The Observatory

Growth Slowdown Ahead

Click here to enter The Observatory.

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Without further ado, let’s dive into what our systems are telling us:

Markets: Equity markets bounced yesterday after beginning the session significantly lower. These bounces generate opportunities to add short exposures, particularly in the Communications sector. We saw selling activity in Gold and Treasuries during this equity market bounce, creating opportunities to add exposure. If market pricing continues this way until the end of the day, our Expected Return Strategy will be short Communications and long Treasuries & Gold heading into next week (alongside commodity positions). After briefly considering Soybeans as a potential exposure, our systems have readjusted, estimating that they have negative expected returns during the current regime mix.

To summarize our systems' current assessment: Our Market Regime Monitors show that we have started the week once again in (+) G (+) I; however, the odds of (-) G (+) I & (-) L remain elevated. Our Momentum Monitors show that Equity and Treasury Momentum Scores remain depressed, at 35% and 0%, respectively. This dynamic reflects the damage done to assets by heightened market pricing of inflation. Consequently, our systems tell us that the best opportunities are LONG Bonds, Gold, Cotton, Lean Hogs, Live Cattle & Sugar, and Short: Communications. However, our Risk Management Monitors indicate that we can ADD to LONG: Bonds, Gold, Live Cattle, Sugar. We can REDUCE our LONG: Cotton & Lean Hogs, and SHORT: Communications. Our Expected Return Strategy is LONG: Cotton & Sugar.

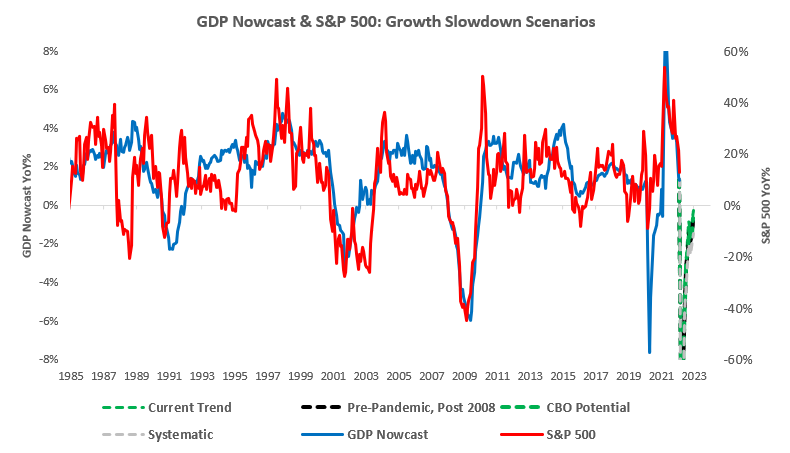

Macro: We saw some big decelerations in our GDP Nowcast as income and spending data guided our systematic assessment of growth lower. Further, our systems estimate that growth is highly likely to turn lower in the months ahead. A regime change is highly likely in this environment.

To summarize our systems' current assessment: The latest economic data create a big move lower in our GDP Nowcast, with economic growth tracking at 1.3%. Economic Momentum has yet to respond, but we expect these measures to once again be in sync as growth further deteriorates. For approximately six months, our systems have been calling for a material GDP growth slowdown in March-April of 2022. Given the prospectively dramatic change, this would elicit, we stress-test this output by adjusting for various degrees of the underlying GDP trend. Our systems currently place the GDP trend at 1.8%, but no matter the trend estimate used, a slowdown beginning in March is highly likely. Our systems estimate that the coming drawdown in spending will (like much of COVID-19) be a tale of two economies, with areas most affected by COVID-19 slowing much more than those which benefitted. However, the slowdown in areas most impacted by COVID-19 is likely to weigh on aggregate spending significantly.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.