Weak Labor = Positive For Stocks?

What the latest labor data means for Stocks & Bonds.

The labor market has sparked much debate about the health of the economy and its implications for markets. We dissect the drivers of the labor market and track the flow of activity from labor to spending to profits to market pricing to provide a clear picture for macro markets.

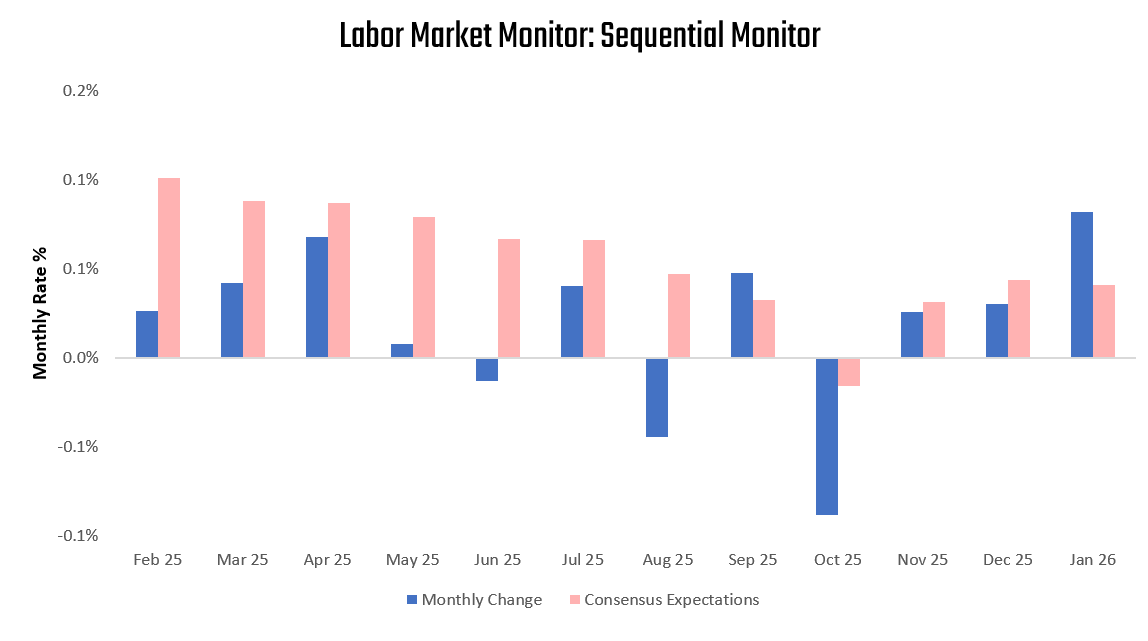

The latest data for January showed Nonfarm Payrolls increased, coming in at 0.08%. This print surprised consensus expectations of 0.04% and contributed to an acceleration in the three-month trend relative to the twelve-month trend. We show the sequential evolution of the data below:

These changes were a material shift in the three-month trend, nudging employment growth into positive territory. We show this modest increase below:

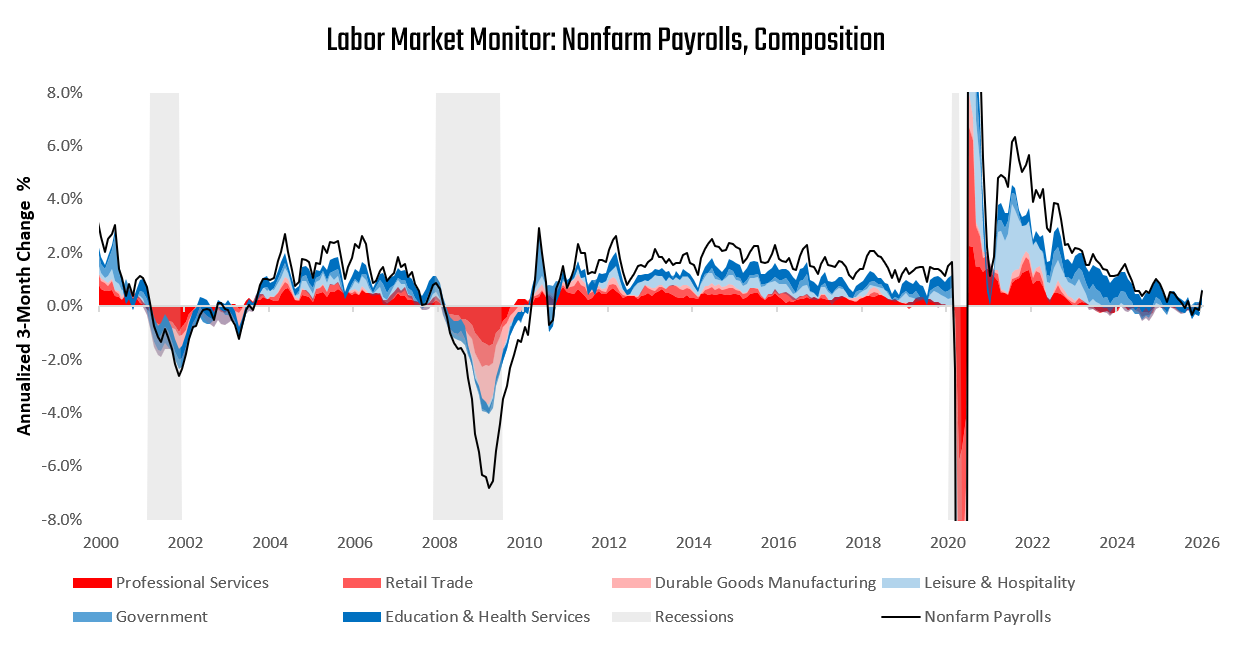

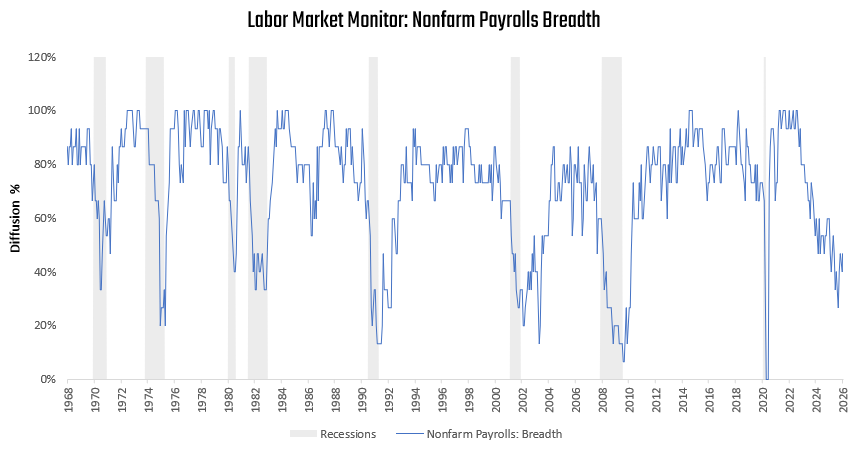

Non-cyclical employment continues to lead the pack. Nonetheless, it is worth noting that employment breadth (the number of sectors seeing higher vs lower employment) continues to show weakness:

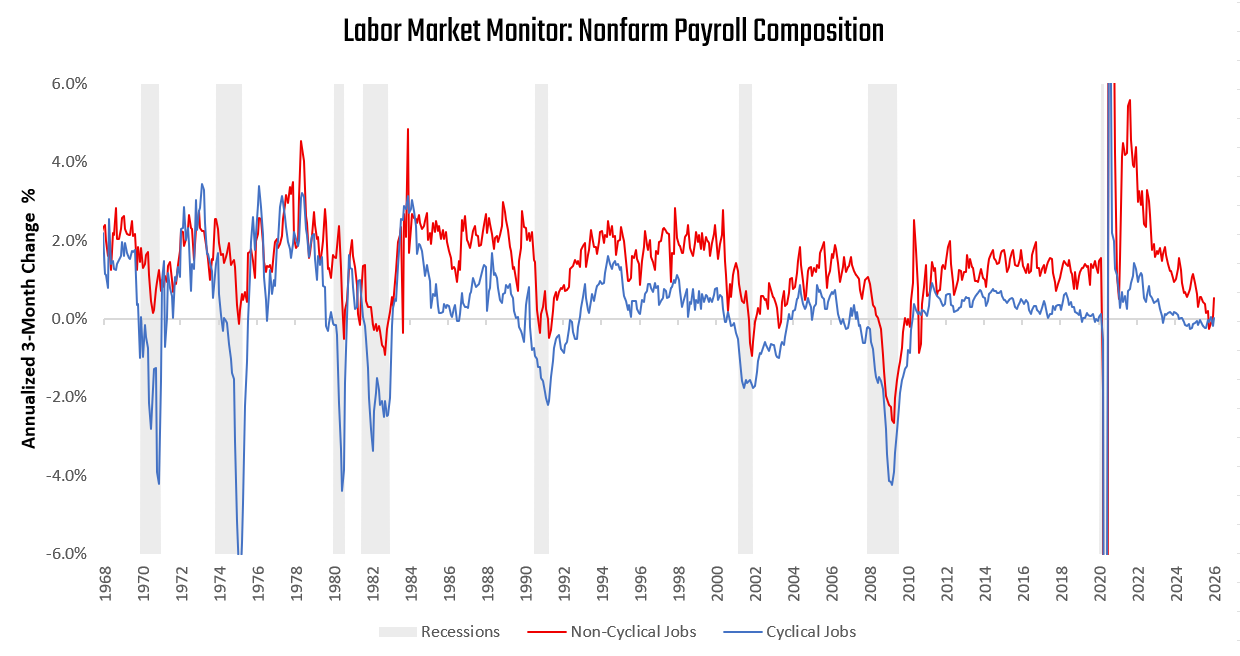

Furthermore, cyclical job growth (manufacturing, construction, and trade) remains weak:

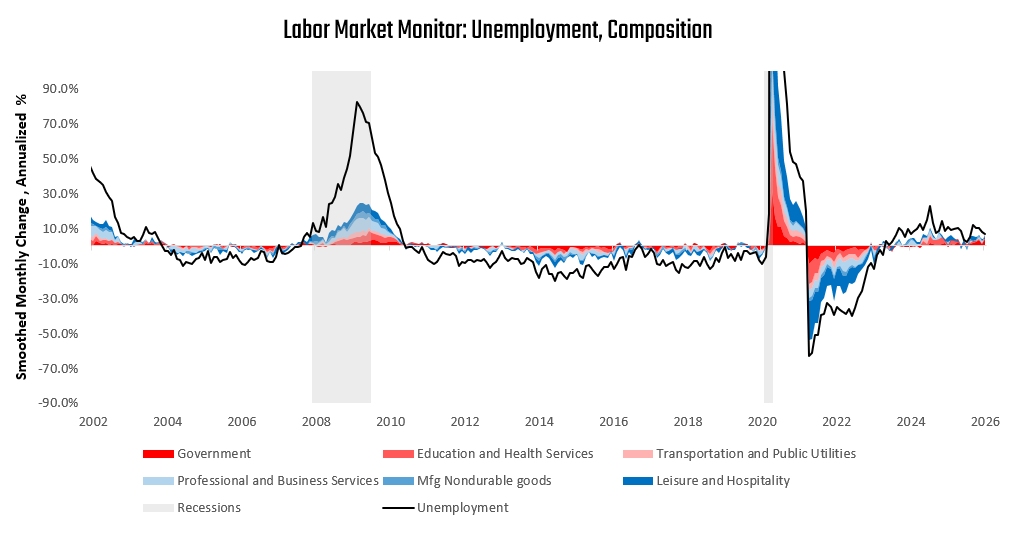

Weakness in cyclical job growth has typically indicated slower credit cycle activity. However, changing population and demographic conditions may potentially be muddying this picture. While job growth in cyclical sectors has remained weak, it is worth noting that the aggregate measures of cyclical conditions (unemployment) have remained contained:

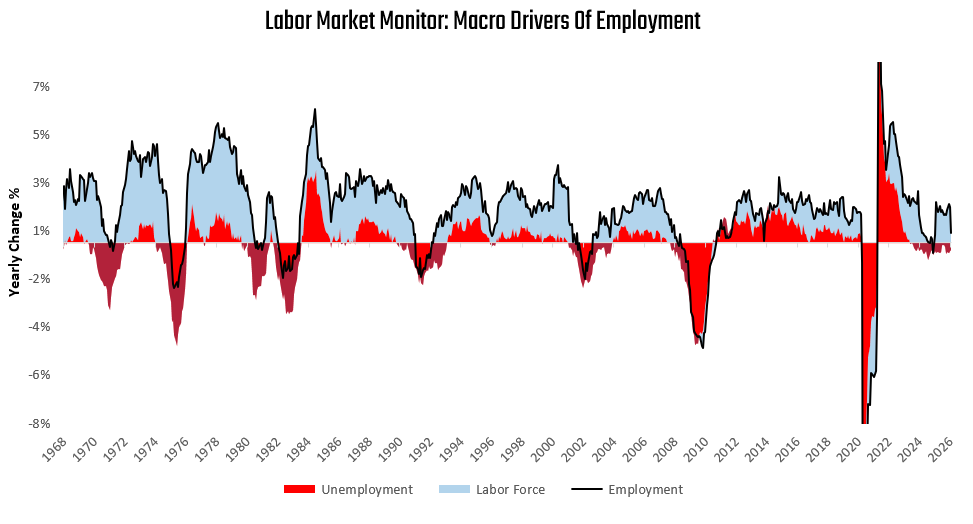

Unemployment remains contained. As such, the weakness in employment is coming not from a tightening of cyclical conditions via unemployment rates, but rather from changes in the labor force.

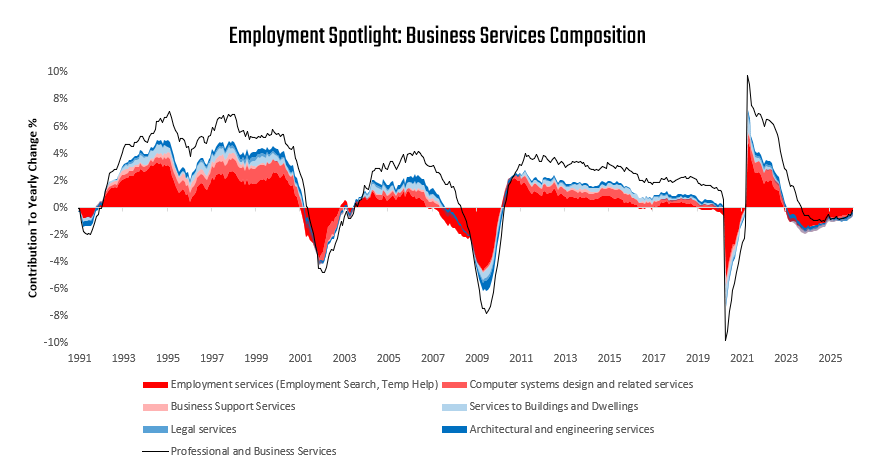

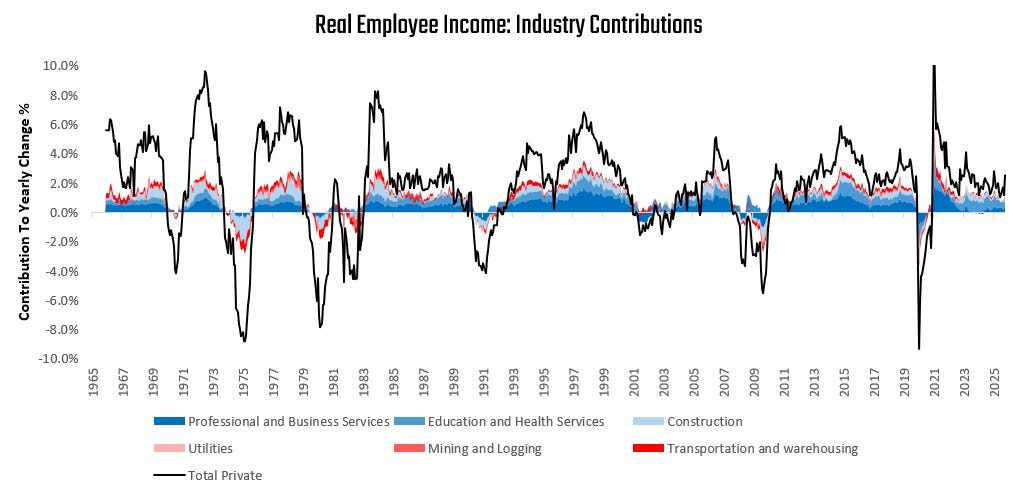

Thus, we continue to see a labor market frozen by a declining labor force rather than a deteriorating cyclical dynamic. Furthermore, we see the lack of cyclical deterioration in the fact that the sector with the weakest job growth today (professional services) is seeing the largest income gains. Below, we see how professional and business services employment is seeing a broad-based and consistent decline:

Meanwhile, the category continues to be the sector with the strongest income growth across sectors:

This is driven by an increase in real wages alongside a structural decline in temporary help services employment, potentially accelerated by the proliferation of artificial intelligence tools. A business cycle downturn driven by declining employment in professional services is highly unlikely to be accompanied by rising real wages and incomes in the sector, which we find is the case today. These conditions, coupled with evidence of a falling labor force, continue to suggest that the labor market is undergoing a secular shift rather than a cyclical weakening.

Market Implications

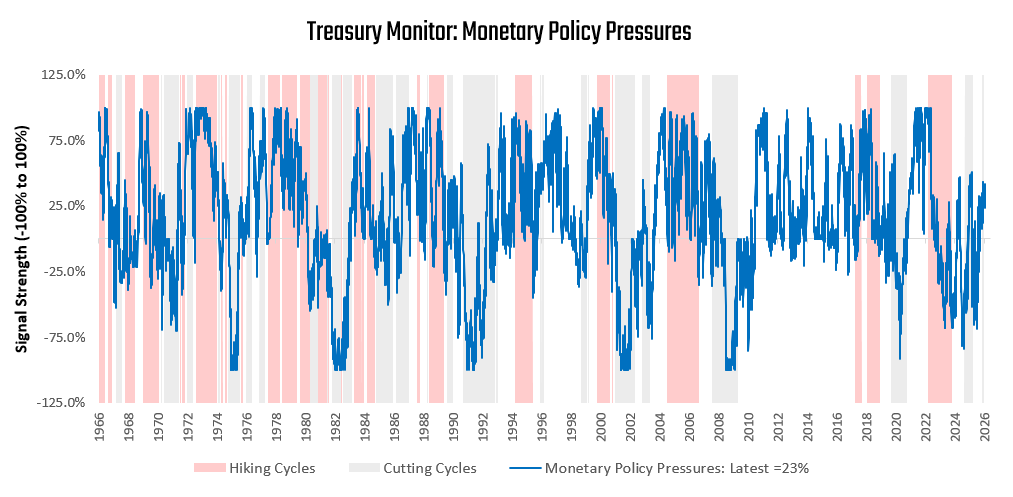

We work through the implications of this data for equity and bond markets. We begin with the fixed-income markets as the linkages are more direct. Cyclical conditions in labor markets directly affect the Fed’s inclination to ease or tighten monetary policy. While employment growth may be anemic, the absence of cyclical weakness (rising unemployment) limits how much the Fed needs to react at this time. This dynamic continues to keep our monetary policy pressures gauge positive:

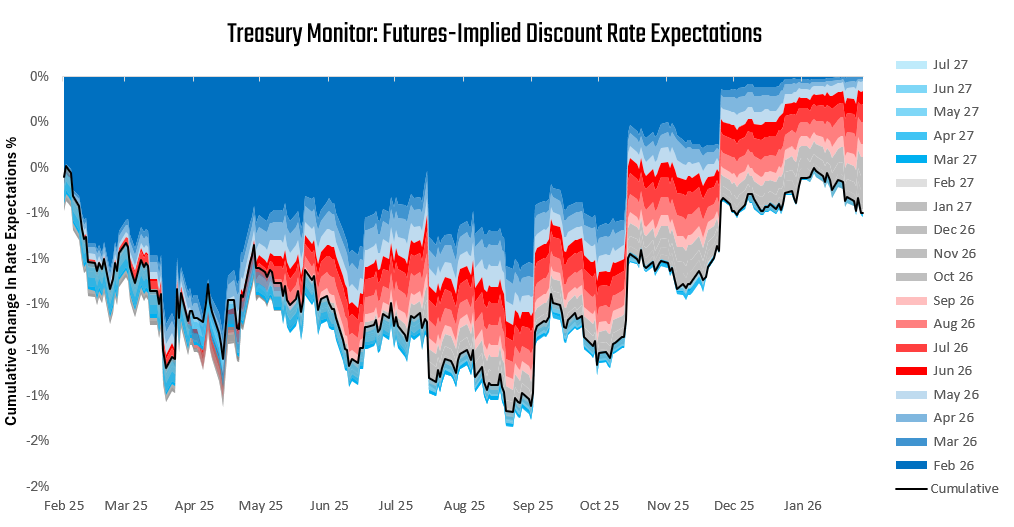

Our gauges suggest that, despite the weakness in the labor market, the Fed will be more likely to hike than to cut based on the data. This theme has paid off well since September 2025, following which markets have moved to discount significantly less easing:

While the opportunity set is now smaller, we continue to see nominal activity, which is inconsistent with a significant easing environment from the Fed. For this to shift, we would need to see a material loosening of the labor market. This may come, but we do not see it yet.

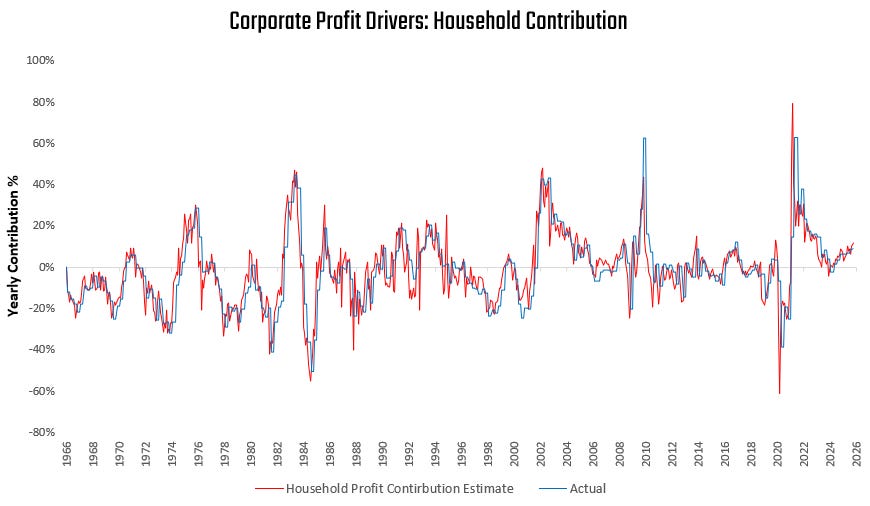

Turning to equities. The linkages from labor to equities are less direct than those from labor to treasuries. Equities benefit from strong labor growth when that labor growth turns into strong spending. Currently, while labor growth is limited, income growth remains persistent and continues to feed into consumer spending. We visualize this flow to corporate profits below:

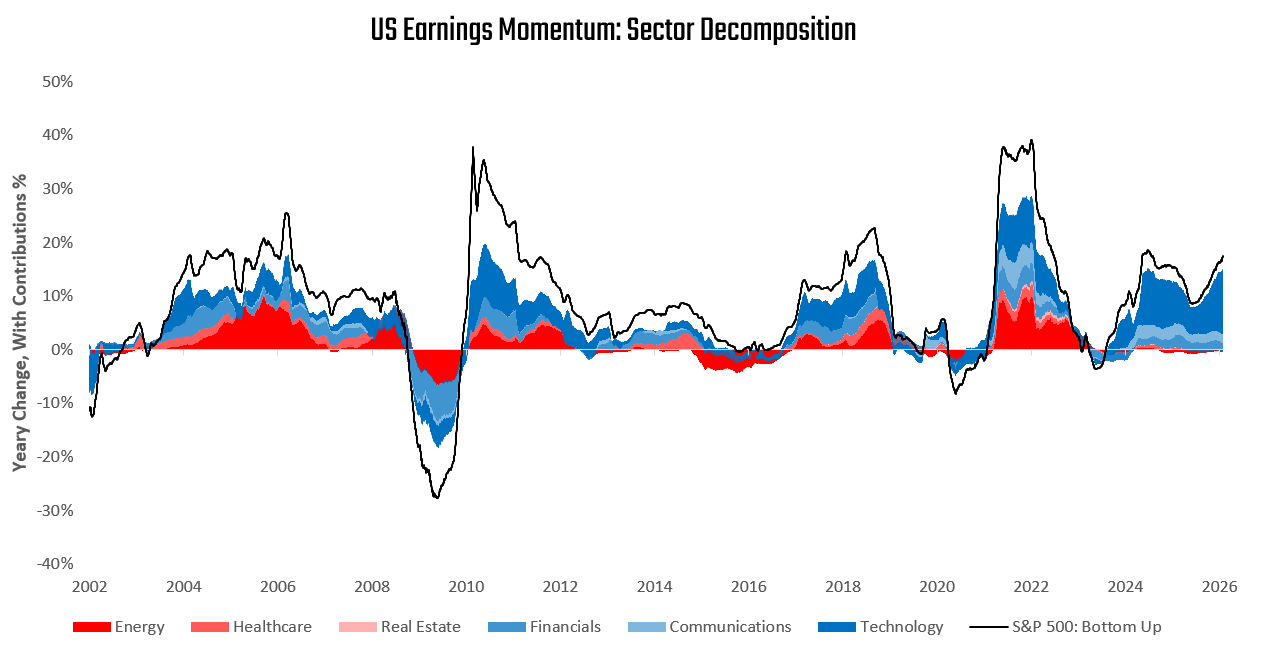

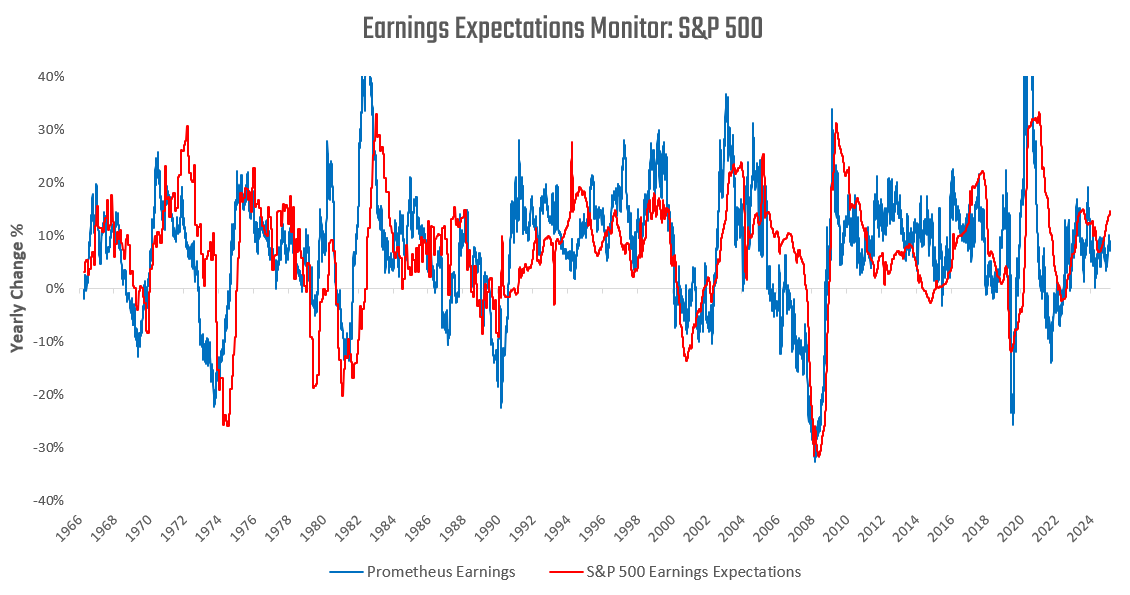

Therefore, even though labor markets continue to weaken, income flows continue to support corporate profits. These dynamics, along with sustained business investment, continue to support corporate profits and their expectations:

Therefore, the latest labor data, while still showing weak trends, does not directly conflict with positive earnings. Therefore, we think today the question is not whether equity earnings should be positive, but how positive they should be.

Today, our measures suggest that consensus expectations are modestly rich. This opens the equity markets to corrections, but not necessarily recessionary dynamics.

Overall, our assessment of the labor market is that there is undoubtedly weakness. However, the broad-based evidence suggests it is not cyclical weakness, but structural change. This limits the need for the Fed to react and has not had a material impact on corporate profits. These conditions continue to support equities and weigh on fixed income.

The discussion around cyclical job growth and sector breadth was particularly interesting. Those internal labor dynamics often have subtle second-order effects across credit and liquidity trends.

Great context in a complicated environment! Super helpful.