The Observatory

Volatility Rising = More Risk-Off Exposures

Click here to enter The Observatory.

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Without further ado, let’s dive into what our systems are telling us:

Markets: Today will likely be an exciting day in markets, following complications around the Ukraine-Russia situation. If the situation continues to escalate, we expect higher realized and implied volatility in the equity market, creating a faster-moving market. We designed our systems to adjust to these sudden shifts in volatility; therefore, we expect our signals to navigate any geopolitical escalation. Additionally, risks of falling growth regimes and tightening liquidity remain elevated; therefore, any sudden risk-off shocks are likely to catalyze a regime shift. In line with this, our systems have started to signal opportunities in Gold and continue to flag Treasuries as optimal exposure while still exploiting the (+) G (+) regime via long Commodity exposures. Additionally, actively managing Communications shorts is likely to be portfolio accretive during a higher volatility regime.

To summarize our systems' current assessment: Our Market Regime Monitors show that we have started the week once again in (+) G (+) I; however, the odds of (-) G (+) I have accelerated significantly. Our Momentum Monitors continue to show elevated momentum in Commodities and Gold, while Equities and Treasuries continue to flounder. This dynamic suggests sustained momentum in the market pricing of inflation. Therefore, while our Market Regime Signal points to (+) G (+) I, persistent inflation and slowing real growth have led our systems to flag Gold as a new optimal exposure. Consequently, our systems tell us that the best opportunities are Long: Bonds, Gold, Cotton, Lean Hogs, Live Cattle & Sugar, and Short: Communications. However, our Risk Management Monitors indicate that we can ADD to LONG: Bonds & Cotton. We can REDUCE our LONG: Gold, Lean Hogs, Live Cattle & Sugar, and SHORT: Communications. Our Expected Return Strategy is LONG: Cotton & Sugar.

Macro: This week, we will receive data critical to assessing the outlook: US Incomes & Spending, Regional PMIs, Durable Goods Orders, and Initial Claims. Though possible, we expect the most severe declarations to begin next month.

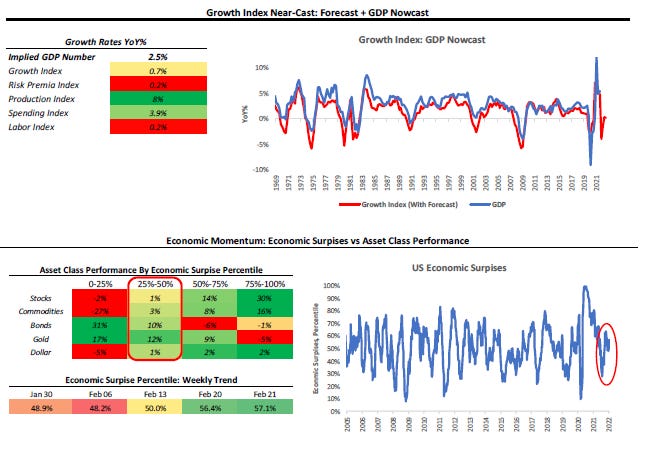

To summarize our systems' current assessment: Our GDP Nowcast and Economic Momentum measures have diverged over the last week, with our GDP Nowcast roughly unchanged, but our Economic Momentum turned higher. This divergence is likely driven by a material repricing of growth expectations lower. However, our systematic forecasts for growth tell us that there is material deceleration ahead of us during the March-April period. Our Liquidity Monitor shows that Repo activity slowed in January, alongside flows into Money Market Funds. These suggest tightening private liquidity for financial markets.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.

TLT, GOVT, IEF, SHY would all be a regime favored assets, however signal strength is still limited. BOND has corporate characteristics and would be less of a pure play.

Long bonds as in long TLT, BOND?