The Observatory

Fading the rout-and-reversal

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Due to the strong demand for the product, we will start sharing the beta version of The Observatory (click to download) as we finalize its designs. This will offer a high-frequency resource to those using our systematic macro approach, allowing them to “Observe” the macroeconomy through our quantitative lenses. We will soon be launching the product officially, i.e., with explainer materials and a standardized format. And don’t worry, it’s all still free! Also, make sure to follow us on Twitter for timely updates:

Without further ado, let's dive into what our systems are telling us:

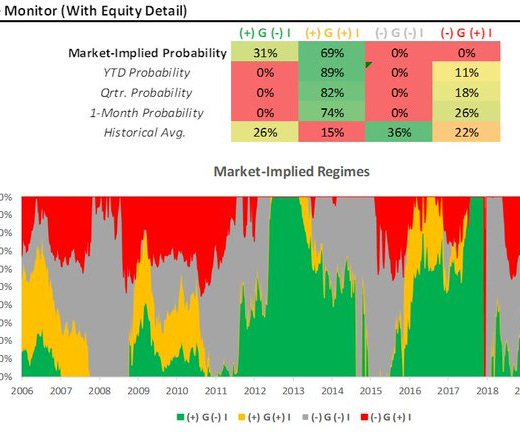

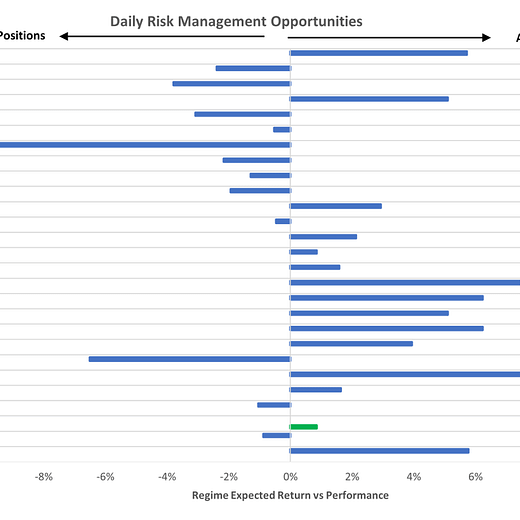

Markets: After a torrid day of trading, US equities closed in the green on aggregate, while our sole position, US bonds, closed in the red. These moves came on the back of significant changes in volume, suggesting technical factors (portfolio rebalancing, de-grossing, etc.) played a prominent role. We designed our systems to capture the underlying market trend, and despite their strength, these moves were too short of having any material change to the market regime. Therefore, going into today, the set-up is similar to yesterday, in that Treasuries offer attractive return-on-risk characteristics for the given regime, alongside a solid trading set-up. Additionally, our systems continue to look for opportunities in select commodities to add exposure. To summarize our systems’ current assessment: Our Market Regime Signal has decidedly moved towards pricing (+) G (+) I, i.e., rising growth and inflation, market regime. Furthermore, (-) G (+) I continue to exhibit momentum on a one-month basis, now vying for dominant status over this period. Consequently, our expected return and risk analysis tell us that the best opportunities are Long: Bonds, Cotton, Lean Hogs, Cattle, Sugar, and Short: Communications. After our Market Regime Signal transition to (+) G (+) I after pricing in (+) G (-) I, the menu of options from a return-on-risk perspective has gotten significantly wider. However, our Risk Management Monitors indicate that we can ADD to LONG: Bonds and Cattle. While our daily signal tells us Cattle is a solid opportunity, our expected return strategy will wait for further confirmation to introduce this position to its allocation.

Macro: Due to the rout-and-reversal in US equities yesterday, financial media seems to have overlooked the extremely significant downside surprises & sequential slowing in US Market PMI data. A considerable amount of selling pressure came following the data, suggesting it catalyzed some amount of the downside experienced yesterday as well. Today, in the lead-up to the FOMC tomorrow, markets will digest FHFA Home Price data, along with Consumer Confidence data—downside surprises in these could renew pressure on markets. To summarize our systems’ current assessment: Yesterday’s economic data, Services & Manufacturing PMI’s, both surprised to the downside significantly, now placing Economic Momentum at 41.3%, a challenging zone for risk markets. The continuation of this trend throughout the week would lower our GDP Nowcast and increase pressure on markets. Our liquidity measures imply significant potential for the yield curve to flatten on the back of a deterioration in the policy impulse. These measures support our systematic estimates for the future market regime, implying that US bonds are likely to show strength in the future.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.