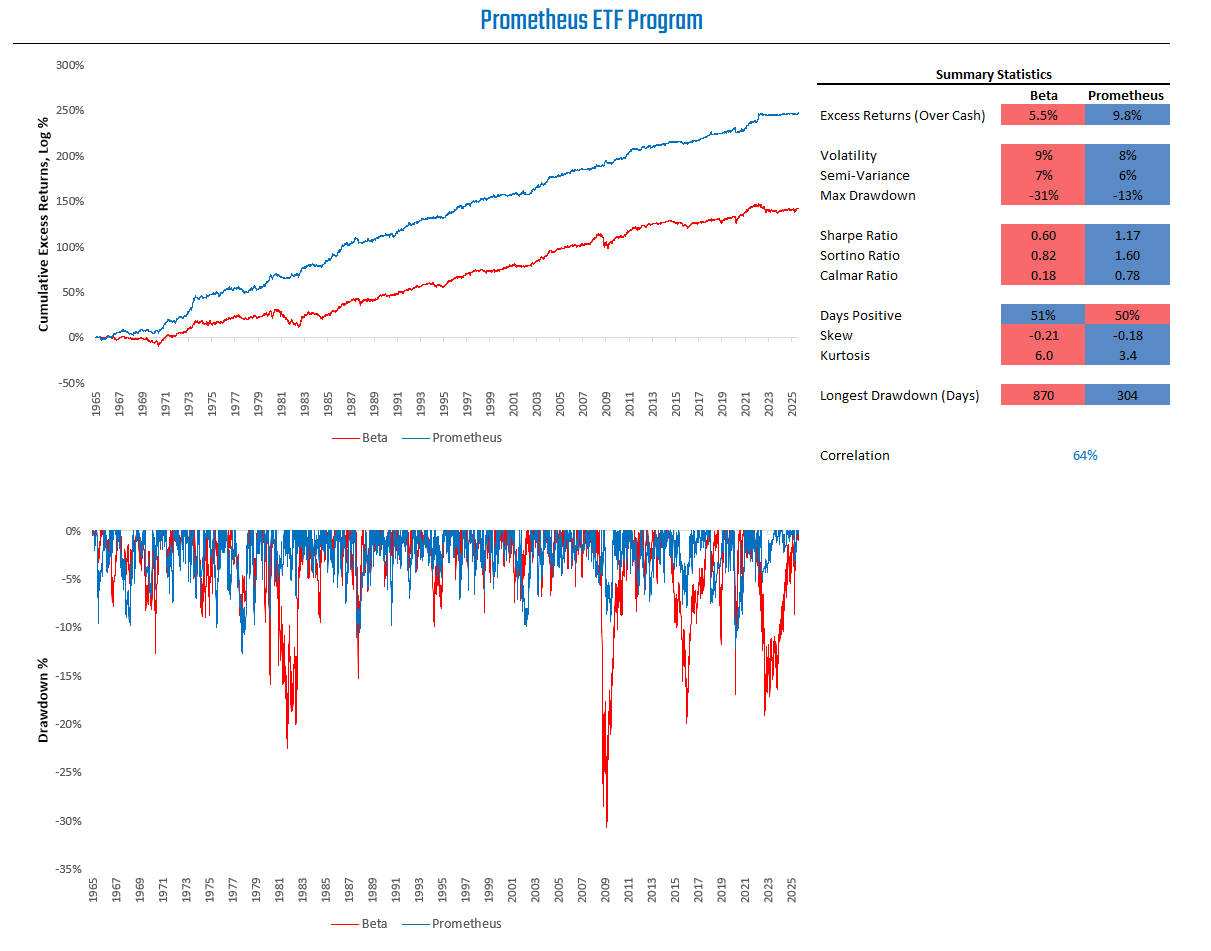

Welcome to the ETF Program. The ETF Program is an investment program that combines active macro alpha and strict risk control, all in an easy-to-follow solution for individual investors.

We visualize the simulated return path for the program below:

To today’s note. Our observations are as follows:

Macro assets are experiencing cross-asset trends consistent with strong nominal growth: equities and commodities are rising, while bonds are falling.

The business cycle remains in an expansion, pressures on monetary policy are now biased towards tightening, and capacity utilization is rising.

Our forward-looking macroeconomic regime probabilities indicate a predominance of rising nominal growth outcomes.

A procyclical asset allocation remains appropriate.

Let’s begin sharing the data that drives our current assessment of the macro regime and our subsequent risk management and positions.

Macro Trend Monitors

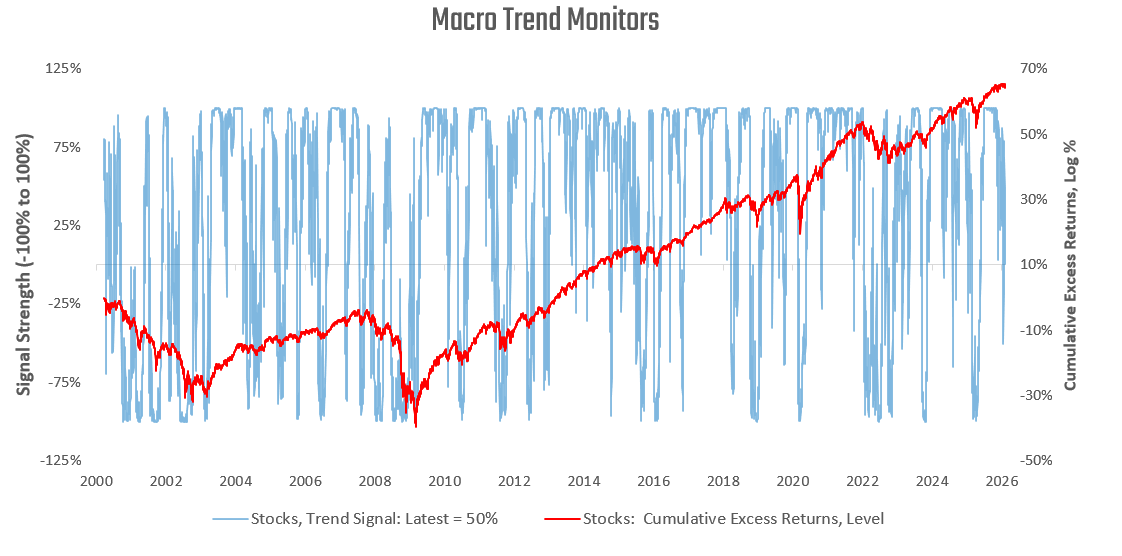

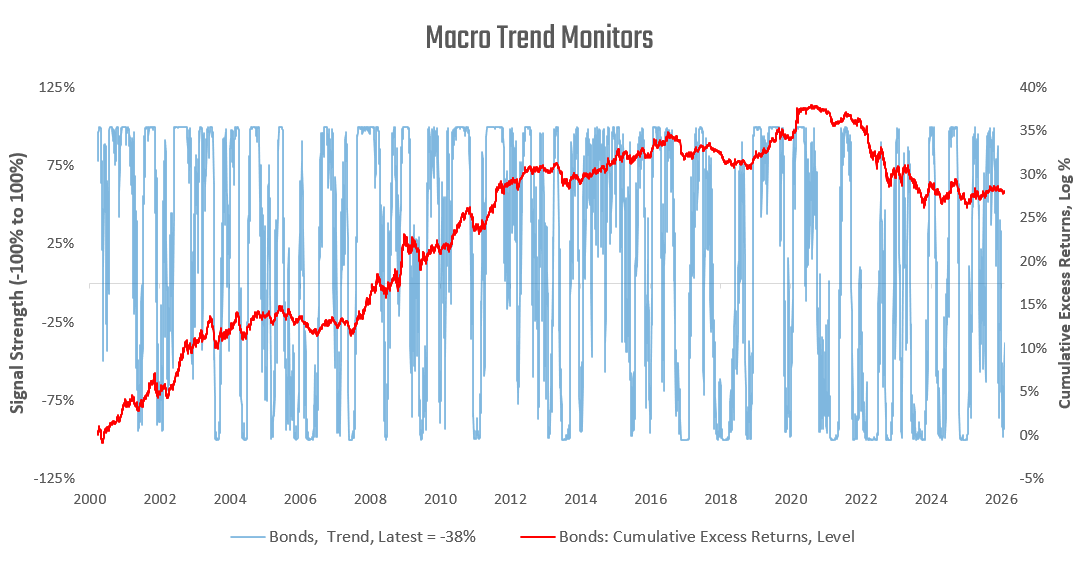

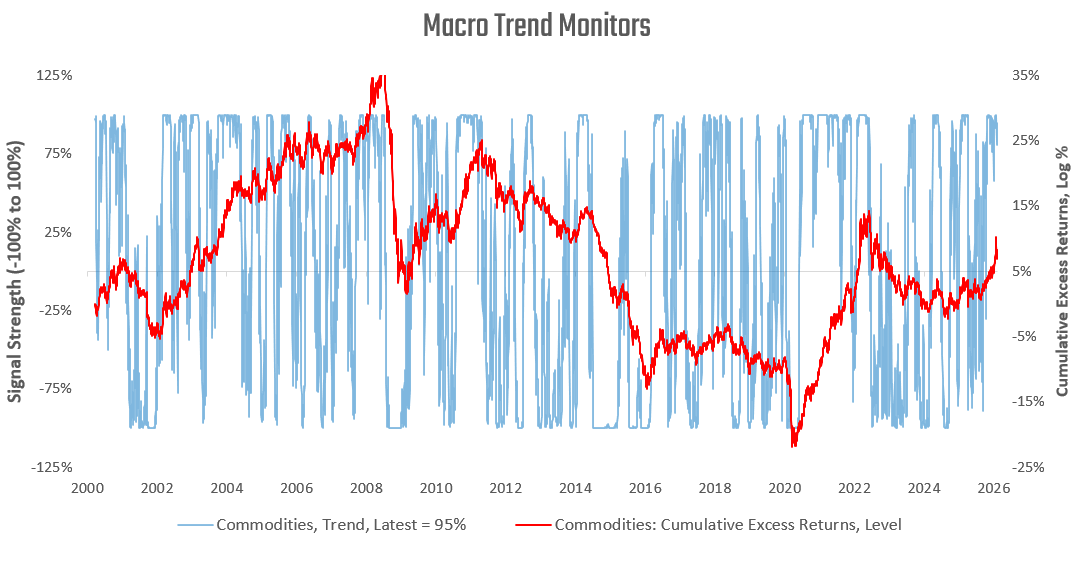

Asset prices in aggregate reflect changes in conditions relative to expectations. As such, carefully monitoring macro market trends is an integral part of evaluating conditions in the macroeconomy. To do this, we use our macro trend monitors, which we share here. We begin with stocks:

Equities trends remain positive, though they have moderated. Next, we turn to bond market trends:

Bond market trends remain moderately negative. We now move on to broad commodity aggregates:

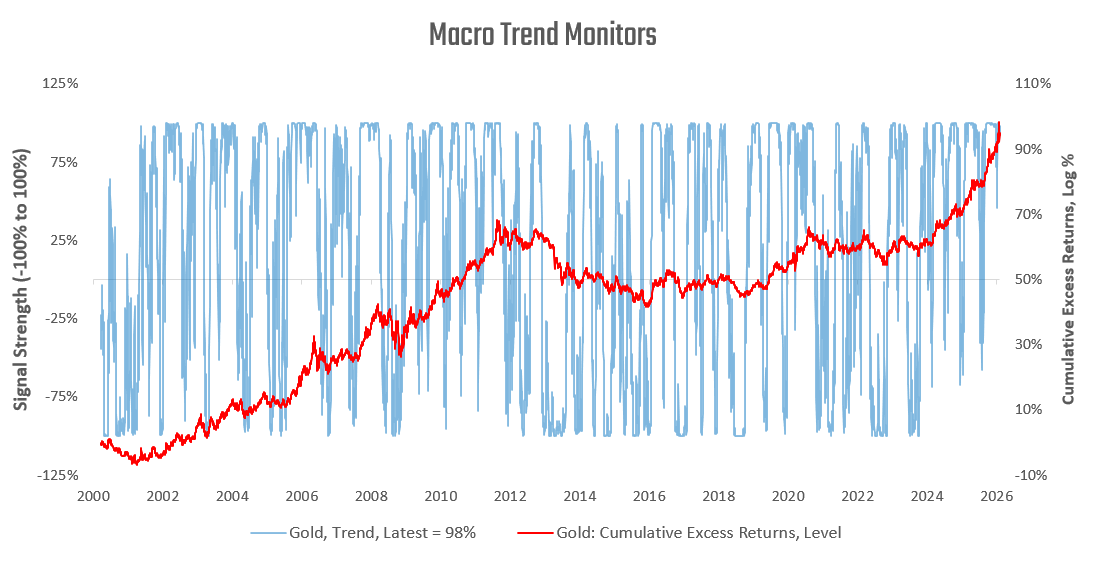

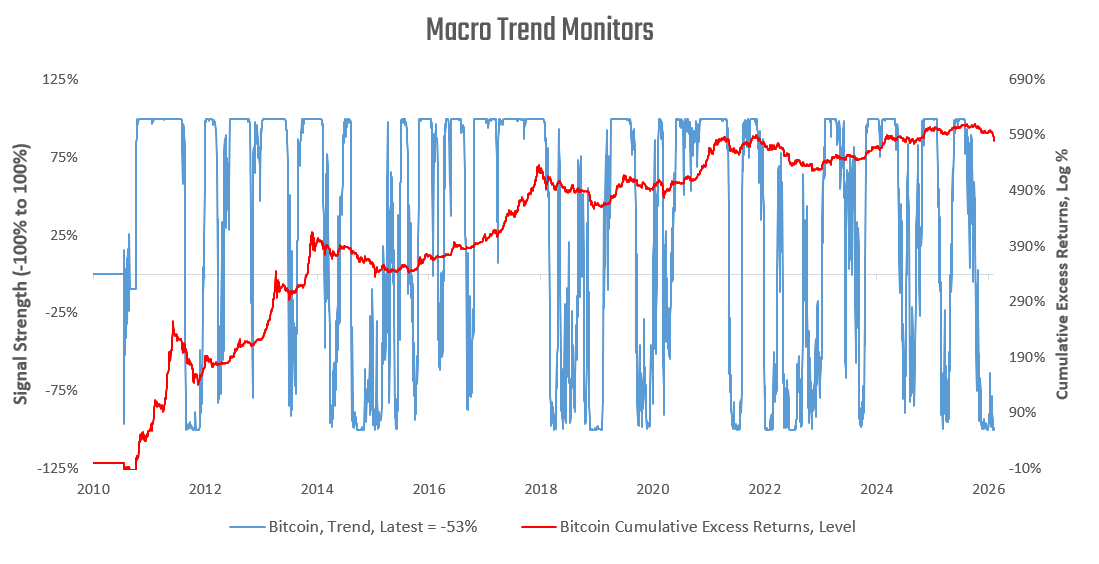

Commodity trends remain strong. Next, we examine our macro trend signals for Gold:

Despite the sell-off in Gold, the trend remains intact. Finally, we examine our trend signals for Bitcoin:

Bitcoin remains in a material downtrend.

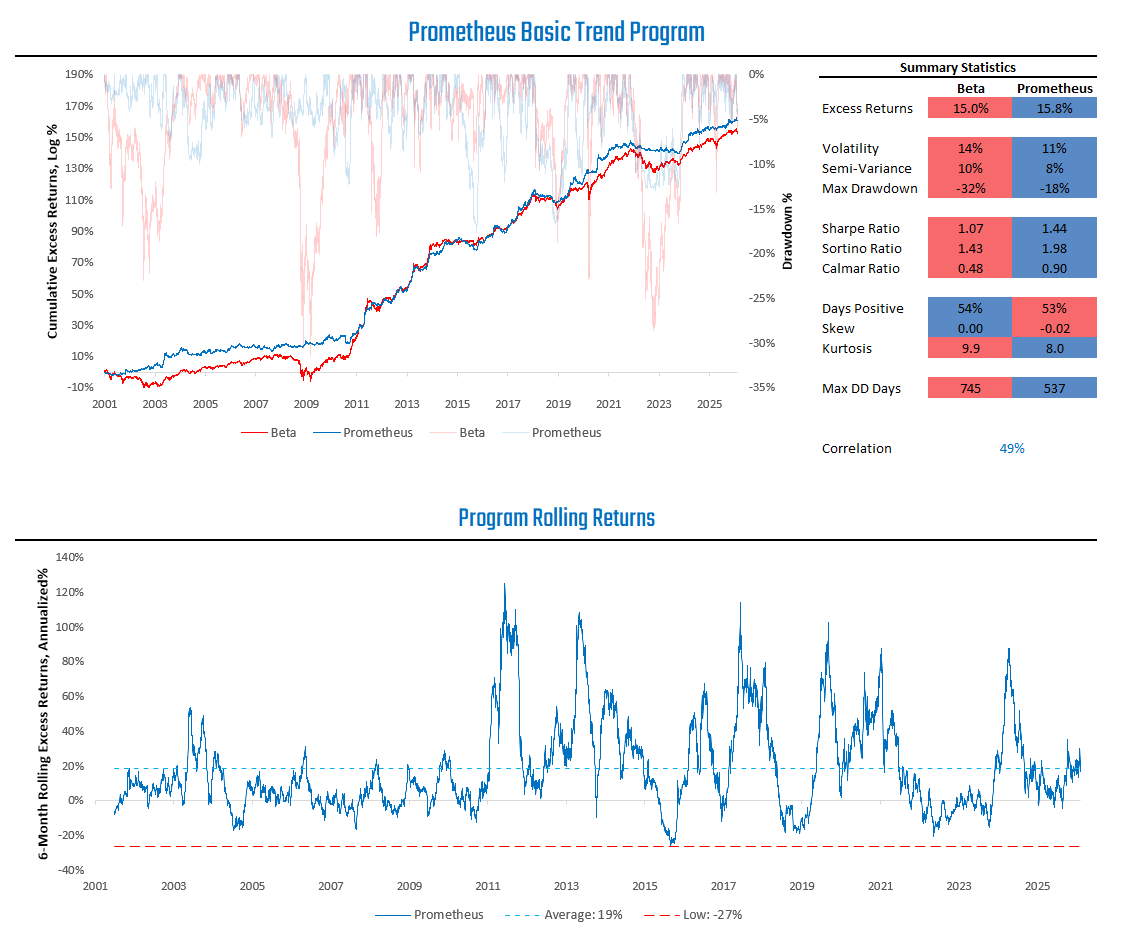

Trend following is a good solution for many investors, as it is intuitive and provides solid risk control. However, the signals used in trend following are fairly basic, so we don’t think there should be a high barrier to entry for basic trend-following strategies. As such, we will provide access to a Basic Trend Program at zero cost to users for a portfolio of stocks, Gold, bitcoin, and bonds. The program uses three layers of portfolio construction: a risk-parity base, a two-speed trend overlay, and a 15% maximum volatility cap. These layers are applied versus a benchmark beta of 60% Stocks, 15% Bonds, 15% Gold, and 10% Bitcoin. We will release a methodology note soon, but in the meantime, we share the summary statistics and current positioning below:

This program currently holds a 50% maximum long position in Stocks, 100% maximum long position in 30-Year Treasuries, a 100% maximum long position in Gold, and a 0% position in Bitcoin. In risk-parity terms, this translates to: Stocks: 18%, Bonds: 47%, Gold: 14%, Bitcoin: 0%, with cash at 21%.

While basic trend following is a strong solution for many investors, there is a world of signals and strategies beyond it. We begin to address these in the following sections.

Macro Cycle Monitor

Our systems aggregate a wide range of fundamental economic data to produce timely, proprietary estimates of the current stages of the macro cycle. We share some of these gauges, starting with our signals for business cycle conditions: