The Observatory

Adding Gold

Click here to enter The Observatory.

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Without further ado, let’s dive into what our systems are telling us:

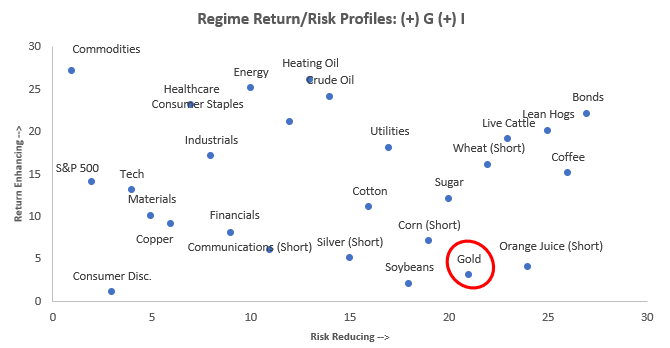

Markets: Yesterday's price action was once again favorable to our Alpha strategies, with Treasuries, Cotton, and Cattle all up. This positive performance was in sharp contrast to the equity market, which extended its year-t-date losses. Our systems have shown a widening distribution of market-implied probabilities, with all regimes in play now, barring (-) G (-) I. This market remains a great one for long-short, cross-asset alpha strategies, given the volatility of asset classes, along with their inter-asset divergences. Looking ahead, the current inflationary pressures will force a transition towards (-) G (+) I, which will give way to (-) G (-) I as the Fed tightens liquidity and the economy decelerates. However, this is a discretionary view, and our systems will lead the way. We see the early stages of this dynamic, with our systems now flagging Gold as an optimal exposure.

To summarize our systems' current assessment: Our Market Regime Monitors show that (+) G (+) I has seeded gains to (-) G (+) I, telling us that inflation is beginning to pressure real growth. Our Momentum Monitors continue to flag strength in Gold. Trend strength has significantly increased the market's inflation pricing. This dynamic adds to markets pricing of (-) G (+) I, which has been a strong trend this month. Therefore, while our Market Regime Signal points to (+) G (+) I, persistent inflation and slowing real growth have led our systems to flag Gold as a new optimal exposure. Consequently, our systems tell us that the best opportunities are Long: Bonds, Gold, Cotton, Lean Hogs, Live Cattle & Sugar, and Short: Communications. Our Risk Management Monitors indicate that we can ADD to LONG: Bonds, Cotton. We can REDUCE our LONG: Gold, Lean Hogs, Live Cattle & Sugar, and SHORT: Communications. Our Expected Return Strategy is LONG: Bonds, Cotton & Live Cattle.

Macro: This week provided respite to economic growth as economic data decelerations slowed. This abatement, alongside some downwards revisions to economic growth estimates, resulted in higher Economic Momentum. However, consensus expectations for 2022 remain elevated, especially given the decelerations due in data in March-April.

To summarize our systems' current assessment: The latest economic data have pushed our GDP Nowcast marginally lower to 2.5%. Contrastingly, Economic Momentum has moved up to 55%, providing a breather for equities. However, the material decelerations are likely to be during the March-April period. Our CPI Nowcast remains elevated and relatively unchanged, mainly due to the surging strength in commodity prices. The longer this gauge remains elevated, the higher the pressure on real growth and real return in the economy and markets, respectively.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.