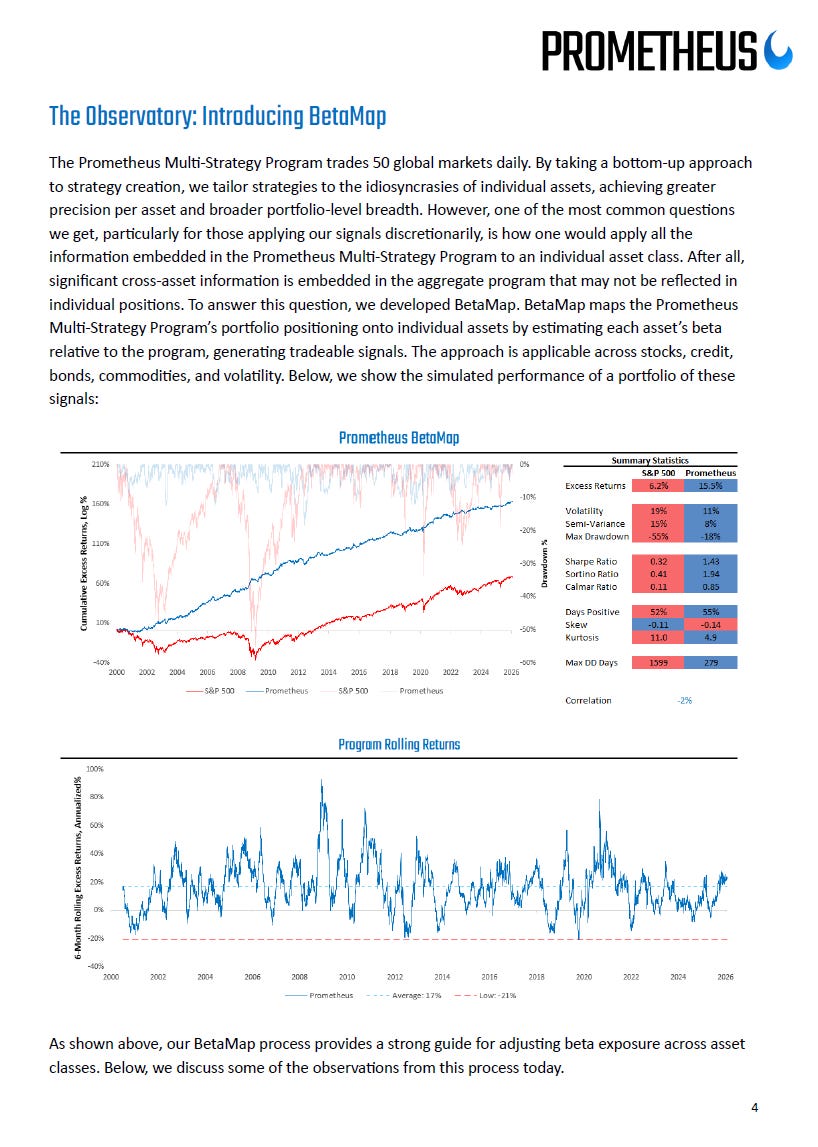

The Prometheus Multi-Strategy Program trades 50 global markets daily. By taking a bottom-up approach to strategy creation, we tailor strategies to the idiosyncrasies of individual assets, achieving greater precision per asset and broader portfolio-level breadth. However, one of the most common questions we get, particularly for those applying our signals discretionarily, is how one would apply all the information embedded in the Prometheus Multi-Strategy Program to an individual asset class. After all, significant cross-asset information is embedded in the aggregate program that may not be reflected in individual positions. To answer this question, we developed BetaMap. BetaMap maps the Prometheus Multi-Strategy Program’s portfolio positioning onto individual assets by estimating each asset’s beta relative to the program, generating tradeable signals. The approach is applicable across stocks, credit, bonds, commodities, and volatility. We share the observations coming from this process in today’s note.

You can read the complete note here: