Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

Our estimates for real incomes showed a sequential increase of 0.21%. Nominal income increased marginally, primarily driven by employment, real wages, and wage inflation. However, the flow of this wage strength to GDP remained subdued due to trade weakness.

The breadth of employment growth has slowed modestly. This is a significant headwind for growth conditions if sustained.

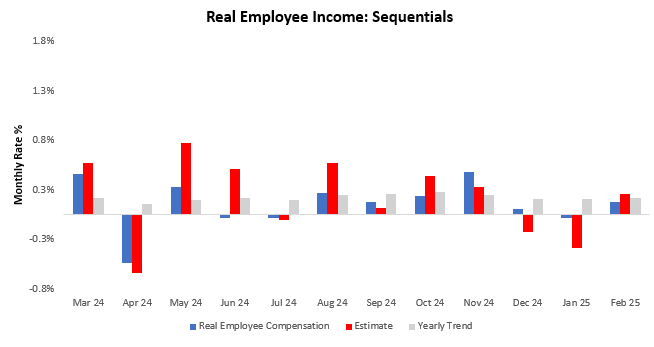

On the current path, real incomes are headed towards contraction. However, we don’t expect the current trend to be sustained. A major driver of recent weakness was a large slowing in retail sales and incomes. In large part, this weakness looked to be seasonal, suggesting a reversal. We don’t see consistent & persistent weakness in any of the income drivers at this time.

Our latest estimates for February showed real employee income increased by 0.21%. This data showed a deceleration in the quarterly trend relative to the one-year trend. We show the evolution of the sequential data below:

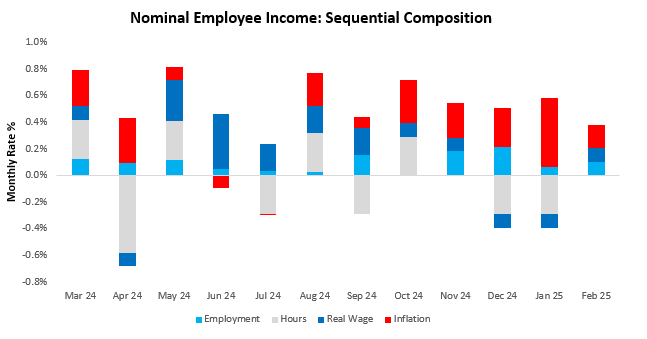

This estimated real income data came alongside a nominal income change of 0.38%. We can decompose this nominal wage growth into growth from employment, hours worked, real wages, and wage inflation, which contributed 0.1%, 0%,0.1%, and 0.18%, respectively, to nominal income. We show the sequential evolution of this compositional data below:

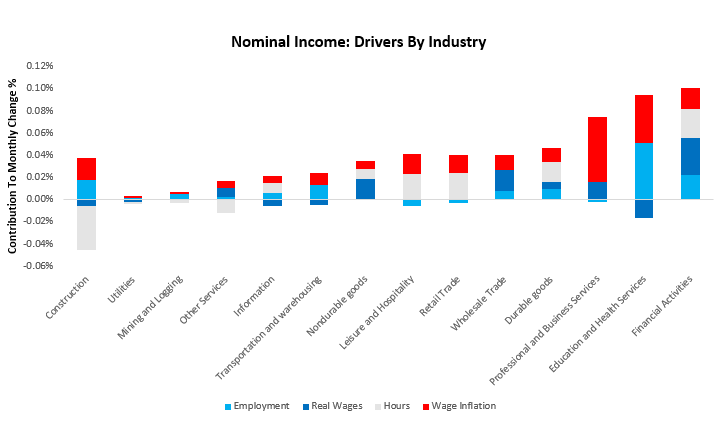

We further decompose these macroeconomic drivers by industry. Below, we visualize the contributions to total nominal income coming from each industry, broken into its drivers, ranked from left (weakest) to right (strongest). As we can see below, nominal income was generally positive, with Financial Activities contributing the most to strength and Construction dragging on nominal income growth:

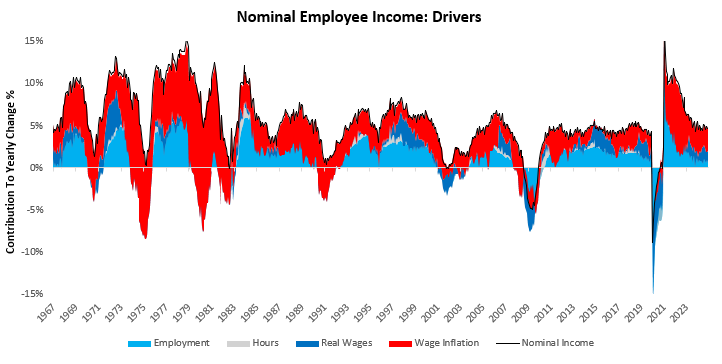

For further perspective, we show how nominal employee income has evolved over the last year, with nominal income growth of 4.62%, 2.02% of which came from real growth. Over the last year, nominal income has primarily been driven by Wage Inflation, which has expanded by 2.58%. We display this below:

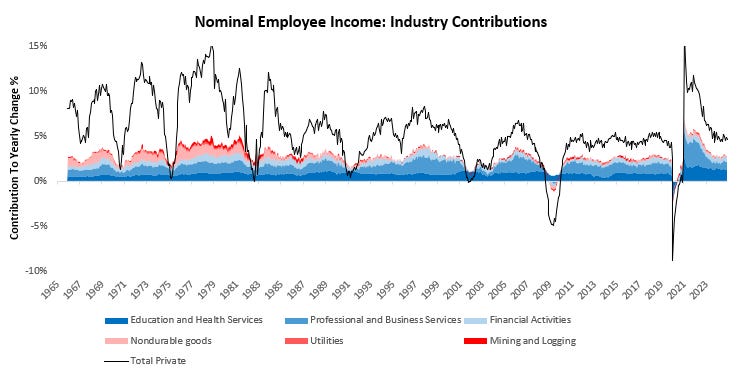

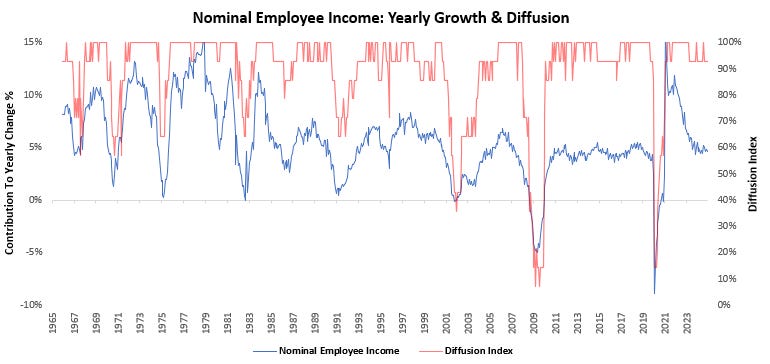

Digging into the industry-level data, we find that nominal employee income over the last year has largely been positive, with Education and Health Services, Professional and Business Services, and Financial Activities contributing strength (shown in shades of blue). On the other hand, Mining and Logging, Utilities, and Nondurable goods are the weakest areas of income (shown in shades of red). Additionally, we show the yearly change in the data, along with the underlying diffusion of industry growth: