Welcome to Prometheus ETF Portfolio. The Prometheus ETF Portfolio aims to allow everyday investors to access an investment solution that combines active macro alpha, passive beta, and strict risk control, all in an easy-to-follow, low-turnover solution. We aim to achieve strong risk-adjusted returns relative to cash, with limited capital drawdowns in depth and duration. We do this in a highly accessible package, which rotates between five highly liquid ETFs, readily available to any investor with a brokerage account.

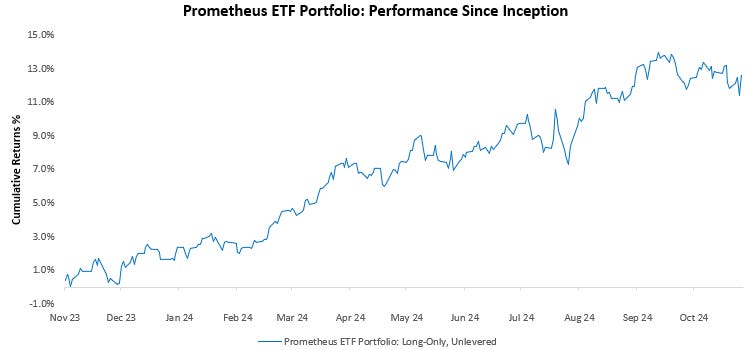

We visualize our live performance below:

We also discussed early stage shifts we’re seeing around equity markets with Capital Flows. You can click here or on the image below to listen.

Turning to our latest ETF Portfolio update, our latest observations are as follows:

Market Monitor: Over the last week, markets shook off some of the recent surge in inflationary pricing. Post FOMC, markets rallied significantly as the Fed reaffirmed its commitment to maintaining stable financial conditions. Market-implied measures of liquidity conditions are now at all-time highs, supporting all assets. This pricing is supported by fundamental liquidity conditions, creating potential trend stability.

Economic Data Monitor: Economic data momentum rose significantly again this week, on the back of stronger survey data. The strength in economic data momentum has significant potential to fade, with our fundamental tracking of macro conditions showing slowing, but economic momentum not reflecting those dynamics.