Welcome to Prometheus Asset Allocation. The Prometheus Asset Allocation program offers a stable, macro-focused approach to asset management. Prometheus Asset Allocation aims to outperform a traditional stock and bond portfolio by leveraging our proprietary systematic macro process to rotate between 3 ETFs monthly (plus cash). As part of the program, we will be sharing our views on Growth, Inflation, and Liquidity in addition to our monthly video updates.

Our primary takeaways are as follows:

The latest CPI data disappointed consensus expectations and drove down the three-month trend.

Looking at the macroeconomic dynamics, inflationary pressures sequentially declined in the energy and transport-related components.

Our forward-looking measures of inflation remain in negative territory, showing nascent signs of moderation towards the 2% target.

In the context of markets, deteriorating inflationary pressures are supportive for stocks, incrementally more supportive for bonds, and a headwind for commodities.

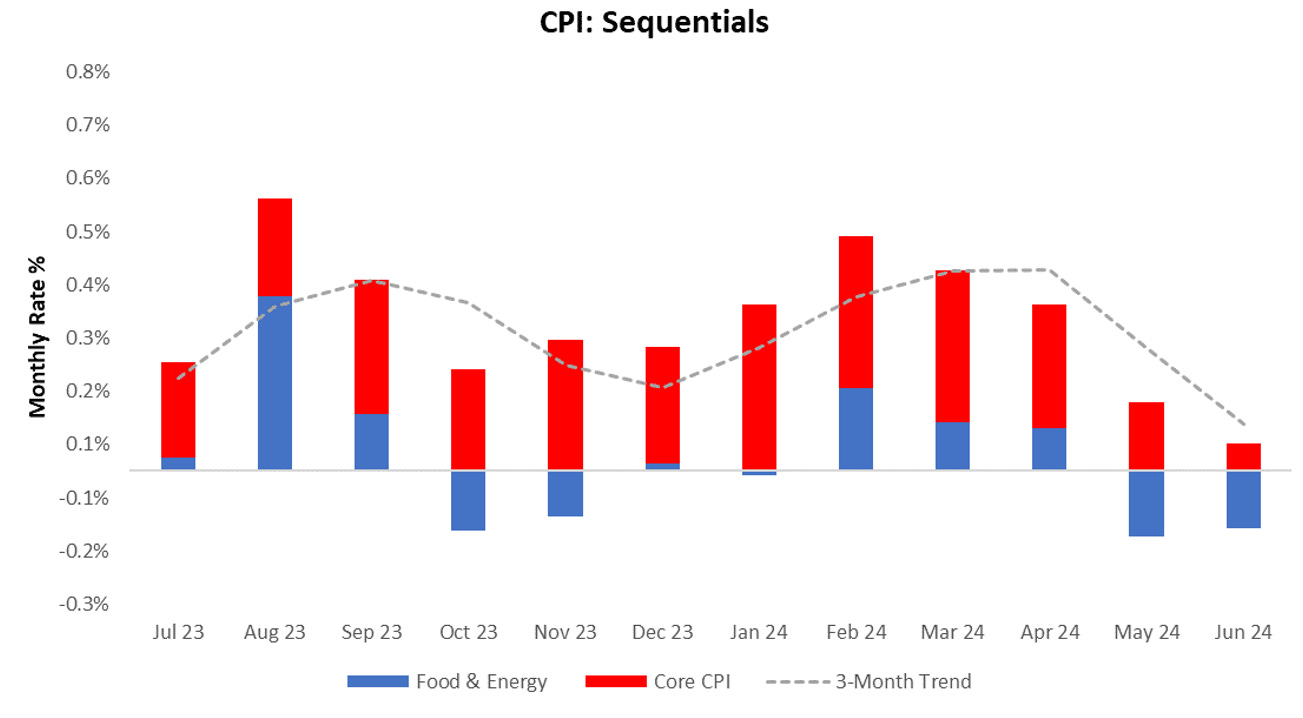

In June, headline CPI came in at -0.06% disappointing consensus expectations of 0.1%. Core CPI contributed 0.05% to this point, with food & energy contributing the remaining -0.11%. This print drove a deceleration in the three-month trend. Below, we display the sequential evolution of the data:

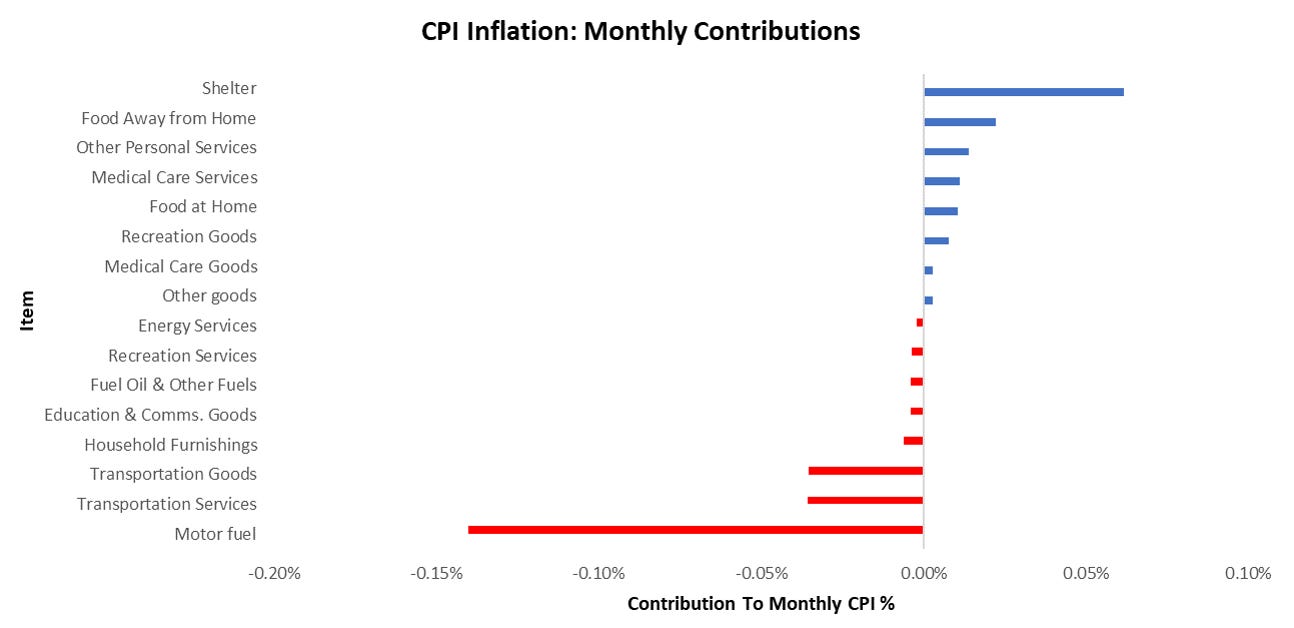

The primary drivers of CPI inflation are food, energy, transport, and shelter. These components have contributed 0.03% (Food), -0.15% (Energy), -0.07% (Transport), and 0.06% (Shelter), respectively. We display these contributions to the -0.06% change in CPI below:

For further perspective, we show how these areas have accounted for the majority of variation in inflation both economically and statistically. Over the last year, food, energy, transport, and housing have contributed 0.3% (Food), 0.1% (Energy), 0.28% (Transport), and 1.8% (Shelter), respectively, to the change in inflation. We display these principal drivers of inflation over time below:

We now zoom back into the most recent print. Inflation was somewhat mixed with Shelter contributing most positively, and Motor fuel contributing most to weakness. We display the largest movers to the upside and downside below:

We now zoom into our major categories of food, energy, transport, and shelter. We begin with food. The most recent data showed food inflation was largely positive with Full-Service Meals & Snacks showing the most relative strength and Fruits and vegetables showing the most weakness.

For further perspective, we also show the evolution of food inflation over the last year with the strongest contributors in shades of blue (Limited-Service Meals & Snacks, Full-Service Meals & Snacks, Meats, Poultry, Fish, and Eggs) and the weakest in shades of red (Fruits and vegetables, Dairy and Related Products, Food from Vending Machines & Mobile Vendors):

Next, we turn to energy. The most recent data showed energy inflation was negative across the board. with Utility & Gas Service showing the most relative strength and Motor Fuel showing the most weakness.

We also show the contributions of these items to total energy inflation over the last year with historical context:

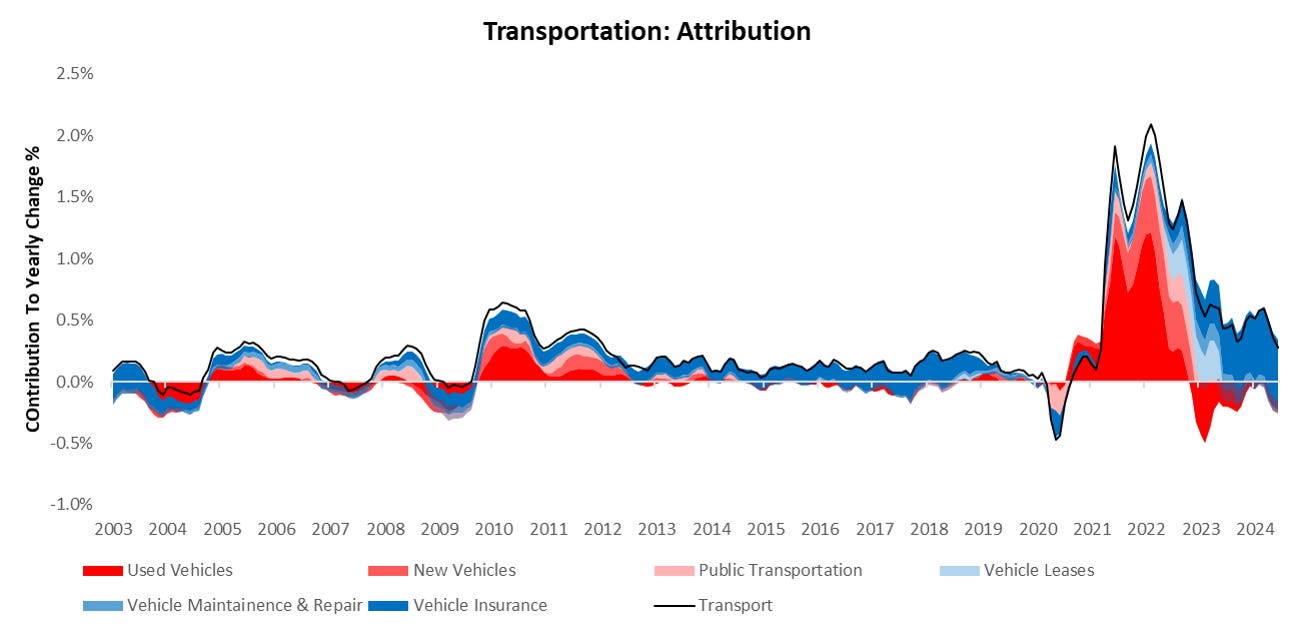

We now turn to transportation. The most recent data showed transport inflation was largely negative with Vehicle Insurance showing the most relative strength and Public Transportation showing the most weakness.

For further perspective, we also show the evolution of transportation inflation over the last year with the strongest contributors in shades of blue (Vehicle Insurance, Vehicle Maintenance & Repair, Vehicle Leases) and the weakest in shades of red (Used Vehicles, New Vehicles, Public Transportation):

Lastly, we examine shelter, which is the largest driver of consumer inflation in the economy. The most recent data showed shelter inflation was somewhat mixed with Owners’ Equivalent Rent showing the most relative strength and Other Lodging (Hotels, Motels, etc.) showing the most weakness.

We also show the contributions of these items to total shelter inflation over the last year with historical context:

Next, we evaluate the relative change of income growth to the debt service costs. This measure allows us to monitor the impact of policy tightening on the health and sustainability of nominal spending, which directly impacts the trend in inflation. As we can see below, currently this measure is sequentially decelerating.

Our Inflation Lead looks at a wide array of price measures to understand the prospective impulse to CPI inflation over the next few months. This gauge has typically been a strong barometer of inflationary pressures. Currently, this measure suggests modestly negative inflationary pressures.

Finally, we share our forecast for headline CPI. We expect headline CPI to average approximately 0.19% over the next twelve months, which equates to an annualized value of 2.35%.

Overall, looking at the macroeconomic dynamics, inflationary pressures sequentially declined in the energy and transport-related components. Our forward-looking measures of inflation remain in negative territory, showing nascent signs of moderation towards the 2% target. In the context of markets, deteriorating inflationary pressures are supportive for stocks, incrementally more supportive for bonds, and a headwind for commodities. Until next time.