Recently, we have received queries regarding potential signs of stress in financial plumbing. We examine the dynamics of the liquidity ecosystem.

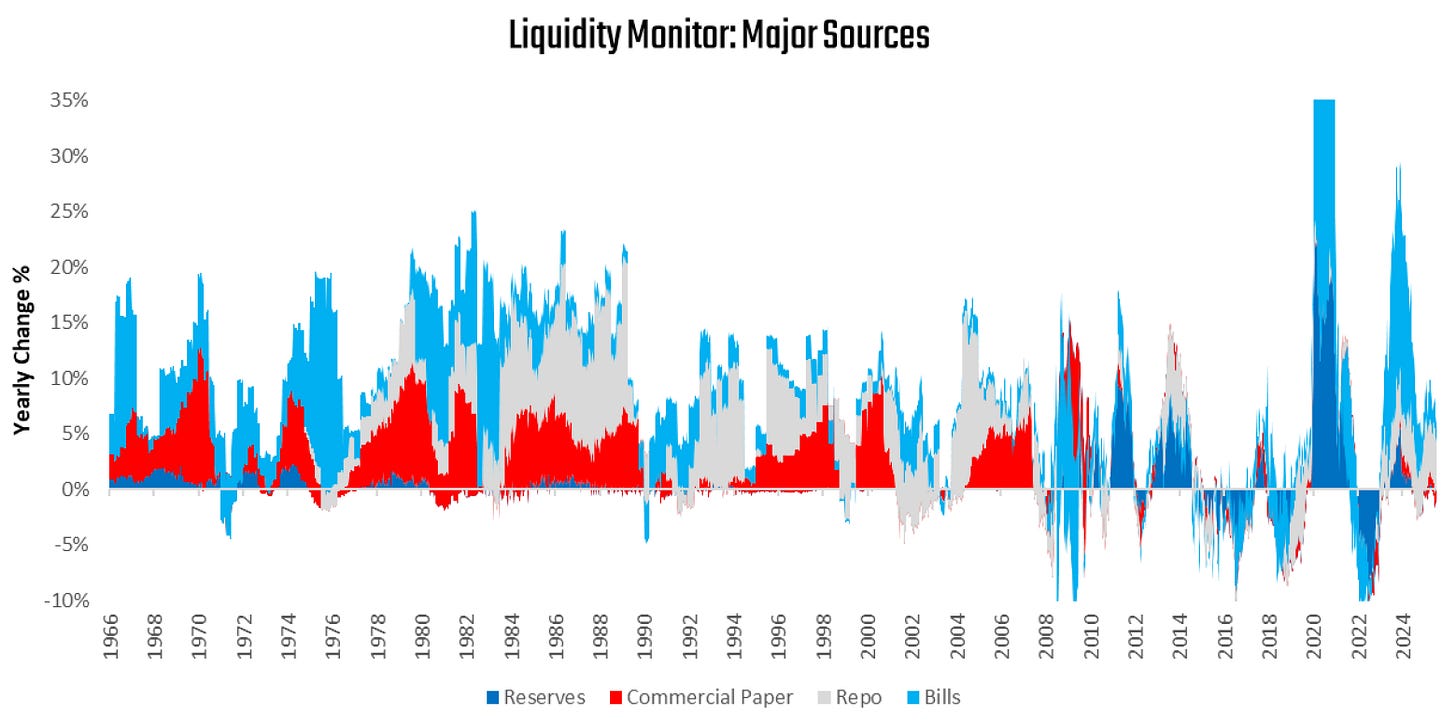

We begin our tracking of the major sources of liquidity:

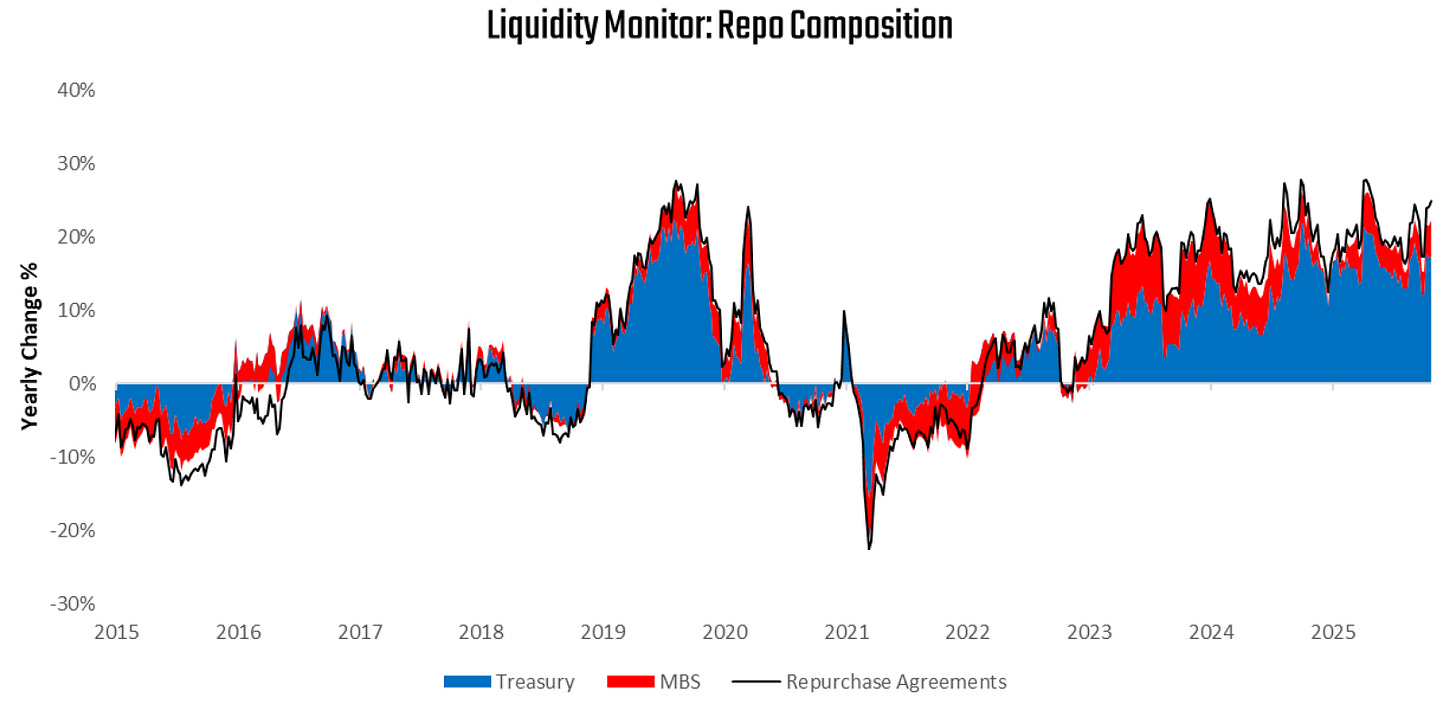

With the Federal Reserve’s balance sheet actions slowing, the dominant driver of liquidity dynamics remains the repo market. We isolate this below:

The primary concerns we see expressed by market participants today are about the stability of repo markets, particularly the widening of SOFR spreads. While these spreads have indeed widened, adding a little historical perspective reduces our concerns:

As we can see, while there has been a rise in SOFR spreads, the rise is extremely small relative to historical periods of stress (2007, 2029, 2022). We see this lack of stress confirmed via repo volumes. We visualize this below:

Repo activity continues to expand at a strong pace.

Underlying this strong rep activity is low collateral volatility:

Fixed income volatility has declined meaningfully, improving collateral conditions. Furthermore, the primary source of repo market funding, i.e., money market funds, continues to see strong inflows:

The combination of these dynamics continues to paint a picture of stability in the liquidity ecosystem. This is broad support for asset prices and low volatility.

Appreciate this clear-eyed look at the macro liquidity ecosystem and repo stability. It's a crucial context for the liquidity decisions made at the company level. TCLM explores the practical counterpart to this - how trade credit terms, AR efficiency, and working capital strategies determine a firm's operational liquidity resilience. Might be a helpful, ground-level complement to your analysis.

(It’s free)- https://tradecredit.substack.com/