Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

This note is one typically reserved for clients of Prometheus Institutional. Occasionally, we share notes from our Prometheus Institutional to augment our retail offering here on Substack. If you’re interested in access to our institutional work, you can click this link:

Or just email us at info@prometheus-research.com.

Diving into today’s note. Our primary takeaways are as follows:

Motor vehicle sales increased marginally, driven by a decrease in production and an acceleration in exports. This contributed to a sequential acceleration in the six-month trend.

While transportation sales have improved, production and capacity utilization remain fairly weak. The combination of these dynamics is indicative of a low level of inventories, driven by a low level of inventories.

In the context of markets, a contraction of transportation output and real estate and industrial manufacturing conditions continue to pose a significant headwind in growth dynamics. These dynamics are consistent with historical recessions, but their effects on the broader economy remain limited. Overall, our Alpha Strategies remain short equities.

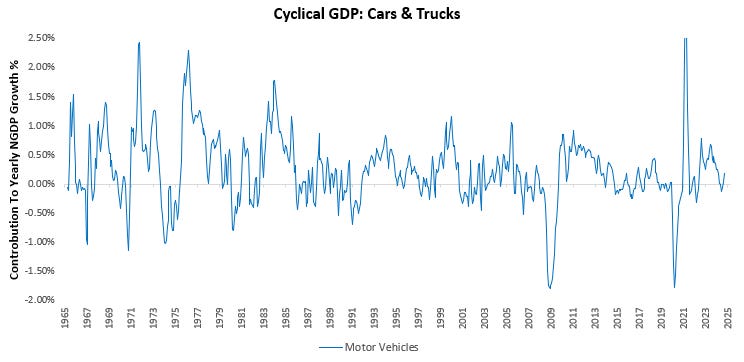

Transportation spending is a key barometer of business cycle conditions, like real estate and industrial. Nominal activity has risen recently:

While nominal activity has risen, output remains contracting. We examine these dynamics in detail.

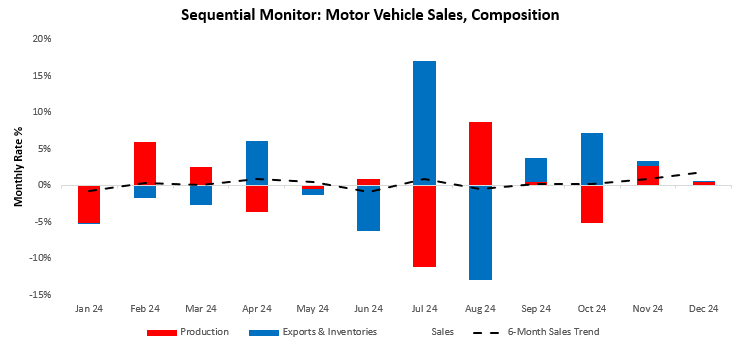

In December, real motor vehicle sales increased by 0.47%. Sales growth can come from a combination of production, exports, or inventory drawdowns. This month, sales were driven by a 0.47% change in production and a 0.01% change in exports and inventories, respectively. This print contributed to a sequential acceleration in the six-month trend. Below, we show the sequential evolution of the data, along with the composition driving these monthly changes:

However, contrary to previous months - the sequential changes were significantly muted across both production and exports & inventories.

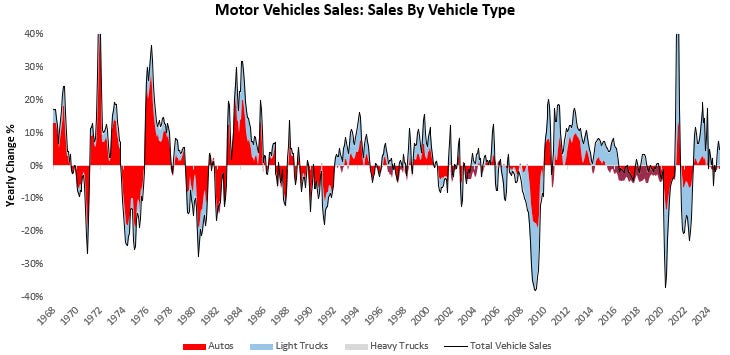

Motor vehicle spending is directly reflected in GDP in the form of consumer motor vehicle purchases and business investment in motor vehicles. To better understand this spending, we look at the composition of total motor vehicle unit purchases by type of motor vehicle. As we can see below, motor vehicle purchases have increased by 5.09% over the last year. This move in purchases was driven by Autos (-1.11%), Light Trucks (6.48%), & Heavy Trucks (-0.27%):

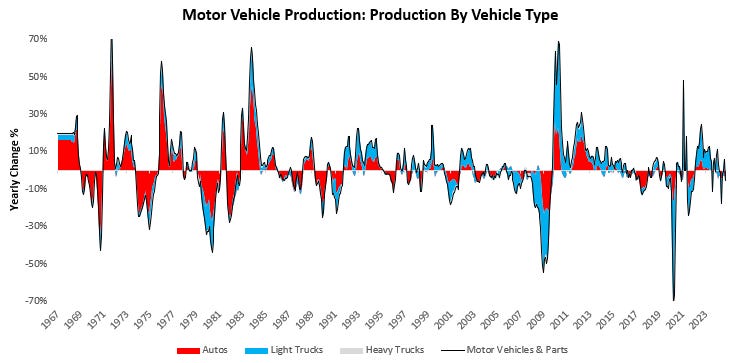

While real sales increased in December, total motor vehicle production decreased. Over the last year, motor vehicle production was driven by Autos (-1.11%), Light Trucks (6.48%), & Heavy Trucks (-0.27%), falling by -5.45%: