The Observatory

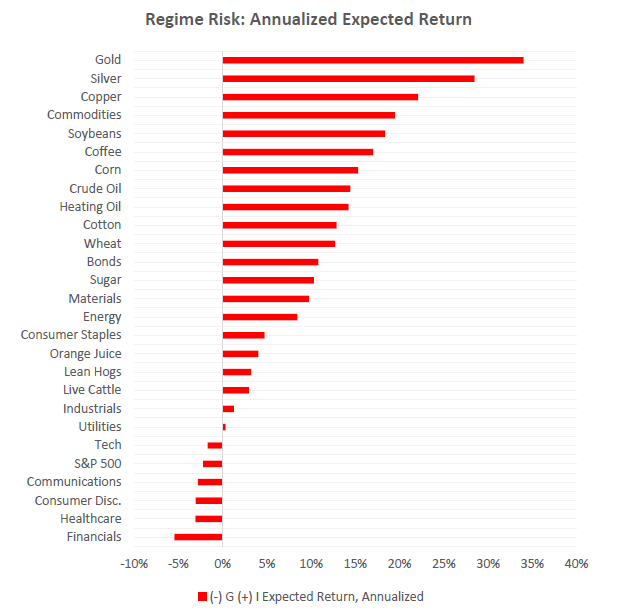

(-) G (+) I Rising

Click here to enter The Observatory.

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Without further ado, let’s dive into what our systems are telling us:

Markets: Recent price action has favored our strategies, both Alpha and Beta. Surging strength in Commodities and other inflation beneficiaries, i.e., TIPS & Gold, have been suitable supports for Beta Rotation. Further, despite the strength in Commodities, there has been adequate inter-asset class volatility, creating opportunities for our Alpha strategies to exploit. 2022 has not been a good year for a pure Beta approach, and active management has been an essential overlay. Over the last week, our signals have now begun to flag Gold & Soybeans as new optimal exposures. This move coincides with a significant rise in the (-) G (+) I market probability, a regime during which Gold & Soybeans have elevated expected returns. Therefore, we think these additions by our system are likely to be portfolio accretive.

To summarize our systems' current assessment: Our Market Regime Monitors show that the rallying Dollar and Gold have taken from (+) G exposures this week. However, (+) G (+) I dominates in market-implied probability. Our Momentum Monitors that Gold Momentum continues to remain extremely strong, particularly since its rise above our regime support estimate of $1808 in the first week of February. Commodities continue to have strong trend support as well. Inflation momentum persists. The market-implied probability of (-) G (+) I has recently risen sharply, increasing the potential for a regime shift. Consequently, our systems tell us that the best opportunities are Long: Bonds, Gold, Cotton, Lean Hogs, Live Cattle, Soybeans & Sugar, and Short: Communications. Our Expected Return Strategy is LONG: Cotton & Sugar.

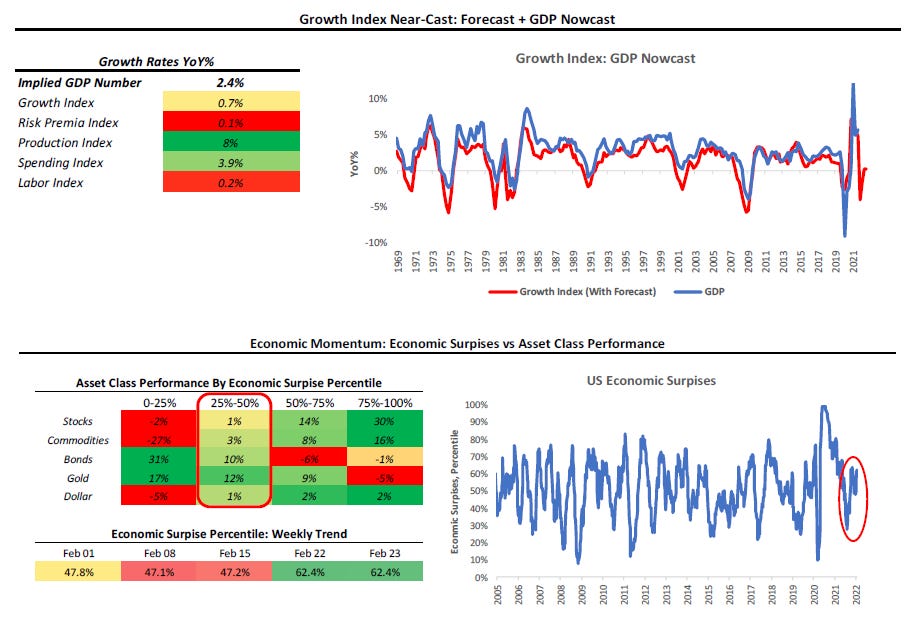

Macro: This morning, Initial & Continuing Claims data came in lower than expected and sequentially weaker, positives for economic growth and momentum. On the other hand, New Home Sales came in sequentially weaker and softer than expectations. The fundamental setup continues to be one where economic growth begins its descent before inflation, creating a pocket of time where markets discount (-) G (+) I before (-) G (-) I.

To summarize our systems' current assessment: Our GDP Nowcast furthered its descent, with the latest data now placing our economic growth tracking 0.1% lower, at 2.4%. Economic Momentum remains at odds with the downtrend in data, suggesting an unsustainable dynamic. Our CPI Nowcast remains elevated and relatively unchanged. The odds of (-) G (+) I are rising. Our Liquidity Monitor shows no signs of liquidity reviving itself. Market finance liquidity (Repo & Institutional Money Funds) showed declines recently, and the removal of Federal Reserve liquidity is unlikely to help the situation.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.