The Observatory

Labor Markets Tight, But Loosening

Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

Today, we received new information in the form of jobless claims data. Jobless claims continue to show secular strength and cyclical slowing. However, they also so significant sequential softening from the cycle peak. These values do not indicate that we are currently experiencing a recession; however, looking backward, there is a significant change that we are in the ballpark of the recession start date if claims begin to weaken considerably.

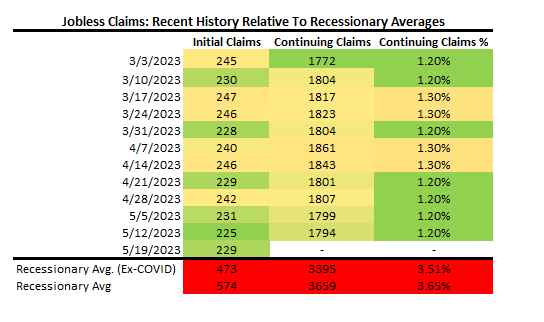

Initial & Continuing Jobless claims both disappointed expectations coming at 229 & 1794 versus the expected 245 & 1800, respectively. Below, we show the history of these measures, along with the Continuing Claims Rate, after adjusting these measures to provide an apples-to-apples comparison. Additionally, we combine these measures into a Jobless Claims Aggregate to capture the broad trend in the data:

Additionally, we show the recent evolution of jobless claims data over the last twelve weeks. Our tracking of Jobless Claims currently tells us that we are a ways off from recessionary territory:

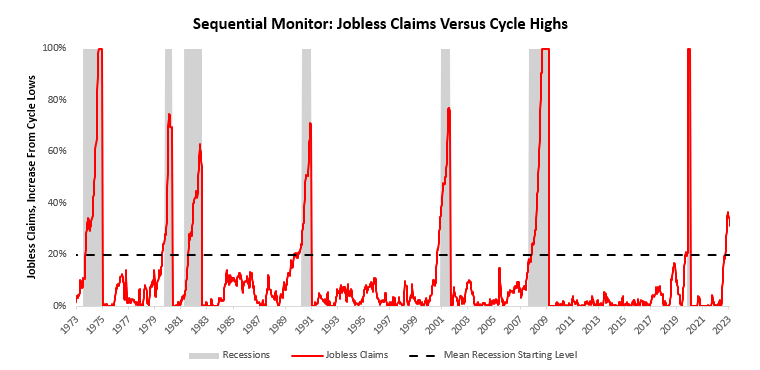

Further, we show these Jobless Claims measures adjusted to show our position in the labor market cycle. We remain in expansionary territory, though we have begun to descend:

Finally, we show jobless claims data from a more sequential perspective to understand where we are in the labor market cycle relative to the most recent cycle peak. As of our latest reading, our labor market measure shows Jobless Claims are 31%. Recessions typically begin around a reading of 20%, suggesting we are within the ballpark of recessionary territory.

Overall, the labor market is secularly tight, cyclically softening, and sequentially contracting. More of the same brings us further into contractionary territory. Until next time.

This is great. How are you calculating sequential jobless claims?