Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

Our primary takeaways are as follows:

The recent trend in manufacturing new orders showed signs of a sequential deceleration, disappointing consensus expectations.

Zooming in, factors such as weak sales, low levels of production, and high labor cost pressures continue to pose significant headwinds to manufacturing profits. Additionally, the forecasted path for manufacturing orders remains in contraction.

Relative to these pressures, price action of industrial equities have moved consistently with the weak manufacturing backdrop. Our alpha strategies remain short stocks.

The latest data for November showed manufacturing new orders for durable goods decreased by -1.16%, disappointing consensus expectations of -0.5%. This print contributed to a deceleration in the quarterly trend relative to the yearly trend. Below, we show the sequential evolution of the data relative to consensus expectations:

This data, along with the latest nondurable orders data, places total manufacturing new orders growth at -0.74% in November. Over the last year, manufacturing new orders have grown by -1.93% compared to one year prior. Below, we show the contributions coming from durables (-2.66%) and nondurables (0.73%) to these changes in total new orders:

We now zoom into the most recent print. Below, we show the composition of the most recent data for manufacturing new orders. Please note that we include our estimates for nondurable goods if the latest data is not yet available. The largest contributor to the most recent change in manufacturing new orders is Nondurable Goods, and the most significant detractor was Transportation equipment. We display the composition below:

To better understand these changes over the last year, we decompose durable goods orders by industry. Over the last year, Electrical equipment & appliances, Fabricated metal products, and Primary metals have been the primary drivers of strength in durable goods orders, as shown in shades of blue below. On the other hand, Transportation equipment, Furniture & Appliances, and Machinery have dragged on growth, as shown below:

Real manufacturing orders and industrial production move hand-in-hand, with new orders fuelling output. Currently, orders are consistent with the latest industrial production data. We display this below:

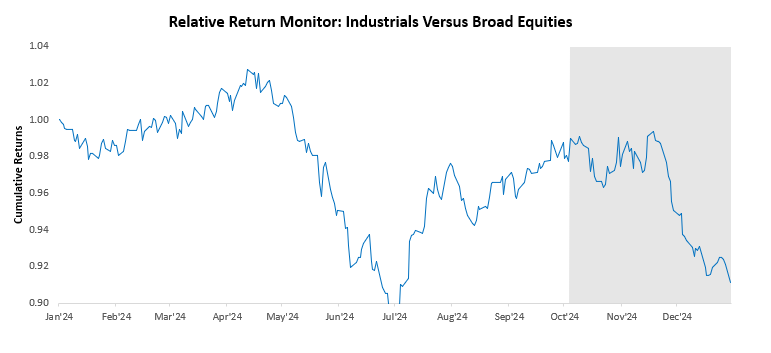

Putting this data in the context of markets, industrial equities have moved consistent with the most recent three-month change in manufacturing new orders, with industrial equities falling relative to broad equity markets. Below, we show the relative performance of industrials versus broader markets over the last year:

To further contextualize this economic data relative to markets, we show a longer lookback comparing the relative returns of industrial equities versus broad equities to manufacturing new orders. As we can see below, industrial equities have typically shown a modest relationship to manufacturing new orders:

Finally, we look ahead to understand how the data is likely to evolve. Currently, the path for manufacturing orders based on recent data is consistent with a recessionary path. We show this below:

Overall, the recent trend in manufacturing new orders showed signs of a sequential deceleration, disappointing consensus expectations. Zooming in, factors such as weak sales, low levels of production, and high labor cost pressures continue to pose significant headwinds to manufacturing profits. Additionally, the forecasted path for manufacturing orders remains in contraction. Relative to these pressures, price action of industrial equities have moved consistently with the weak manufacturing backdrop. Our alpha strategies remain short stocks. Until next time.