Welcome to the ETF Program. The ETF Program is an investment program that combines active macro alpha and strict risk control, all in an easy-to-follow solution for individual investors.

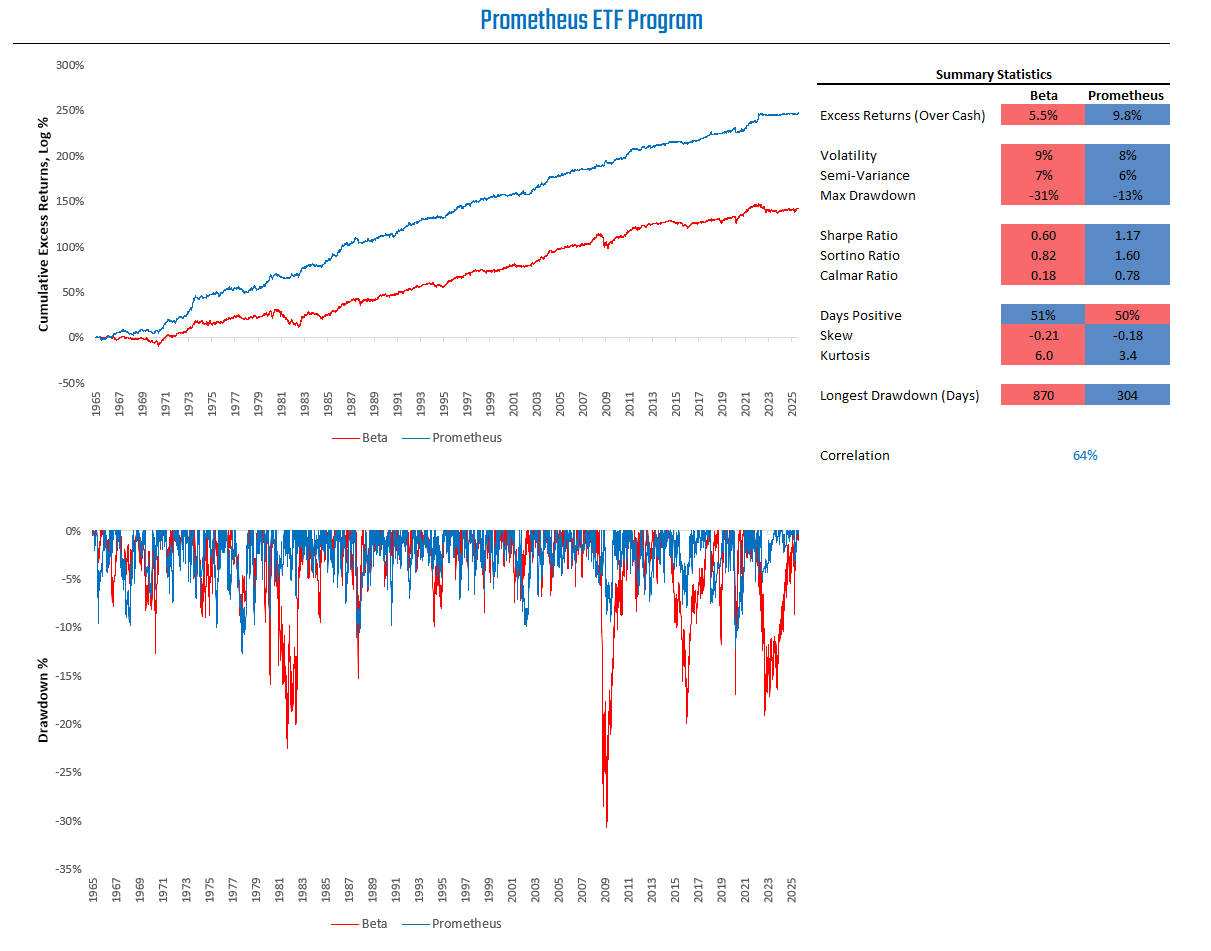

We visualize the simulated return path for the program below:

Our observations are as follows:

Macro assets are experiencing strong upward trends in aggregate, with trends led by stocks and gold.

The business cycle remains in an expansion, pressures on monetary policy are now biased towards tightening, and capacity utilization is rising.

Our forward-looking macro regime probabilities show a dominance of rising growth outcomes.

A procyclical asset allocation remains appropriate.

Let’s begin sharing the data that drives our current assessment of the macro regime and our subsequent risk management and positions.

Macro Trend Monitors

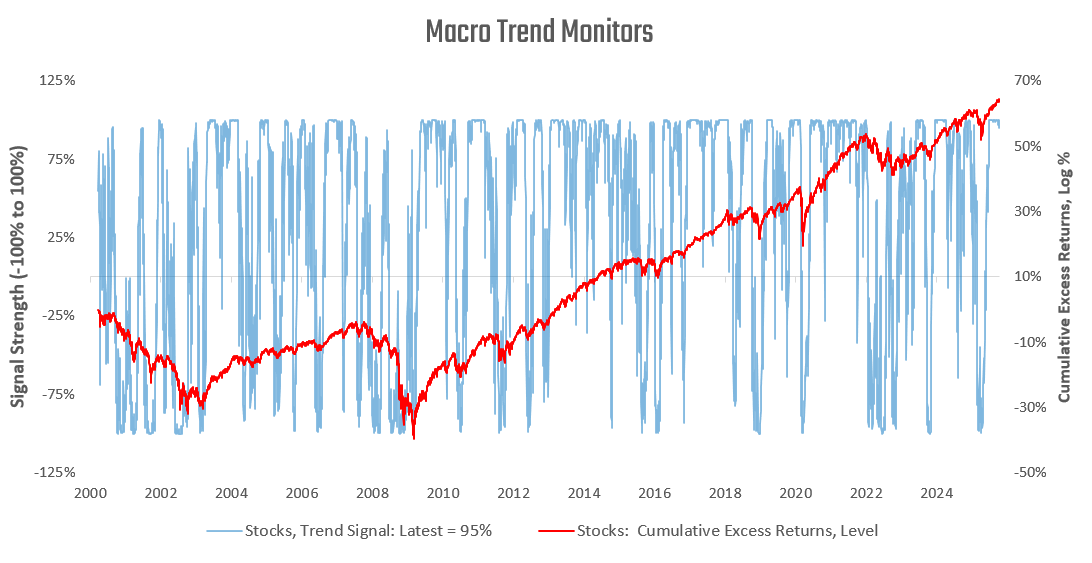

Asset prices in aggregate reflect changes in conditions relative to expectations. As such, carefully monitoring macro market trends is an integral part of evaluating conditions in the macroeconomy. To do this, we use our macro trend monitors, which we share here. We begin with stocks:

Equities continue to show extremely strong trend signals. Next, we turn to bond market trends:

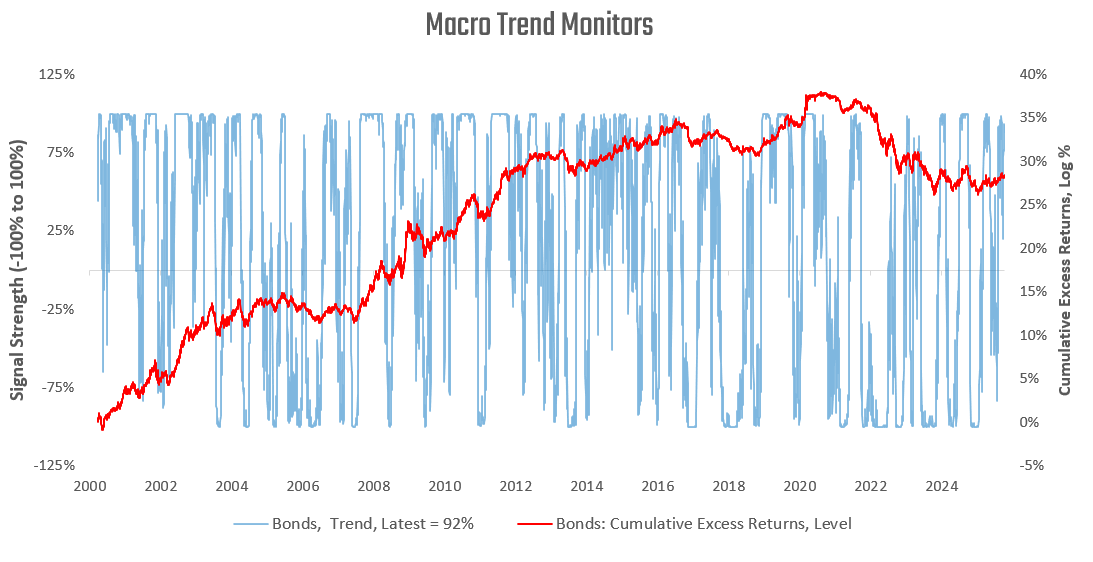

Bond market trends are significantly positive. We now move on to broad commodity aggregates:

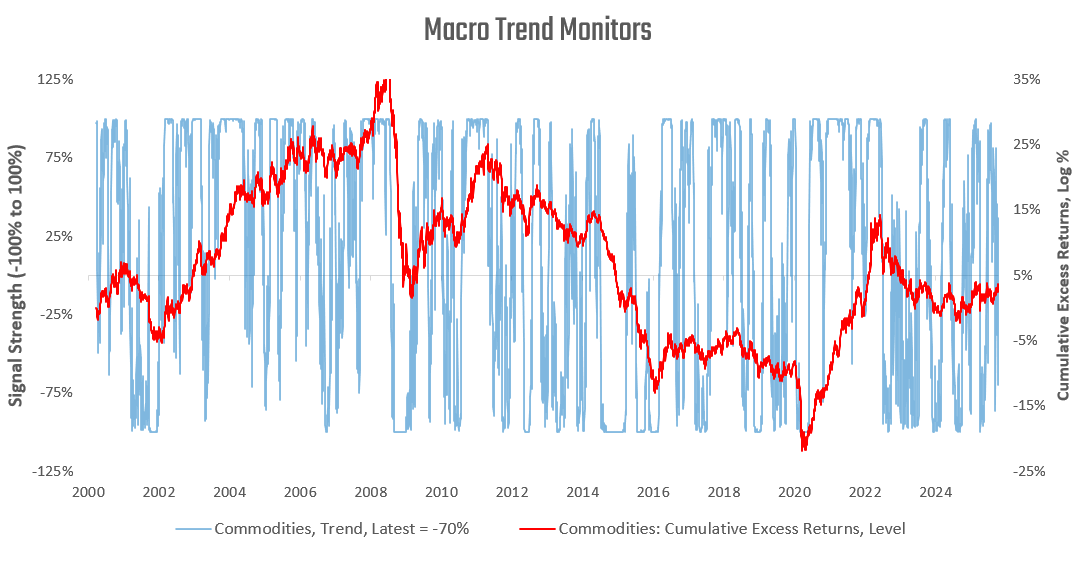

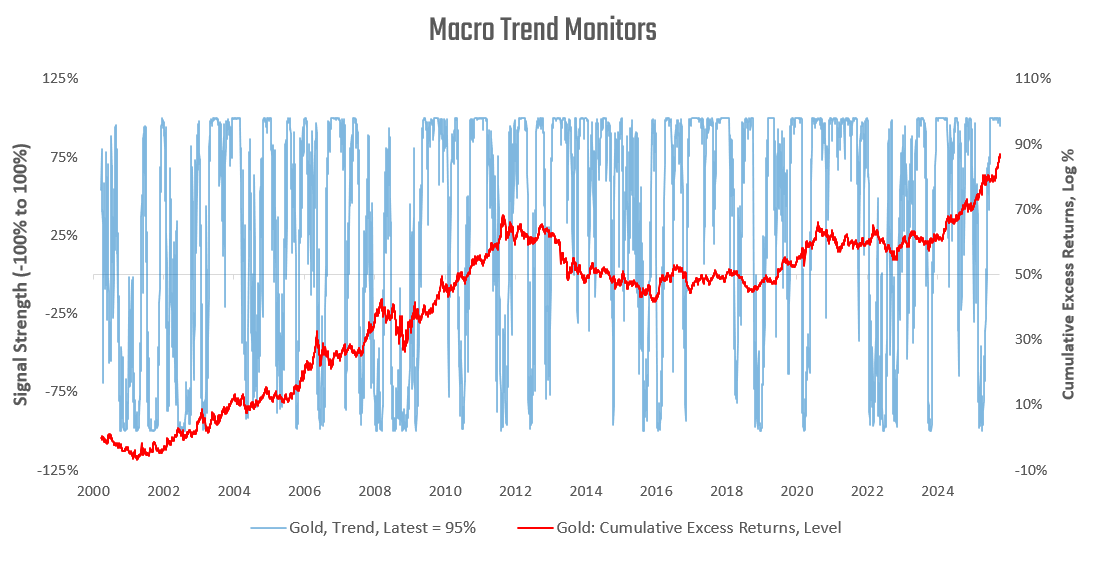

Commodity trends have turned decisively negative. Finally, we examine our macro trend signals for gold:

Our trend signals continue to show robust trends in gold. Assets in aggregate are experiencing strong upward trends, suggesting stable financial conditions and moderate macro volatility.

Macro Cycle Monitor

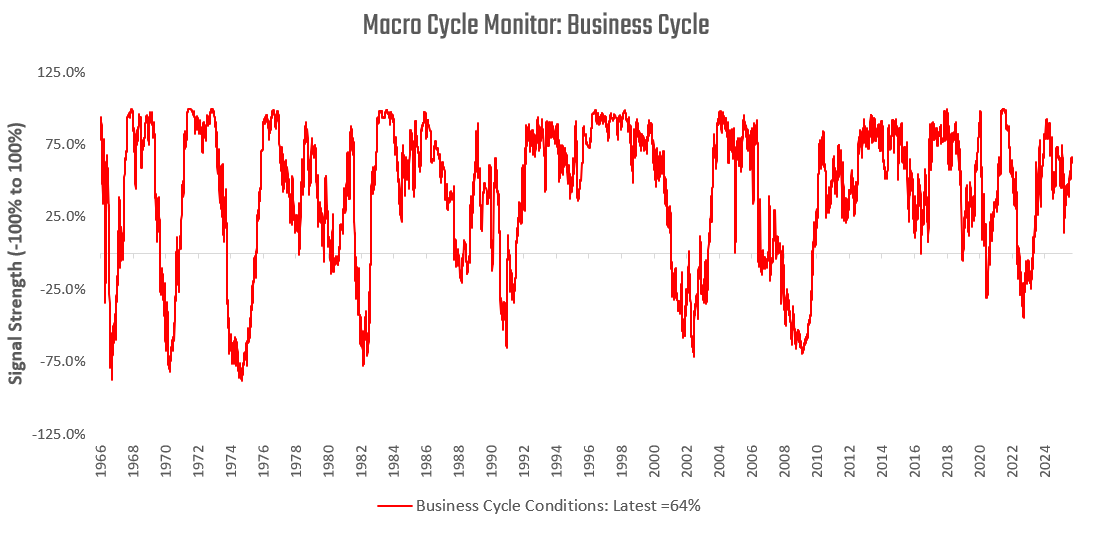

Our systems aggregate a wide variety of fundamental economic data to create timely proprietary estimates for the current stages of the macro cycle. We share some of these gauges, starting with our signals for business cycle conditions:

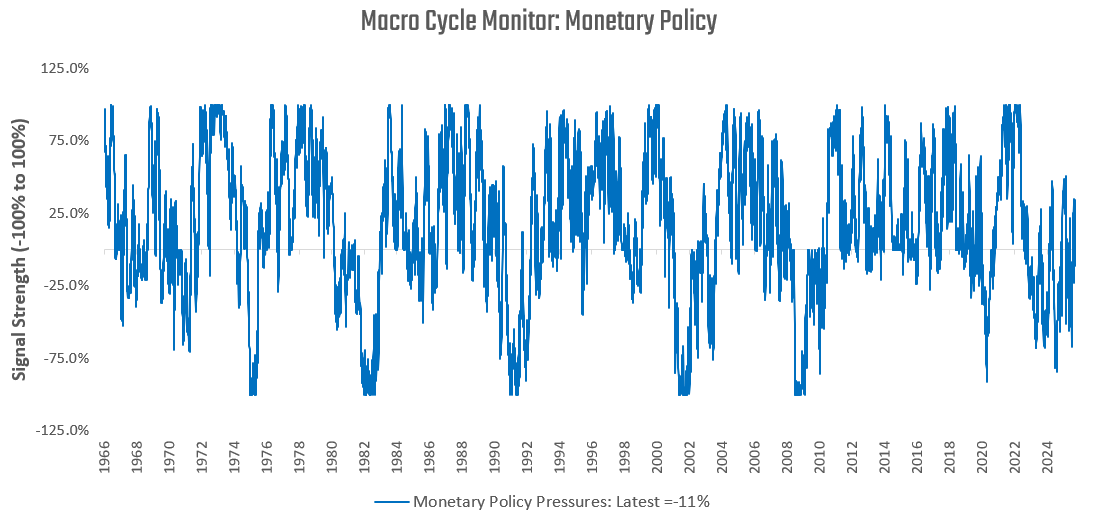

Our latest readings continue to show consistent signs of an expanding business cycle. Next, we turn to monetary policy pressures. Our monetary policy gauges measure the pressures on the Federal Reserve to move monetary policy based on the trade-off between growth and inflation data. The higher our readings, the more pressure there is to hike policy rates. The lower the gauge, the more pressure there is to cut policy rates.

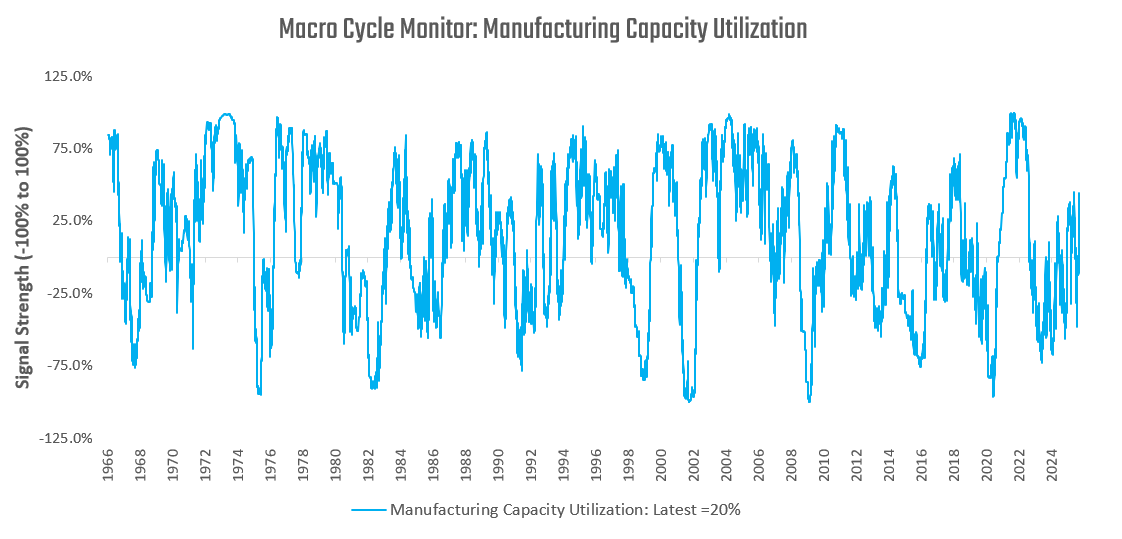

Pressures on monetary policy are now biased towards tightening. Next, we turn to measures of economic tightness. Our gauges of manufacturing tightness tell us whether the economy is running up against capacity constraints when its readings are high, or when there is a significant amount of economic slack when readings are low:

Our latest readings show that manufacturing capacity utilization is rising.

Macro Signal Composites

Using the macro cycle gauges, adding asset-specific factors, and leveraging carry, trend, and reversion, we can create asset-class-specific composite signals. We share these signals below and their latest readings. These signals are proportional to our conviction for a given asset and are directly tradeable. We begin with our stock signals for SPY: