We will release our Prometheus S&P 500 program this month. However, markets are moving quickly, and we wanted to share insights from our signals to help investors navigate risk during these challenging times. Additionally, we offer insights from our Prometheus Sector Selection Program in this note.

The objective of this note is to offer a comprehensive view of equities, ranging from beta management (S&P 500 Program) to alpha generation (Sector Selection). We leave it to the user to decide which is most appropriate for them.

We begin with the Prometheus S&P 500 Program. The Prometheus S&P 500 Program seeks to outperform the S&P 500 over a full investment cycle. We define a full investment cycle as a period of time where markets have experienced bull and bear markets with a generalized upward drift.

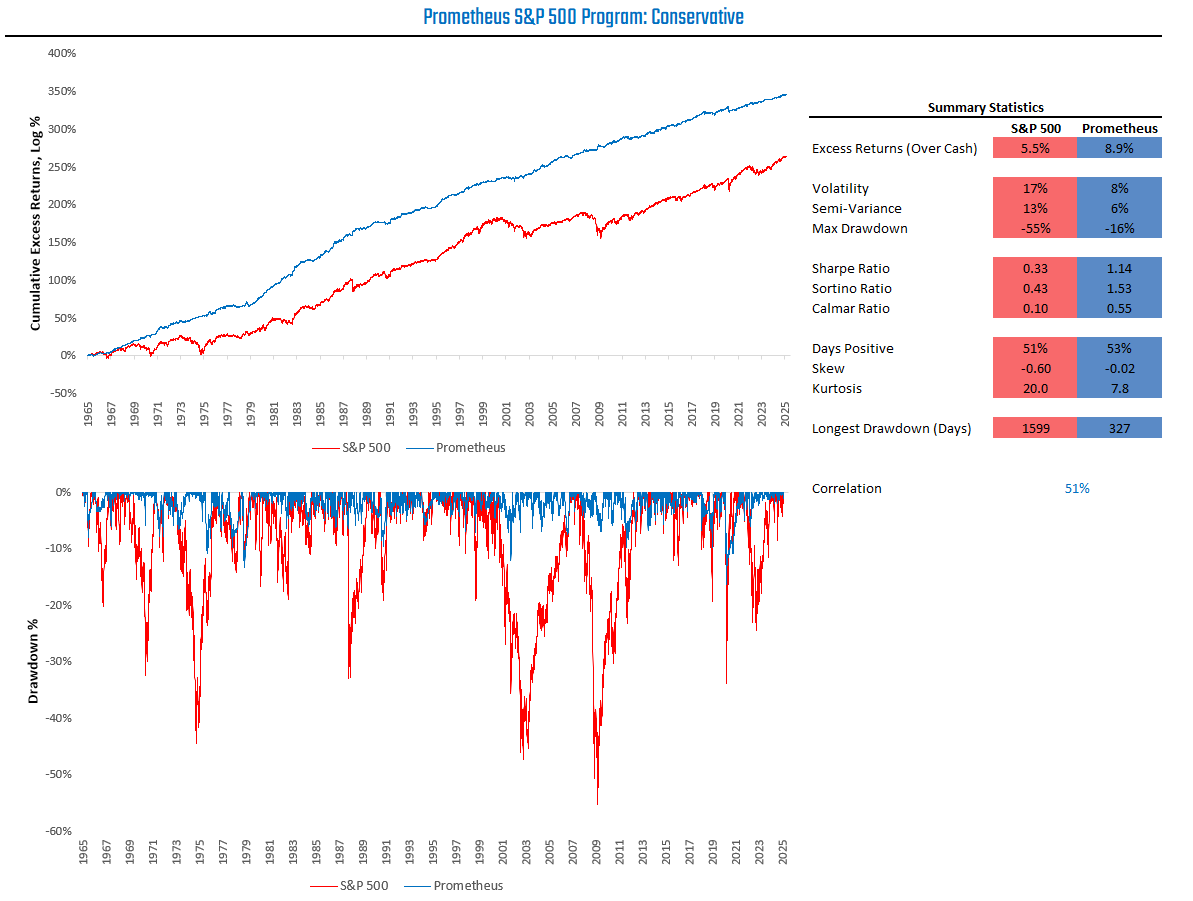

For the purposes of this post, we will share the programmatic views of the conservative version of this program. This program targets a maximum of 10% expected risk. This version will lag indexes during extremely strong, highly volatile bull markets. However, over the full investment cycle, this program seeks to outperform by maintaining responsible upside exposure while reducing or avoiding drawdowns. We visualize the simulated path below:

Today, this program continues to control the equity market drawdown using its risk control measures. While the S&P 500 is down 8.5%, the Prometheus S&P 500 Program is down a much more modest 3.8%. This is consistent with the portfolio objectives.

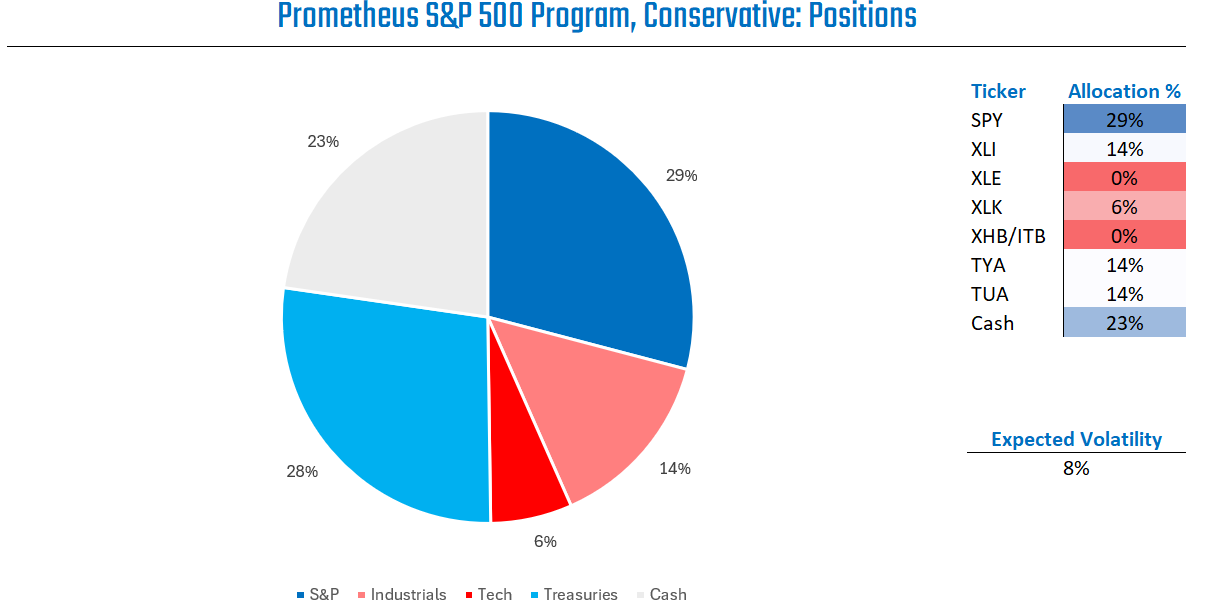

Today, the portfolio is positioned as follows:

Our strategies continue to maintain similar exposures as last week. Our 10% risk control continues to limit equity risk, with modest Treasury and cash positions as complements. There are three major takeaways from these positions:

Beta Timing: Our beta timing program suggests a higher likelihood of positive forward returns than negative ones. The economy is still in expansionary territory, and this sell-off has cheapened equities relative to other assets, earnings expectations, and recent price levels. Despite accounting for near-term trends, our beta timing process indicates a positive near-term outlook for equities. However, the conviction around this outlook remains small, leading to modest position sizing. While our Beta Timing engine continues to suggest a positive near-term outlook for equities with low conviction, we would be reticent to neglect more standard valuation measures. These measures have reduced our overall equity exposure.

Sector Selection: Within the cross-section of equity sectors, our signals prefer Industrial & Technology stocks as their investment activity continues to climb, tilted towards industrials over technology, largely due to better valuations. While the medium-term outlook for equity expected returns is low, we expect relative value opportunities for sector selection.

Risk Control: Risk across markets has begun to rise. If it rises any further, our ex-ante drawdown control will likely kick in to reduce overall exposure. Today, our systems expect our allocations to have an expected volatility of 8%. However, in an outlier event, this volatility could be significantly higher. Currently, in a multi-standard deviation event, this would result in a portfolio drawdown of 14%. While the likelihood of achieving such an outcome is minimal, our systems will cap risk to limit realized drawdowns to 15%.

Bond Overlay: Our systems have deployed a tactical bond overlay. We think it is crucial to note that while equity markets were down approximately 6% in March, 10-year Treasury bonds rose less than 1% during that time. We think this is in large part driven by the structural and cyclical challenge faced by US Treasuries. Thus, while we maintain bond exposure, we remain prepared to exchange these exposures for cash in short order. Without a Fed interest rate cutting cycle, bonds are unlikely to rally durably.

We think combining these measures will allow investors to have significant up-capture during a bull market and limited down-capture in a bear market. Equity markets are at elevated valuations and have begun to experience a meaningful correction. During these types of corrections, volatility spikes dramatically. A cautious approach to risk is warranted, and our systems are moving accordingly.

Thus far, we have shared our views on beta management. We now turn to alpha generation. For this purpose, we turn to our Sector Selection Program. The Prometheus Sector Selection Program seeks to deliver absolute returns, going long and short equity sectors using our proprietary macro measures of value, fundamentals, trend, and mean reversion. The program trades the following 11 S&P 500 Sectors:

Energy

Materials

Industrials

Consumer Discretionary

Consumer Staples

Health Care

Financials

Information Technology

Communication Services

Utilities

Homebuilders

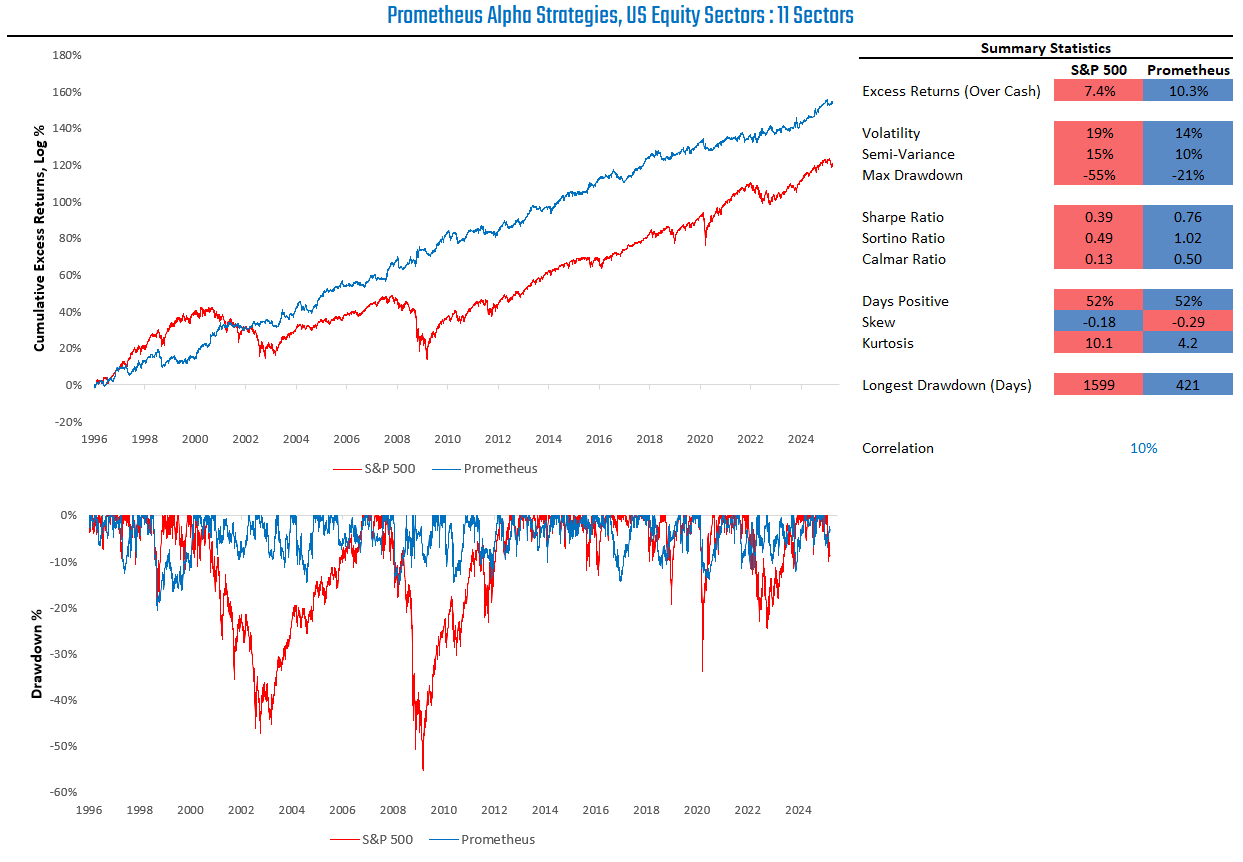

The program seeks both relative value and directional signals on a dynamic basis. We visualize the strategy profile below:

Consistent with its absolute return focus independent of beta, the strategy was entirely unphased by recent downturn in equity markets. We visualize this below:

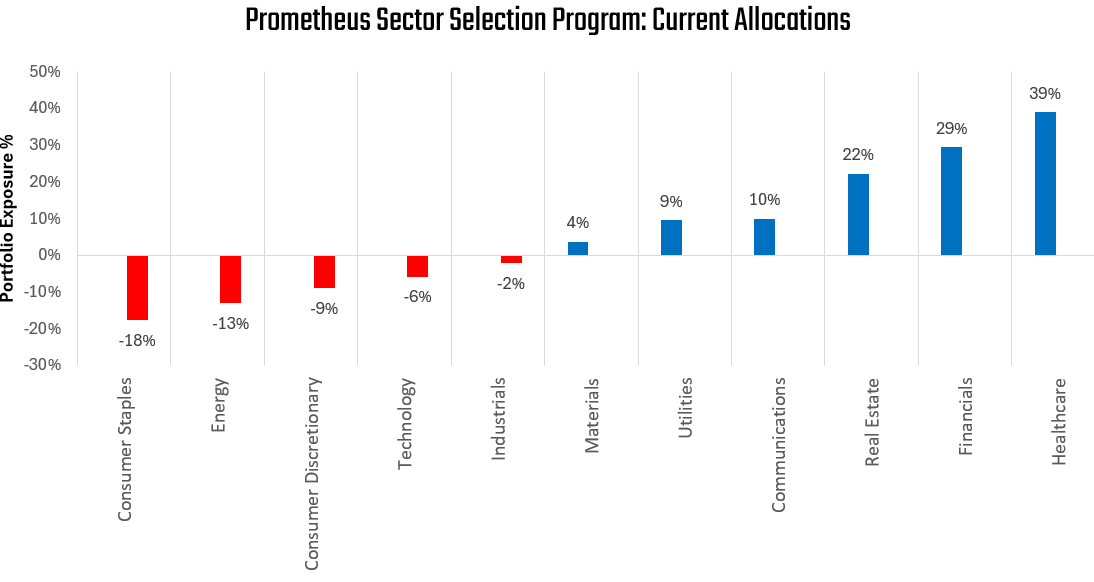

Currently, our systems are adopting a mixed set of exposures, with relative value opporunties dominanting the portfolio rather than macro trends. We visualize the current portoflio allocations below:

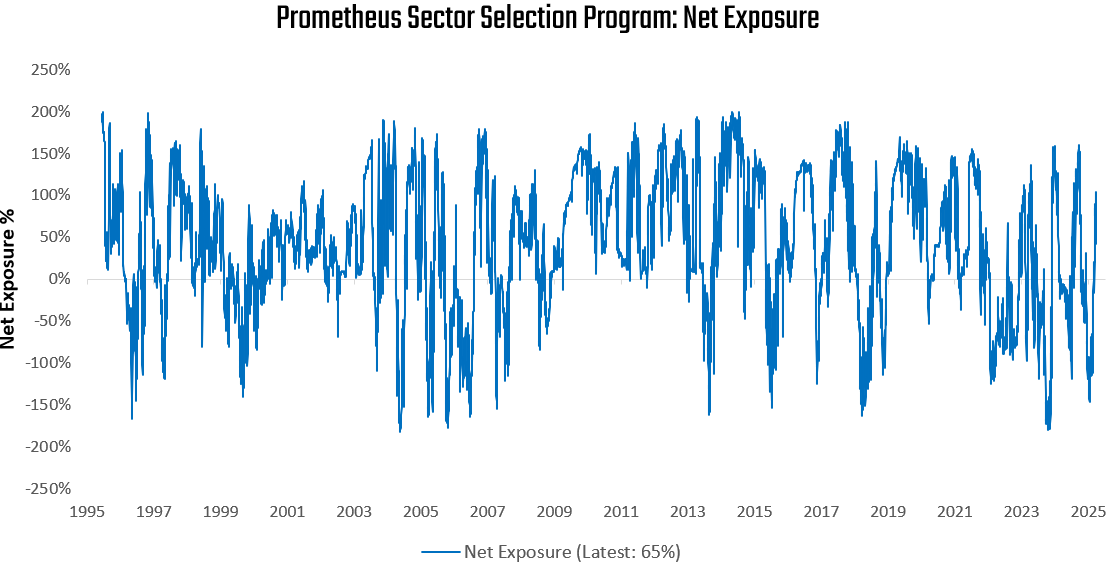

The distribution of positions currently places us at a net long position. We visualize the current net portfolio exposure:

We think this net exposure is telling. The portfolio can have net exposure which range from 200% to -200%. The bigger the macro drivers of current moves, the more concentrated the portfolio will become, in either direction. In a bull market, we’d expect the portfolio to have positions closer to 200% than -200%, and vice versa during a bear market. With current net exposure of 65%, our systems are indicating low macro trend drivers. This is consistent with our fundamental models, which continue to suggest a positive backdrop for the economy. This relatively neutral positions translates into a more moderate level of portfolio volatility.

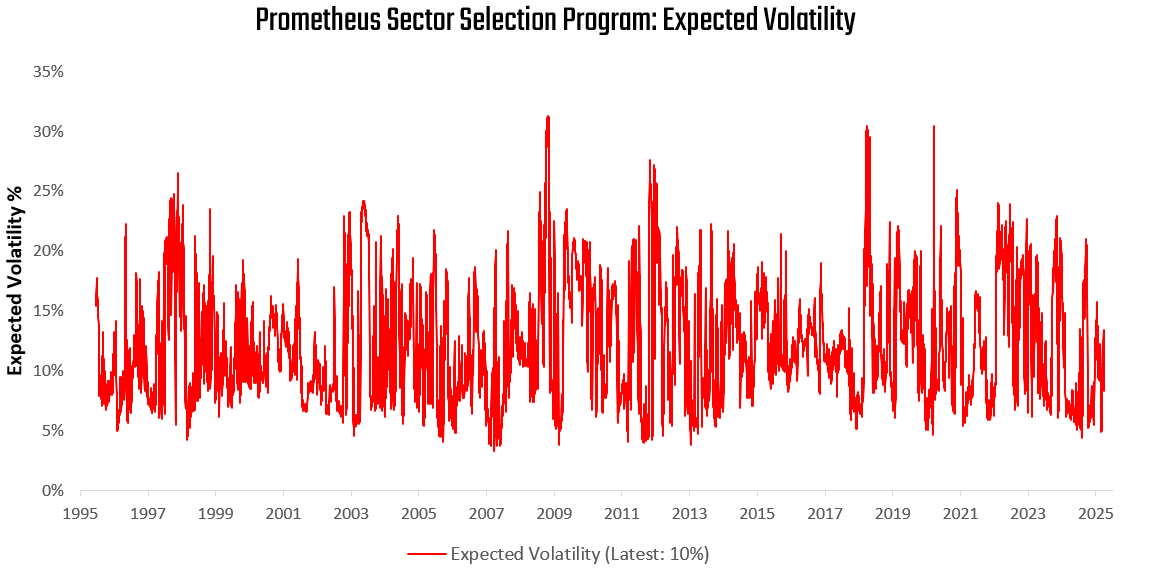

We visualize our expect volatility below:

As we can see above, relative to history, our Prometheus Sector Selection program continues to maintain a modest annual volatility of 10%. Relatively low net exposure is currently containing expected volatility.

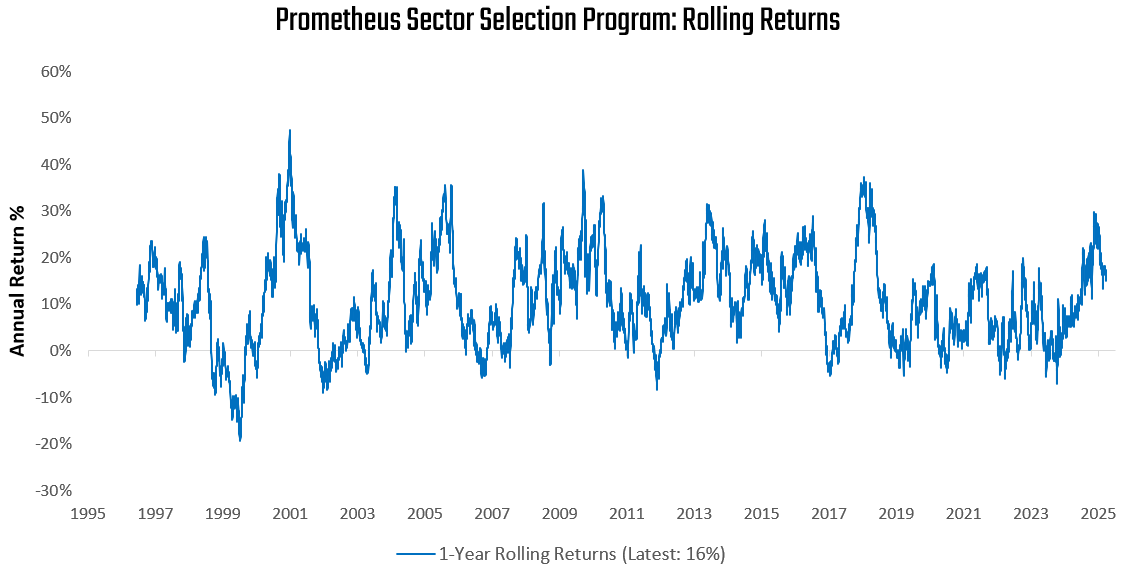

Finally, we help contextualize these portfolio metrics by examining how they translate into portfolio returns. We visualize the programs rolling return profile below:

As we can see above, the portfolio has experienced some degree of slowing of its pace of returns in the recent past. On an annual basis, the strategy is relative quick to make adjustments, not allowing for protracted loss periods. However, returns can be somewhat convex and mean-reverting , and given the strategies recent success in navigating the current environment, a big reversal of macro conditions may weigh on performance. For instance, the administration were to reverse its tariffs stance, leading to improved confidence and certainity in markets, the current mix of long/short exposures may likely suffer briefly before adapting.

Stitching together the perspectives coming from our two independent systematic processes, we think one thing is clear: maintaining low beta exposure to the index is likely to well-reward in the pursuit to maximize risk adjusted returns. As ever, the future is dynamic, and our systems will adapt as the data evolves. For now, a mildly positive outlook with tight risk control is what they see as appropriate. We will inform you as that changes.

Until next time.