The Observatory

Treasuries oversold?

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Due to the strong demand for the product, we will start sharing the beta version of The Observatory (click to download) as we finalize its designs. This will offer a high-frequency resource to those using our systematic macro approach, allowing them to “Observe” the macroeconomy through our quantitative lenses. We will soon be launching the product officially, i.e., with explainer materials and a standardized format. And don’t worry, it’s all still free! Also, make sure to follow us on Twitter for timely updates:

Without further ado, let’s dive into what our systems are telling us:

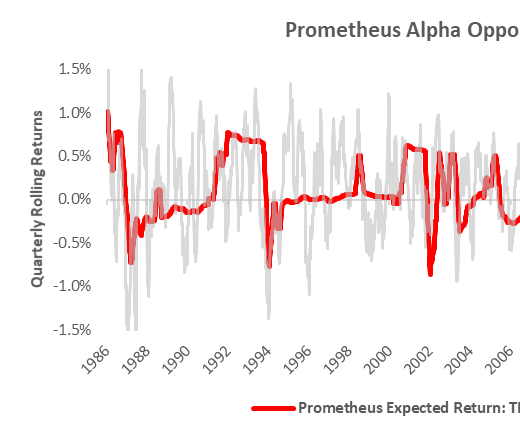

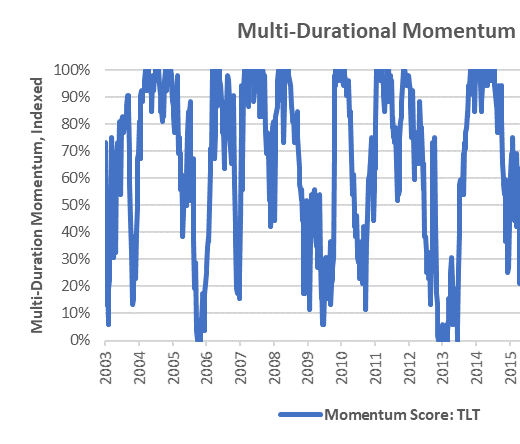

Markets: As we approach the end of the week, (+) G (+) I has re-emerged to dominate markets. Yesterday, equities sold off in earnest, with Communications down 6.7%, a move well telegraphed by our systems. At the same time, commodities continued their march upwards, of which our Sugar exposure was a beneficiary. According to our gauges, treasuries continue to struggle, with their momentum going to extremely low levels; however, this creates opportunities for our systems to exploit. Looking ahead is the current cross-asset pricing holds through today; this is likely to trigger buy signals on Treasuries, Lean Hogs, & Sugar for next week. Price action remains volatile, so we will need to wait until the end of today to get confirmation. To summarize our systems' current assessment: Our upgraded Market Regime Monitors shows a resurgence of (+) G (+) I this week, after a period of rising (-) L. Our Expected Return Strategy is now LONG: Sugar & SHORT: Communications. Consequently, our expected return and risk analysis tell us that the best opportunities are Long: Bonds, Cotton, Lean Hogs, Cattle, Sugar, and Short: Communications. Our Risk Management Monitors indicate that we can ADD to LONG: Bonds, Lean Hogs & Sugar, and SHORT: Communications. We can REDUCE our LONG: Cotton & Cattle. Our Expected Return Strategy has exited other positions and remains LONG: Sugar & SHORT: Communications. Our Expected Return Strategy is now LONG: Sugar & SHORT: Communications. However, if current cross-asset pricing holds, it will soon go long Treasuries, Lean Hogs & Sugar.

Macro: This week's economic data left our GDP Nowcast and Economic Momentum roughly unchanged. Our Inflation Nowcast continues to show heightened (but weakening) overall inflation levels, suggesting a solid underlying inflation trend. These signs point to (-) G (-) I eventually, i.e., favoring Treasuries. Further, with quantitative tightening on the horizon, US Treasuries maturing will be allowed to roll off the balance sheet, i.e., the Treasury will pay down this debt. The private sector will finance this roll-off, with financing predominantly coming from banks and dealers directed toward notes & bonds. This dynamic extends the case for a flattening curve. To summarize our systems' current assessment: Contrary to the recent trend, yesterday was a good day for Economic Momentum. Claims data, Markit PMI's, and ISM Services all surprised the upside. Our GDP Nowcast remained unchanged, waiting for today's NFP data. As our Market-Implied Regime measures are beginning to confirm, asset markets increasingly discount the tightening policy impulse. Mechanically, these moves should strengthen and continue as the Fed becomes more restrictive in its liquidity provision.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.