The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly.

The latest CPI data surprised consensus expectations and drove an acceleration in the three-month inflation trend. This print was dominated by shelter and transportation.

Elevated nominal spending relative to interest expense remains a significant upside pressure for inflation.

The constellation of these factors pose significant challenge to the Fed’s ability to ease policy further.

In the context of markets, neutral inflationary pressures are a headwind for bonds. This is reflected in our Prometheus Asset Allocation Strategy.

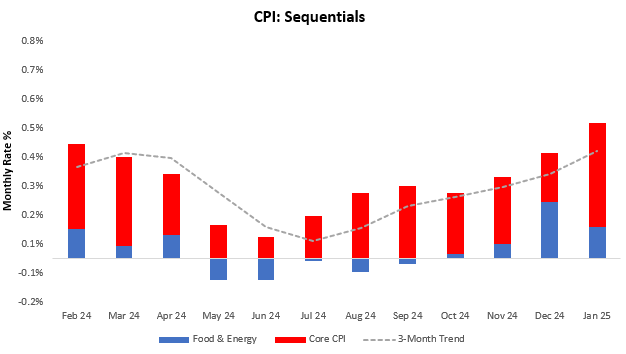

In January, headline CPI came in at 0.47%, surprising consensus expectations of 0.3%. Core CPI contributed 0.36% to this print, with food & energy contributing the remaining 0.11%. This print drove an acceleration in the three-month trend. Below, we display the sequential evolution of the data:

The primary drivers of CPI inflation are food, energy, transport, and shelter. These components have contributed 0.05% (Food), 0.07% (Energy), 0.17% (Transport), and 0.13% (Shelter), respectively. We display these contributions to the 0.47% change in CPI below: