In this note, we share our thoughts on the macro mechanics at play in the context of the current economic cycle. If well received, we will continue to share these Macro Mechanics. Let us know in the comments below.

Monetary and fiscal policy are dominant drivers of treasury markets. Yesterday, we received significant information on both these policy levers, which significantly impacts the outlook for Treasuries.

Before diving into our conclusions, it makes sense to share our mechanical understanding of how monetary and fiscal policy impact bond prices. At a high level, monetary (Fed) and fiscal (treasury) policy are just two parts of a whole, i.e., the Government. While they have distinct roles, the overarching goal is to conduct policy for societal good. Three key determinants of this broad societal good are price stability, full employment, and financial stability, all contributing to moderate interest rates.

Since the 1960s, most of these conditions have been largely influenced by the Fed, which used interest rate policy to achieve outcomes consistent with policymakers' objectives. The Fed has achieved these objectives largely through interest rates. However, when rates proved insufficient or hit zero, they turned to asset purchases and sales (QE/QT). As the role of fiscal policy has grown in recent years, the role of the treasury has expanded significantly as elected officials have moved to increase deficit spending.

A crucial understanding in this dynamic is that the Treasury itself does not decide the size of stimulus/deficits it injects into the economy but rather plays the role of optimally executing the spending initiatives of elected officials. As such, the role of the Treasury QRA is to issue debt in a manner consistent with maintaining a stable treasury market today and moderate interest costs over time.

Putting these together: Monetary policy moves primarily to optimize for full employment and price stability. Treasury QRA is the execution of fiscal policy, which moves to optimize the funding mix for a given level of fiscal spending. Both these policies overlap in their objectives of financial stability and moderate interest rates/funding costs. While this may seem like a clean delineation, the reality is often much more mixed, but these divisions help capture the primary muscle movements. Turning to their impact on bonds.

A treasury bond is a government liability, and all of these policy moves impact the price of that liability. The most immediate and impactful policy with bonds is the changes of short-term interest rates by the Fed. Additionally, the expected path of these short-term rates is one of the most dominant drivers of interest rates. This expected path is a function of cyclical expectations for the labour market and inflation over the next 12-24 months and is highly sensitive to the Fed. Next, we have asset purchases.

The Fed engages in asset purchases to bolster liquidity in the financial system. These purchases are of longer-duration assets—they create reserves in the banking system and remove treasuries. The immediate impact of these purchases is to increase bond prices; however, over time, this increase in liquidity in the financial system bolsters balance sheets and expands risk-taking. As such, we see a migration from long-term bonds into riskier assets, causing a steepening of the yield curve. Often, this can be a bull steepening with short rates moving downwards. As such, the asset purchase policy is largely supportive of bonds & assets (as intended) but primarily moves to impact the yield curve. The more asset purchases, the more the steepening pressure, and vice versa.

We now turn to the treasury. Recall, that the treasury does not choose the total fiscal spending. While this is an extremely meaningful driver today of the government achieving full employment and price stability, it is not in the hands of the QRA. The QRA seeks to create stability of borrowing conditions to facilitate the best borrowing costs for the government for a given level of approved spending. The key determinant of maintaining this stability is the compositional choices of the funding, i.e., does the Treasury issue more treasury bills (short term) or coupons (long term) securities. This decision requires an evaluation by the Treasury of the existing demand for securities across various tenors.

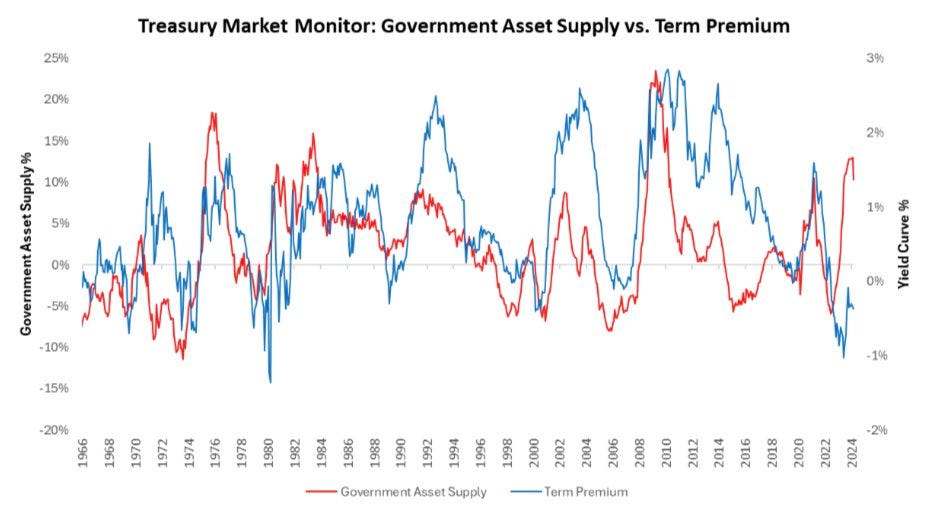

The more the treasury issues of a specific tenor relative to the existing balance sheet capacity of the private sector to absorb that issuance, the more pressure there is on the price of the treasuries. Therefore, when there is a high amount of liquid asset seekers in the form of money market funds in the private sector, more bill issuance may be more suitable to more coupon issuance. It’s important to recognize that a significant amount of this balance sheet capacity also varies by the economic environment—coupons may be more easily absorbed during disinflationary periods than stagflationary ones. The treasury will always seek to maintain stable outcomes to make sure bond market yields are not too volatile or rise too fast. We now put these drivers in the current context.

With nominal GDP conditions largely stable and inflation above target, the Fed is unlikely to be able to move policy rates lower. Meanwhile, markets continue to price approximately 3 cuts. Given the persistence of nominal growth, this pricing is unlikely to be realized. At the same time, the Fed has also telegraphed the reduction of its balance sheet roll-off (less asset sales), which will likely stabilize liquidity in the financial system. This dynamic, amidst a stable nominal GDP environment, is unlikely to support a flattening of the yield curve but rather supports a steepening, with a bias towards bear steepening.

Finally, the Treasury has once again committed to a significant amount of treasury coupon issuance through Q3 of this year. Additionally, they have increased the pace of total (coupon + bill) issuance. This elevated pace of issuance will likely remain a pressure on the private sector to absorb amidst a high NGDP environment. Overall, the outlook for bonds remains a weak one based on our assessment.

Bonds remain tough for asset allocators to hold with these pressures. Our portfolios continue to avoid them. We hope this post shares the mechanics so you can come to your views rather than just hear ours. Until next time.

Thank you! Very clear and helpful!

Insightful explanation