The Observatory

Liquidity Slowdown Showing

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Due to the strong demand for the product, we will start sharing the beta version of The Observatory (click to download) as we finalize its designs. This will offer a high-frequency resource to those using our systematic macro approach, allowing them to “Observe” the macroeconomy through our quantitative lenses. We will soon be launching the product officially, i.e., with explainer materials and a standardized format. And don’t worry, it’s all still free! Also, make sure to follow us on Twitter for timely updates:

Without further ado, let’s dive into what our systems are telling us:

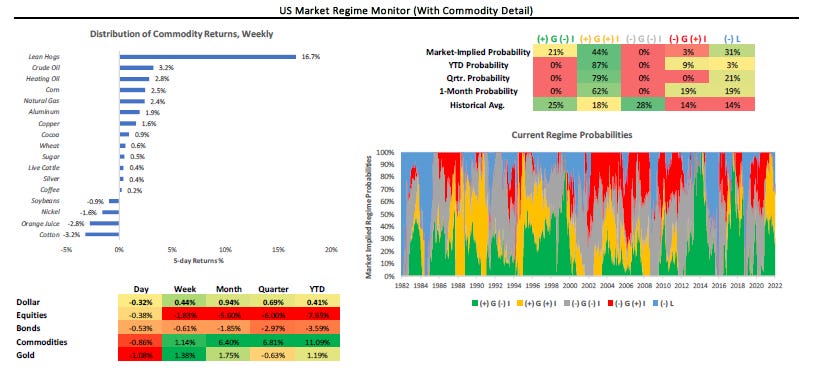

Markets: Markets began this week by strengthening the pricing of (-) L., which remains a dominant regime risk. The degree of (-) L pricing has been significant enough to detract from the performance of all risk assets except commodities. By our estimates, markets have predominantly moved to price the tightening on public sector liquidity, which has resulted in a bear flattening of the Treasury curve, and the compression in equity valuations. Thus far this year, our Alpha generation strategies have successfully navigated these waters. While the current environment has allowed beta rotation into commodities and commodity-like exposures to flourish, the next chapter of 2022 is likely to be more challenging, as the Fed's liquidity tightening tends to weigh on all risk assets relative to cash. Nonetheless, current market dynamics continue to support commodities, which due to their unique inter-asset correlations, continue to afford attractive opportunities.

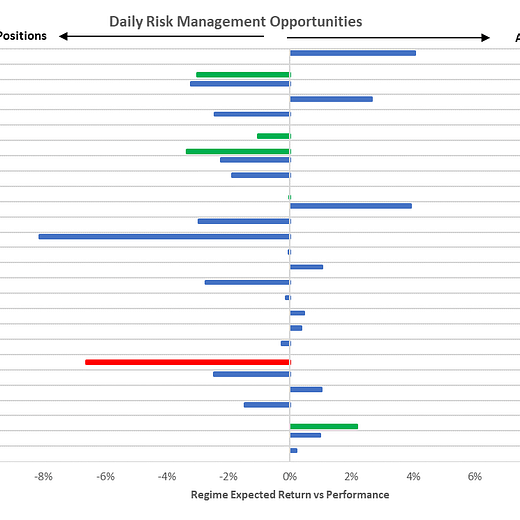

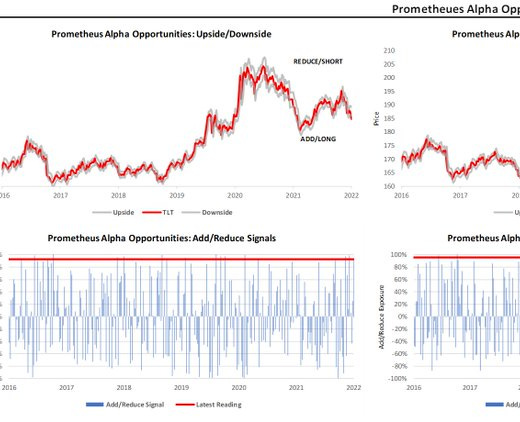

To summarize our systems' current assessment: Our Market Regime Monitors shows a dominance of (+) G (+) I, with a high and rising chance of (-) L, dragging on risk assets. Our Momentum Monitors show that Equities have lost significant trend support, with a Momentum Score of 50%, while Commodities maintain their robust Momentum Score of 100%. Notably, Equities have lost trend support while Gold has coincidently gained it. Consequently, our systems tell us that the best opportunities are Long: Bonds, Cotton, Lean Hogs, Cattle, Sugar, and Short: Communications. However, Risk Management Monitors indicate that we can ADD to LONG: Bonds & Cotton. We can REDUCE our LONG: Lean Hogs, Live Cattle, & Sugar and SHORT: Communications. Our Expected Return Strategy is LONG: Bonds, Cotton & Live Cattle.

Macro: Cyclicality and policy today are coalescing to create a challenging environment for risk assets. Our systematic forecasts of growth show material decelerations coming on the forecasts horizon, just as the Federal Reserve will raise interest rates. Further, the prospect of balance sheet reduction has significant ramifications for markets; however, the mechanisms are more complex, and we will provide guidance on this in the future.

To summarize our systems' current assessment: The latest economic data that feed our GDP Nowcast places our growth estimate even lower, at 2.5%. Economic Momentum continues to stagnate, with a middling reading of 49%. Our Liquidity Monitor shows that the Treasury bill supply perked up in January. Increased bill supply relative to long-end supply will force flattening. The composition of the Treasuries issuance is likely to be a dominant driver in determining the market impact of QT.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.