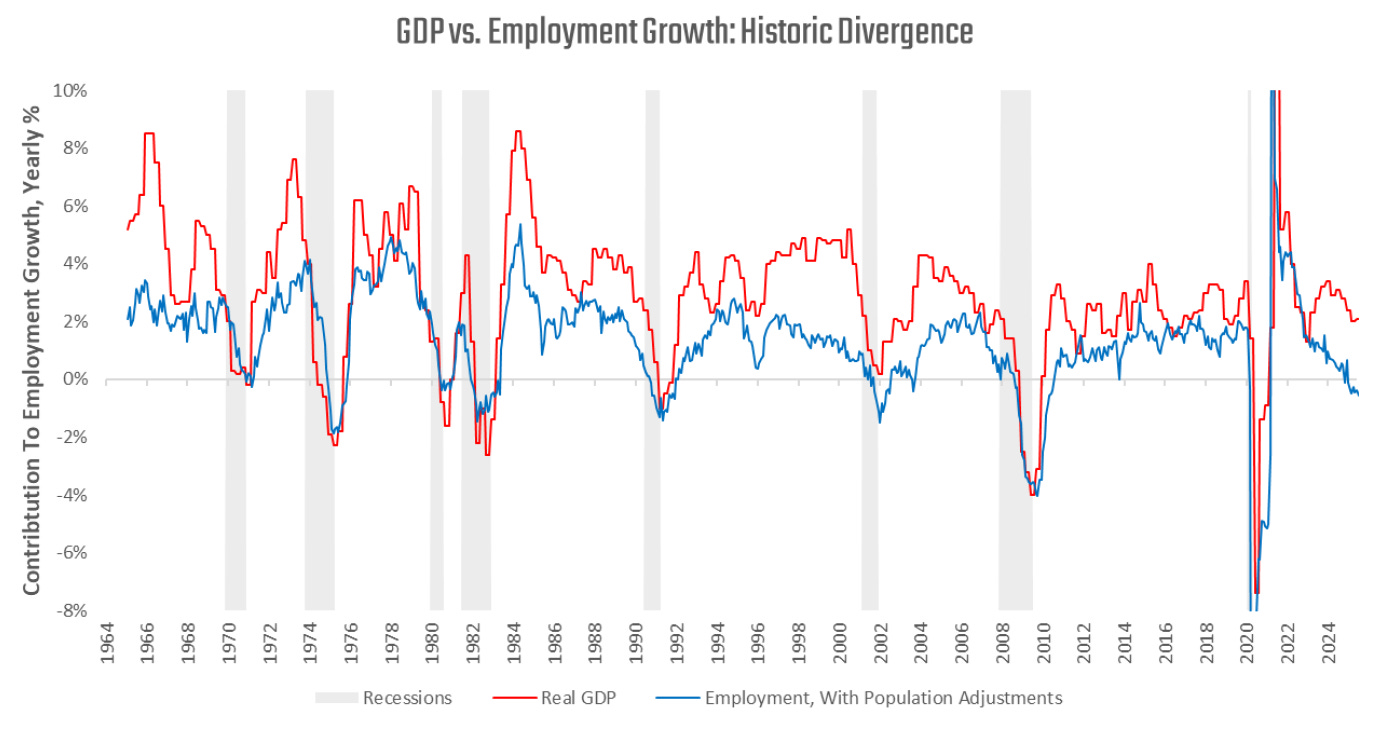

Recall, while we have indeed noted the positive and profit-producing effects of technology investment, the economy also has a meaningful headwind in the form of slowing population growth:

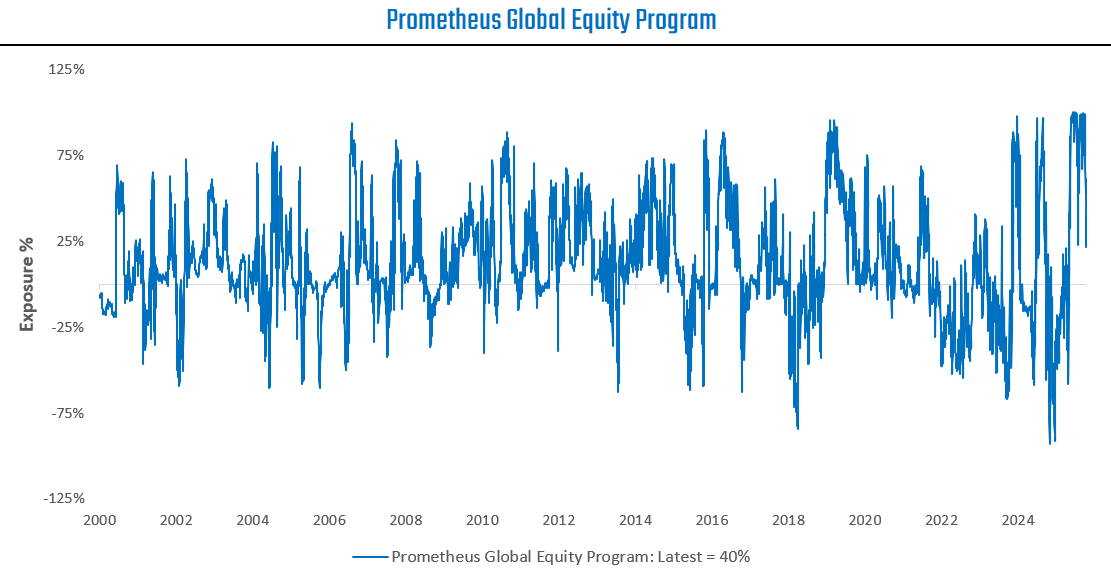

Thus, while our measures continue to show an expanding business cycle, the pricing of US equities may see some declines as they re-rate to reflect these pressures. We observe these dynamics reflected in our Global Equity Program, which has de-risked meaningfully over the past week, now standing at 40% of maximum exposure.

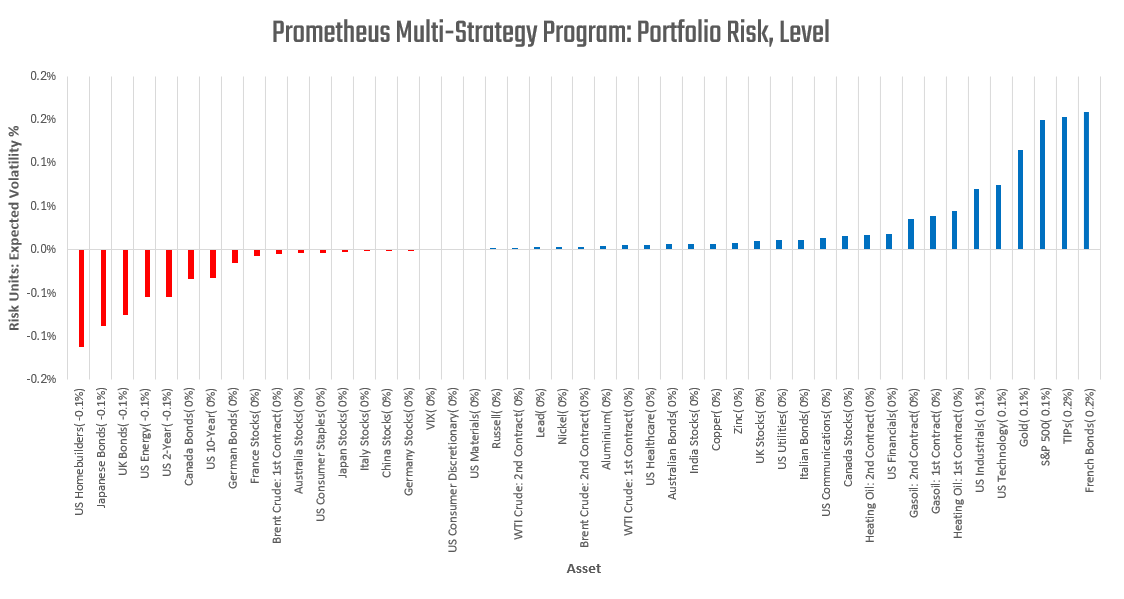

By no stretch do we think the economy has dived into a recession. However, our multifaceted systematic process is revealing more mixed signals than it has all year, and we believe they are noteworthy. These pressures can be resolved simply through some devaluation of equities—part of which occurred last week. Heading into next week, the Prometheus Multi-Strategy program is taking on more idiosyncratic long/short opportunities in equity markets, rather than the outright bets it has had on beta recently:

Our systematic process now suggests that a more cautious and dynamic approach to beta is required in the near term. Tactical shorts are likely to be more available than they were prior to the last two weeks, and our Prometheus Multi-Strategy Program is well-adapted to take advantage of short-term opportunities.

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.

Seems like your models suggest a slight preferences in commodities ex energy.

Any views on the dollar?

I am bullish for the week ahead due to Hammer pattern noticed in Friday trading.