The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly.

We visualize the simulated performance of the systems that drive this strategy below:

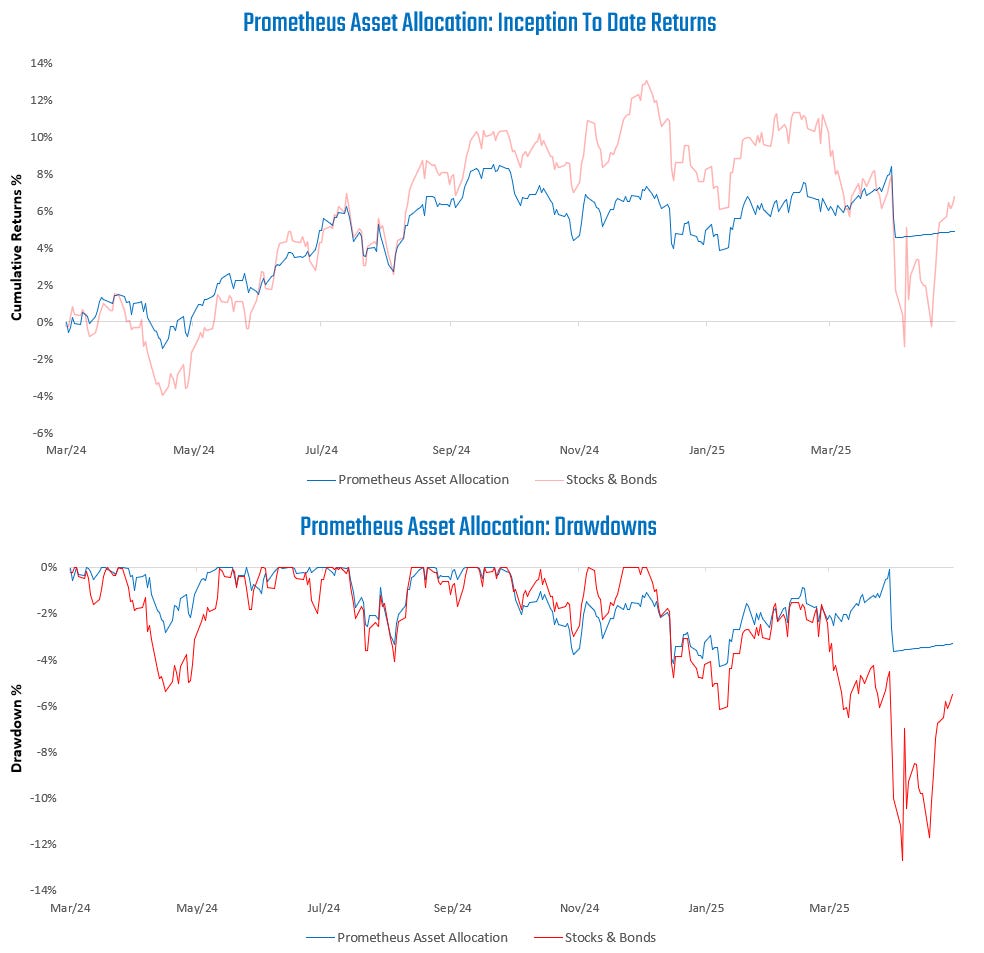

This strategy has performed well through the most recent market volatility, avoiding the volatility of the 60/40 portfolio. We visualize the inception-to-date returns of the program and the accompanying drawdown:

Our observations are as follows:

Market volatility remains elevated across markets, reducing risk-adjusted return opportunities for asset allocators.

Assets are broadly offering little by way of expected returns given this cross-asset volatility.

While market volatility remains elevated, the economy remains strong domestically, with strong business cycle conditions. However, tariff prospects continue to weigh on forward-looking measures of growth.

Reflecting these dynamics, we share the latest positions from our Prometheus Asset Allocation Program: