Welcome to The Observatory. The Observatory is how we at Prometheus monitor the evolution of the economy and financial markets in real-time. The insights provided here are slivers of our research process that are integrated algorithmically into our systems to create rules-based portfolios.

Our observations are as follows:

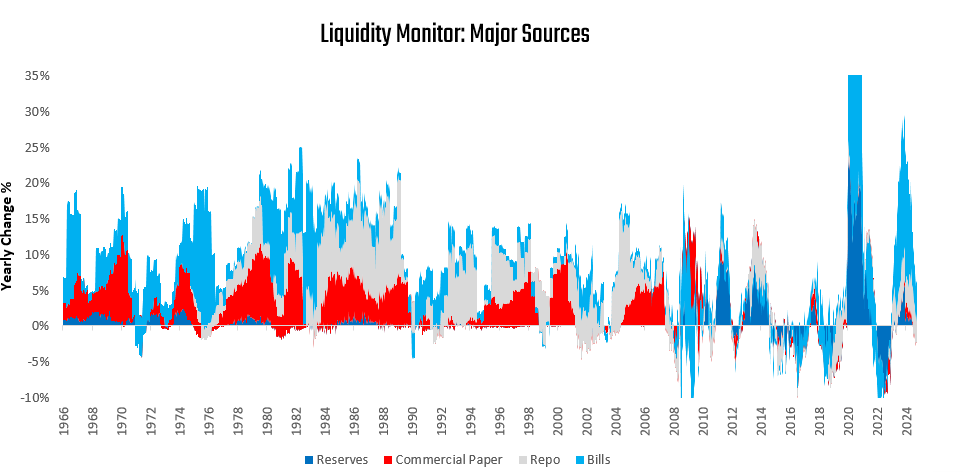

Reserve balances at the Fed remain relatively unchanged, and treasury bill issuance has slowed.

While commercial paper issuance remains muted in the modern economy, repo activity continues to expand rapidly. The private sector continues to create liquidity in a pro-cyclical manner.

With collateral volatility low and measures of short-term funding risk showing little strain, liquidity can continue to expand unfettered.

Liquidity is the flow of cash and cash-like assets that facilitate spending in the economy. Nominal dollar values and the relative risk profile of the various sources of liquidity determine liquidity. We begin our tracking of liquidity conditions by sharing the weighted growth rate of the major sources of liquidity: reserves, treasury bills, commercial paper, & repurchase agreements.

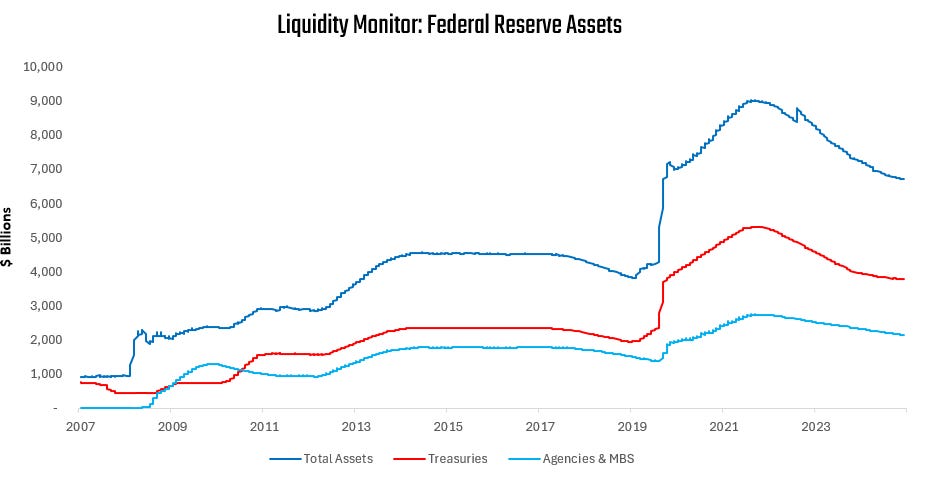

We zoom in on each of these components, starting with reserve balances. Reserve balances held by financial institutions at the Fed are a function of the gross liquidity supplied by the Fed through the asset side of their balance sheet, relative to the gross liquidity absorbed by inflows into the liability side of their balance sheet. We visualize the asset side below:

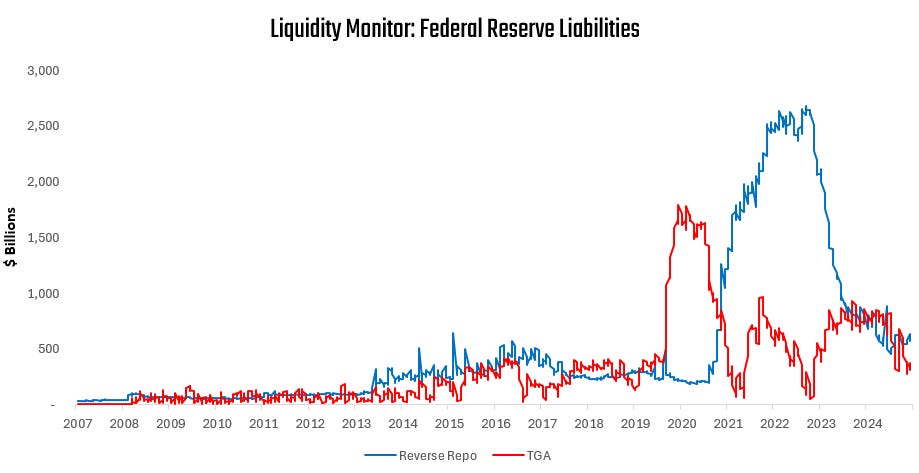

Additionally, we examine the changes in major liabilities of the Fed, i.e., the liquidity drain on the financial sector:

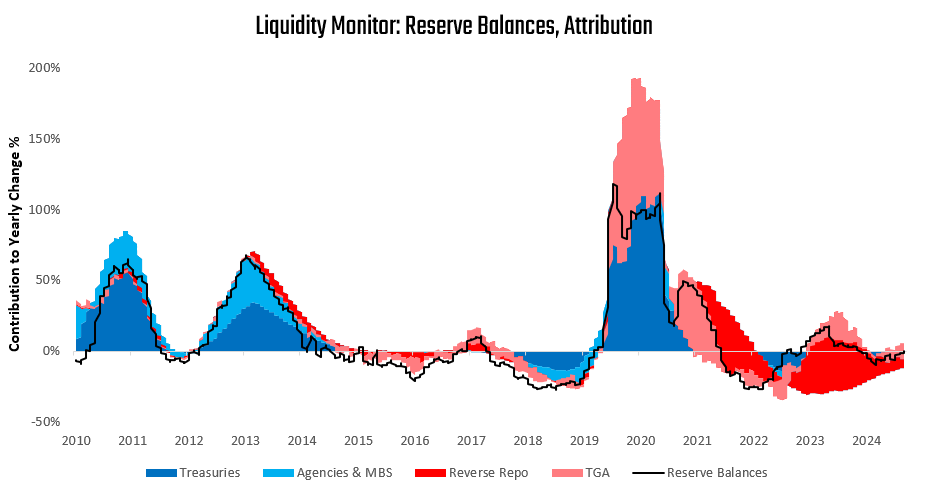

We combine these perspectives to show the drivers of changes in reserve balances over time.

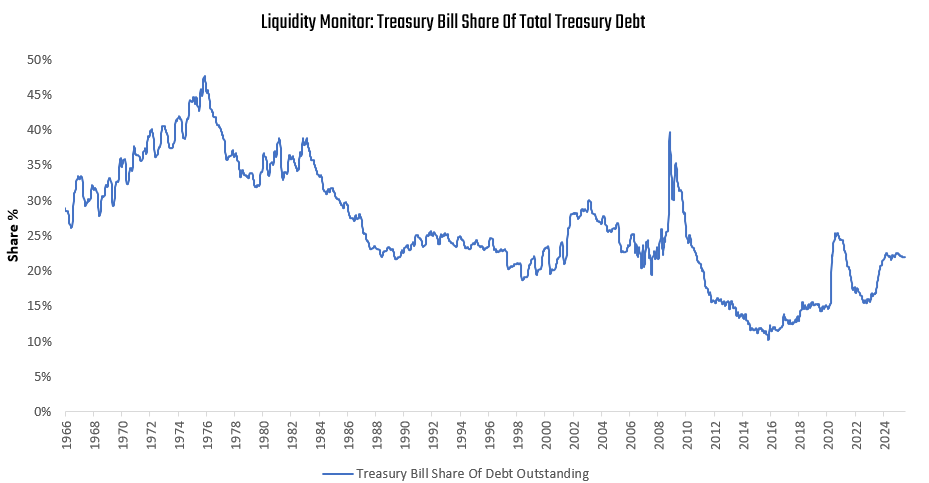

Next, we turn to the other side of government liquidity, i.e., Treasury bill supply. Much like the Fed, the Treasury can impact liquidity conditions by increasing the supply of liquid assets, primarily through Treasury bill issuance. We begin by showing the secular context for this liquidity supply by showing the treasury bills outstanding as a share of total treasury debt.

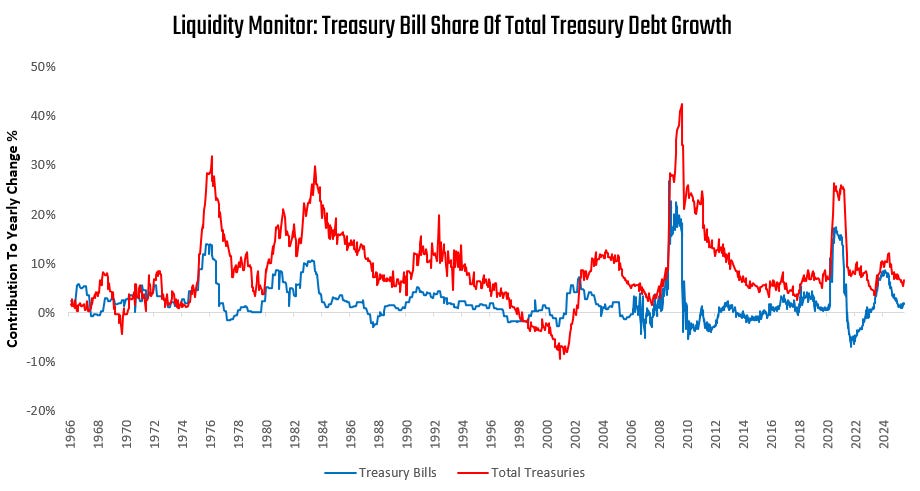

For a more timely perspective, we examine the contribution of treasury bill growth to total treasury debt growth over time.

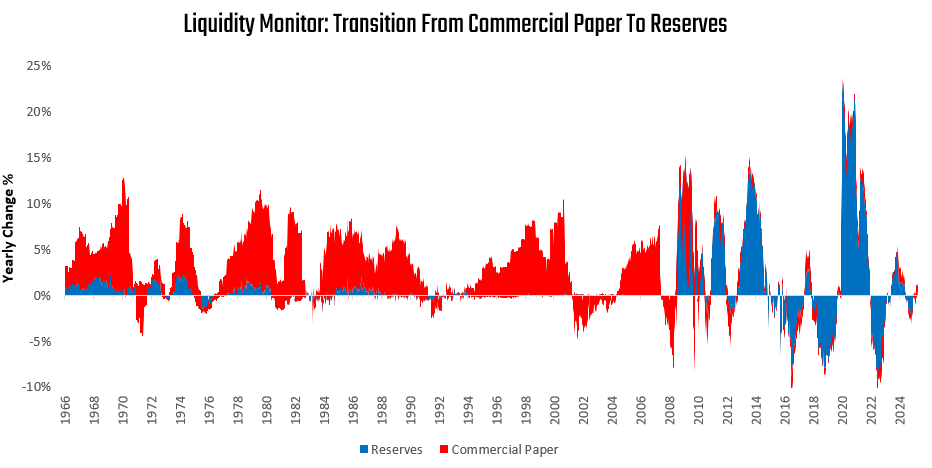

Now that we have looked through the primary government sources of liquidity, we turn to the private sector. We begin with commercial paper markets. During the financial crisis, commercial paper markets were replaced by reserves as the primary repository for storing short-term liquid assets. Nonetheless, commercial paper remains a mechanical driver of the liquidity ecosystem. We visualize the transition from commercial paper to reserves:

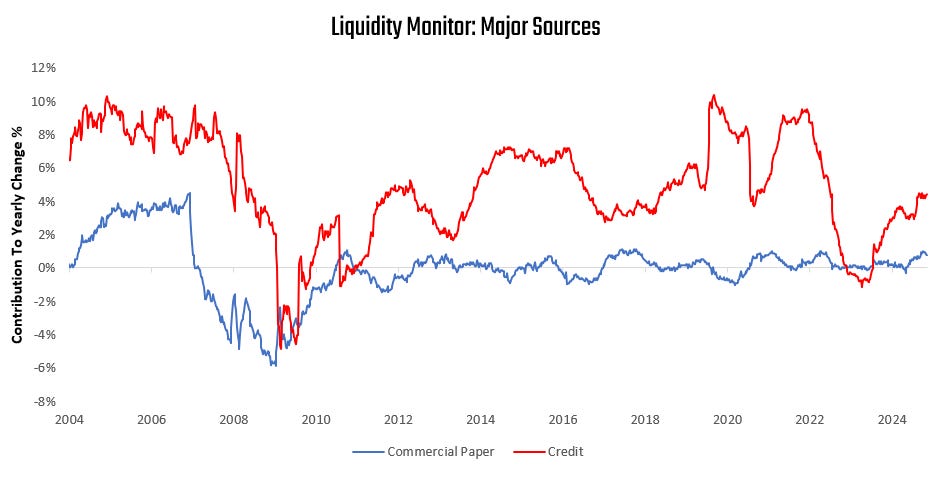

To further contextualize commercial paper activity, we compare the growth of commercial paper to total bank credit:

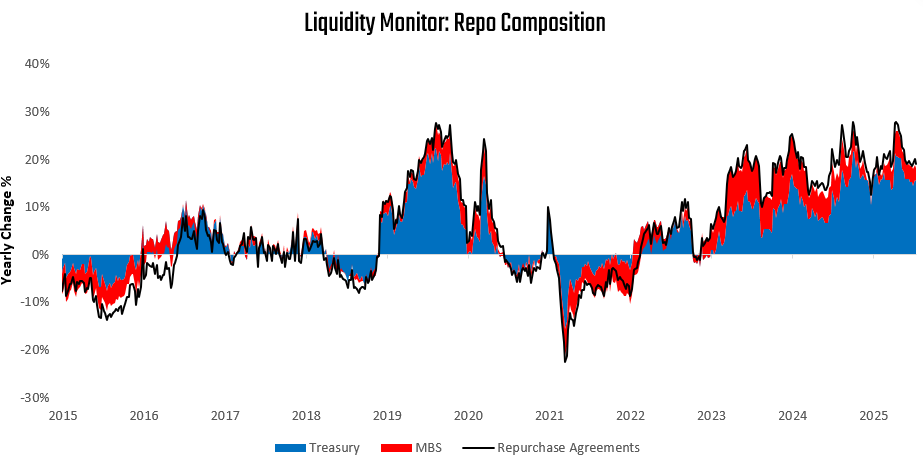

While private sector activity in the form of commercial paper has dwindled, other forms of private sector activity have flourished. Particularly, repo markets have expanded to become a dominant driver of financial markets. Repo market activity is largely contingent upon the supply of collateral, particularly in the form of Treasury & MBS securities. We show the composition of repo growth below:

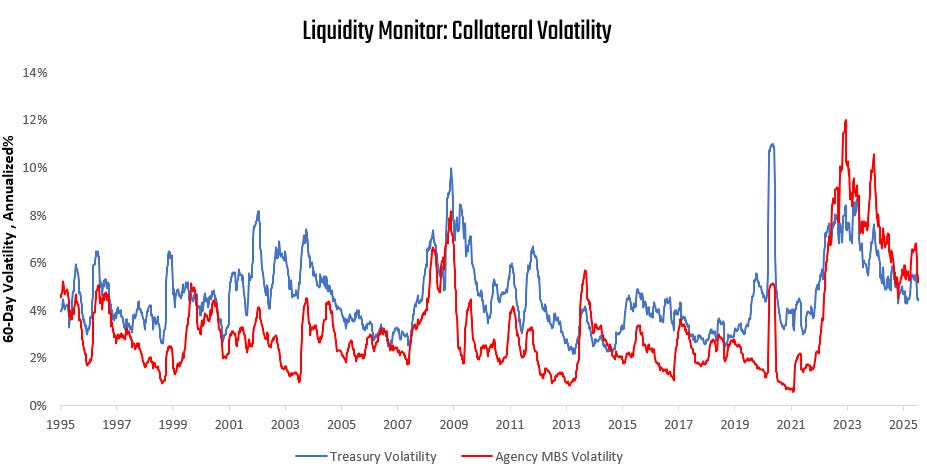

For a further understanding of the drivers of repo activity, we examine the volatility of the underlying collateral, i.e., the volatility of Treasury & Agency MBS. We visualize this below:

While collateral quality is essential to create a supportive backdrop for repo activity, we can gain a further understanding of the drivers of repo by examining the primary source of funds for repo activity: money market funds. Below, we visualize the growth of money market funds, along with their composition:

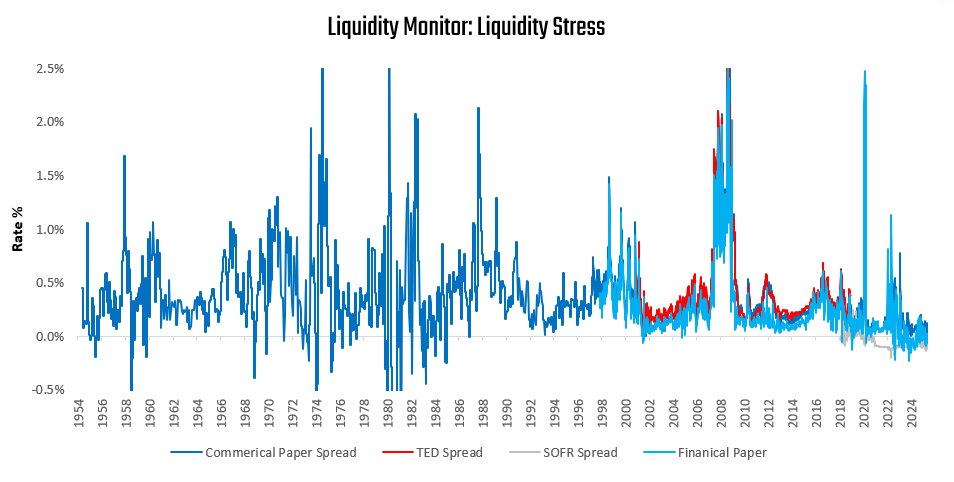

Now that we have examined all the big-picture drivers of liquidity dynamics, we conclude by reviewing timely measures of liquidity stress in the form of short-term interest rate spreads. A widening of spreads will impact private sector credit creation and liquidity conditions. Stability in these spreads continues to support ongoing liquidity creation.

Spreads remain contained.

Examining our measures of liquidity conditions, it remains apparent that repo markets continue to be the dominant driver of financial activity. For repo markets to begin to weaken in a self-reinforcing way, we would need to see a combination of:

Significantly, financial asset expected returns are compared to cash.

Increased asset price volatility.

Increasing collateral volatility.

Short-term funding stress.

A meaningful rate-of-change slowing in repo activity.

This mix of conditions is no longer present, which continues to support asset prices.

The future is dynamic, and our systems will adapt as the data evolves. We will keep you updated as the outlook shifts. Until next time.