Today, we share our views on liquidity conditions. If you are unfamiliar with our approach to liquidity, we highly recommend reviewing our Macro Mechanics, where we outline our understanding:

What Is Liquidity?

14 October 2024

Turning to today’s note.

Our primary takeaways are as follows:

Liquidity conditions have tightened sequentially.

Policy liquidity has begun to decline, driven by declining reserve balances. Further, private sector liquidity is also starting to see initial signs of stress, with repo activity and commercial paper issuance decelerating

While declining liquidity broadly pressures assets, the confluence of macro conditions is likely to weigh on all assets.

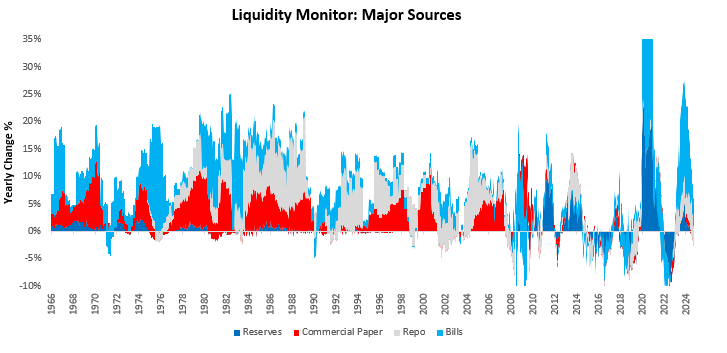

Liquidity is the flow of cash and cash-like assets that potentiate spending in the economy. Liquidity is determined by nominal dollar values and the relative risk profile of the various sources of liquidity. We begin our tracking of liquidity conditions by sharing the weighted growth rate of the major sources of liquidity: reserves, treasury bills, commercial paper, & repurchase agreements.

As we can see above, the current liquidity dynamics are primarily driven by repo conditions after being dominated by treasury bill issuance, and are starting to show stark signs of contraction.

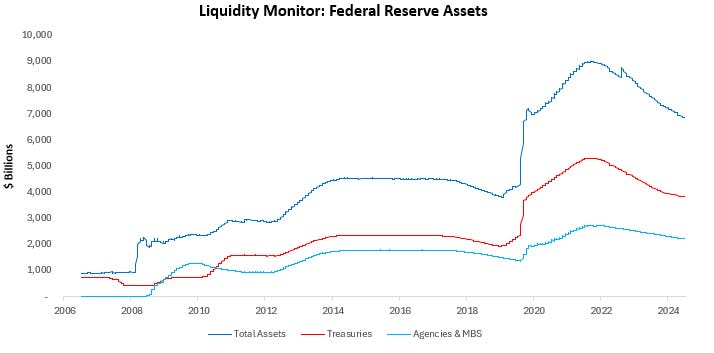

We zoom on each of these components, starting with reserve balances. Reserve balances held by financial institutions at the Fed are a function of the gross liquidity supplied by the Fed through the asset side of their balance sheet, relative to the gross liquidity absorbed by inflows into the liability side of their balance sheet. We visualize the asset side below:

The Fed continues to roll off its assets.

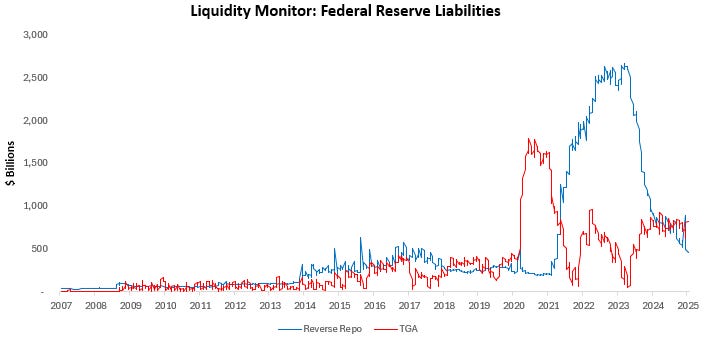

Additionally, we examine the changes in major liabilities of the Fed, i.e,. the liquidity drain on the financial sector:

While the treasury general account has begun to see stabilization, reverse repo has begun to decelerate sequentially. This is a drain on reserves, which is a drain on liquidity.

We combine these perspectives to show the drivers of changes in reserve balances over time.

We remain in the highest period of treasury bill supply since the early 2000s.