The Observatory

(+) G (+) I, dominating

The Observatory is how we systematically track the evolution of financial markets and the US economy in real-time. Due to the strong demand for the product, we will start sharing the beta version of The Observatory (click to download) as we finalize its designs. This will offer a high-frequency resource to those using our systematic macro approach, allowing them to “Observe” the macroeconomy through our quantitative lenses. We will soon be launching the product officially, i.e., with explainer materials and a standardized format. And don’t worry, it’s all still free! Also, make sure to follow us on Twitter for timely updates:

Without further ado, let's dive into what our systems are telling us:

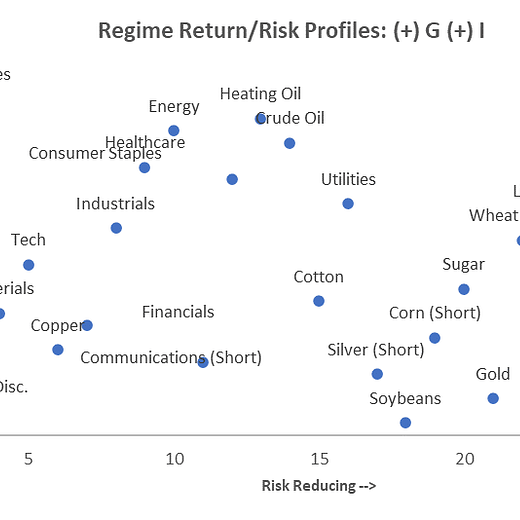

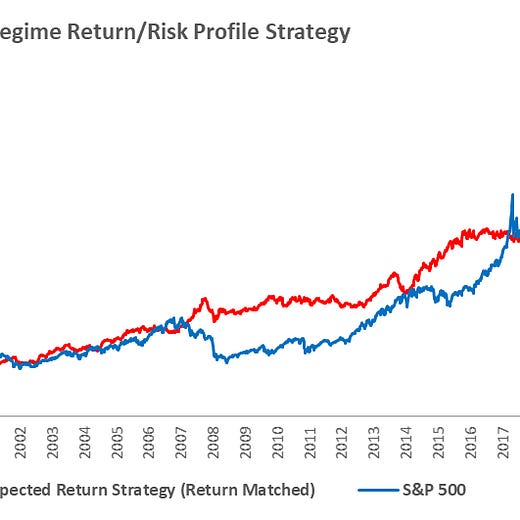

Markets: Over the last few weeks, markets have moved to support (+) G (+) I resoundingly, a move validated by the lackluster performance of treasuries during a strong equity sell-off, coincident with a vicious bid for commodities. Our systems suggest there is now a fairly wide margin for this regime to hold; however, it is worth noting that transitions from (+) G (+) I to other market regimes can be swift and violent. To summarize our systems' current assessment: Our Market Regime signal now shows a dominance of (+) G (+) I, i.e., rising growth and inflation, market regime. In aggregate, markets are pricing rising inflation, i.e. (+) I is evident. Consequently, our expected return and risk analysis tell us that the best opportunities are Long: Bonds, Cotton, Lean Hogs, Cattle, Sugar, and Short: Communications. After our Market Regime Signal transition to (+) G (+) I after pricing in (+) G (-) I, the menu of options from a return-on-risk perspective has gotten significantly wider. However, our Risk Management Monitors indicate that we can ADD to LONG: Bonds, Cotton, Live Cattle, & Sugar. US equities now have a Momentum Score of less than 50%, implying shorts will begin to gain significant support. However, it is essential to note that equities are empirically not trending following at shorter durations but instead mean-reverting. Our systems account for this and therefore continue to look for opportunities to Short: Communications.

Macro: Today, markets will focus predominantly on the FOMC, and while no major moves are expected in the current meeting, the focus will be on the policy path hinted/outlined for the March meeting. Markets are likely to predominantly focus on the path for interest rates hikes, both in terms of timing and number; however, there is significant time (and data) between today and March. We think it's too early to make any conclusions on the matter. For our part, we will be focused on processing new information regarding the speed, composition, and timing of quantitative tightening, as this will be a significant driver of the policy liquidity. To summarize our systems' current assessment: The latest economic data that feed our GDP Nowcast showed further decelerations. The effect weakened our GDP Nowcast to 3.1% from 3.2% and coincidently dampened Economic Momentum to 42.2%. Economic data continues to put pressure on risk assets. This weakening growth and our leading-liquidity measures (which declined through 2021) implies a challenging macroeconomic backdrop for risk assets and is likely one of the culprits behind the current equity sell-off. These measures support our systematic estimates for the future market regime, implying that US bonds are likely to show strength in the future.

The future is dynamic, and our systems adjust as new information is available. Our bias is to allocate for the existing regime while trying to peek around the corner to what the future may hold. Finally, we optimize these views to minimize portfolio risk, resulting in our trading signals. We show all this in the document below.

Click here to enter The Observatory.