We begin with the Prometheus S&P 500 Program. The Prometheus S&P 500 Program seeks to outperform the S&P 500 over a full investment cycle. We define a full investment cycle as a period of time where markets have experienced bull and bear markets with a generalized upward drift.

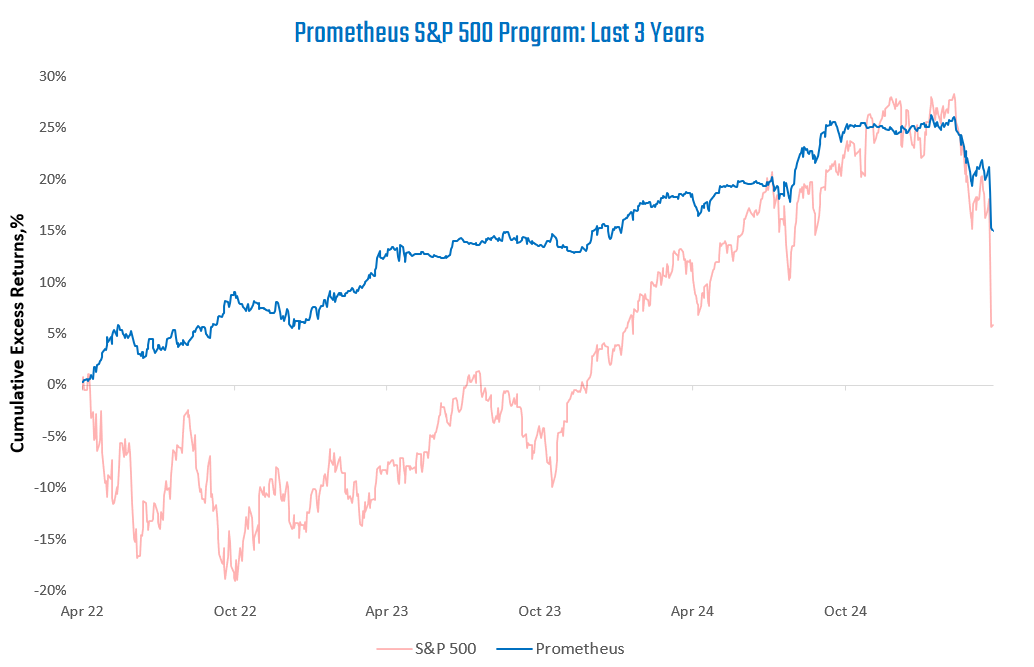

For the purposes of this post, we will share the programmatic views of the conservative version of this program. This program targets a maximum of 10% expected risk. This version will lag indexes during extremely strong, highly volatile bull markets. However, over the full investment cycle, this program seeks to outperform by maintaining responsible upside exposure while reducing or avoiding drawdowns. We visualize the simulated path below:

Today, this program continues to control the equity market drawdown using its risk control measures. While the S&P 500 is down 17%, the Prometheus S&P 500 Program is down a much lower 8%. This is consistent with the portfolio’s objectives, i.e., maintaining upside exposure to equities while reducing or avoiding drawdowns.

Today, the portfolio is positioned as follows: