This is an excerpt from our latest Month In Macro report that was shared with all of our Bespoke and Research Suite Subscribers. Below we explain the primary drivers of total returns of a Treasury security (policy rates, policy rate expectations & term premia) and isolate the drivers of excess returns (policy rate expectations). Consequently, a holistic view of treasuries requires a view of each of these drivers.

Over this month’s Month In Macro edition, we assess what we think of labor conditions, inflationary pressures, and supply forces to create this holistic view. If you’re an institution looking for access to our research, contact us at info@prometheus-research.com. See you on the other side.

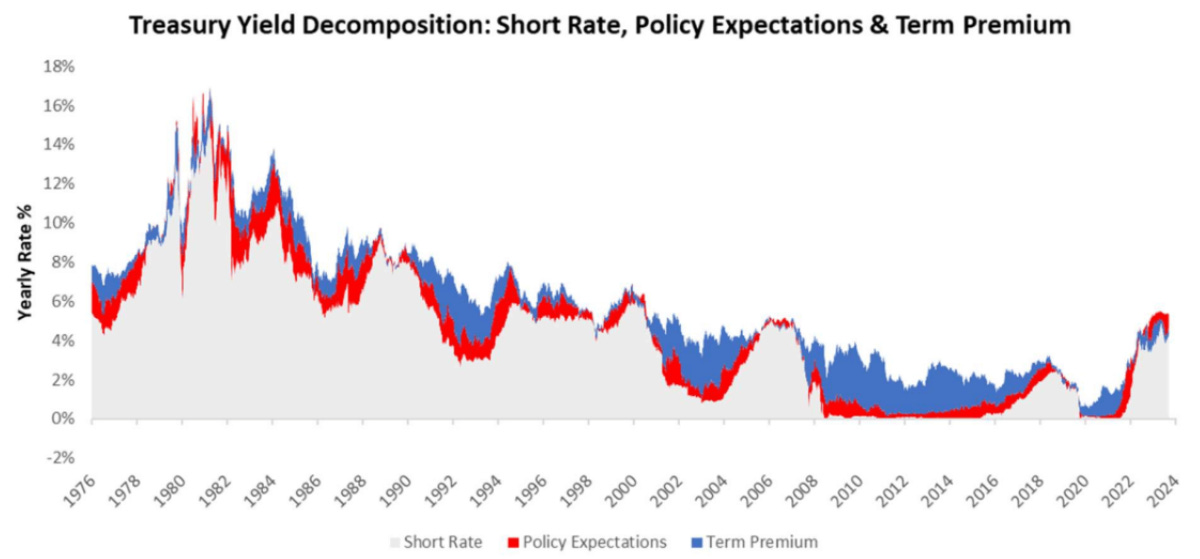

Changes in the yield of a Treasury security inversely drive the total return on the security. These yields have three components: the realized policy rate, the expected policy rate, and a term premium. We deal with each of these components individually.

The realized short rate of the policy rate is the most important driver of total returns of treasuries over time. This mechanism is a function of the fact that all treasury securities earn interest over their life, which includes the policy rate plus a spread. Therefore, changes in the policy rates slow through to all securities and, over long periods, are the most important driver of total returns. However, these realized policy rates do not matter for alpha generation, as it is already in the security price and cannot be levered up. Therefore, what matters to alpha generation is the shape of the yield curve, which has two components: the expected policy rate and the term premium.

Expected policy rates are set by market participants who react to growth and inflation data to assess the expected path of policy rates. This pricing is highly reactive to ongoing economic data but can sometimes depart significantly from the bigger picture. Views on the expected policy rate require a careful evaluation of cyclical dynamics to ascertain whether what’s priced into policy expectations is consistent with the probabilities of where the economy is headed over the next eighteen months. At inflection points in the economic cycle, this component of the Treasury curve is the dominant driver of excess returns over cash for Treasuries.

Beyond policy rate expectations, we have Term premia. Term premia reflect the added risk of investing in long-term security rather than simply rolling a series of short-term securities over the same period. As such, term premia exists for every maturity of treasuries but progressively expands the further we go out in maturity, i.e., a 10-year note contains a larger term premium than a 2-year note (which has almost none). This term premium is a function of the player’s demand and supply forces in the long-term treasury market and reflects longer-term nominal growth dynamics.

The higher the long-term expectation for nominal growth, the higher the term premium required to entice investors to lock their money into a fixed-income security. Unlike the expected policy rate, the pricing in this part of the curve is slower moving, has less practice with monetary conditions, and is more consistent with longer-term macro conditions.

Further, term premia are more sensitive to relative demand and supply conditions. When the government issues more long-term securities, the private sector must take on more risk. The risk needs to be adequately compensated for a given level of expected nominal GDP, which moves term premiums.

In summary, term premia are a priced function of long-term NGDP, underwritten by demand from economic entities. Outside of periods of monetary policy shifts, term premia are often the dominant driver of treasury excess returns, but rarely during. Until next time.